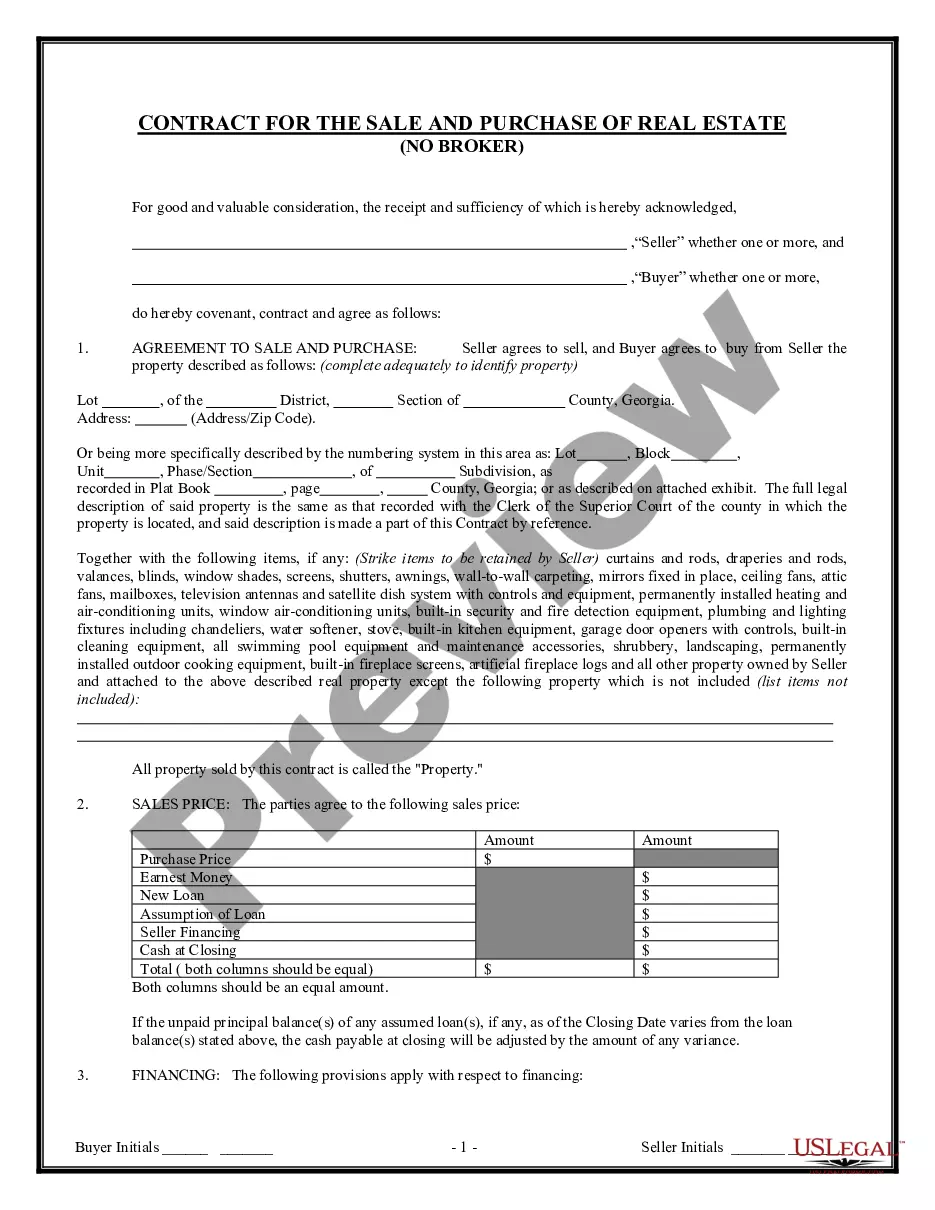

This form is a Transfer on Death Deed, or Beneficiary Deed, where the Grantor are two individuals or hsuband and wife and the Grantees are two individuals or husband and wife. If one Grantee Beneficiary fails to survive the Grantors their interest goes to their estate or the surviving Grantee Beneficiary. If neither Grantee Beneficiary survive the Grantors, the transfer fails and the deed is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to the surving Grantor's death. This deed complies with all state statutory laws.

