Alabama Limited Liability Company With Multiple Owners

Description

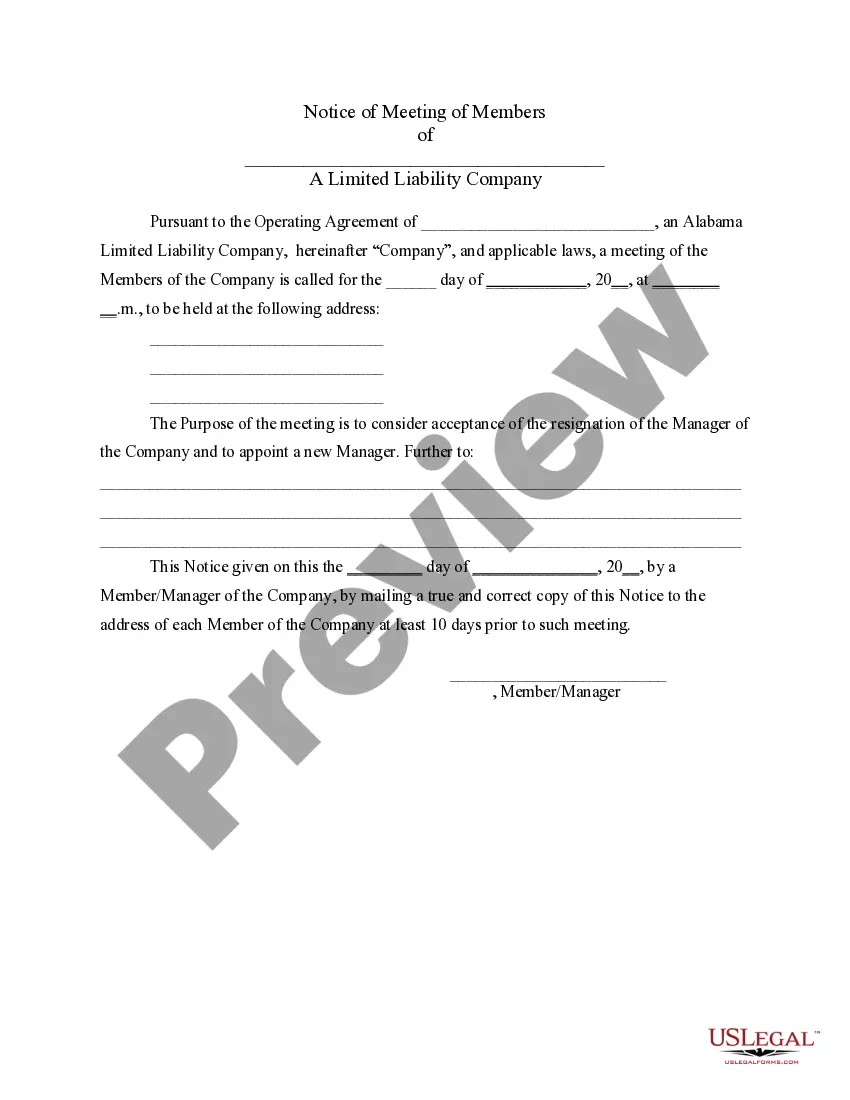

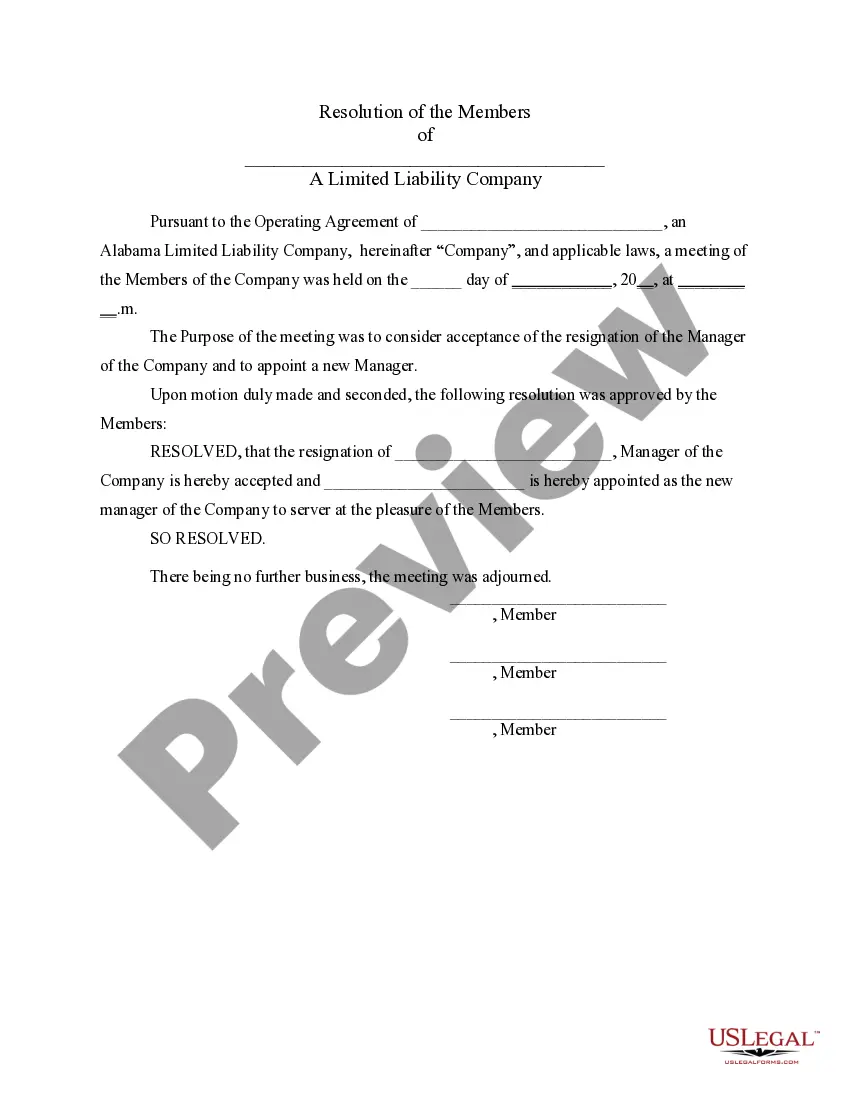

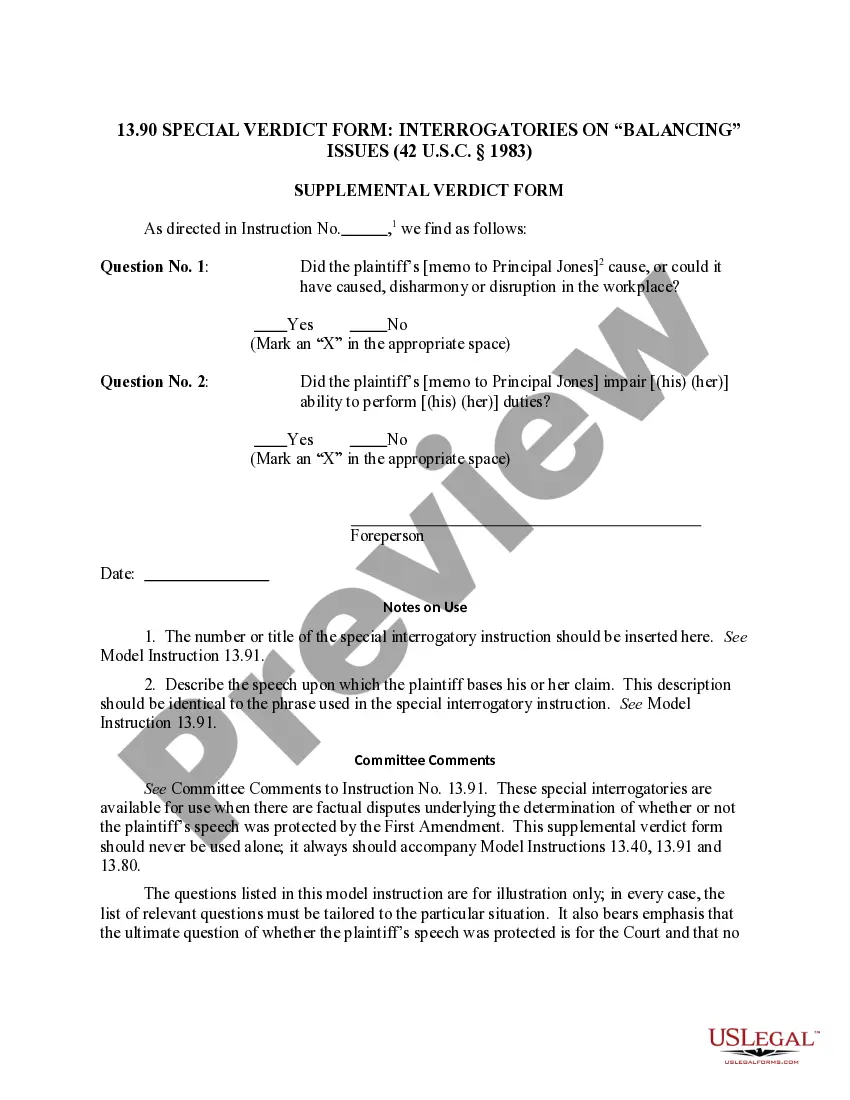

How to fill out Alabama LLC Notices, Resolutions And Other Operations Forms Package?

It’s no secret that you can’t become a legal expert overnight, nor can you figure out how to quickly prepare Alabama Limited Liability Company With Multiple Owners without having a specialized set of skills. Creating legal documents is a time-consuming process requiring a certain training and skills. So why not leave the creation of the Alabama Limited Liability Company With Multiple Owners to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

