Trust Deed With A Mortgage

Description

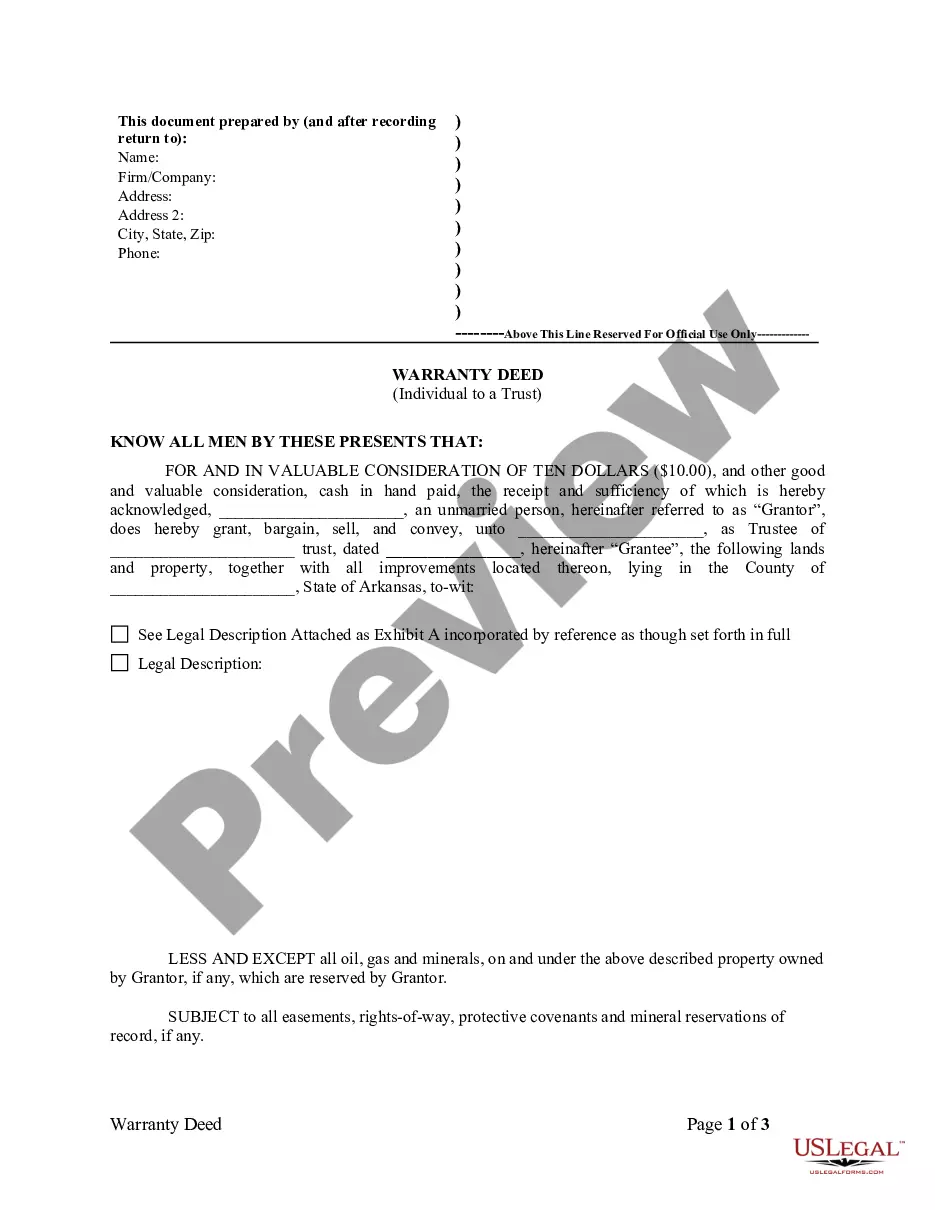

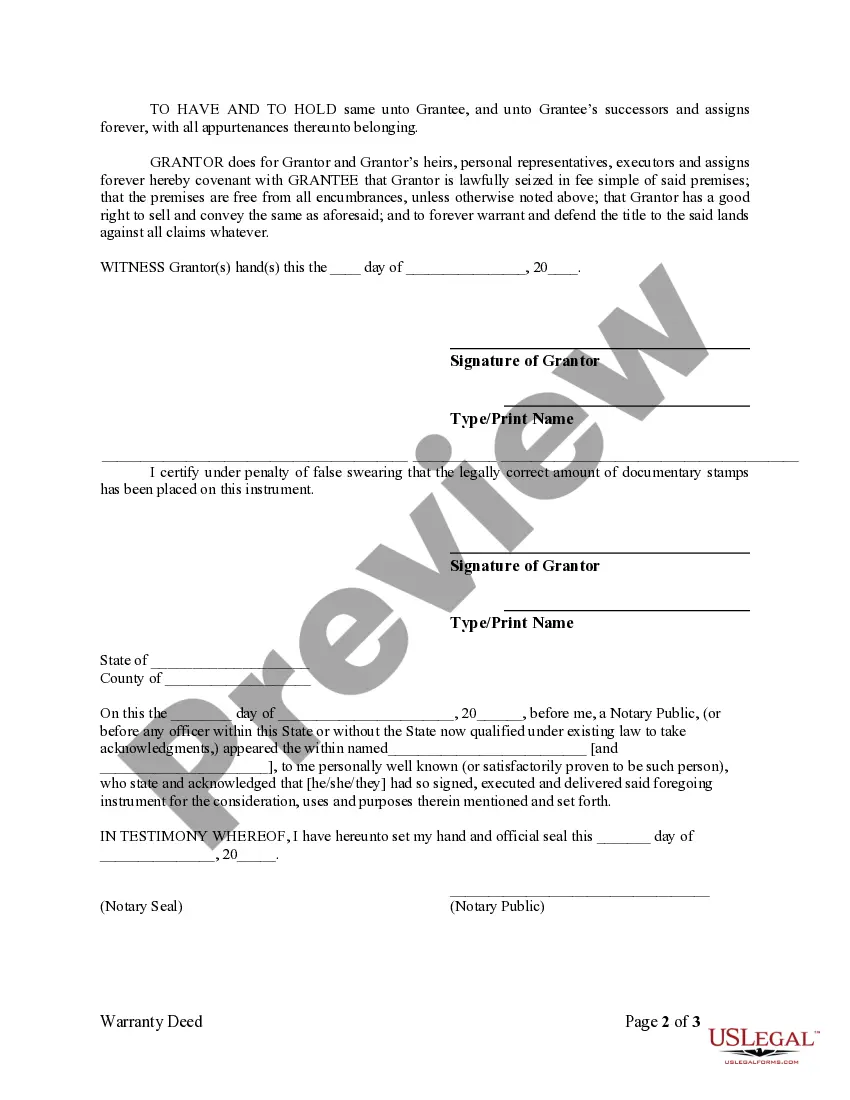

How to fill out Arkansas Warranty Deed From Individual To A Trust?

- Log into your US Legal Forms account if you are an existing user, ensuring your subscription is active. Download the desired form by clicking the Download button. If your subscription is expired, renew it according to your chosen payment plan.

- For first-time users, begin by checking the Preview mode and reading the form description to confirm it meets your needs and complies with local jurisdiction requirements.

- If you find that the current template isn't suitable, use the Search tab for alternatives that better fit your requirements.

- Once you’ve found the right form, click on the Buy Now button and select a subscription plan that works for you. You’ll need to register an account for access to the library.

- Complete your purchase by providing your credit card information or using PayPal for a smooth transaction.

- After your payment is processed, download the form to your device. You can access it later in the My Forms section of your profile when needed.

In conclusion, US Legal Forms greatly simplifies the process of acquiring legal documents like a trust deed with a mortgage, ensuring that you have access to high-quality templates and expert assistance.

Start your journey now by visiting US Legal Forms and find the template that suits you best!

Form popularity

FAQ

Using a deed of trust instead of a mortgage may offer advantages such as quicker foreclosure processes and more straightforward lending terms. Trust deeds with mortgages can provide clarity about the lender's rights and your obligations. This option can also simplify estate transfers compared to traditional mortgages. When considering this route, it’s always wise to consult with a professional for tailored advice.

You can indeed put a house in a trust while having an existing mortgage, including a trust deed with a mortgage. However, it's crucial to check your mortgage's terms for any restrictions. This action can provide significant benefits, such as estate planning advantages or simplifying property management. Always speak with a qualified expert to navigate this process effectively.

Yes, declaring a trust deed is often necessary, especially for legal and financial reasons. By properly declaring it, you ensure that your rights and the terms regarding your property are legally recognized. This step is particularly important in areas where trust deeds with mortgages are commonly used. For clarity, consulting a legal professional is recommended.

