Arkansas Transfer Deed Without Consideration

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Four Individuals?

Creating legal documents from the ground up can frequently feel a bit daunting.

Some situations may entail hours of investigation and significant financial expenditure.

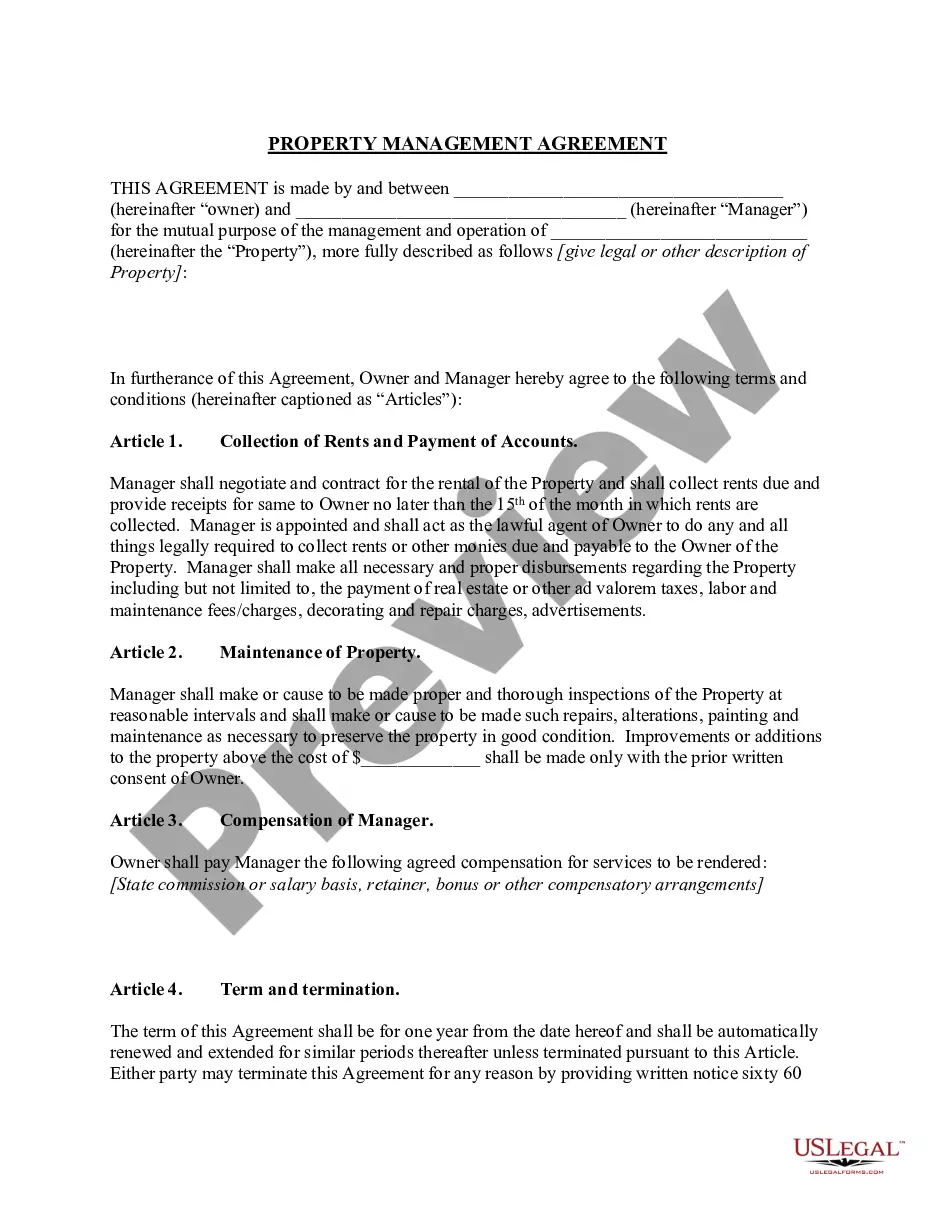

If you are searching for a simpler and more economical method of drafting the Arkansas Transfer Deed Without Consideration or any other paperwork without unnecessary complications, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal concerns.

However, before you rush to download the Arkansas Transfer Deed Without Consideration, consider these tips: Review the form preview and details to confirm that you are on the correct document you seek. Ensure the form you select adheres to the regulations and laws of your state and county. Choose the most appropriate subscription option to purchase the Arkansas Transfer Deed Without Consideration. Download the document, then complete, validate, and print it. US Legal Forms has a flawless track record and over 25 years of expertise. Join us today and transform form filling into a straightforward and efficient process!

- With just a few clicks, you can promptly obtain state- and county-specific templates painstakingly assembled for you by our legal experts.

- Utilize our site whenever you require a dependable and trustworthy service through which you can conveniently locate and download the Arkansas Transfer Deed Without Consideration.

- If you’re already familiar with our platform and have previously registered an account with us, simply Log In to your account, select the document, and download it anytime or re-download it later in the My documents section.

- Not signed up yet? No problem. It takes hardly any time to create an account and browse the library.

Form popularity

FAQ

This is on the condition that no other chargeable consideration is given. If you get property as a gift, you won't pay Stamp Duty Land Tax as long as there's no outstanding mortgage on it. Do I need to pay tax or stamp duty on gifting a property to a family member? taxcare.org.uk ? do-i-need-to-pay-tax-or-stamp-d... taxcare.org.uk ? do-i-need-to-pay-tax-or-stamp-d...

Usually, a deed is executed for consideration, but this is not essential for a valid transfer. Moreover, even when consideration is given for the property, this point need not be mentioned in the deed.

As a matter of contract law, a deed must have consideration to be valid. Consideration is defined as something of value given for the deed. Usually the consideration is money, but it could be for services or anything of value.

Voluntary conveyance refers to an elective transfer of title from one individual to another without adequate consideration. Consideration refers to compensation which is expected in return for the property. Without it, the conveyor should be prepared to offer a legal explanation for the transfer.

It actually means that the property is being transferred via deed without money exchanging hands. However, not all no consideration deeds are exempt from transfer and recordation taxes.