Deed Assignment Of Receivables

Description

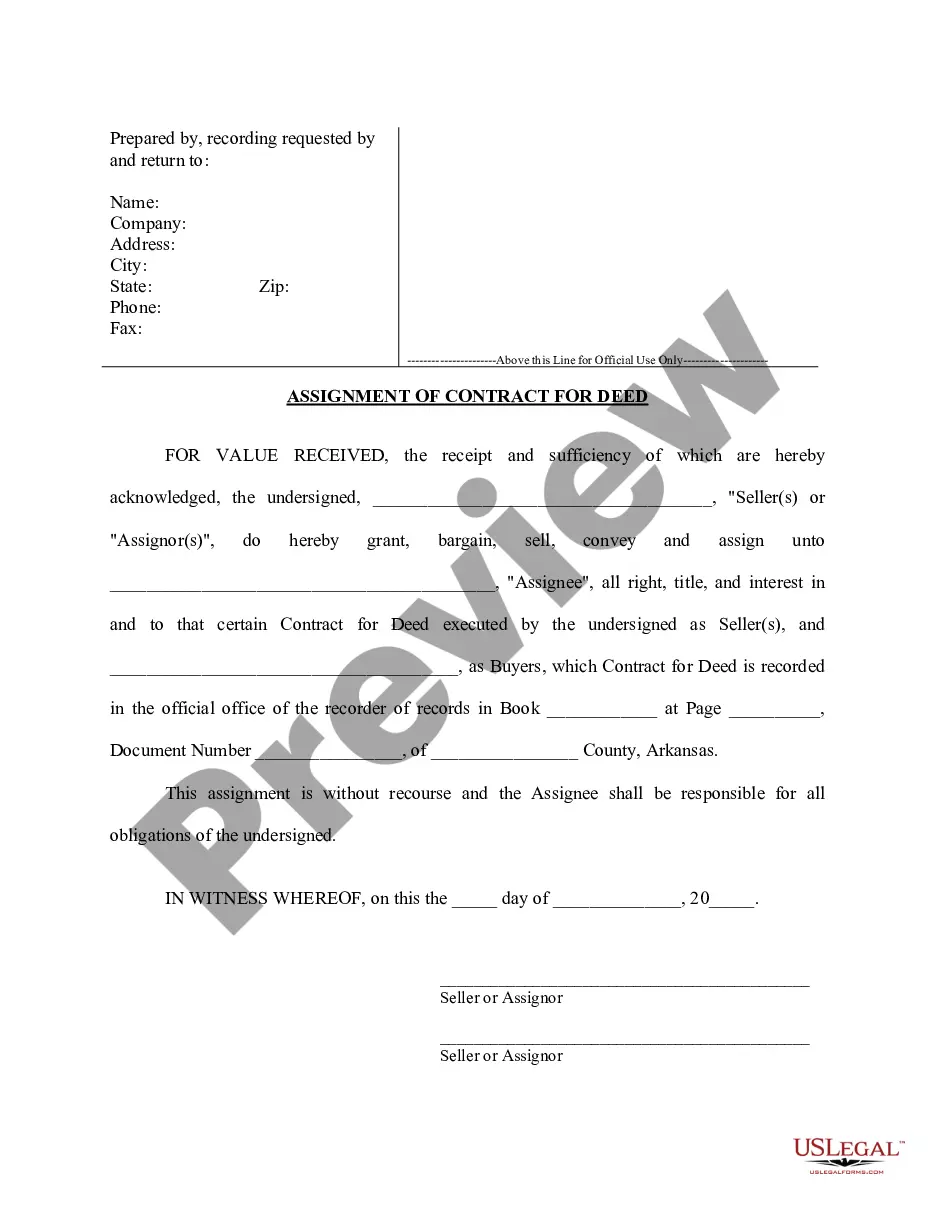

How to fill out Arkansas Assignment Of Contract For Deed By Seller?

Individuals typically link legal documentation with something complicated that only an expert can handle.

In a sense, this is accurate, as creating a Deed Assignment Of Receivables demands a considerable comprehension of subject matters, including state and county laws.

Nonetheless, with US Legal Forms, everything has become easier: readily-available legal templates for any life and business circumstance specific to state regulations are gathered in a single online database and are now accessible to everyone.

Print your document or upload it to an online editor for a faster completion. All templates in our collection are reusable: once buyed, they remain saved in your profile. You can access them whenever necessary through the My documents section. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and purpose, making it quick to find the Deed Assignment Of Receivables or any other specific template.

- Previously registered users with a valid subscription must Log In to their account and click Download to obtain the form.

- New users to the site will need to create an account and subscribe prior to downloading any documents.

- Here is the detailed process on how to get the Deed Assignment Of Receivables.

