Starting An Llc In Arkansas Without An Llc

Description

How to fill out Arkansas Limited Liability Company LLC Formation Package?

Creating legal documents from the ground up can frequently be daunting.

Certain circumstances may necessitate numerous hours of investigation and substantial financial expenditure.

If you're seeking a more straightforward and economical method of drafting Starting An Llc In Arkansas Without An Llc or any other paperwork without the hassle of navigating obstacles, US Legal Forms is perpetually accessible to you.

Our web-based repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

However, prior to proceeding directly to downloading Starting An Llc In Arkansas Without An Llc, adhere to these guidelines: Review the document preview and details to ensure that you are on the specific document you seek. Verify if the template you select meets the stipulations of your state and county. Opt for the proper subscription plan to obtain the Starting An Llc In Arkansas Without An Llc. Download the form, then complete, sign, and print it out. US Legal Forms enjoys an impeccable standing and over 25 years of expertise. Join us today and revolutionize document completion into an easy and efficient process!

- With merely a few clicks, you can quickly obtain state- and county-compliant templates meticulously prepared for you by our legal professionals.

- Utilize our platform whenever you require reliable and dependable services through which you can effortlessly find and download the Starting An Llc In Arkansas Without An Llc.

- If you’re familiar with our offerings and have previously set up an account with us, just sign in to your account, find the form, and download it right away or re-download it at any point in the My documents section.

- Not registered yet? No problem. Establishing your account takes mere minutes and allows you to explore the catalog.

Form popularity

FAQ

The individual member should report the single member LLC's income and deductions on a Federal Schedule C included with their individual income tax return. All resident and non-resident partners, including corporations, must report and pay taxes on any income derived from an Arkansas partnership.

