Power Of Attorney Irs

Description

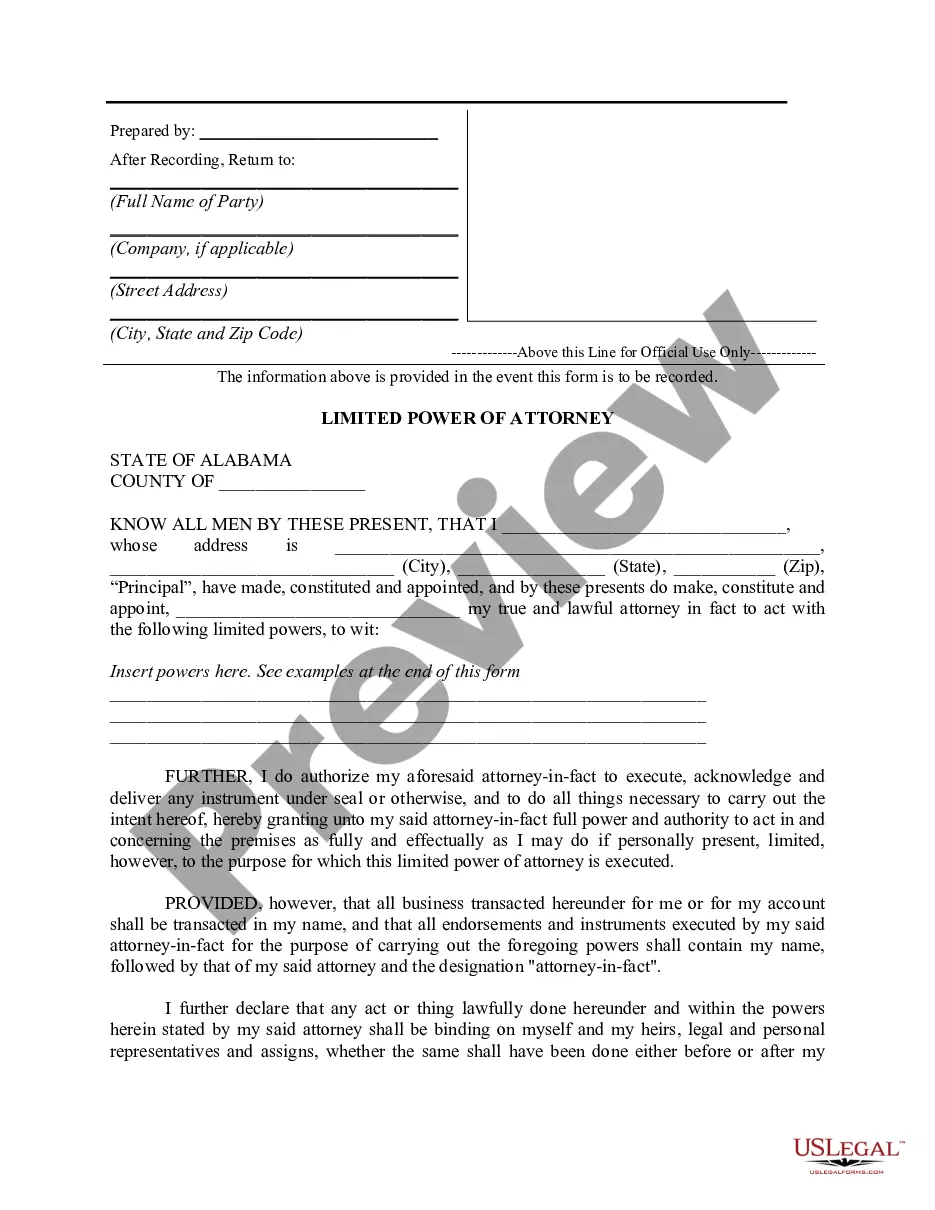

How to fill out Alabama Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you're an existing user, log in to your account and click the Download button to retrieve your needed form template. Verify that your subscription is active, and renew if necessary.

- For first-time users, start by browsing the Preview mode to read the form description. Confirm you've selected the appropriate form that aligns with your local jurisdiction requirements.

- If there's a mismatch, utilize the Search tab to find the correct template. Once you locate the right form, proceed to the next step.

- Purchase the necessary document by clicking the Buy Now button and selecting a subscription plan that suits you. Registration is required to access the full library.

- Complete your purchase by entering your credit card information or logging in with your PayPal account.

- Finally, download your form and save it to your device. You can also access it later through the My Forms menu in your profile.

With US Legal Forms, users can benefit from a vast collection of legal documents, more than offered by competitors at a similar cost. The platform also provides premium expert assistance to ensure that your forms are completed meticulously.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents like the Power of Attorney IRS form. Take advantage of this comprehensive service today to secure your legal needs efficiently.

