Arkansas Transfer On Death Form For Property

Description

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal files calls for precision and attention to detail, which is the reason it is very important to take samples of Arkansas Transfer On Death Form For Property only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and view all the details concerning the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to finish your Arkansas Transfer On Death Form For Property:

- Utilize the library navigation or search field to find your template.

- Open the form’s description to ascertain if it suits the requirements of your state and region.

- Open the form preview, if available, to make sure the template is the one you are looking for.

- Go back to the search and find the proper document if the Arkansas Transfer On Death Form For Property does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Select the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (credit card or PayPal).

- Select the file format for downloading Arkansas Transfer On Death Form For Property.

- Once you have the form on your device, you can change it with the editor or print it and finish it manually.

Eliminate the hassle that accompanies your legal documentation. Explore the comprehensive US Legal Forms library where you can find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

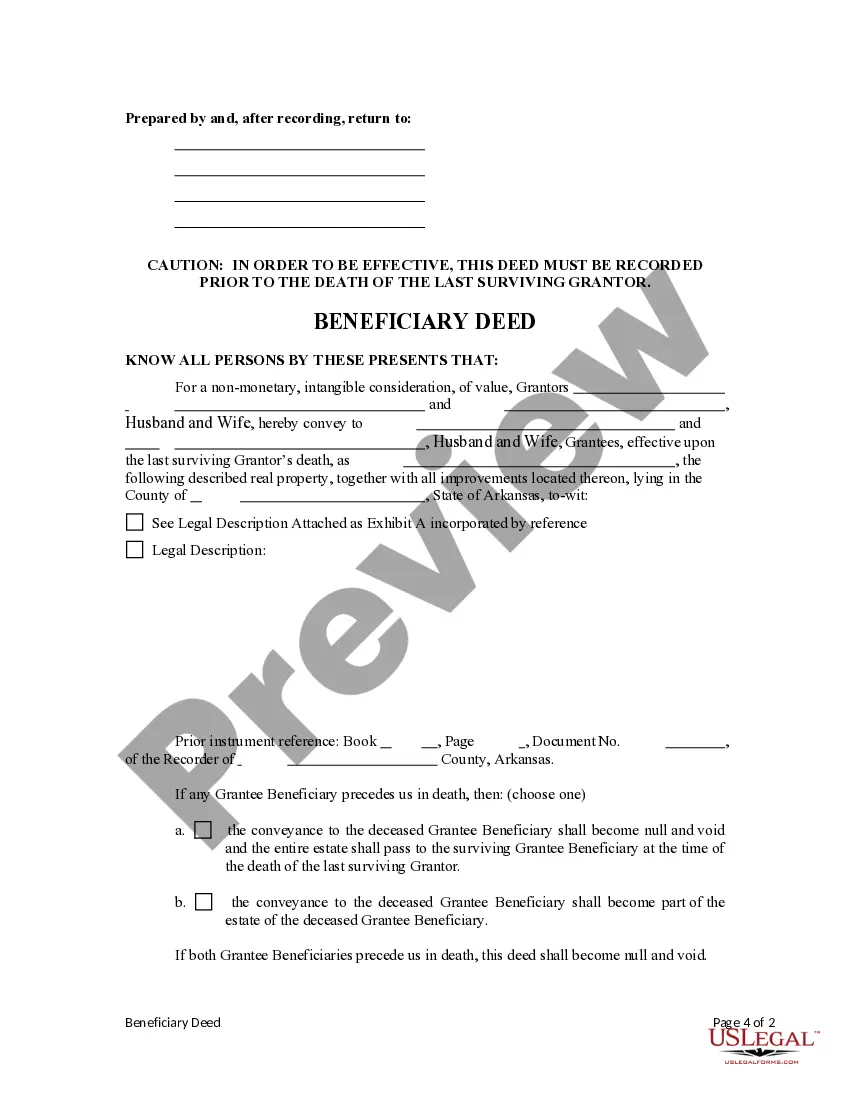

Arkansas Beneficiary (Transfer-on-Death) Deed At your death, the real estate goes automatically to the person you named to inherit it -- the "grantee beneficiary" -- without the need for probate court proceedings. (Ark. Code Ann. section 18-12-608.)

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.

Arkansas allows you to leave real estate with transfer-on-death deeds. These deeds are also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

When transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located.