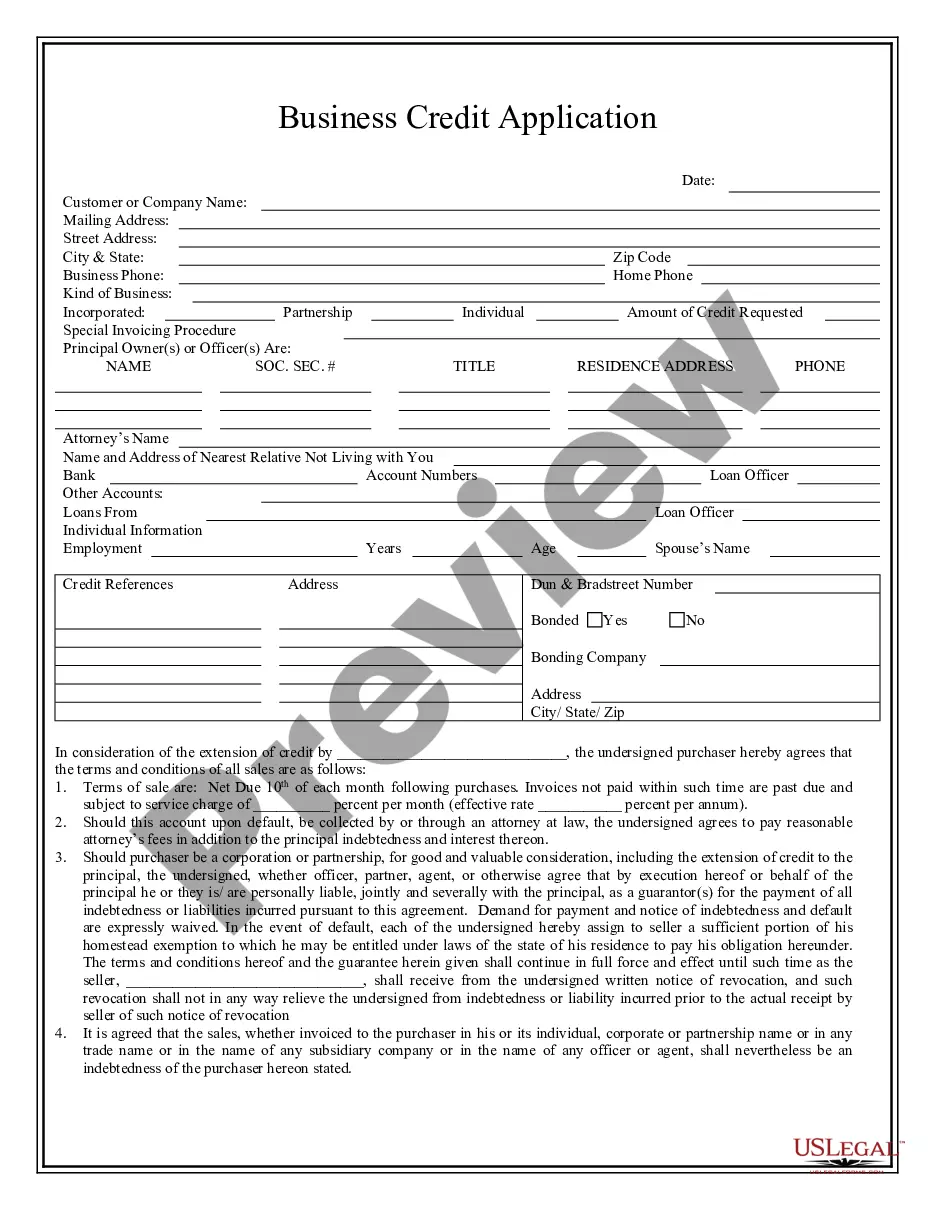

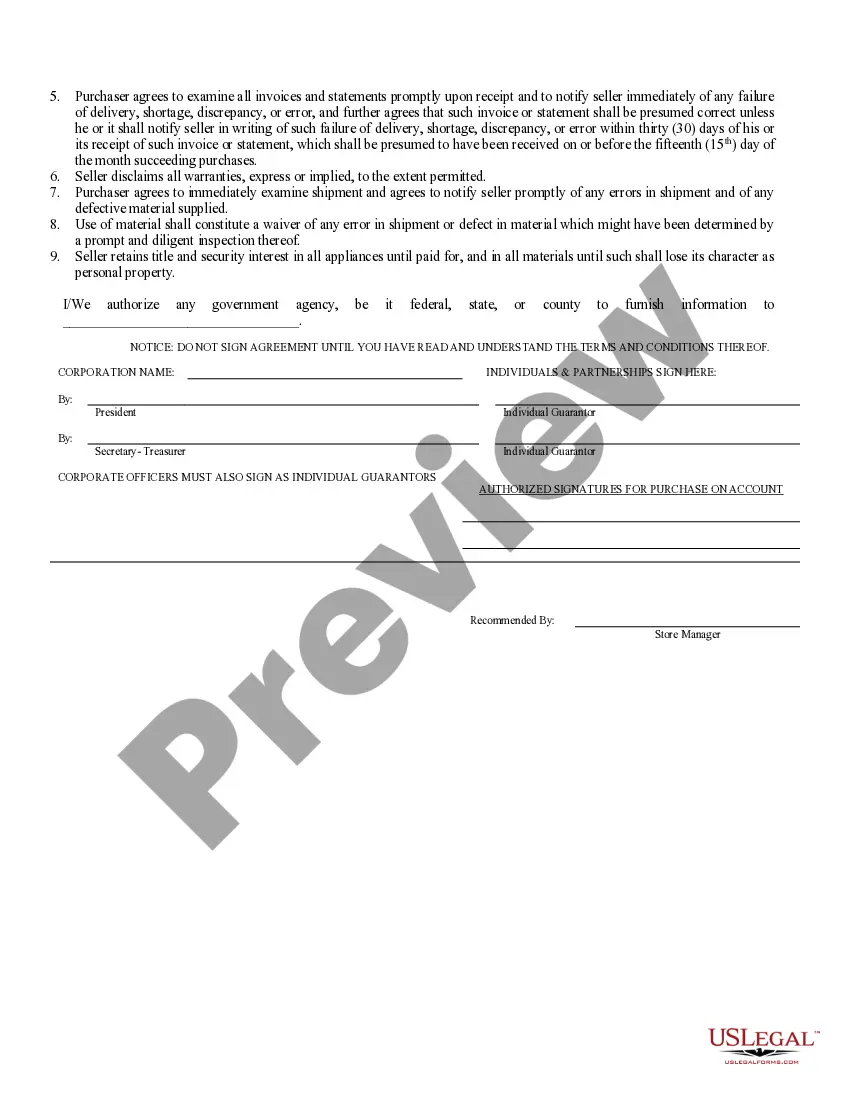

Business Credit Application Terms And Conditions Template

Description

How to fill out Alabama Business Credit Application?

- If you already have a US Legal Forms account, log in and download the desired template. Check that your subscription is active, or renew it if necessary.

- If you are a new user, start by browsing the Preview mode and form description to verify you've selected the appropriate document that aligns with your local regulations.

- If you find inconsistencies, utilize the Search bar at the top of the page to locate the correct template.

- After selecting the right document, click the Buy Now button and select your preferred subscription plan. Registration for an account is required to access the extensive library.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Finally, download your form and save it on your device. You can access it anytime in the My Forms section of your profile.

In conclusion, utilizing the US Legal Forms platform not only saves you time but also ensures that your legal documents are accurate and tailored to your specific needs. With an impressive collection of templates and the backup of premium legal experts, your documentation process is in capable hands.

Get started today with US Legal Forms and experience the convenience of easy legal document access!

Form popularity

FAQ

To fill out a business credit card application effectively, gather all necessary financial documents beforehand. Provide honest and accurate information about your business, including revenue and business history. Make sure to read all terms and conditions carefully. A business credit application terms and conditions template can guide you through the process and enhance your understanding.

Yes, filling out a credit application online can be safe, provided you are using a secure and trusted platform. Look for signs that indicate security, such as encrypted connections and privacy policies. Protecting your personal information should be a top priority. Utilizing a business credit application terms and conditions template can also ensure secure handling of your data.

Creating a credit card form involves defining the information you wish to collect from users. Typically, this includes personal identification details, financial information, and consent clauses. Ensure that your form is user-friendly and complies with legal standards. A business credit application terms and conditions template can assist you in setting up this form correctly.

