Odometer Disclosure Statement Arkansas Withholding Tax

Description

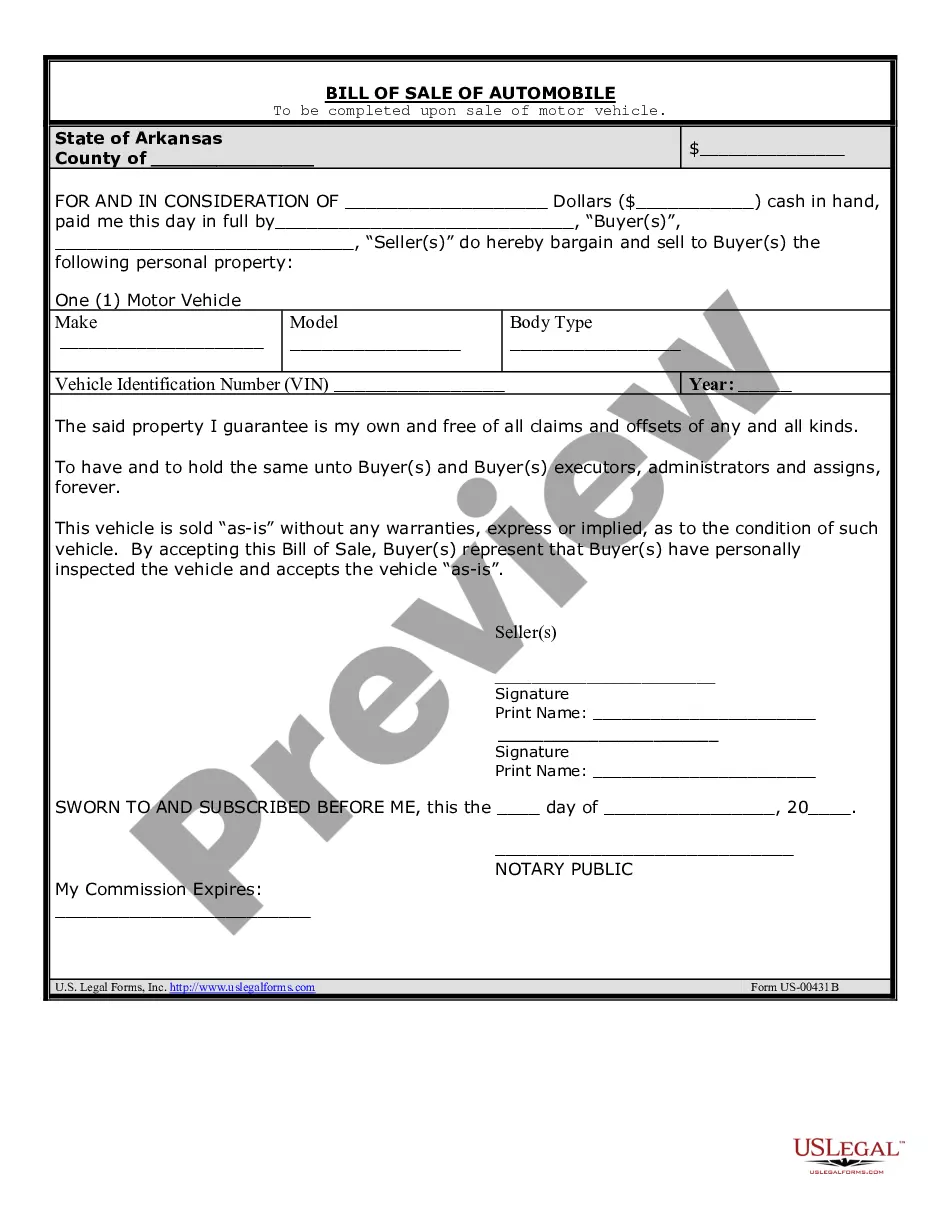

How to fill out Arkansas Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

The Odometer Disclosure Notification Arkansas Tax Withholding you see on this site is a versatile official format prepared by experienced attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 certified, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most reliable way to acquire the documentation you require, as the service guarantees bank-level data protection and anti-malware safeguards.

Re-download your documents again as needed. Access the My documents tab in your account to retrieve any previously purchased forms. Sign up for US Legal Forms to have authenticated legal templates for all of life's situations readily available.

- Search for the document you require and review it.

- Browse the template you found and preview it or read the form description to ensure it meets your requirements. If it doesn’t, utilize the search bar to find the suitable one. Click Buy Now once you have identified the template you need.

- Choose a subscription and Log In. Select the payment plan that fits you and create an account. Use PayPal or a credit card to complete a swift transaction. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template. Pick the format you desire for your Odometer Disclosure Notification Arkansas Tax Withholding (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the document. Print out the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a legally binding electronic signature.