Yes, a house with a mortgage can be placed in a trust, including a trust deed with a mortgage. However, it's essential to notify your lender, as the terms of your mortgage may require it. This move can help in estate planning by allowing for a smoother transfer of ownership. Consulting with an expert can ensure compliance with legal requirements.

One disadvantage of a deed of trust is that it can lead to a more complicated foreclosure process. In a deed of trust with a mortgage, the lender has the right to sell the property without going through the court system, which can be alarming for borrowers. Additionally, the process may vary by state, making it harder to anticipate results. It is wise to consult a legal expert to understand your specific situation.

In the U.S., various states use either mortgages or deeds of trust, depending on local laws. For instance, states like California and Texas primarily use deeds of trust, while others, including Florida and New York, utilize traditional mortgages. Understanding the difference can help in your real estate dealings, especially when considering a trust deed with a mortgage. Always consult local regulations to ensure compliance.

To obtain a trust deed, you typically work with a real estate attorney or a title company. They can help draft the necessary paperwork while ensuring all legal requirements are met. You may also want to explore resources offered by platforms like USLegalForms, which can guide you through creating a trust deed with a mortgage step-by-step. Taking these steps helps ensure your transaction proceeds smoothly.

Lenders often prefer a deed of trust because it simplifies the foreclosure process. With a trust deed, a trustee can handle foreclosures more efficiently, allowing for quicker recoveries of outstanding debts. Additionally, a trust deed with a mortgage offers convenient options for both lenders and borrowers. Therefore, understanding the differences can be beneficial.

Not all mortgages include a deed of trust. Some states utilize a deed of trust instead of a traditional mortgage. This deed acts as a security instrument that provides the lender the right to foreclose in case of default. Understanding your specific situation is crucial in determining whether a trust deed with a mortgage applies to you.

Yes, a house with a mortgage can be placed in a trust. However, you need to ensure you notify your mortgage lender about this action. Additionally, it's important to understand that the trust will need to hold the mortgage responsibility. Utilizing a trust deed with a mortgage can provide several benefits, including estate planning advantages.