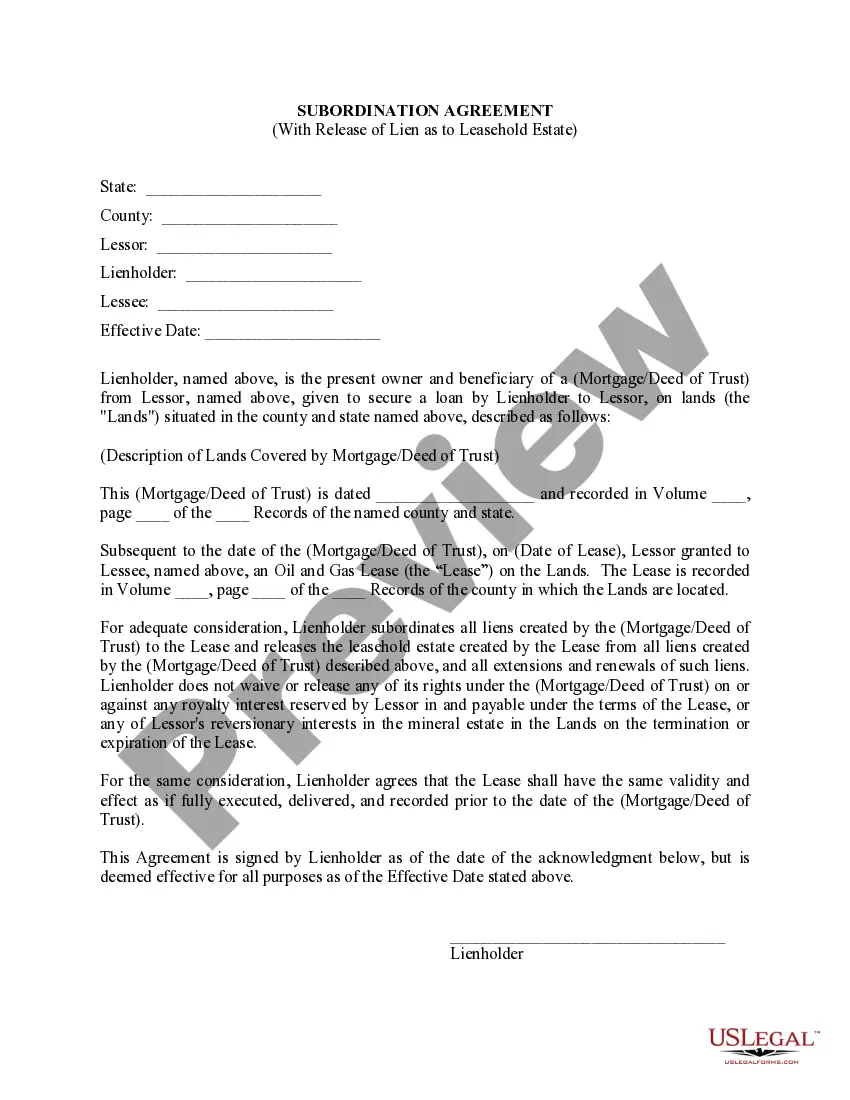

Subordination Agreement Form

Description

How to fill out Alabama Lease Subordination Agreement?

What is the most dependable service to obtain the Subordination Agreement Form and other current versions of legal documents.

US Legal Forms is the answer! It boasts the most extensive collection of legal paperwork for any purpose. Each template is expertly crafted and verified for adherence to federal and local laws and regulations.

US Legal Forms is an ideal solution for anyone needing to manage legal paperwork. Premium members can enjoy even more features as they can complete and sign previously saved documents electronically at any time using the integrated PDF editing tool. Explore it today!

- They are categorized by field and state of application, making it effortless to locate the one you require.

- Experienced users of the website just need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Subordination Agreement Form to access it.

- Once saved, the template is accessible for future use in the My documents section of your account.

- If you do not yet possess an account with our library, follow these steps to create one.

Form popularity

FAQ

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Subordination agreements are usually carried out when property owners take a second mortgage on their property. As a result, the second loan becomes the junior debt, and the primary loan becomes the senior debt. Senior debt has higher claim priority over junior debt.

There is no legal reason why any HELOC lender must agree to subordinate. In fact, many such lenders have started to either restrict the amount of money that can be tapped from HELOC loans or actually have canceled them outright.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.