- Review the page content carefully to confirm it meets your requirements.

- Examine the form description or view it using the Preview option.

- Search for another template using the Search bar in the header if the first one does not fit your needs.

- Click Buy Now when you find the appropriate Deed Assignment Of Receivables.

- Pick a subscription plan that aligns with your needs and budget.

- Create an account or Log In to continue to the payment page.

- Complete the payment for your subscription through PayPal or with your credit card.

- Choose the format for your file and click Download.

Form popularity

FAQ

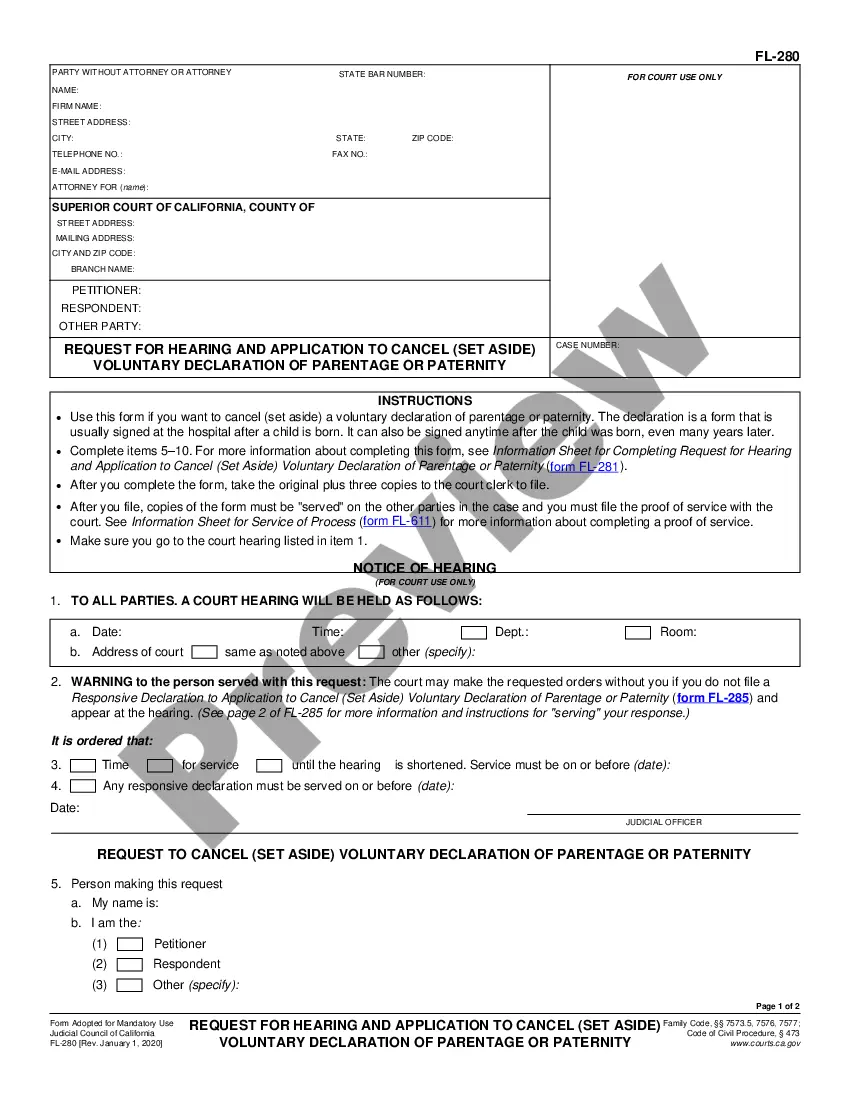

The consent to assignment of receivables is a requirement for transferring the right to collect payments, which ensures that the debtor acknowledges and agrees to the change. It is crucial for avoiding conflicts and providing a clear path for payment collection under the deed assignment of receivables. This consent protects all parties involved and maintains the integrity of the financial obligation.

The assignment of receivables refers to the process where a creditor transfers their rights to collect payments from a debtor to another party. This occurs through a deed assignment of receivables, allowing the new party to pursue payment. It can benefit both the original creditor, in terms of liquidity, and the new party, securing revenue streams. Knowing these processes can simplify your business transactions.

To assign accounts receivable, you should create and execute a deed assignment of receivables that outlines the specific accounts being assigned. Be sure to include all necessary details, such as the parties involved and the obligations of the debtor. After finalization, provide notice to the debtor to ensure they are aware of the assignment. Tools like US Legal Forms can guide you through each step.

To transfer receivables, you need to execute a deed assignment of receivables. This legally documents the transfer from one party to another, ensuring that the new owner has the right to collect. It's essential to provide notice to the debtor about the changing party. Using a platform like US Legal Forms can make this process smoother for you.

