Arkansas Foreign Llc Registration Without Llc

Description

How to fill out Arkansas Registration Of Foreign Corporation?

It’s clear that you cannot instantly become a legal expert, nor can you understand how to swiftly prepare Arkansas Foreign LLC Registration Without LLC without possessing a specialized skill set.

Drafting legal documents is a lengthy task that demands specific training and expertise. So why not entrust the preparation of the Arkansas Foreign LLC Registration Without LLC to the professionals.

With US Legal Forms, one of the largest legal document repositories, you can find everything from court filings to templates for internal corporate communication.

If you need a different form, restart your search.

Create a free account and select a subscription plan to purchase the form. Click Buy now. Once the payment is completed, you can download the Arkansas Foreign LLC Registration Without LLC, complete it, print it, and deliver it either by post or electronically to the appropriate individuals or entities.

- We recognize how crucial compliance and adherence to federal and state laws and regulations are.

- This is why, on our platform, all documents are location-specific and current.

- Here’s how you can begin using our platform and acquire the form you need in just a few minutes.

- Identify the document you require using the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to decide if the Arkansas Foreign LLC Registration Without LLC is what you’re looking for.

Form popularity

FAQ

An incorporator/organizer is the person responsible for filing the articles of incorporation or certificate of organization. The incorporator/organizer may or may not be an officer, shareholder or the registered agent. A.C.A. §4-27-201.

