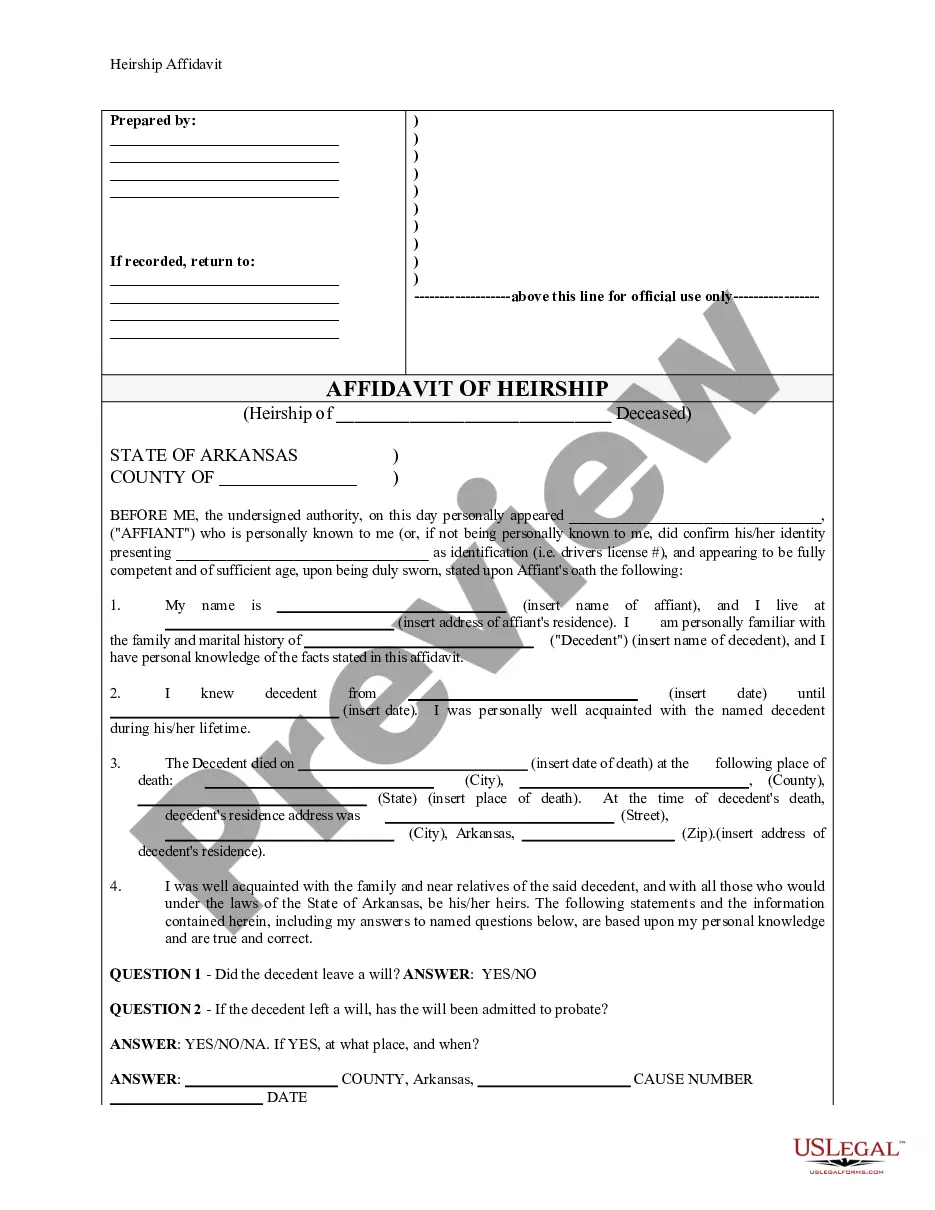

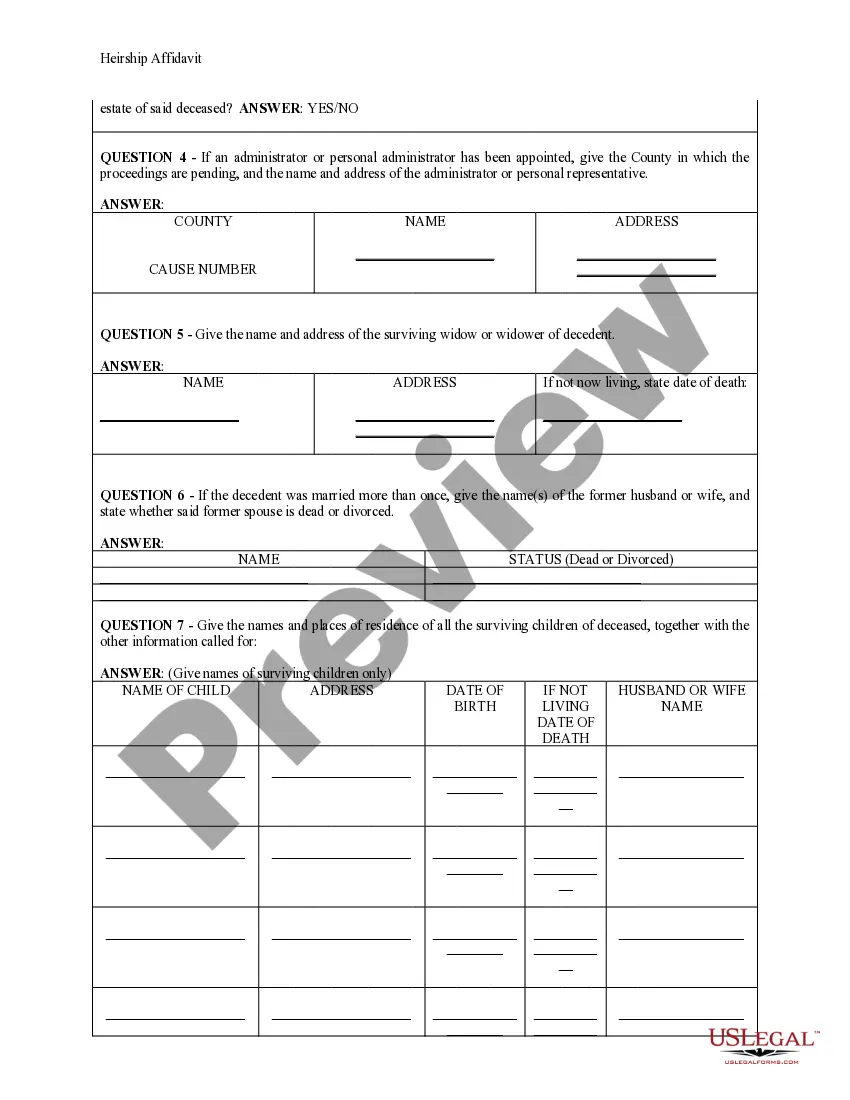

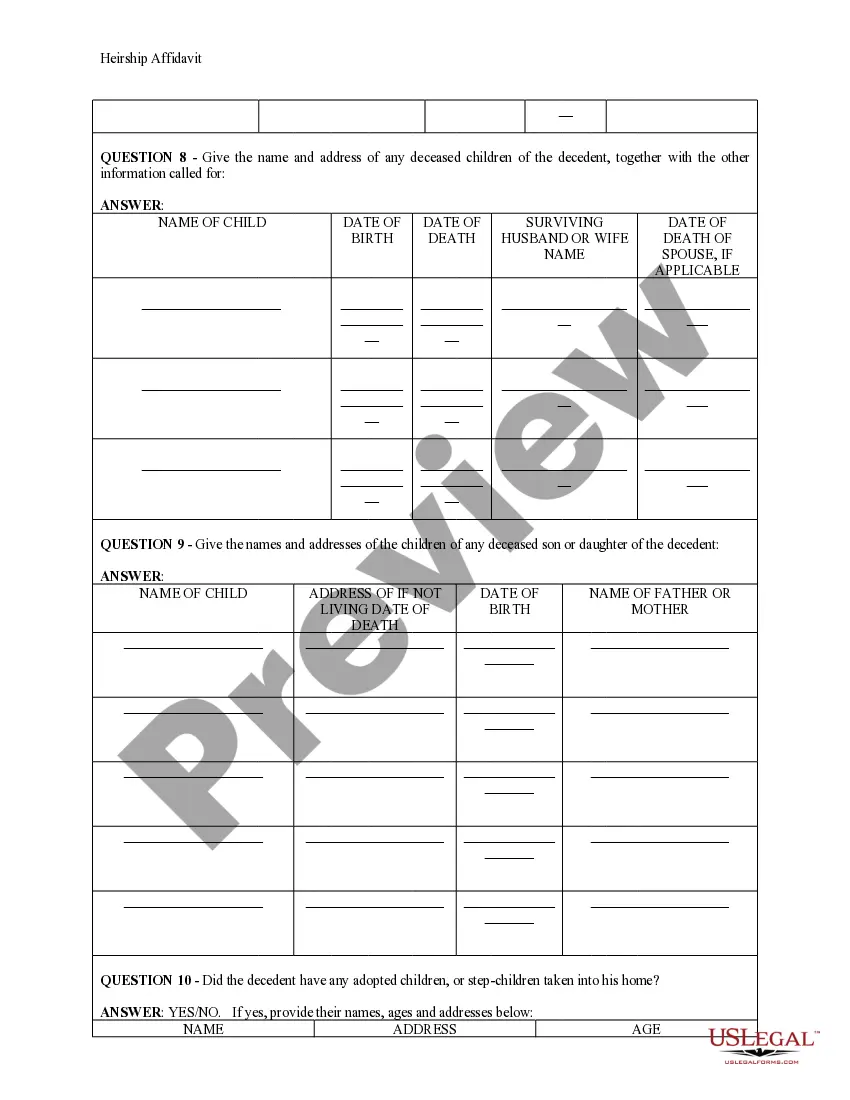

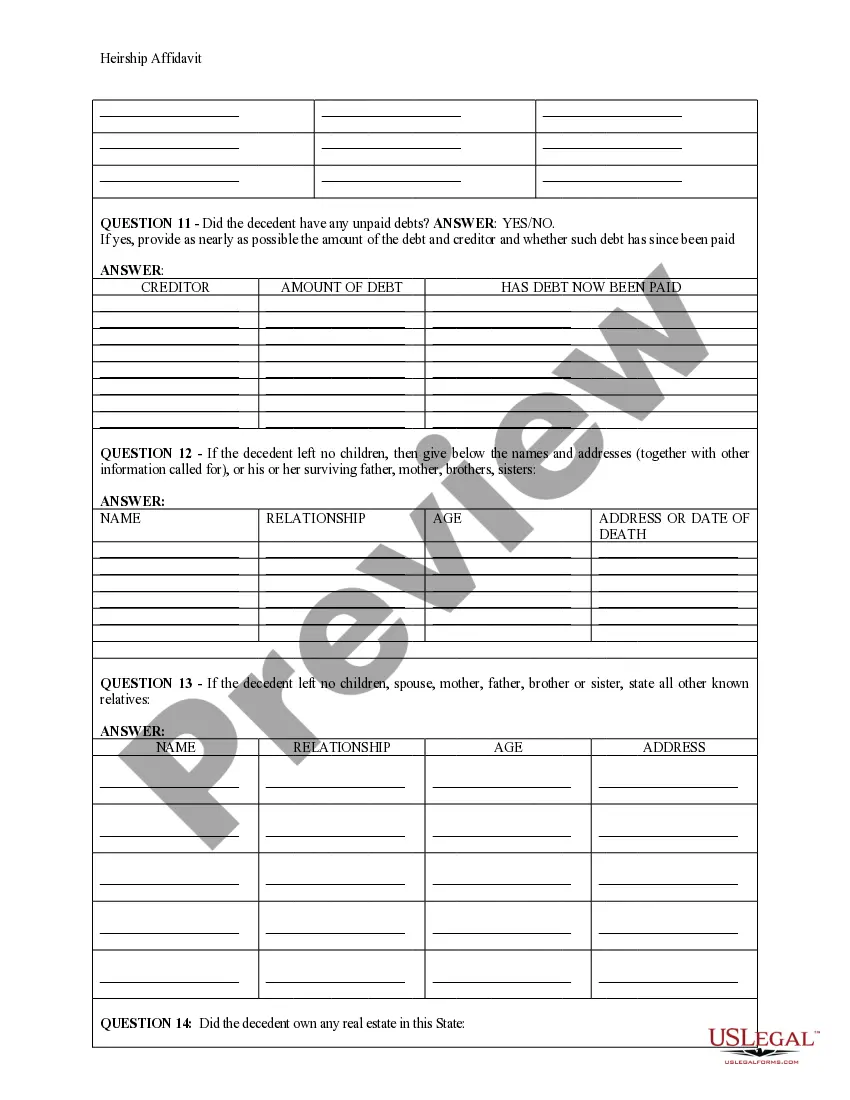

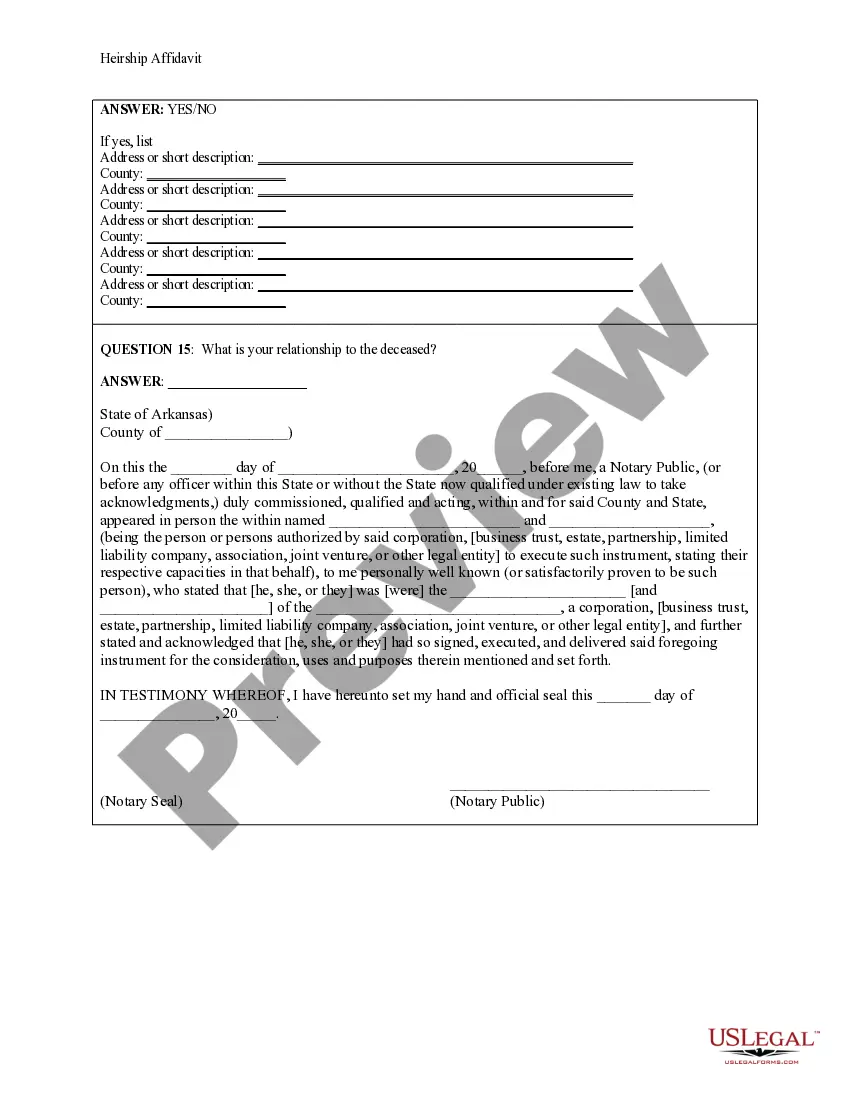

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Arkansas Determination Of Heirship Withholding Tax

Description

How to fill out Arkansas Heirship Affidavit - Descent?

Whether for business purposes or for personal matters, everybody has to handle legal situations at some point in their life. Completing legal papers demands careful attention, beginning from selecting the correct form template. For instance, when you choose a wrong