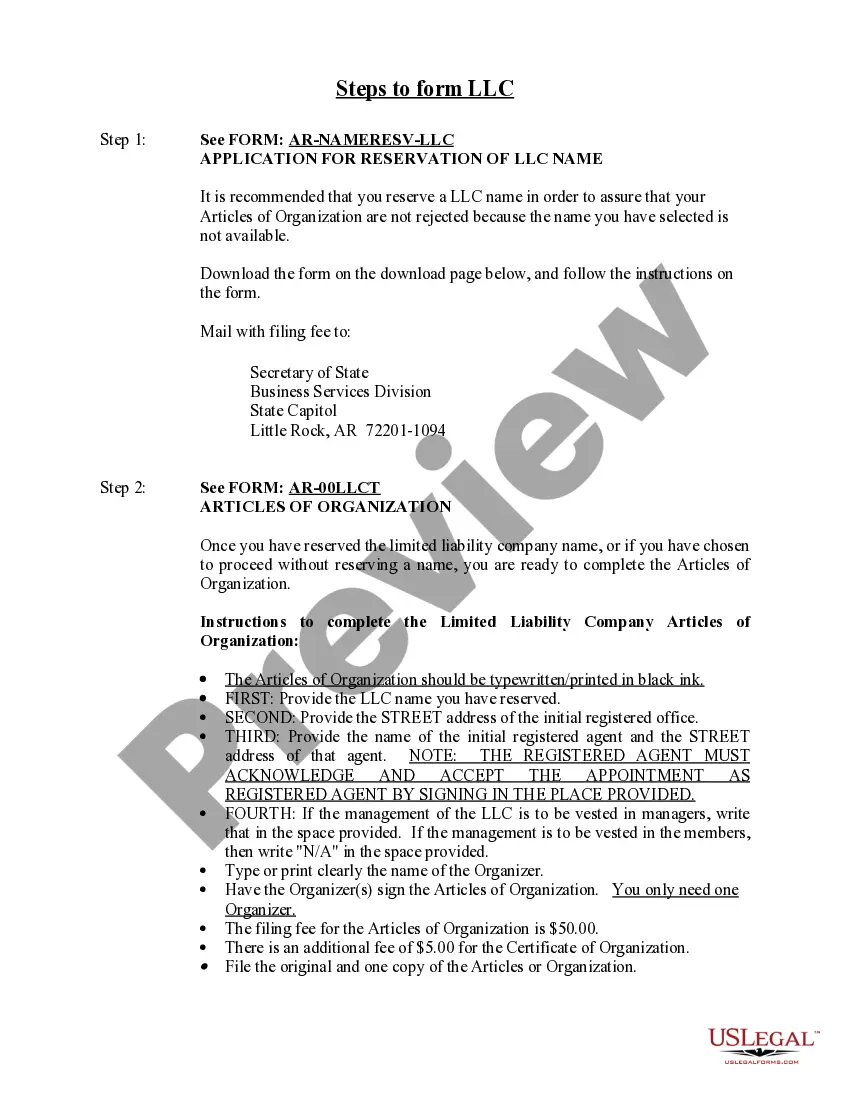

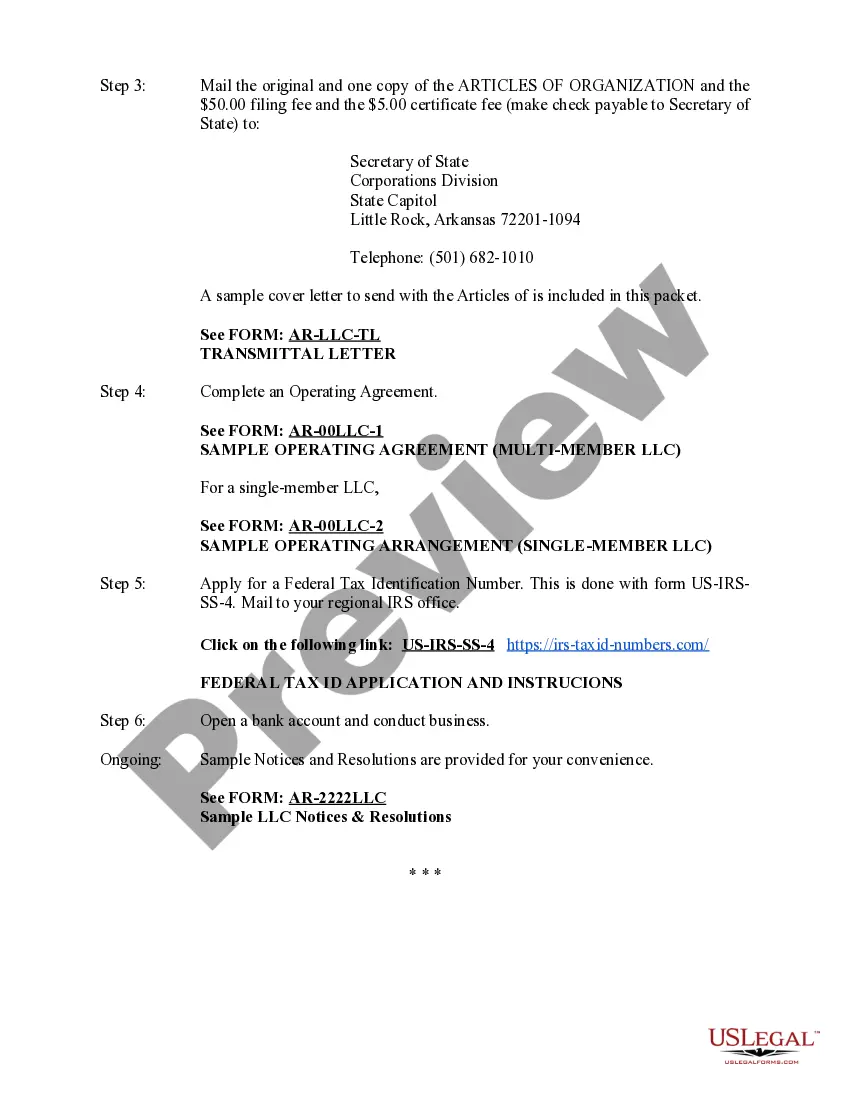

Starting an LLC in Arkansas will include the following steps: #1: Choose a Name for Your Arkansas LLC. #2: Hire a Registered Agent in Arkansas. #3: Request a Federal Employer Identification Number (EIN) #4: File Your Certificate of Organization. #5: Create an Operating Agreement. #6: Fulfill Your Ongoing Obligations.

Overall, a limited liability company offers more protection in terms of personal liability protection than sole proprietorships?one of the major benefits of this business type. In an LLC, the owner is only personally liable up to the amount of money they've invested in the LLC.

Yes, you can be your own registered agent in Arkansas. With that said, however, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

Differences between LLC and sole proprietorship The most significant difference is whether you have limited liability for the business' debts and obligations, as with an LLC, or whether the business' liabilities and obligations fall to you personally in the event of a lawsuit or debt collection.