Administration In Deed

Description

How to fill out Arkansas Administrator's Deed Distributing Real Property To Beneficiaries Of Estate?

It’s clear that you can’t become a legal authority instantly, nor can you understand how to swiftly prepare Administration In Deed without possessing a specialized skill set.

Assembling legal documents is a lengthy endeavor necessitating particular education and expertise. So why not entrust the preparation of the Administration In Deed to the professionals.

With US Legal Forms, one of the most comprehensive legal template collections, you can access everything from court documents to templates for internal corporate correspondence.

You can regain access to your forms from the My documents tab at any time. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the intention behind your paperwork - whether financial and legal, or personal - our platform has you covered. Try US Legal Forms now!

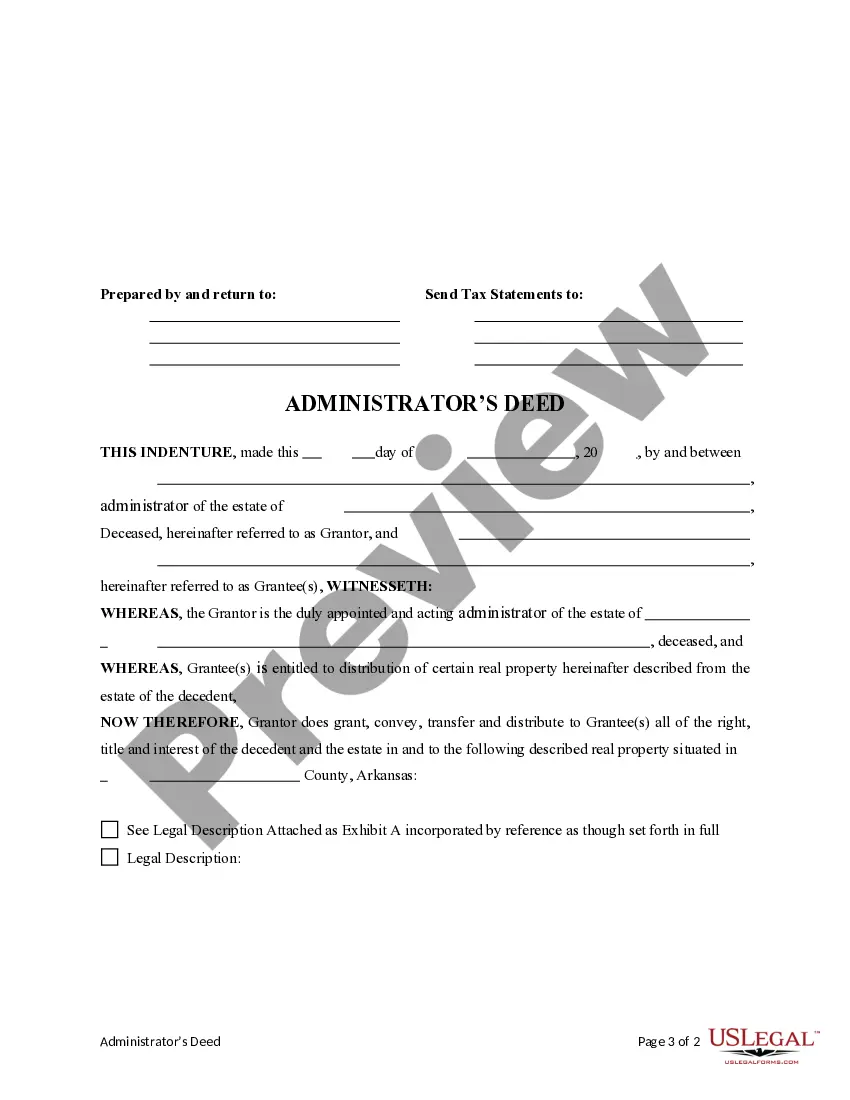

- Locate the form you require using the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain whether Administration In Deed is what you’re looking for.

- Initiate your search again if you need a different form.

- Create a free account and choose a subscription plan to purchase the template.

