Transfer Death Tod For Life

Description

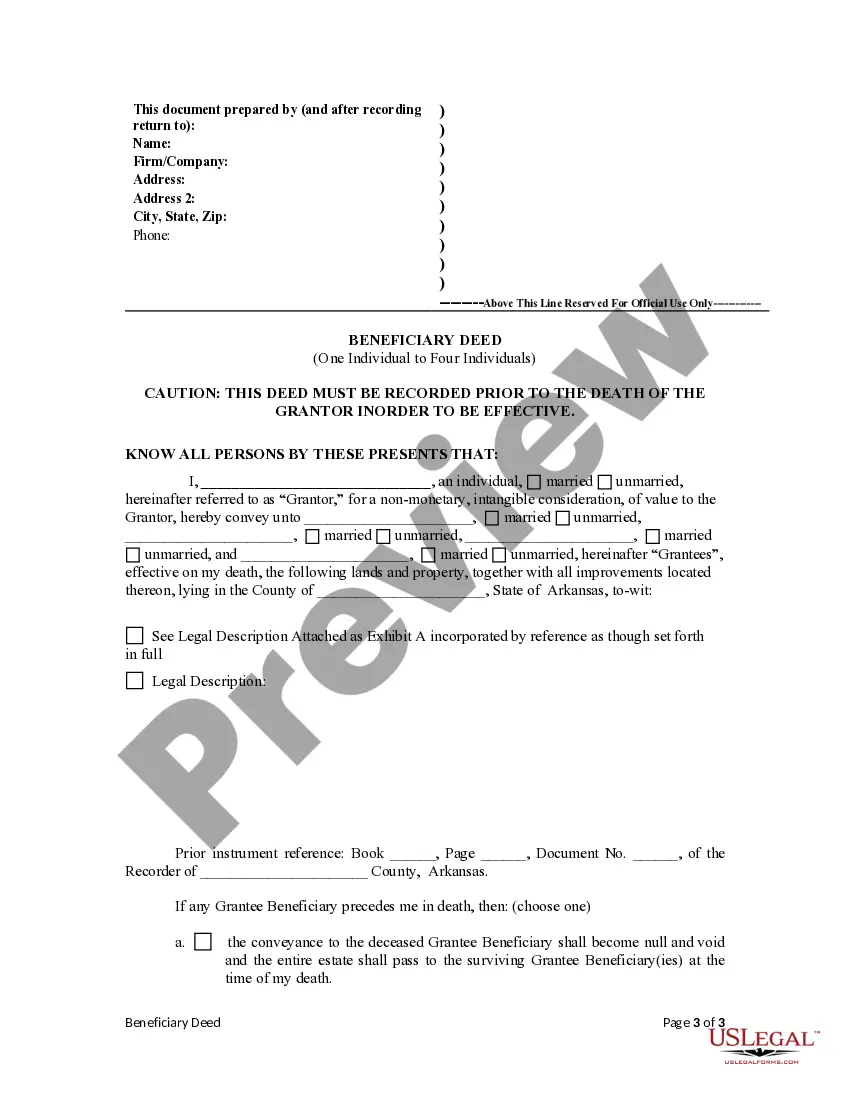

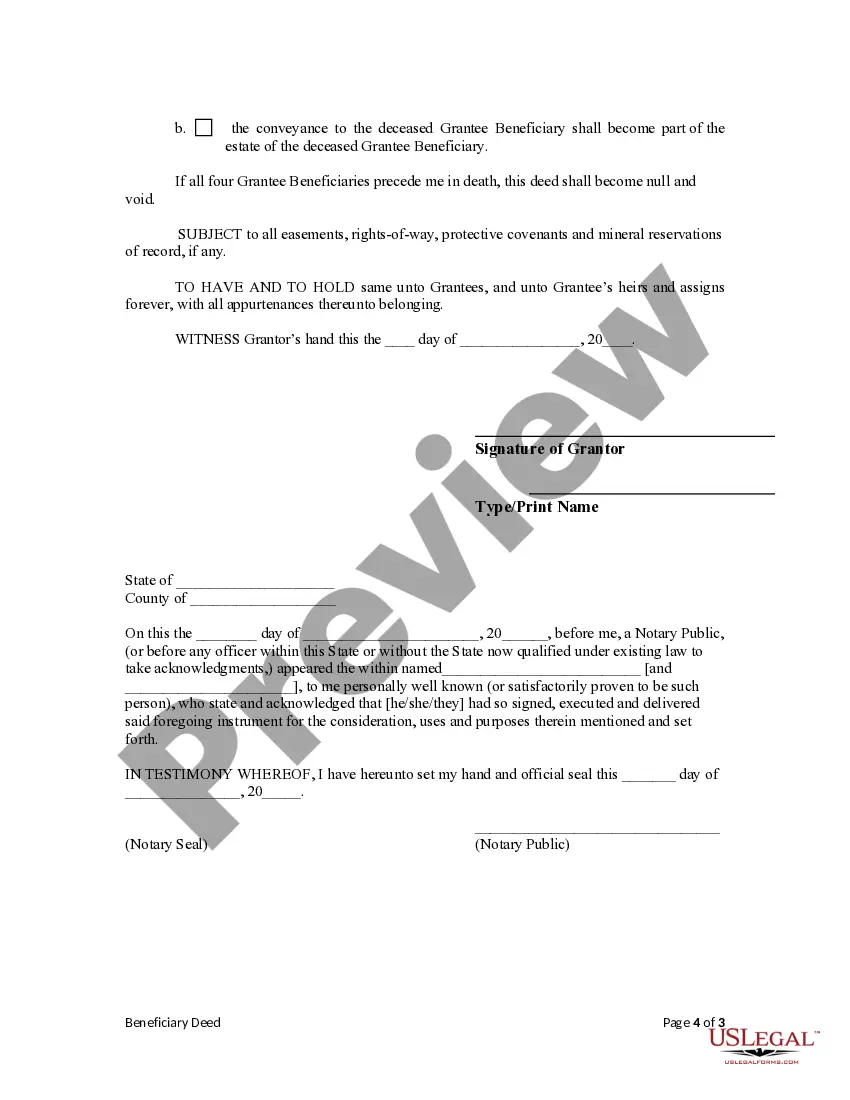

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Four Individuals?

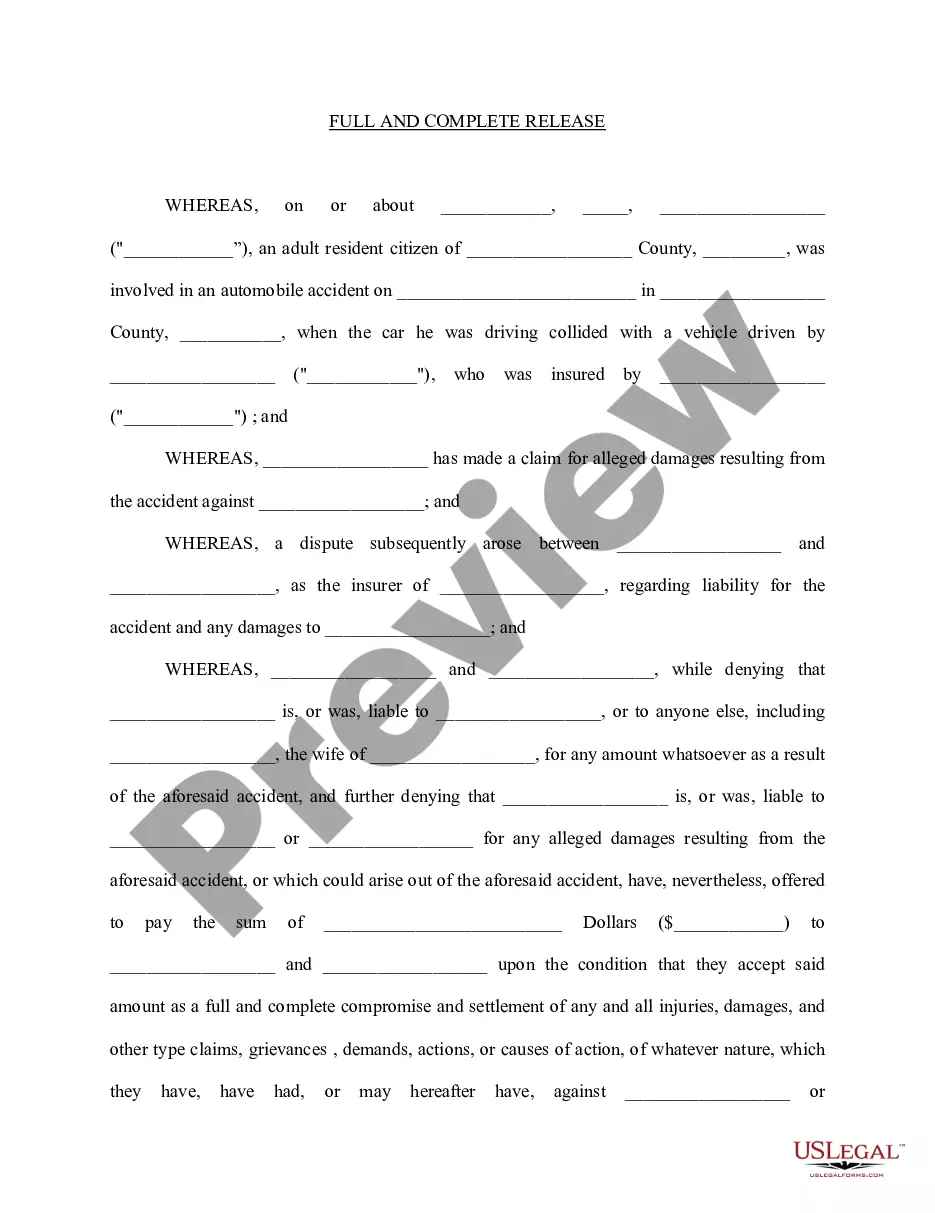

- If you are a returning user, log in to your account on the US Legal Forms website and click the Download button for your chosen template. Ensure your subscription is active, and if necessary, renew it under your payment plan.