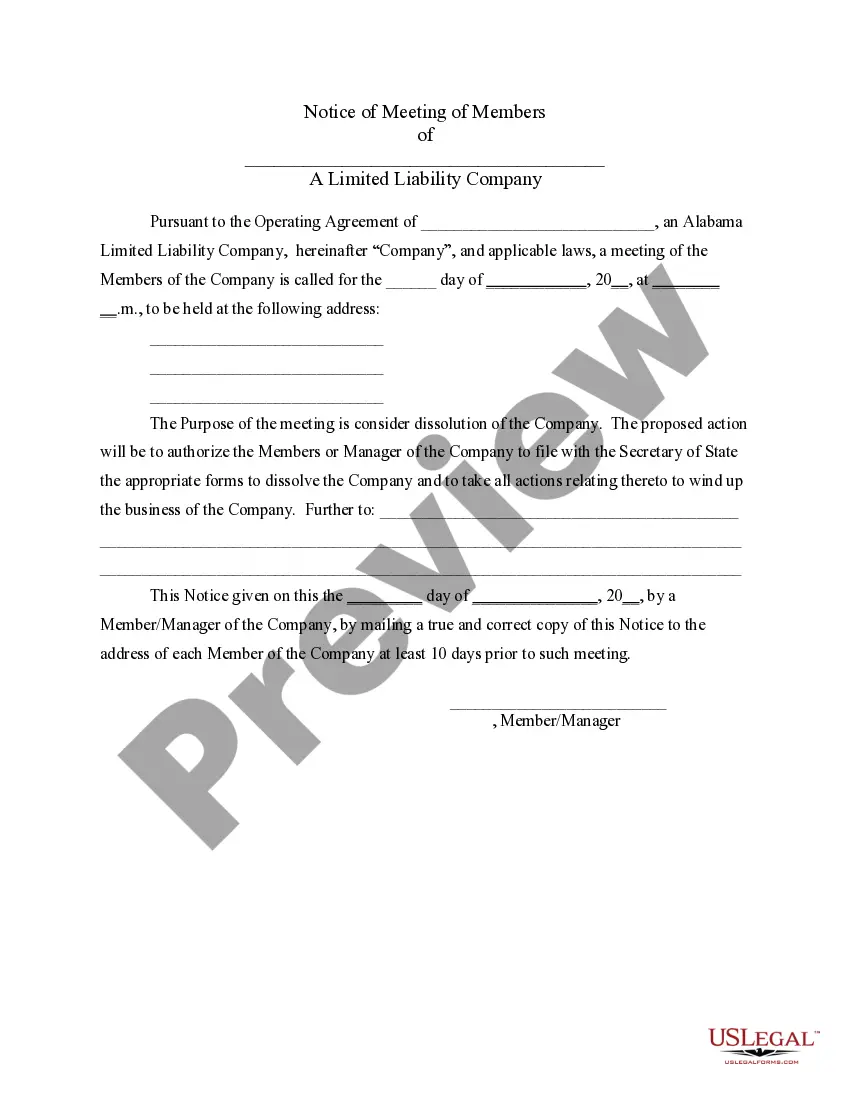

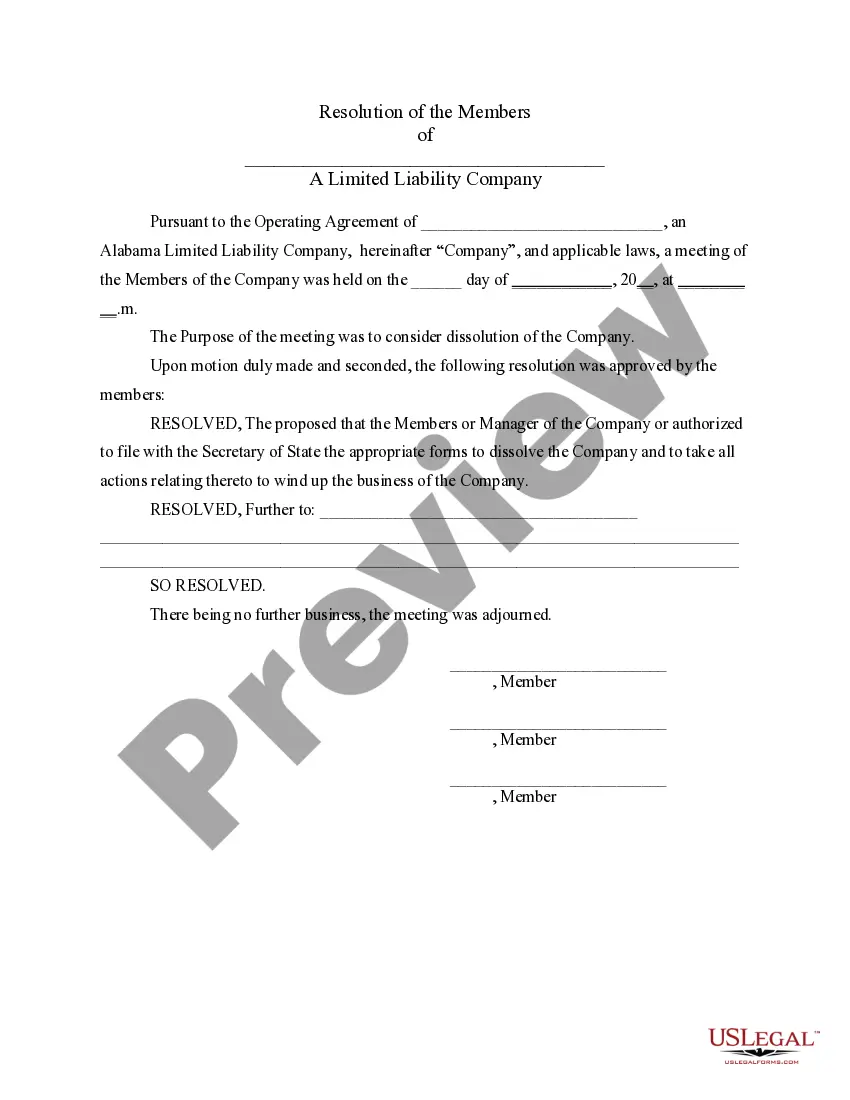

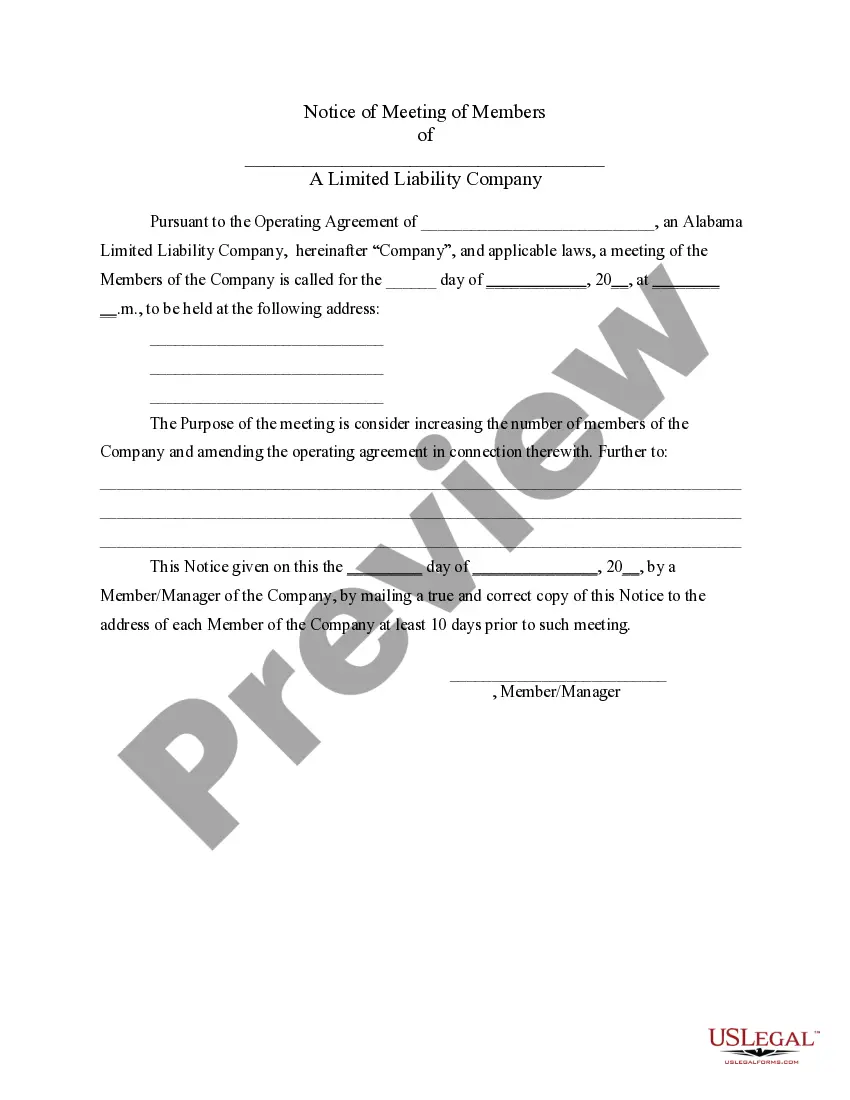

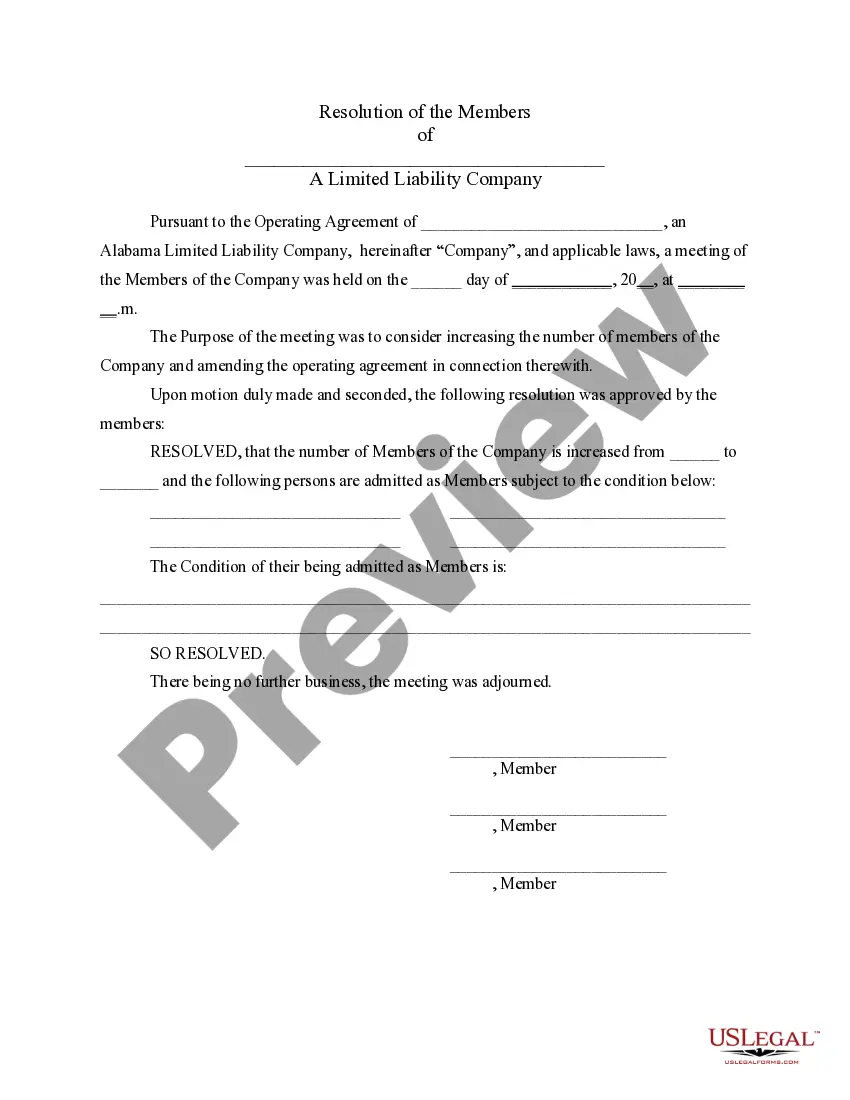

- Preview it (if this option provided) and check the supporting description to determine whether Alabama Limited Liability Company With Multiple Owners is what you’re searching for.

- Begin your search again if you need a different form.

- Register for a free account and select a subscription option to purchase the form.

- Choose Buy now. Once the transaction is through, you can get the Alabama Limited Liability Company With Multiple Owners, fill it out, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Name your Alabama LLC. ... Choose your registered agent. ... Prepare and file a certification of formation. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number. ... Keep certain LLC records on-site. ... Alabama LLCs must file a business privilege tax return.

Here are the steps you need to take to start a limited liability company (LLC) in Alabama. Choose a name for your LLC in Alabama. Appoint a registered agent. File a Certificate of Formation. Prepare an Operating Agreement. File a state tax return / annual report. Comply with other requirements.

Updating LLC members information will be done on the Officers page during the tax account license renewal process. Enter a cease date for old members/officers and add new members/officers' information on the next empty record.

The process of adding a member to a Alabama LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

Most states do not restrict LLC ownership, and there is generally no maximum number of members. An LLC with one owner is known as a single-member LLC, while an LLC with multiple owners is known as a multi-member LLC.