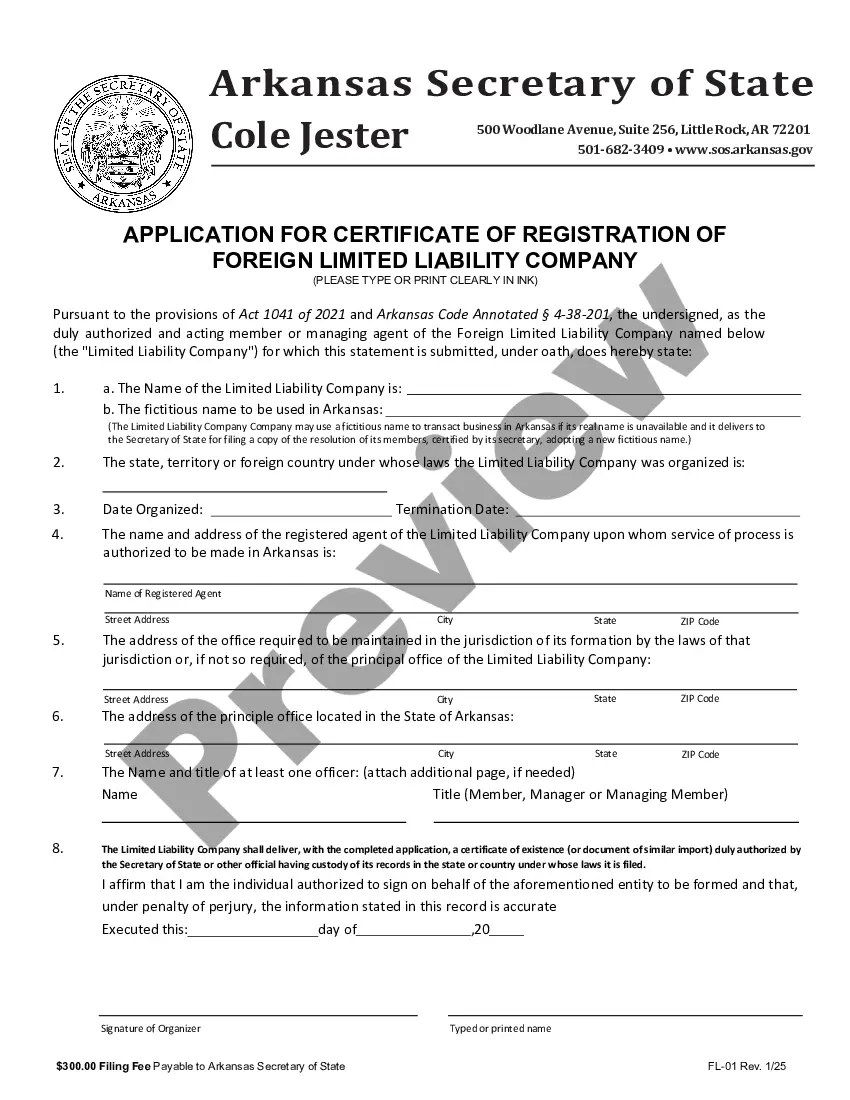

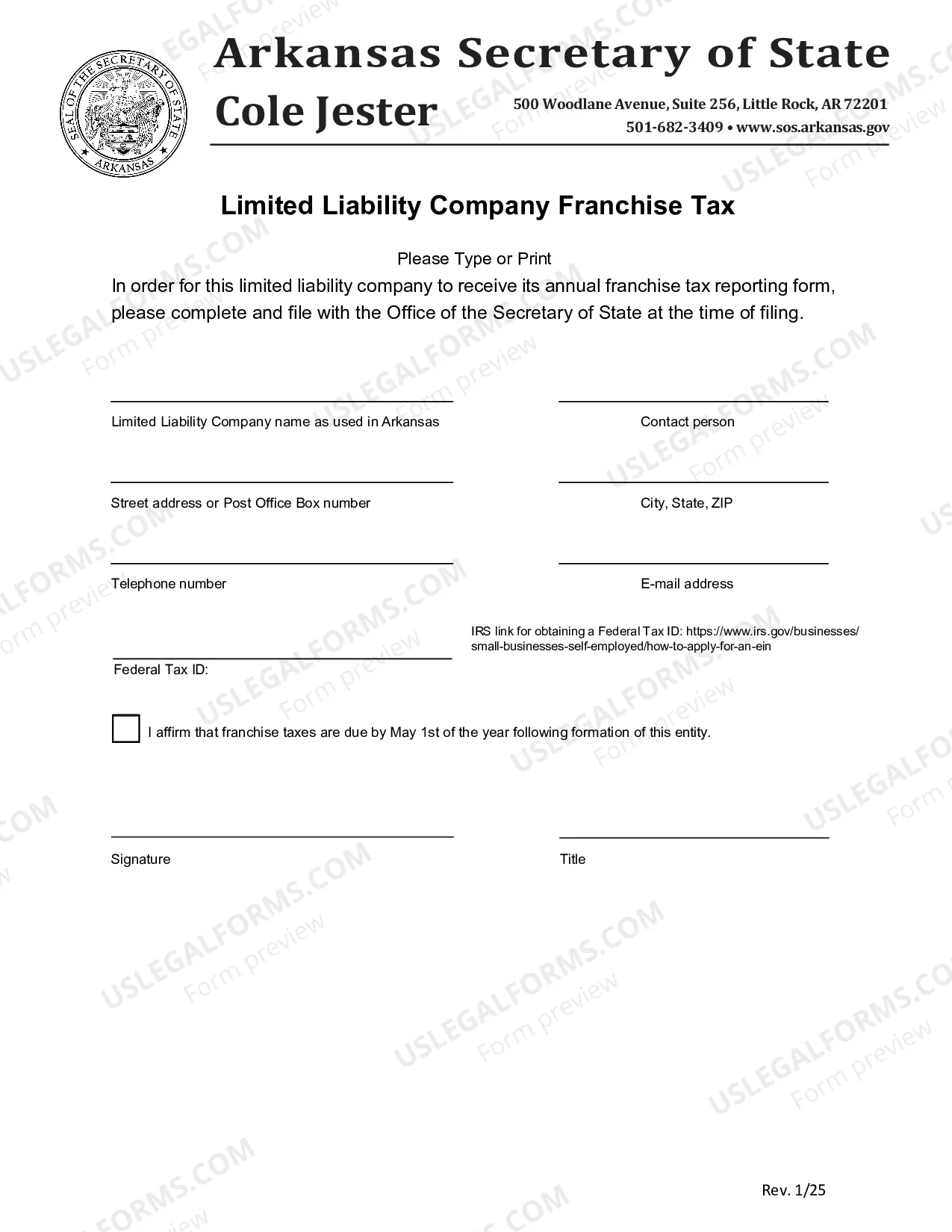

An Arkansas Foreign LLC is an LLC that does business in Arkansas but was formed in another state or jurisdiction. When a foreign LLC wants to do business in Arkansas, it must register with the Arkansas Secretary of State and pay the $300 state filing fee ($270 online).