- For first-time users, start by checking the Preview mode and reading the form description carefully to verify that it corresponds with your requirements and complies with local jurisdiction laws.

- If the form doesn't meet your needs, utilize the Search tab to find an alternative template that suits your situation.

- Once you have identified the correct document, click on the Buy Now button and select your desired subscription plan. You will need to register an account to access the complete library.

- Complete your transaction by entering your payment information or using your PayPal account to finalize the subscription.

- Finally, download the form to your device and access it anytime via the My Forms menu on your profile for eventual completion.

US Legal Forms not only provides a robust collection of over 85,000 legal templates but also connects users with premium experts for precise assistance, ensuring your legal documents are expertly crafted and valid.

Start your journey to secure your estate today. Explore the benefits of US Legal Forms and empower your legal processes!

Form popularity

FAQ

A transfer on death deed can limit your control over the property. Once you designate a beneficiary, you cannot enforce changes to that beneficiary via your will. Additionally, if the beneficiary is unable or unwilling to take ownership after your passing, the property could become a burden. Considering these potential issues is essential when opting for a transfer death Tod for life, and using UsLegalForms can help guide you through this process.

While a Transfer on Death (Tod) deed offers simplicity, it does have drawbacks. One significant issue arises if the property owner has outstanding debts; creditors may still claim the property after death. Moreover, if there are multiple heirs, disputes may occur regarding the distribution. Therefore, it’s critical to weigh these factors when considering a transfer death Tod for life.

Transfer on death (TOD) accounts can be an excellent choice for a smooth and efficient transfer of assets. They eliminate probate and reduce delays, making it easier for beneficiaries to access funds. However, it's essential to review your financial situation and consult professionals when considering a TOD to ensure it aligns with your overall estate planning goals. For comprehensive assistance, consider platforms like USLegalForms to help navigate this process.

While a transfer on death (TOD) account offers many advantages, there are some potential disadvantages to consider. One concern is that a TOD account may not account for changes in family dynamics or intentions since it only allows beneficiary designations for the designated individual. Additionally, it does not provide the same level of control or terms that other estate planning tools may offer, such as trusts.

A transfer on death (TOD) refers to a legal arrangement where the account holder designates a beneficiary to receive assets automatically upon their death. This process allows for immediate transfer of ownership without the need for probate proceedings, making it an efficient means of estate management. Using a TOD can significantly simplify the transition of assets, ensuring your wishes are respected after you're gone.

In general, the beneficiary of a transfer on death (TOD) account is responsible for any taxes that may arise from the assets transferred. When the account holder passes away, the assets are transferred directly to the beneficiary, and they need to report any income generated from those assets. Engaging legal or tax expertise can provide clarity on potential tax obligations related to TOD accounts.

A transfer on death (TOD) account does not inherently avoid inheritance tax, as tax obligations can vary by state and individual circumstances. However, because TOD accounts bypass probate, they can streamline the process and potentially lessen the tax burden for heirs. It is always advisable to consult with a tax professional or legal advisor to understand the specific implications for your estate and beneficiaries.

A transfer on death (TOD) account specifically transfers ownership of financial assets upon the owner’s death to a designated beneficiary, ensuring a quick and straightforward transfer without probate. In contrast, a beneficiary designation is a broader term that can apply to various types of accounts or policies, such as life insurance or retirement accounts. Therefore, while all TOD accounts name beneficiaries, not all beneficiaries are necessarily linked to a TOD request.

When considering how to transfer assets after death, many people ask whether a transfer on death (TOD) designation or a beneficiary designation is better. A TOD account allows assets to pass directly to the named beneficiary, thus avoiding probate. On the other hand, a beneficiary designation may be more flexible, as it can apply to various asset types. Ultimately, the decision may depend on your specific financial situation and goals.

While you do not necessarily need a lawyer to create a TOD deed, consulting with one can provide valuable guidance. A lawyer can help ensure the deed complies with laws and protects your interests fully. On the other hand, if you prefer a DIY approach, platforms like USLegalForms offer user-friendly tools to assist you in drafting a proper Transfer Death TOD for life without professional assistance.