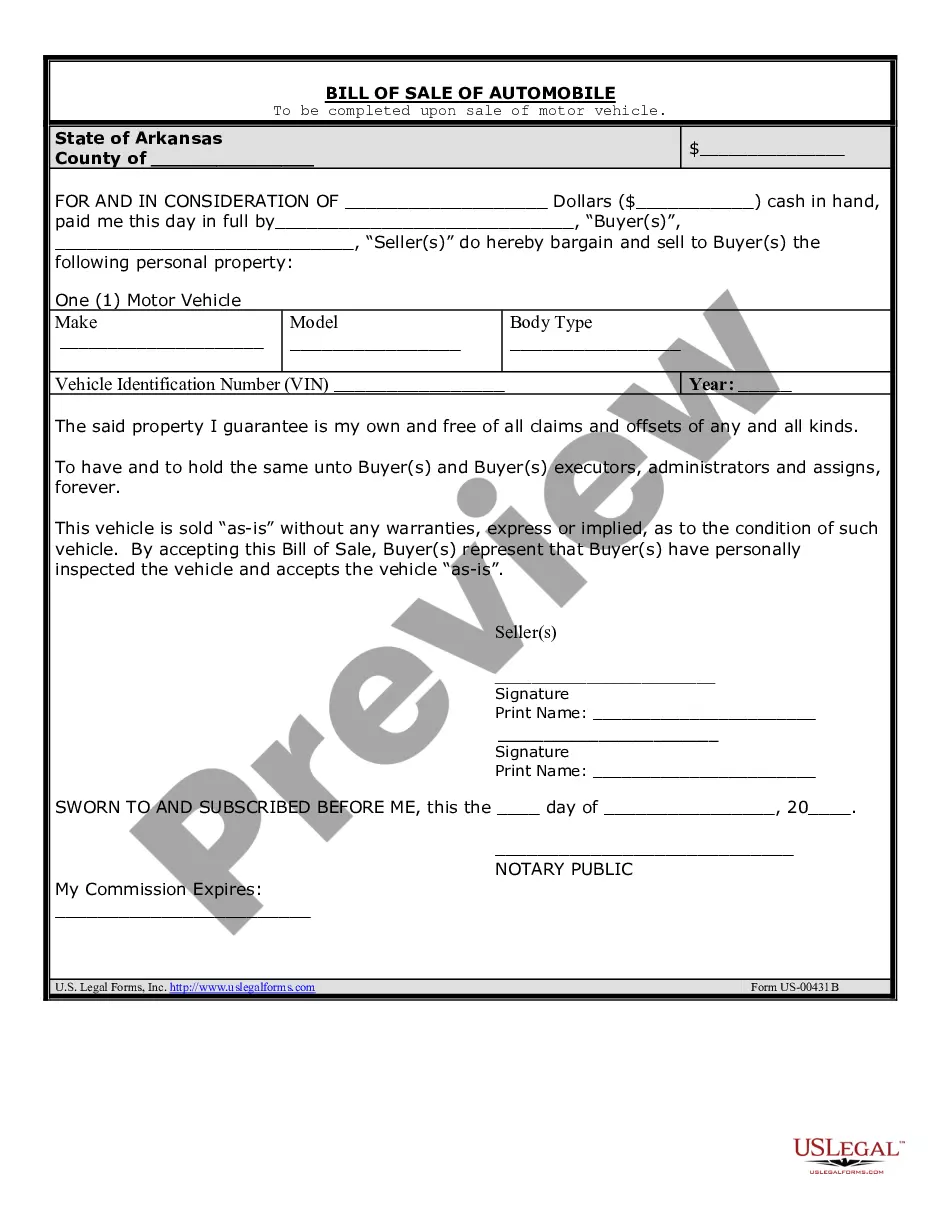

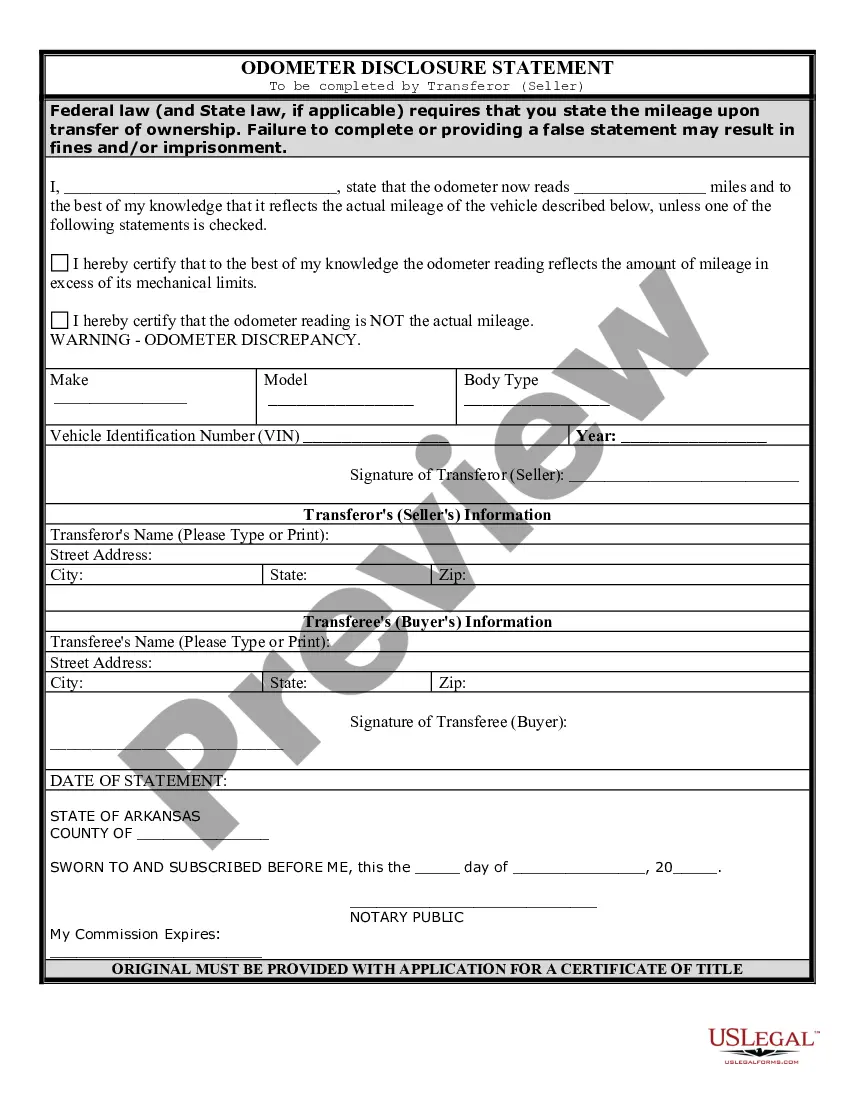

This form is a bill of sale of an automobile. The seller(s) guarantees that the automobile is his/her/their property and is free of all claims and offsets of any kind. The bill of sale also states that the automobile is sold "as-is" without any warranties, express or implied. A separate Odometer Disclosure Statement is included with the bill of sale.

Arkansas Odometer Statement For Lease Buyout

Description

How to fill out Arkansas Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Managing legal paperwork and processes can be a lengthy addition to your day.

Arkansas Odometer Declaration For Lease Buyout and similar forms frequently necessitate searching for them and understanding how to fill them out properly.

As a result, whether you're addressing financial, legal, or personal issues, having access to a thorough and user-friendly online database of forms will be immensely beneficial.

US Legal Forms is the top online resource for legal templates, featuring more than 85,000 state-specific documents and an array of tools to assist you in completing your paperwork swiftly.

Is this your initial experience with US Legal Forms? Register and create a free account in a few minutes, granting you access to the form catalog and Arkansas Odometer Declaration For Lease Buyout. Then, follow the steps below to fill out your form.

- Explore the collection of relevant documents available to you with just a click.

- US Legal Forms provides state- and county-specific documents that are available for download at any time.

- Protect your document management processes with a reliable service that enables you to create any form in minutes without additional or hidden costs.

- Simply sign in to your account, find Arkansas Odometer Declaration For Lease Buyout, and download it immediately from the My documents section.

- You can also access any previously saved documents.

