Arkansas Purchase Real Foreman

Description

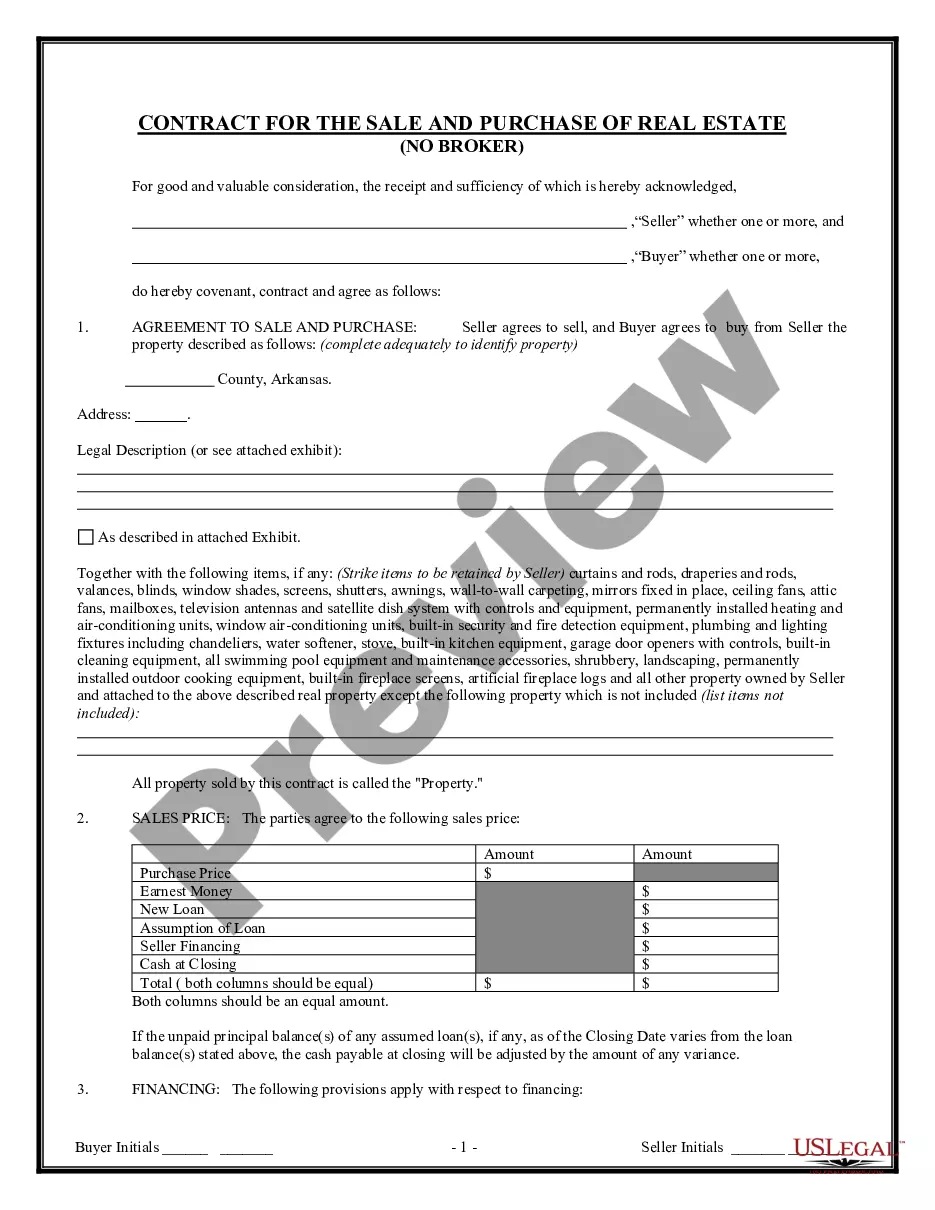

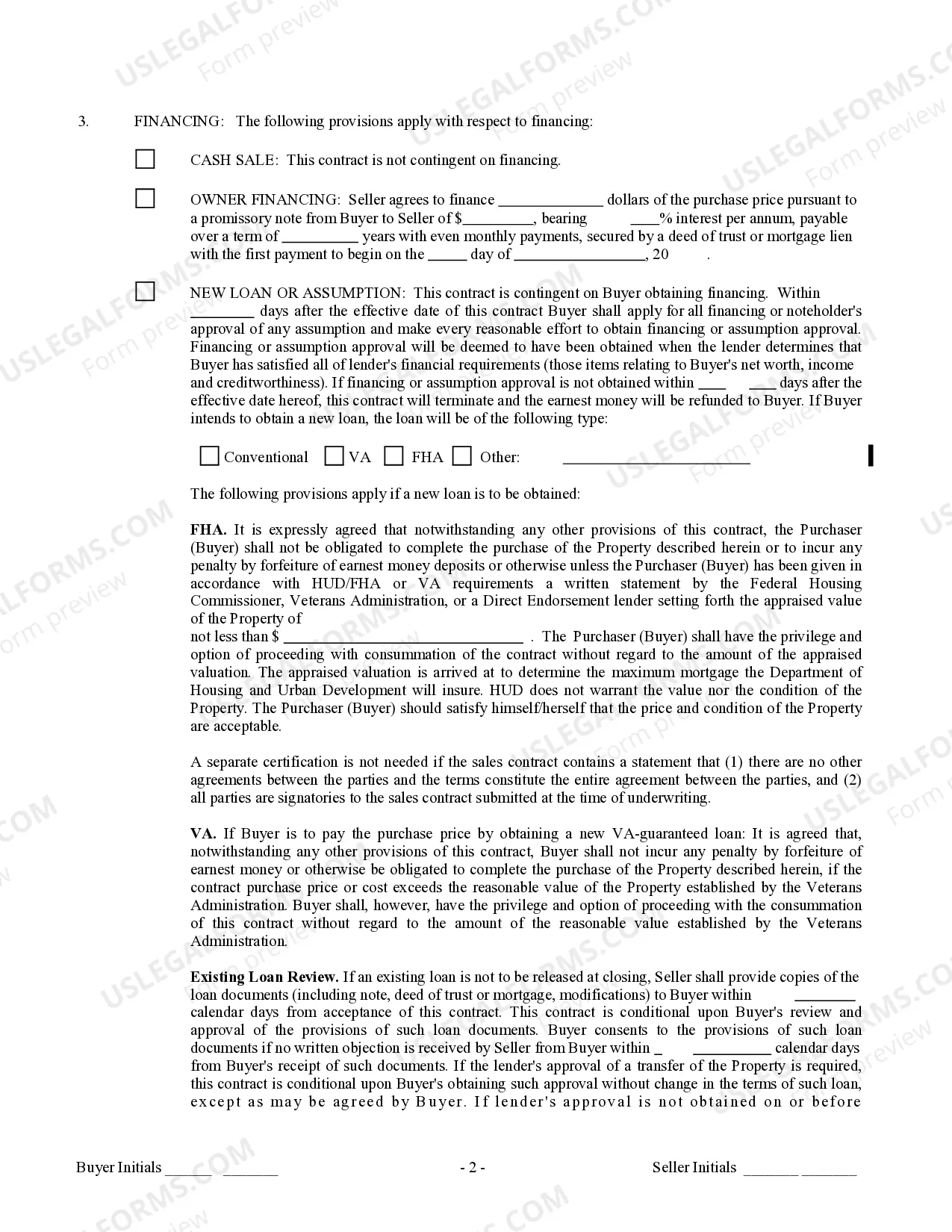

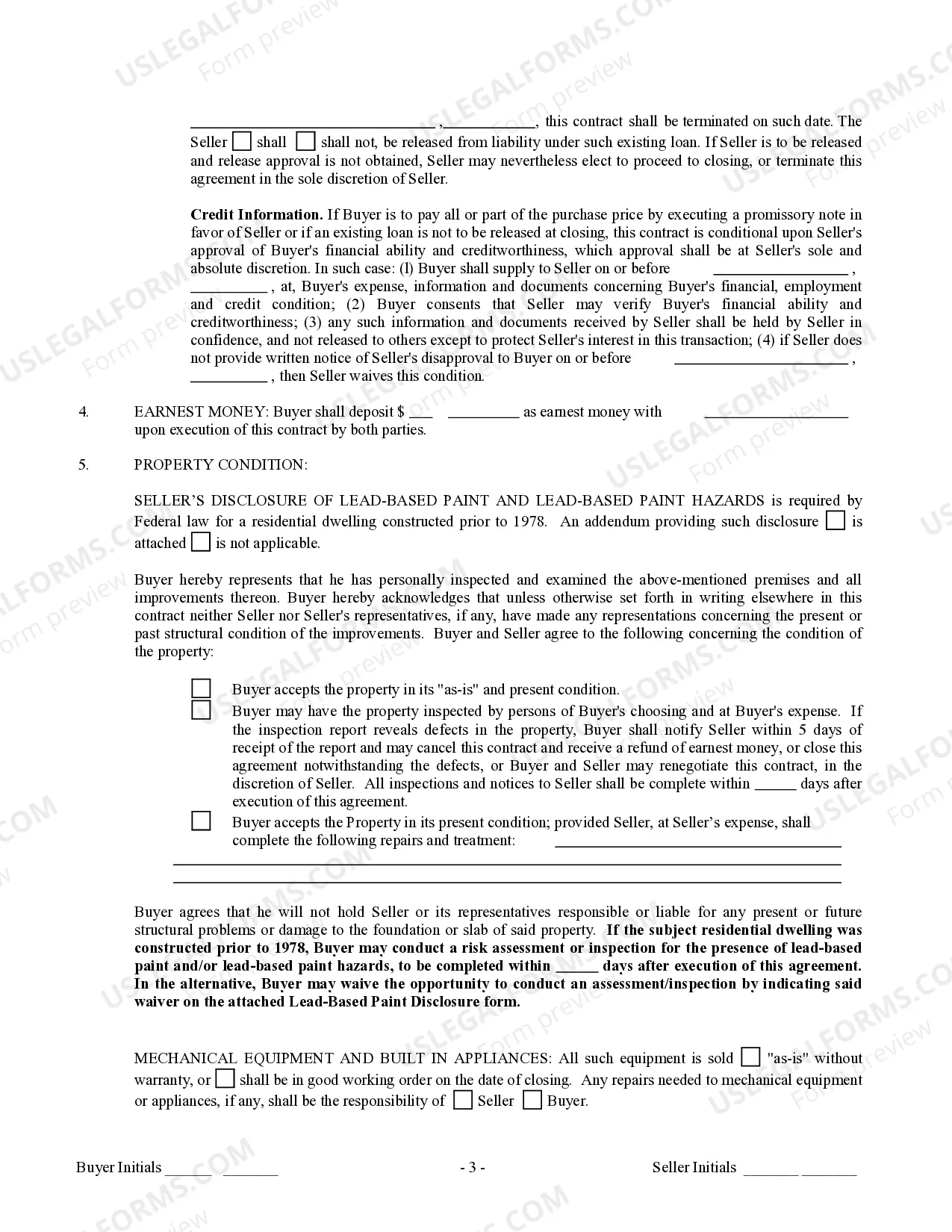

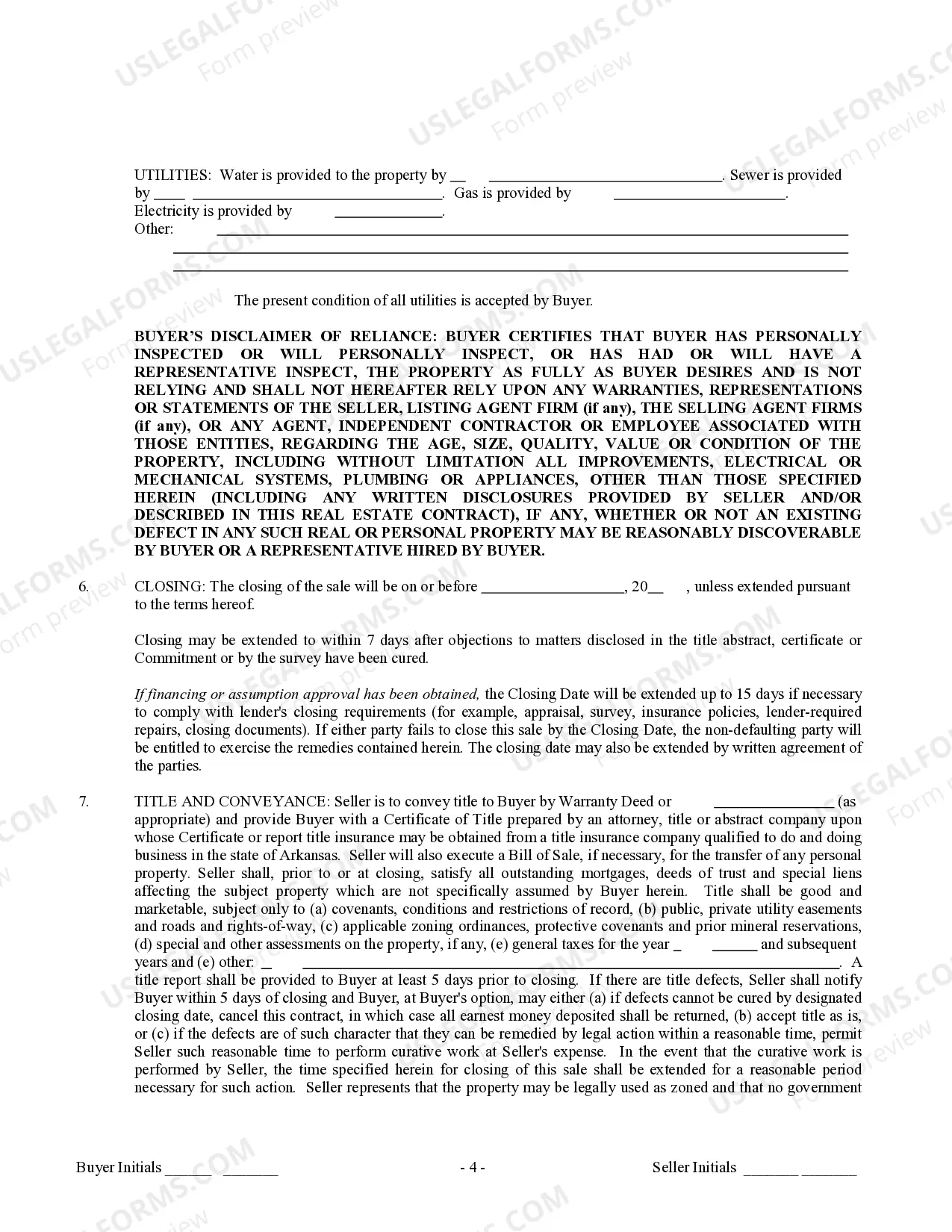

How to fill out Arkansas Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

The Arkansas Purchase Real Foreman you observe on this page is a versatile legal template crafted by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any professional and personal situation. It’s the fastest, easiest, and most reliable method to acquire the paperwork you require, as the service assures bank-level data protection and anti-malware safeguards.