To create a credit application form, start by outlining the necessary information your business requires from applicants. Include sections for personal and business details, financial history, and consent for credit checks. Make the form accessible and easy to fill out to enhance the applicant experience. Leveraging a business credit application terms and conditions template can provide the structure you need.

Appropriate questions for a credit application often include inquiries about the applicant's business revenue, years in operation, and existing debts. These questions help assess the creditworthiness of the business. Crafting these questions carefully is essential for gathering the right information. A business credit application terms and conditions template can offer a solid framework for these questions.

A credit application form is a document businesses fill out to apply for credit. This form typically collects vital information such as business details, ownership structure, and financial history. Understanding what you need to provide on this form can streamline the process. Using a business credit application terms and conditions template can simplify this task.

Yes, you can include your expected income on a business credit card application. It helps the lender evaluate your repayment ability and the overall financial health of your business. However, ensure the income figures align with your business's actual earnings and are realistic. For detailed guidance, consider using a business credit application terms and conditions template from US Legal Forms.

Yes, an LLC has its own business credit score, which evaluates its creditworthiness based on various financial activities. Establishing and maintaining good credit practices, such as timely bill payments, can improve this score. Using a business credit application terms and conditions template can further demonstrate your commitment to responsible borrowing.

Building business credit with an LLC requires consistent credit utilization and timely payments. Start by opening a business bank account and applying for vendor accounts that report payments to credit bureaus. Additionally, utilize a business credit application terms and conditions template to formalize your agreements, which can help establish a solid credit profile.

To create a business credit application form, start by including essential information such as business name, address, and financial details. Incorporating a business credit application terms and conditions template within the form helps clarify the borrowing requirements and responsibilities. Using templates from UsLegalForms can simplify this process significantly.