- Select Buy now. Once the payment processes, you can obtain the Administration In Deed, complete it, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

Although funeral and burial arrangements are usually made by family members, it is the executor who has the legal authority to make those decisions. Interestingly, directions contained in a Will as to the wishes of the deceased are not legally binding on an executor, although they are generally followed.

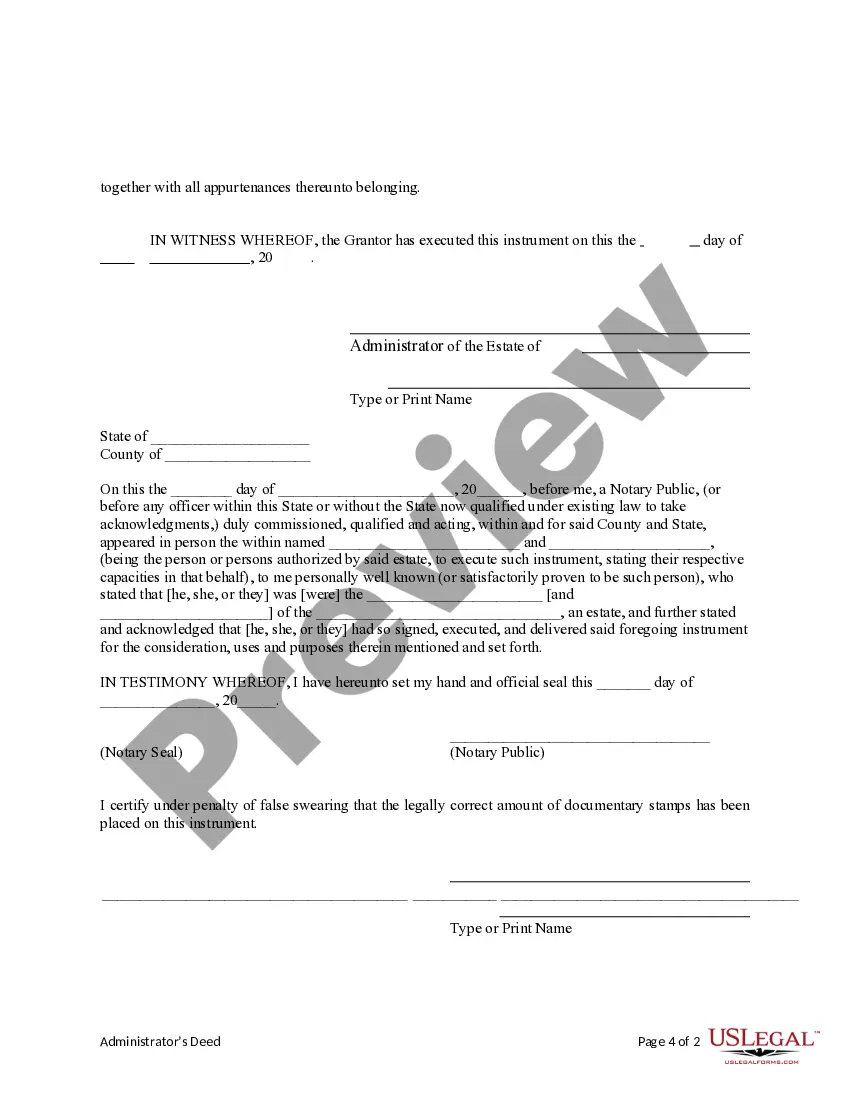

To administer the estate, the main tasks of a personal representative are to: identify the estate assets and liabilities. administer and manage the estate. satisfy the debts and obligations of the estate, and. distribute and account for the administration of the estate.

File the application in a probate registry of the Supreme Court of BC. To find the closest probate registry, you can contact Enquiry BC by calling 1-800-663-7867 (toll-free). When you file the application, you'll have to pay a court filing fee. The fee is currently $200.

Estate administration involves gathering the assets of the estate, paying the decedent's debts, filing tax returns, and distributing the remaining assets to beneficiaries.

Finally, an executor has the power to distribute what remains of the estate to the beneficiaries. However, the executor cannot independently decide how the estate is distributed. They must follow the instructions in the will or the succession laws of the relevant jurisdiction.