Fiduciary Deed Alabama Form

Description

How to fill out Alabama Warranty Deed For Fiduciary?

Red tape necessitates exactness and meticulousness.

If you do not manage filling out documents like Fiduciary Deed Alabama Form daily, it might lead to some misunderstanding.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of resubmitting a document or repeating the same effort from the beginning.

Acquiring the correct and updated samples for your documentation takes just a few minutes with a US Legal Forms account. Eliminate the bureaucratic worries and simplify your paperwork.

- Discover the suitable template by utilizing the search box.

- Verify that the Fiduciary Deed Alabama Form you have found is pertinent to your state or county.

- Examine the preview or review the description that includes the specifics on the use of the template.

- If the result aligns with your search, click the Buy Now button.

- Choose the suitable option from the available pricing plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal account.

- Receive the form in your preferred format.

Form popularity

FAQ

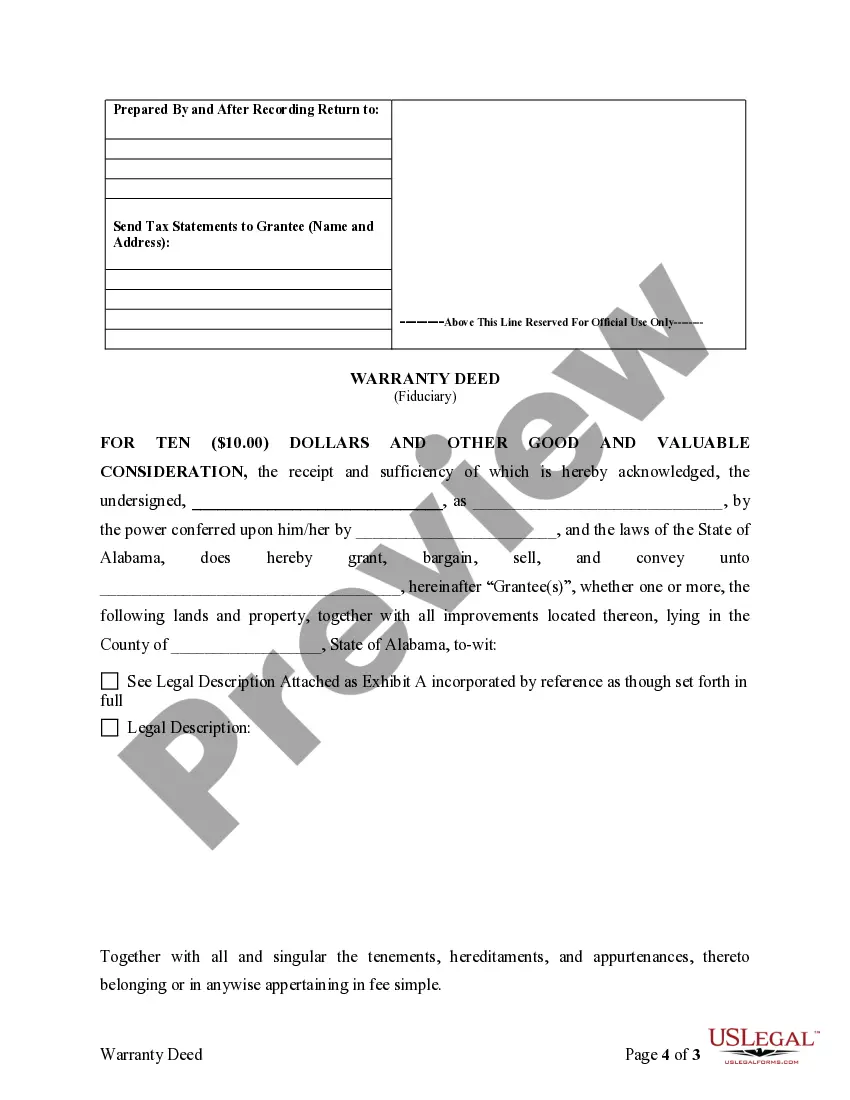

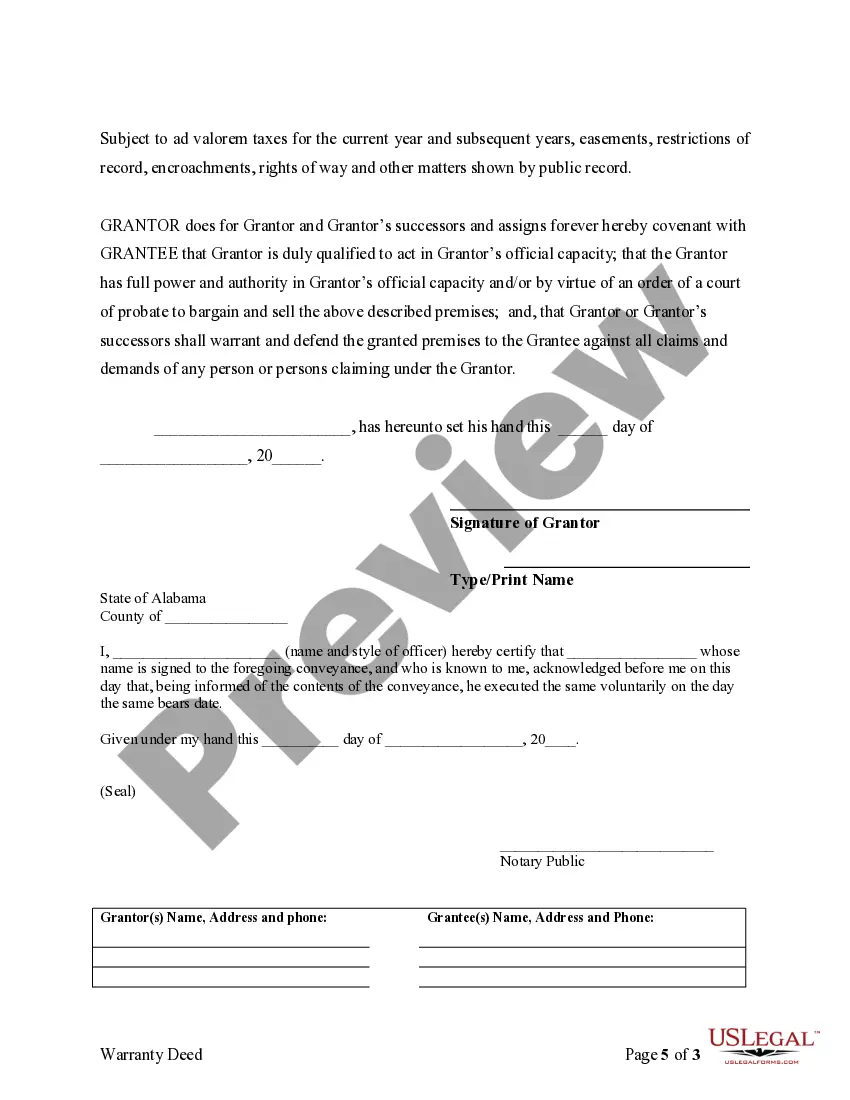

For a deed to be valid in Alabama, it must meet certain requirements, which include using a Fiduciary deed Alabama form. The deed should clearly identify the property being transferred, include the names of both the grantor and grantee, and be properly signed and notarized. Additionally, filing the deed with the county probate court is crucial to finalize the transfer and establish the new ownership legally.

An attorney does not have to prepare a deed in Alabama; you can use a Fiduciary deed Alabama form for DIY options. This form is designed for ease of use, allowing you to create a legally valid deed without hiring a lawyer. However, if you have complex issues or questions, seeking legal advice may be beneficial to ensure everything aligns with Alabama law.

To transfer ownership of a property in Alabama, you can use a Fiduciary deed Alabama form. This form must be completed with accurate details about the property and the parties involved. After filling out the form, you should file it at the local probate court to make the transfer official. This legal step finalizes the change in ownership and protects your rights.