Form popularity

FAQ

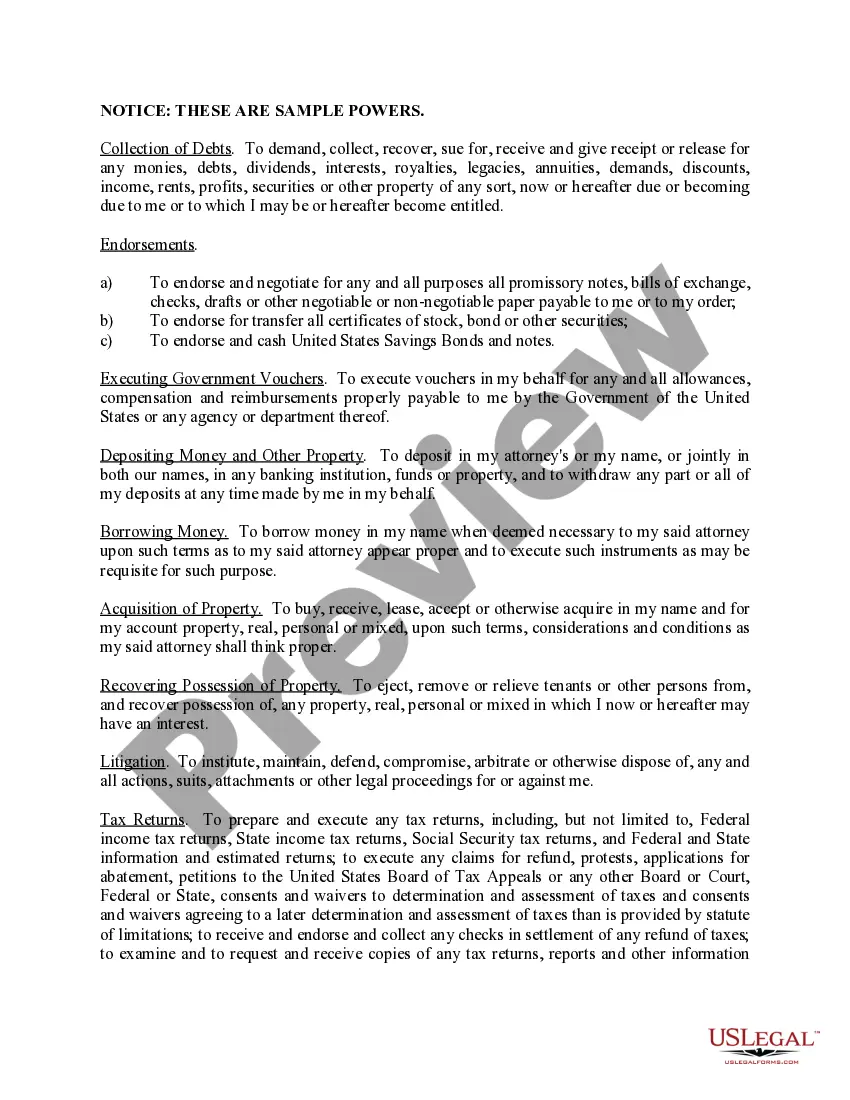

A CPA may need a power of attorney to efficiently represent you in tax matters and communicate with the IRS on your behalf. This authority allows them to access your tax information, file your returns, and respond to IRS inquiries without delays. Utilizing a power of attorney empowers your CPA to handle your tax obligations effectively while you focus on other priorities.

While a power of attorney is not required for taxes, it can be highly beneficial in certain situations. If you are unable to file your own taxes or need assistance with complex tax matters, establishing a power of attorney for the IRS can streamline the process. This allows a trusted individual to handle your tax affairs effectively and promptly.

Processing a power of attorney with the IRS typically takes about four to six weeks. However, the timeline may vary based on the IRS's workload and specific circumstances. To expedite the process, ensure that you complete IRS Form 2848 accurately and provide all required information; this will help pave the way for quicker approval.

A power of attorney (POA) for the IRS is a legal document that allows you to appoint someone to act on your behalf regarding tax matters. This document must comply with IRS guidelines and can cover various tasks, including filing returns and discussing your account. Using a POA simplifies interactions with the IRS and provides peace of mind knowing that a trusted person is managing your tax affairs.

The IRS does accept power of attorney, provided that it is correctly completed and submitted. By utilizing IRS Form 2848, you can authorize someone to represent you in tax matters. This acceptance helps facilitate communication and ensures that your tax needs are managed accurately and efficiently.

You do not need an attorney to file a federal income tax return unless your situation is particularly complex. Many individuals successfully file their taxes without legal representation. However, if you feel uncertain about the tax implications, consulting an attorney or using a power of attorney for the IRS can help ease your concerns.

Yes, the IRS recognizes a power of attorney when it meets their specified requirements. This legal document grants someone authority to handle tax matters on your behalf, ensuring that your requests are processed appropriately. It's crucial to use the IRS Form 2848 to ensure acceptance and recognition of your power of attorney.

You do not need a power of attorney to file taxes, but having one can simplify the process. A power of attorney for the IRS allows someone to act on your behalf, which can be useful if you cannot file your taxes personally. This arrangement can save time and reduce stress, especially if you face complex tax situations.

In Texas, a power of attorney must be signed by the principal and must indicate the scope of authority granted to the agent. Some forms may also require witnesses or notarization. To ensure compliance with Texas laws for the IRS power of attorney, USLegalForms offers specific templates and resources designed to meet local requirements.

Choosing the best person to act as your power of attorney requires careful consideration. Ideally, the individual should be trustworthy, responsible, and familiar with your wishes regarding IRS matters. When selecting a candidate, think about someone you can communicate openly with and who understands your financial and legal needs.