Form popularity

FAQ

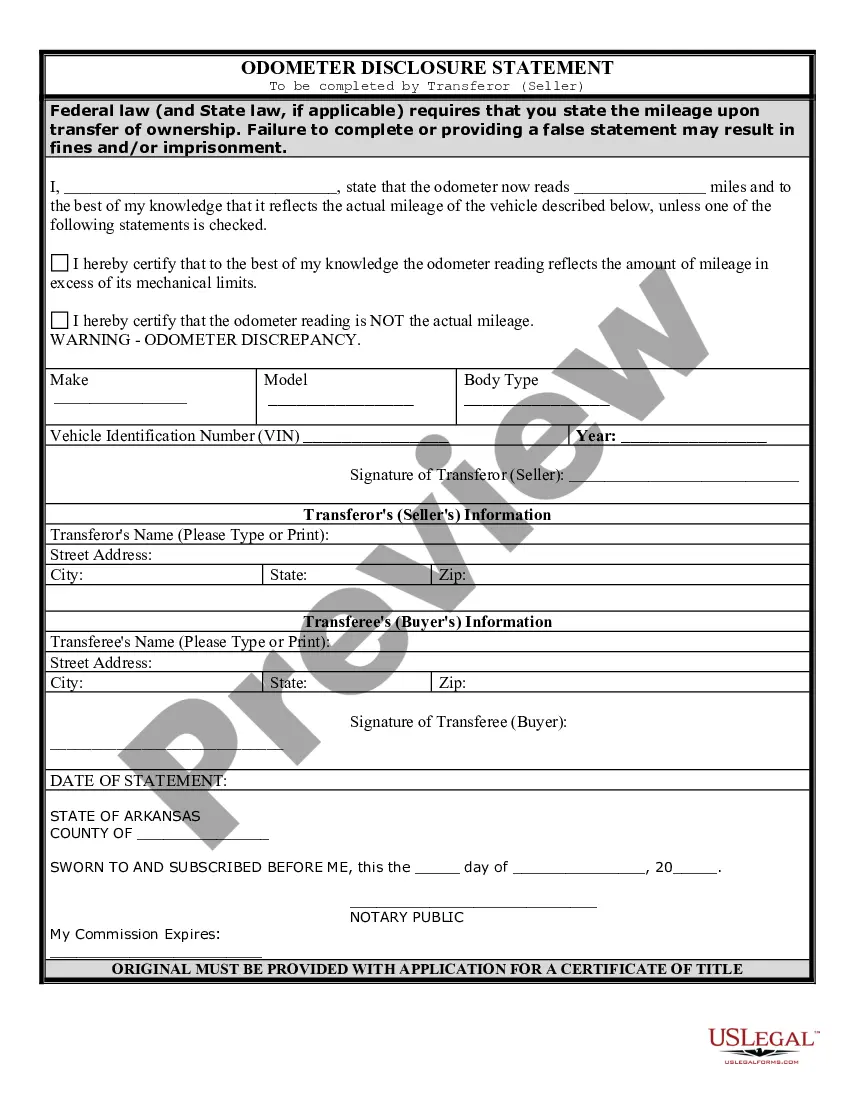

To obtain a federal odometer statement in Arkansas, you need to fill out the appropriate forms provided by the Department of Motor Vehicles. This process ensures accurate recording of a vehicle's mileage. You can usually access these forms online through the DMV’s website or visit a local DMV office for assistance. Remember, understanding the odometer disclosure statement Arkansas withholding tax laws could save you time and ensure compliance.

Odometer Statement. Under federal guidelines, vehicles less than 20 years old must have a fully completed odometer disclosure statement signed by both the buyer and the seller.

This written disclosure must be signed by the transferor, including the printed name, and shall contain the following information: (1) The odometer reading at the time of the transfer (not to include tenths of miles); (2) The date of the transfer; (3) The transferor's name and current address; (3a) The transferee's ...

The Federal Odometer Statement, also known as the Odometer Disclosure Statement (ODS), is a form that is required by the federal government to be completed whenever a motor vehicle is sold or transferred. It is used to disclose the actual mileage of the vehicle at the time of sale or transfer.

Box one should be used if the vehicle's odometer has ?rolled over.? Years past this was common when most vehicles only had an odometer that went up to 100,000 miles, but nowadays it is very uncommon to use this box. Box two should be used if the odometer is inaccurate.

Odometer Statement. Under federal guidelines, vehicles less than 20 years old must have a fully completed odometer disclosure statement signed by both the buyer and the seller.