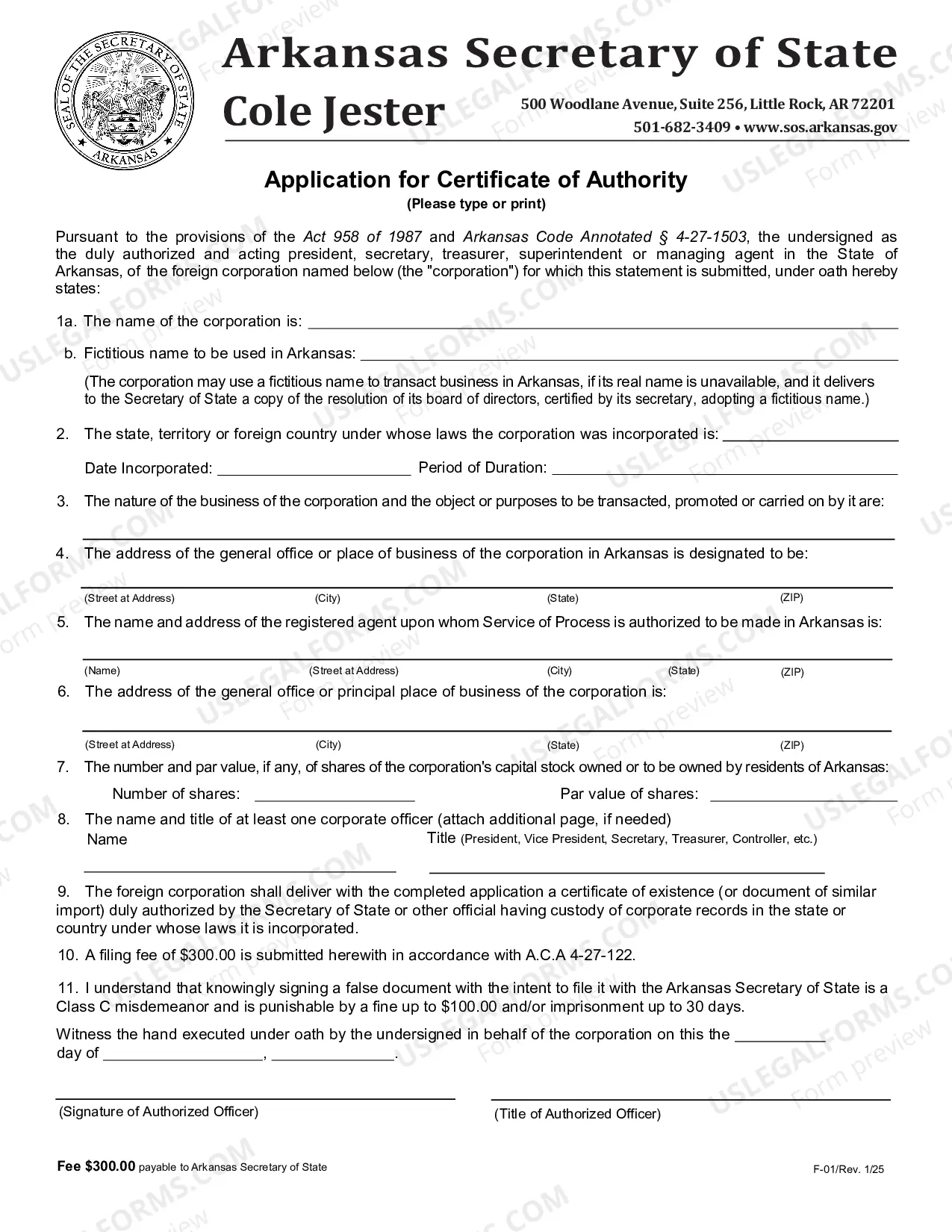

An ?Application for Certificate of Authority? is filed along with an original certificate of existence (?good standing?) from the ?home? state. The filing fee is $300.00 for business corporations and $300.00 for nonprofit corporations and can be filed online.