Form popularity

FAQ

In a nutshell, if you use drop shipping in Pennsylvania and you have nexus there, you'd be the one to collect sales tax, not the wholesaler. On the other hand, if you don't have nexus in Pennsylvania but the drop shipper does, they could be responsible for collecting sales tax from you.

Drafting Legal Documents: How to Keep It Simple Plan Out the Document Before You Begin. ... Write with Clear and Concise Language. ... Ensure the Correct Use of Grammar. ... Be as Accurate as Possible. ... Make Information Accessible. ... Ensure All Necessary Information Is Included. ... Always Use an Active Voice. ... Pay Attention to Imperatives.

If a shipment contains both taxable and exempt goods, the shipping and handling charges for the entire shipment are subject to tax. Tax may also apply to drop shipping scenarios. If you use drop shipping to deliver items to customers in Pennsylvania, you may be responsible for collecting and reporting tax.

In a nutshell, if you use drop shipping in Pennsylvania and you have nexus there, you'd be the one to collect sales tax, not the wholesaler. On the other hand, if you don't have nexus in Pennsylvania but the drop shipper does, they could be responsible for collecting sales tax from you.

The Commonwealth makes registering an LLC in Pennsylvania an easy and affordable process. The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70.

Yes, dropshipping is legal. Like in any business, you must adhere to local, national, and international laws regarding the sale of merchandise. As long as you do this, dropshipping usually is a low-risk business model with little personal liability risk.

Whether you're selling things online or in a store, you need sales tax licenses in Pennsylvania. Here is a quick primer on what businesses are required to have a sales tax license in Pennsylvania. Ready to start your business? Plans start at $0 + filing fees.