Foreclosure Homes With Inground Pool

Description

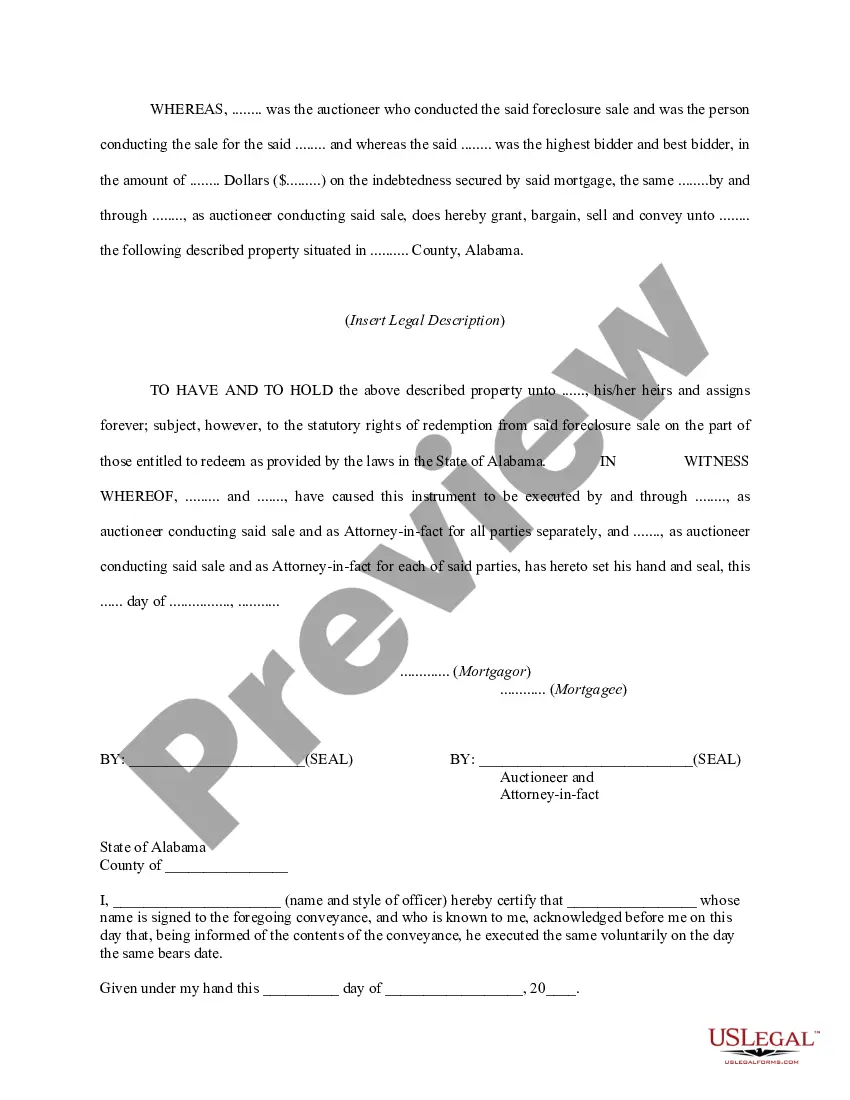

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- First, visit the US Legal Forms website and log in to your account. If you're a new user, create an account for access.

- Once logged in, search for foreclosure home documents by entering relevant keywords in the search bar.

- Preview the available templates to ensure they fit your legal needs and adhere to your local jurisdiction.

- If you need a different template, utilize the search feature to find more options until you locate the right one.

- Click 'Buy Now' for your chosen document, select a subscription plan that works for you, and proceed to register your account.

- Complete your purchase using a credit card or PayPal, then download the necessary forms directly to your device.

- Access your downloaded forms anytime via the 'My Forms' section in your profile for convenient edits and completions.

Using US Legal Forms not only saves time but also provides peace of mind knowing you're working with legally sound documents. Their robust collection and expert assistance ensure you find exactly what you need.

Start your journey with foreclosure homes featuring inground pools today by signing up with US Legal Forms and take the hassle out of legal paperwork!

Form popularity

FAQ

Deciding whether to remove a pool from your property can be a complex choice. If your foreclosure home with an inground pool is not attracting buyers and the costs outweigh the benefits, removal could be a smart move. However, pools can add significant appeal in the right market, so carefully consider the implications of such a decision. Consulting resources like USLegalForms can provide valuable insights when navigating property changes.

Foreclosure homes with inground pools might take longer to sell depending on various factors, including location and pool condition. Buyers often factor in the maintenance and costs associated with a pool before making an offer. Conversely, if marketed effectively, these homes can attract buyers more quickly due to their desirable features. You might assess your pool’s condition and market it positively to speed up the selling process.

While some may believe that inground pools lower home value, it largely depends on market demand and local buyer preferences. In regions where pools are desirable, foreclosure homes with inground pools may see increased value. However, properties in colder climates may not fetch a premium due to a pool’s seasonal use. Understanding your local market can clarify how a pool impacts your home’s value.

The presence of a swimming pool in foreclosure homes can influence the selling process. Some prospective buyers are deterred by the costs and responsibilities associated with pool maintenance. On the flip side, many homebuyers value the lifestyle a swimming pool provides, especially in regions with good weather. Properly showcasing the benefits of your pool can make a significant difference in attracting potential buyers.

Selling foreclosure homes with inground pools can present unique challenges. Some buyers may view pools as more of a liability due to upkeep and safety concerns. However, many buyers actively seek homes with pools for their enjoyment, which means a well-maintained pool can be a significant selling point. Thus, ensuring the pool is in excellent condition can help mitigate potential selling difficulties.

Investing in foreclosure homes with inground pools can offer substantial benefits. Inground pools can enhance your property’s appeal, particularly in warm climates. Additionally, having a pool may attract buyers looking for leisure amenities, potentially leading to higher resale value. Always consider the maintenance costs associated with pool ownership when evaluating your investment.

The timeline for foreclosure can vary by state and lender procedures, but it generally takes several months. After a missed payment, the process can start as early as 90 days, and the entire process may take up to a year. Buyers should act quickly when interested in foreclosure homes with inground pool, as these properties may attract multiple offers.

North Carolina follows a non-judicial foreclosure process. Once a homeowner defaults, the lender must provide a notice and file a petition to initiate the sale. Buyers interested in foreclosure homes with inground pool can benefit from understanding local laws to navigate this process successfully and safely acquire properties.

In Arizona, the foreclosure process can be non-judicial and follows a specific timeline. The lender sends a Notice of Default if payments are missed, and then goes through a public auction to sell the home. Buyers can find attractive opportunities in foreclosure homes with inground pool here, with a high chance of obtaining these properties at reduced prices.

Foreclosure is a structured process that typically includes six phases: pre-foreclosure, auction, judgment, redemption, eviction, and final turnover. During pre-foreclosure, lenders notify homeowners about missed payments. Next, properties go to auction, where buyers can bid on foreclosure homes with inground pool. If no sale occurs, banks take possession of the property during the judgment phase, leading to eviction and turnover if necessary.