Fill out and sign the documents. Print the template to complete it manually. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a valid signature. Download your documents again whenever necessary. Open the My documents tab in your profile to redownload any previously purchased templates. Sign up for US Legal Forms to have verified legal templates for all of life's situations at your fingertips.

- Search for the document you require and review it.

- Browse the example you looked for and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, use the search bar to find the right one. Click Buy Now once you’ve located the template you want.

- Register and Log In.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Arkansas Purchase Real Foreman (PDF, DOCX, RTF) and download the sample to your device.

Form popularity

FAQ

Arkansas Procurement Law gives agencies the discretion to purchase commodities and services that do not exceed the amount set in Ark. Code Ann. § 19-11-204(13)(A)(i), which is currently $20,000, without the need of formally soliciting bids or posting notice. 1 These are commonly called ?small procurements.?

(A) A cooperative purchasing agreement is limited to commodities and services for which the public procurement unit may realize savings or material economic value, or both.

Property taxes in Arkansas are lower than in most of the rest of the country. The majority of the state's counties have median annual property tax payments below $800. The statewide average effective property tax rate is 0.57%.

How much is sales tax in Arkansas? The base state sales tax rate in Arkansas is 6.5%. Local tax rates in Arkansas range from 0% to 5%, making the sales tax range in Arkansas 6.5% to 11.5%.

Option 1: Sign into your eFile.com account, modify your Return and download/print the AR Form AR1000F (residents) or AR1000NR (nonresidents and part-year residents) under My Account. Check the "Amended Return" box, sign the form, and mail it to one of the addresses listed below.