edition of a Arkansas Determination Of Heirship Withholding Tax, it will be turned down once you submit it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

If you have to obtain a Arkansas Determination Of Heirship Withholding Tax template, stick to these simple steps:

- Get the template you need using the search field or catalog navigation.

- Look through the form’s information to ensure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search function to find the Arkansas Determination Of Heirship Withholding Tax sample you need.

- Get the file if it matches your needs.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Choose your payment method: use a bank card or PayPal account.

- Pick the document format you want and download the Arkansas Determination Of Heirship Withholding Tax.

- Once it is downloaded, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the right template across the internet. Use the library’s straightforward navigation to get the proper form for any occasion.

Form popularity

FAQ

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

To make the election, the pass-through entity must file Form AR1100PET (e-file) or AR 362PT (by mail). The election must be made by the due date or extended due date of the return. Once made, the election is in effect for the entity for each year until revoked.

While Arkansas has no inheritance tax, inheritance laws in other states may apply to you if you inherit money or assets from someone who lives in a state that does have an inheritance tax. Additionally, Arkansas also has no gift tax. The federal gift tax exclusion is $17,000 in 2023.

The amount withheld depends on: The amount of income earned and. Three types of information an employee gives to their employer on Form W?4, Employee's Withholding Allowance Certificate: Filing status: Either the single rate or the lower married rate.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W?4.