Transfer On Death Deed Form Arkansas With Wisconsin

Description

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

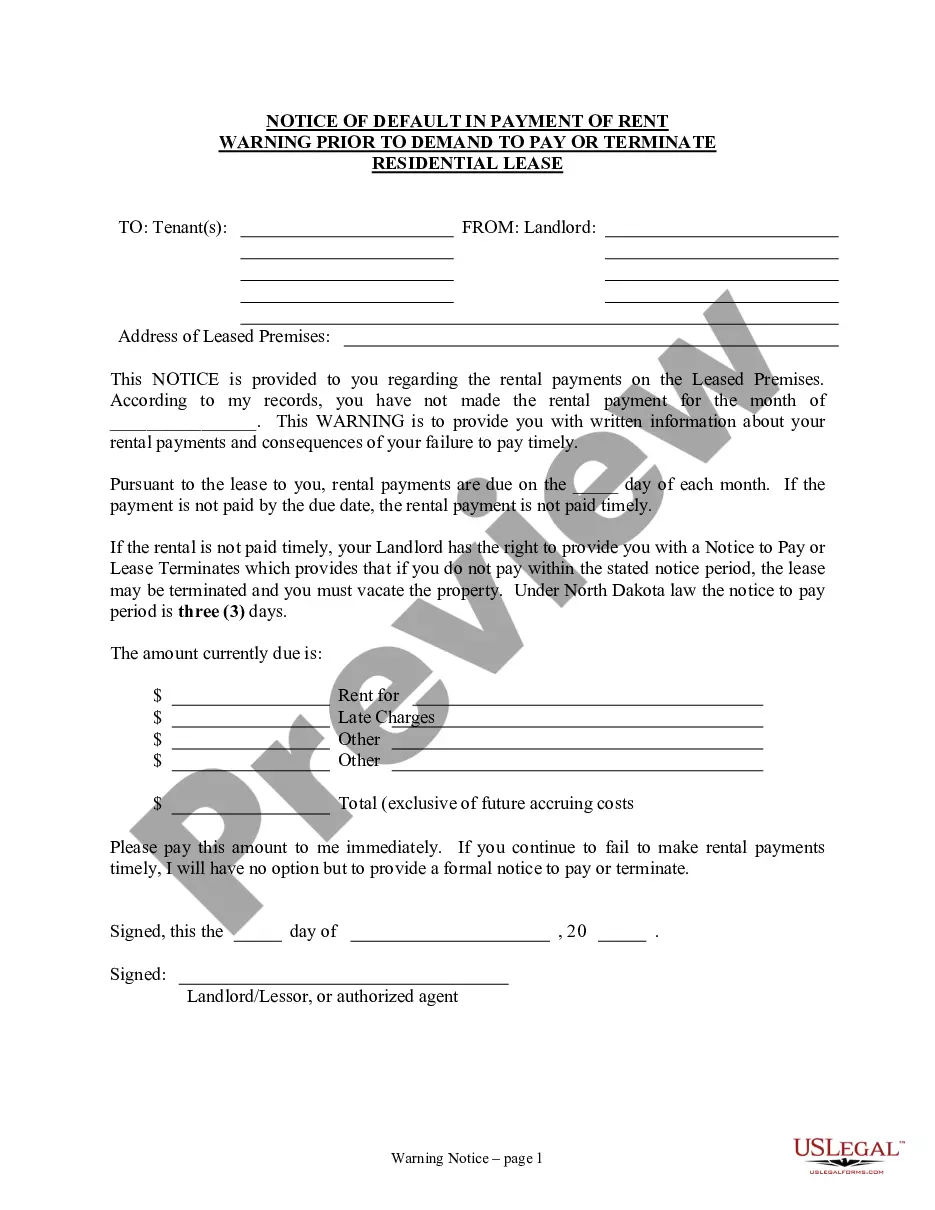

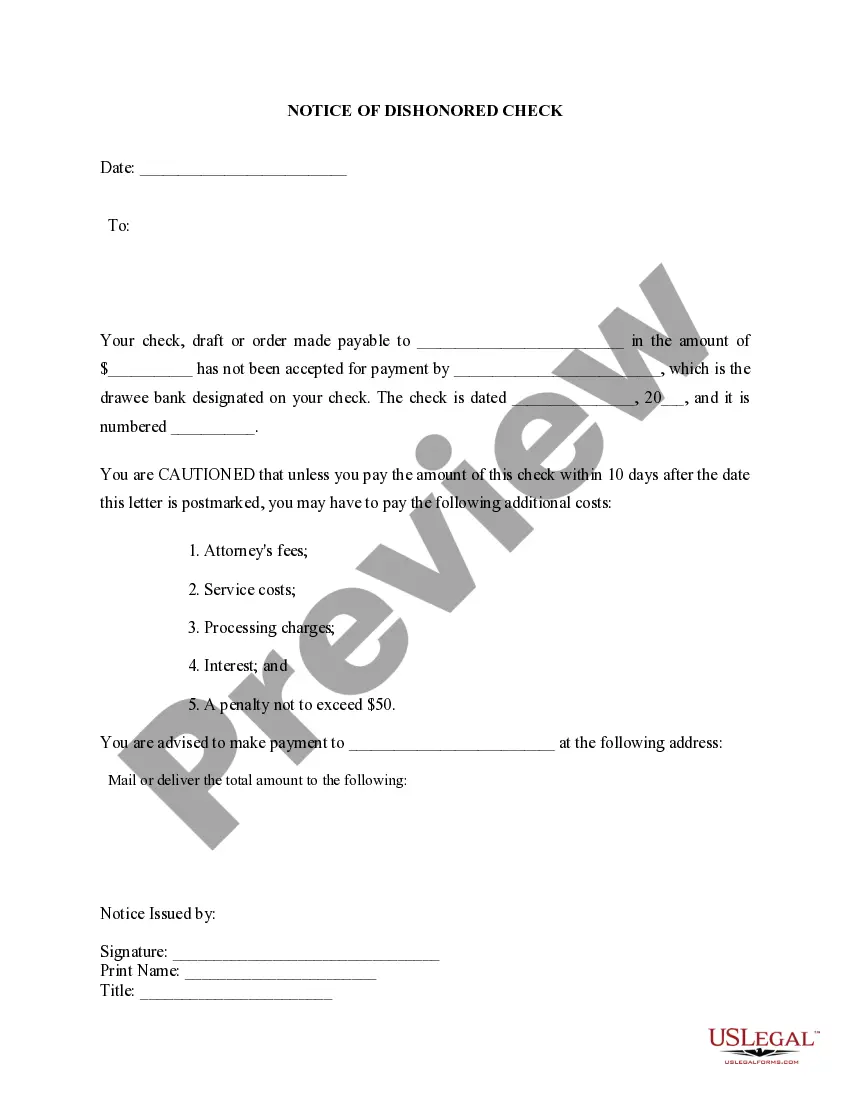

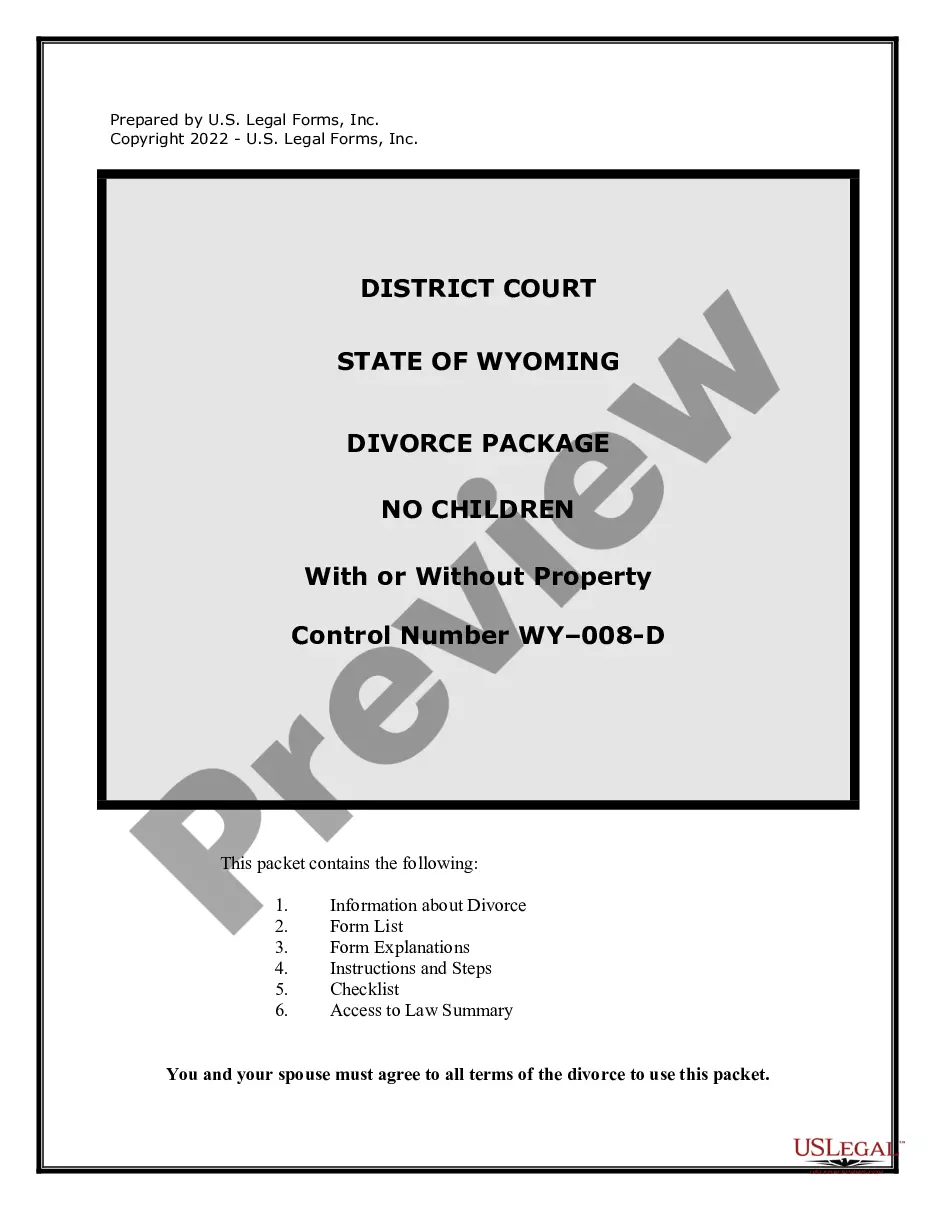

Working with legal documents and procedures could be a time-consuming addition to your day. Transfer On Death Deed Form Arkansas With Wisconsin and forms like it typically require that you search for them and navigate how you can complete them properly. As a result, regardless if you are taking care of economic, legal, or personal matters, having a thorough and practical web library of forms close at hand will go a long way.

US Legal Forms is the top web platform of legal templates, offering over 85,000 state-specific forms and numerous tools to help you complete your documents effortlessly. Explore the library of pertinent papers available to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Shield your papers management operations