Short Sale Foreclosure

Description

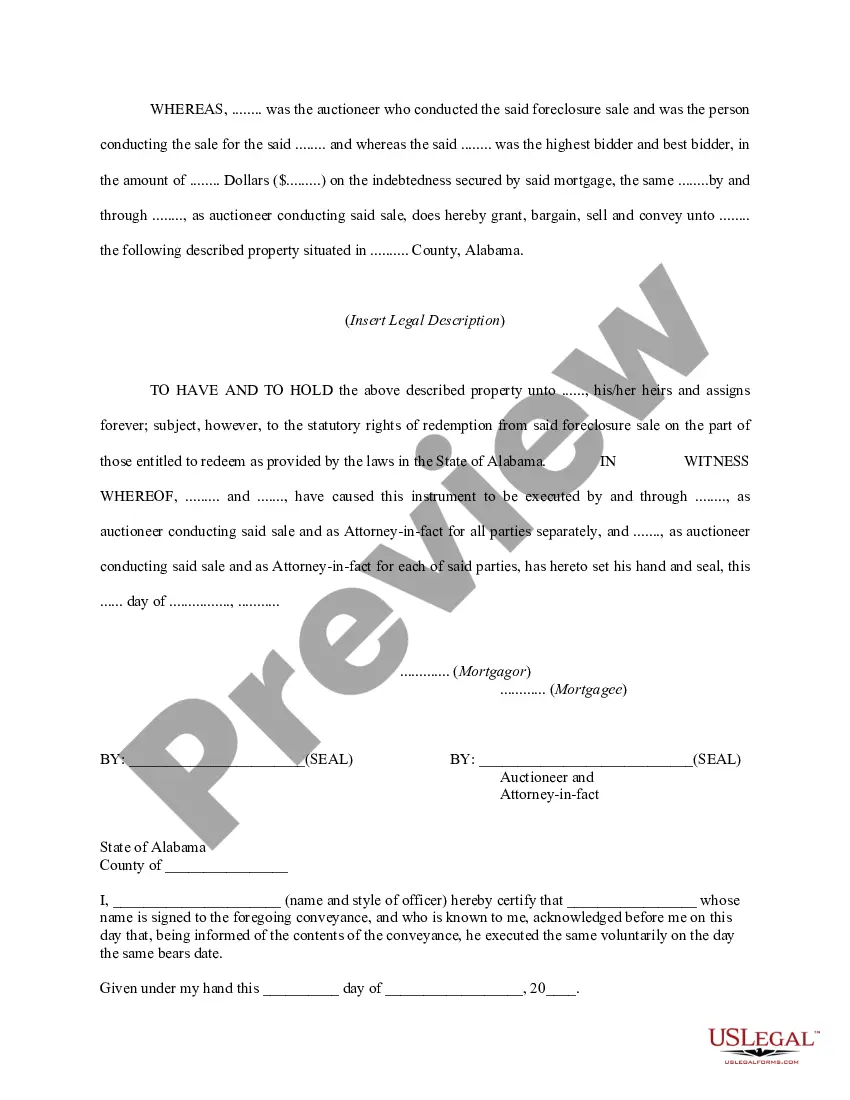

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Log in to your US Legal Forms account if you're a returning user. If you're new, create an account to get started.

- Review the form description in Preview mode to ensure it fits your local jurisdiction and specific requirements.

- Utilize the Search tab if you need additional documents; this will guide you to the correct form that meets your needs.

- Select the document by clicking the Buy Now button and choose an appropriate subscription plan.

- Complete your purchase by entering your payment information, choosing between credit card or PayPal for a smooth transaction.

- Download your completed form to your device, ensuring you can access it anytime through the My Forms section in your profile.

Following these steps will help you secure the necessary documentation for your short sale foreclosure with ease and accuracy.

Don't hesitate to explore US Legal Forms today for unparalleled access to a vast collection of legal forms and expert assistance!

Form popularity

FAQ

The time it takes for a bank to approve a short sale can vary significantly, generally taking between 30 to 90 days. Factors like the complexity of the sale, the lender’s internal processes, and current market conditions can all affect approval time. Patience is important during this time, as banks often take their time to assess each request carefully. Utilizing platforms like US Legal Forms can streamline documentation, potentially speeding up the process.

A short sale does not count as a foreclosure. Instead, it is an alternative solution where the bank agrees to accept less than what is owed on the mortgage. This option allows the homeowner to avoid the damaging effects of foreclosure on their credit. In most cases, a short sale is a more favorable outcome for both the lender and the borrower.

While a short sale can still impact your credit, it usually contains less severe repercussions compared to a full foreclosure. A short sale often allows for more flexibility and control in the selling process, leading to less emotional and financial strain. Homeowners who choose a short sale generally have the chance to rebuild their credit score sooner. It's essential to weigh both options and consider a short sale foreclosure as a viable solution to your financial challenges.

The duration a property remains in pre-foreclosure can vary widely, typically lasting between three to six months. During this time, homeowners have the opportunity to explore options such as a short sale to avoid the negative consequences of foreclosure. However, if no action is taken, the lender may proceed with the foreclosure process. Understanding this timeline can help you make timely decisions regarding your financial situation.

Pre-foreclosure and short sale are related but not the same. Pre-foreclosure refers to the phase where a homeowner is at risk of losing their property due to missed payments, while a short sale involves the actual sale of the property for less than the owed amount, with approval from the lender. A homeowner in pre-foreclosure may opt for a short sale as a strategy to mitigate the financial repercussions of foreclosure. Navigating these stages can be more manageable with the right resources.

A short sale occurs when a property is sold for less than what is owed on the mortgage, with the lender's approval. On the other hand, pre-foreclosure represents the period after a homeowner misses payments but before the lender has completed the foreclosure process. During pre-foreclosure, a homeowner often has the chance to pursue a short sale, potentially minimizing the negative impacts on their credit score. Understanding these distinctions can empower homeowners facing financial challenges.

Choosing between foreclosure and short sale can significantly impact your financial future. A short sale, which involves selling your home for less than what is owed, typically results in less damage to your credit score compared to a foreclosure. Additionally, a short sale often allows for more negotiation power and a quicker resolution. Ultimately, assessing your personal circumstances is crucial to make an informed choice.

Absolutely, obtaining a mortgage to buy a short sale is quite common. Many buyers are attracted to the lower prices typically associated with these properties. However, it's important to ensure you have a solid financial background and can demonstrate stability. Working with professionals, like those found on the US Legal Forms platform, can help streamline the mortgage process and address any concerns regarding short sale purchases.

Yes, you can often get a mortgage for a short sale property. Buyers typically find short sale homes at lower prices, which can make them more attractive. However, many lenders may require a larger down payment or higher credit scores due to the risks involved. It's crucial to explore your mortgage options and consult with a financial advisor before proceeding.

To qualify for a short sale foreclosure, you generally need to demonstrate financial hardship to your lender. This might include loss of income, divorce, or significant medical expenses. The lender will also look at your current mortgage balance and the property’s market value. Working with a professional, like those at US Legal Forms, can help you gather the required documentation for approval.