The best way to transfer property title between family members often involves using a Fiduciary deed Alabama form. This form simplifies the transfer process and eliminates unnecessary taxes or fees. Additionally, it helps clarify ownership rights, ensuring that all family members understand their interests in the property. It is essential to clearly document the transfer for future reference.

Yes, you can prepare your own deed in Alabama using a Fiduciary deed Alabama form. This form is user-friendly and offers clear instructions to help you complete the deed correctly. However, you must ensure that all required information is accurately filled out to avoid legal issues later. If you have any doubts, you might consider consulting a legal professional.

The fastest way to transfer a deed in Alabama usually involves using a Fiduciary deed Alabama form. This specific form allows you to quickly and efficiently move property ownership without complicated legal procedures. You can also streamline the process by filing the deed directly with the county probate court. This method reduces delays and ensures the transfer is legally binding.

Any individual or entity that earns income in Alabama must file a state tax return. This requirement applies to residents and non-residents alike. If you're navigating the complexities of tax filings or a fiduciary deed Alabama form, using resources from U.S. Legal Forms can guide you in fulfilling your obligations efficiently.

Alabama Form 41 is the return used by partnerships to report income, deductions, and tax for their activity in the state. This form requires detailed information about the partnership's financial performance. If your partnership involves processing a fiduciary deed Alabama form, using U.S. Legal Forms can help simplify your compliance with Form 41.

Any partnership that conducts business in Alabama is required to file a partnership return. This includes both general and limited partnerships. If you're involved in a partnership that handles a fiduciary deed Alabama form, it’s crucial to adhere to the filing requirements, or you might face penalties.

In Alabama, all businesses operating within the state must file a business privilege tax return. This includes corporations, limited liability companies, and partnerships. If you are uncertain about filing or managing a fiduciary deed Alabama form, consider seeking assistance from professionals or using U.S. Legal Forms to ensure compliance.