The main difference between factoring and assignment of accounts receivable lies in ownership. In factoring, a company sells its receivables to a third party and relinquishes ownership. Conversely, with the deed assignment of receivables, the company retains ownership but allows another party to collect on the accounts. Knowing this difference can help businesses choose the best financing option.

Factoring involves selling receivables to a third party at a discount, while assignment of receivables generally refers to a formal transfer of the right to collect. In factoring, the original business might not retain control over the collection process. Contrastingly, in an assignment of receivables, the original entity often remains responsible for customer relations until the debt is settled.

An assignment of receivables is a process where a business transfers its rights to collect payment on specific invoices to another entity. This transaction occurs to improve liquidity and support business operations. The deed assignment of receivables formalizes this transfer, ensuring that the assignee can legally collect the outstanding amounts.

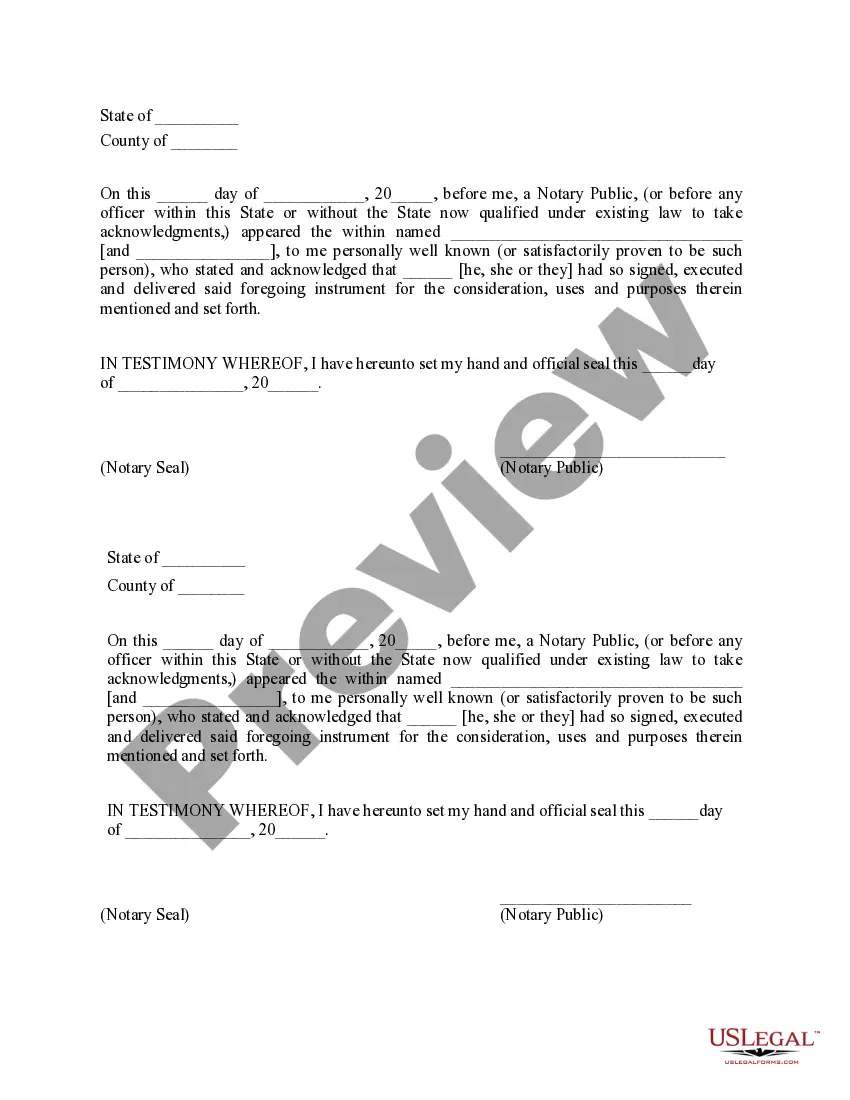

Drafting a deed of assignment involves outlining the key parties, the specifics of the receivables being assigned, and the terms of the assignment. Make sure to include both the assignor and assignee's details, along with a clear description of the receivables involved. Finally, include provisions such as payment terms and the responsibilities of both parties to create a comprehensive document.

Accounts receivable often include unpaid invoices for goods sold to customers and services rendered, awaiting payment. For example, a consulting firm may have accounts receivable from clients for services delivered in the previous month. Additionally, a retail store may have accounts receivable from its customers who purchased products on credit.

When executing a deed assignment of receivables, the journal entries typically involve debiting the accounts receivable and crediting a specific liability account. This reflects the transfer of receivables ownership to another party. Additionally, if there are any fees associated with the assignment, those should be recorded accordingly to maintain accurate financial reporting.