A foreign (out-of-state) LLC can be registered to do business in California by filing an Application to Register a Foreign LLC with the Secretary of State's office, along with a current Certificate of Good Standing, and paying all associated fees.

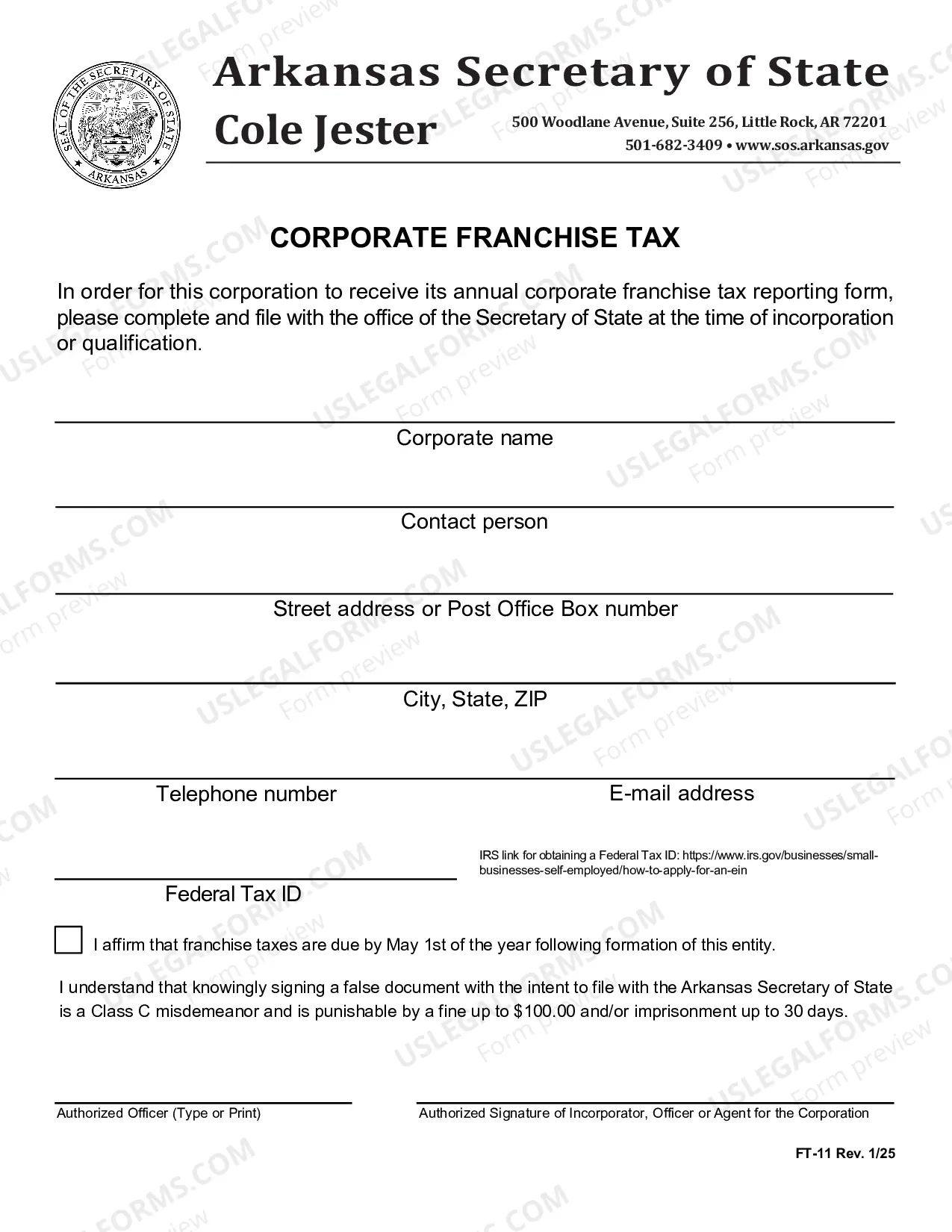

Failure to pay can result in the imposition of additional fees, penalties and interest, or even revocation of the authorization to do business. Franchise taxes continue to accrue, even for revoked businesses, until the business is dissolved, withdrawn, or merged.