using a top-notch service that lets you put together any form within minutes with no additional or hidden charges. Just log in to your profile, find Transfer On Death Deed Form Arkansas With Wisconsin and download it immediately in the My Forms tab. You can also access previously saved forms.

Would it be your first time utilizing US Legal Forms? Sign up and set up an account in a few minutes and you will have access to the form library and Transfer On Death Deed Form Arkansas With Wisconsin. Then, follow the steps listed below to complete your form:

- Ensure you have discovered the correct form by using the Preview feature and reading the form information.

- Select Buy Now as soon as ready, and select the monthly subscription plan that meets your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience assisting users handle their legal documents. Find the form you require today and streamline any operation without breaking a sweat.

Form popularity

FAQ

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

To get title to the property after your death, the beneficiary must take a few administrative steps. The beneficiary can call the county clerk, circuit clerk, or recorder's office for details, but the process will likely require recording a certified copy of the death certificate. No probate is necessary.

A ?Transfer on Death? (TOD) Deed can be a useful tool when creating an estate plan. This particular type of deed can streamline the process of conveying real property incident to your death.

Lack of Resources To Pay Final Expenses A significant downfall with relying upon TOD or POD account registration to administer your assets upon death is that there might not be remaining assets in your estate to cover such expenses.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result. Problems with Transfer on Death Deeds: A Deep Dive - ClearEstate clearestate.com ? en-us ? blog ? transfer-dea... clearestate.com ? en-us ? blog ? transfer-dea...