Deed Tod Beneficiary With The Inheritance Payment

Description

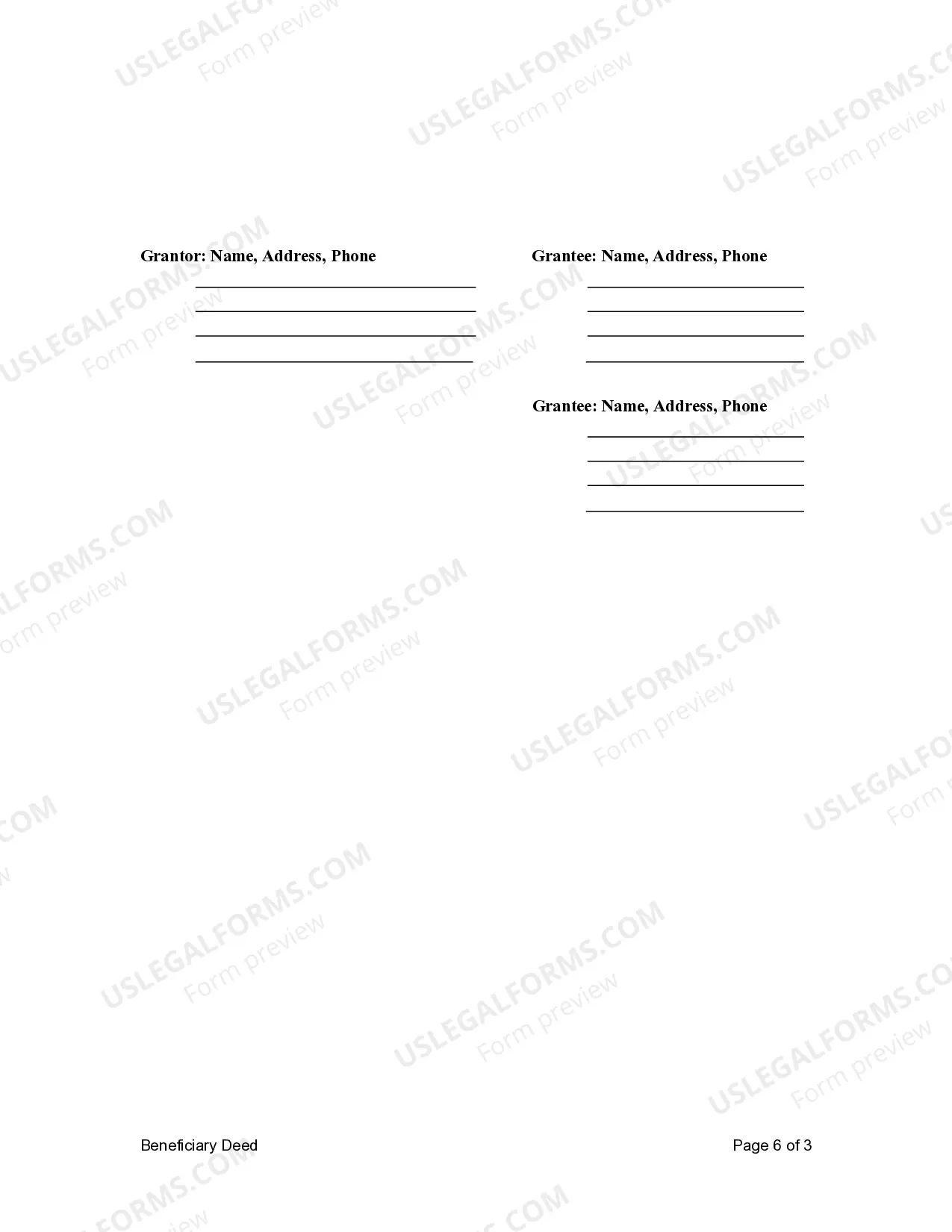

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Two Individuals?

It’s clear that you cannot instantly become a legal authority, nor can you swiftly learn how to draft a Deed Tod Beneficiary With The Inheritance Payment without possessing a specialized background.

Assembling legal documents is a lengthy process that necessitates specific training and expertise.

Therefore, why not entrust the formulation of the Deed Tod Beneficiary With The Inheritance Payment to the professionals.

Preview it (if this feature is available) and read the accompanying description to determine whether the Deed Tod Beneficiary With The Inheritance Payment is what you are looking for.

If you need a different form, start your search again. Create a free account and select a subscription option to purchase the template. Click Buy now. Once the purchase is complete, you can download the Deed Tod Beneficiary With The Inheritance Payment, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

- With US Legal Forms, one of the most extensive legal document repositories, you can find anything from court documents to templates for in-office correspondence.

- We understand how crucial compliance and following federal and state laws and regulations are.

- That’s why, on our platform, all templates are region-specific and current.

- Here’s how to get started on our website and acquire the form you require in just a few minutes.

- Locate the document you need using the search bar at the top of the page.

Form popularity

FAQ

POD and TOD accounts do not pass through the probate estate. They are non-probate assets and are paid directly to the beneficiary or beneficiaries of the account.

?A TOD account can have multiple beneficiaries, as long as the account owner establishes how the assets will be divided," said Damaryan. ?But even if the account has equal distribution of assets, you could still have conflicts over who is in charge of the money because there is no one designated to handle it."

A transfer on death, or TOD, is a designation that allows a creditor's assets to pass directly to their beneficiary after they die. The account owner specifies the percentage of assets each beneficiary is to receive, allowing their executor to distribute the assets without first passing through probate.

Primary tabs. Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death. This is often accomplished through a transfer-on-death deed.

Lack of Resources To Pay Final Expenses A significant downfall with relying upon TOD or POD account registration to administer your assets upon death is that there might not be remaining assets in your estate to cover such expenses.