Life Estate Form

Description

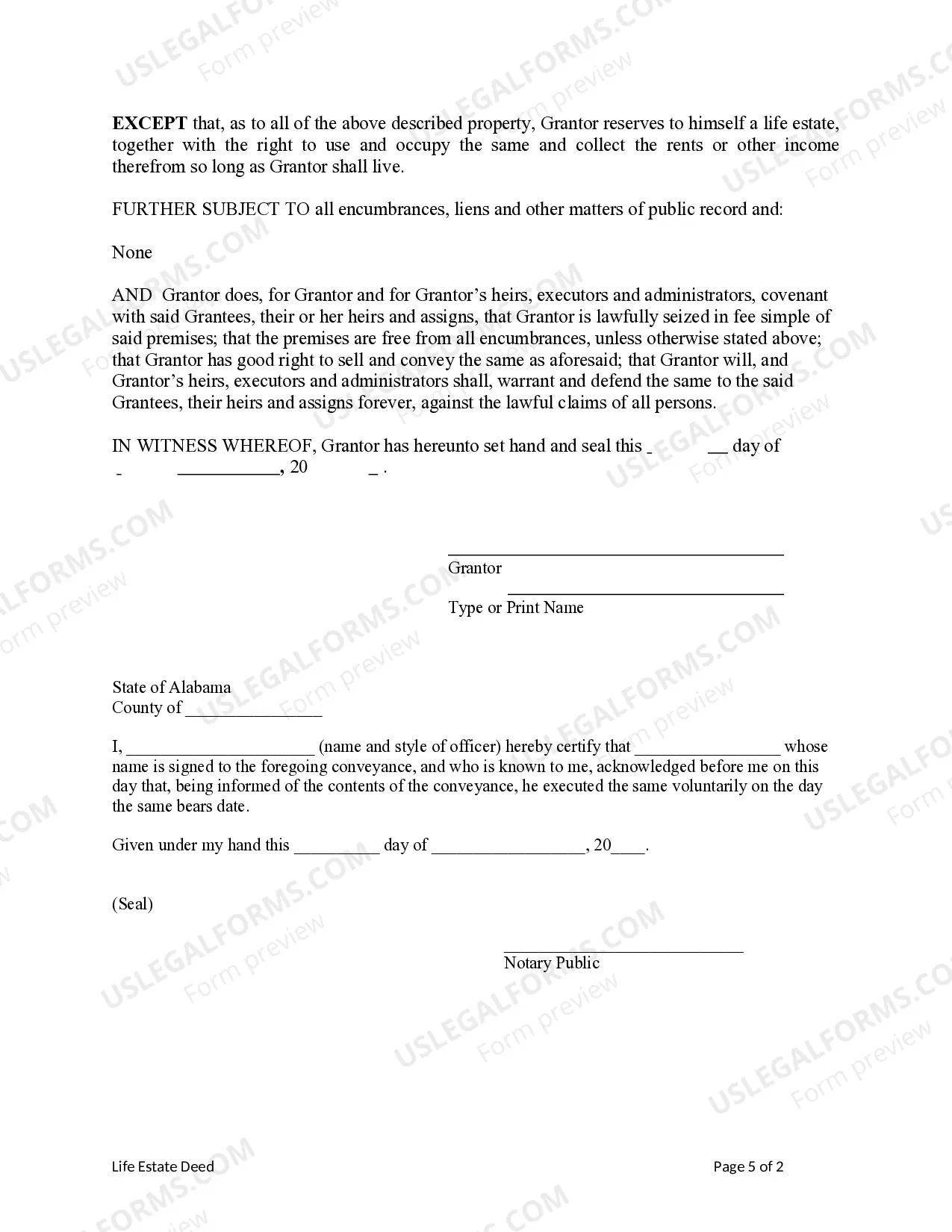

How to fill out Alabama Life Estate Deed - Individual To Two Individuals With Grantor Retaining Life Estate?

There’s no longer a justification to spend countless hours searching for legal paperwork to comply with your local state laws.

US Legal Forms has compiled all of them in a single location and made their accessibility easier.

Our website provides over 85,000 templates for any business and personal legal needs organized by state and area of application. All forms are properly prepared and verified for accuracy, so you can trust in obtaining a current Life Estate Form.

Select the most suitable pricing plan and create an account or Log In. Make your payment with a credit card or through PayPal to proceed. Choose the file format for your Life Estate Form and download it to your device. Print your form out to fill it in manually or upload the sample if you prefer to do so in an online editor. Preparing official documents under federal and state regulations is quick and simple with our library. Try out US Legal Forms today to keep your records organized!

- If you are acquainted with our platform and possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all downloaded documents at any time by opening the My documents section in your profile.

- If you’re unfamiliar with our platform, the procedure will require a few additional steps to complete.

- Here’s how new users can locate the Life Estate Form in our collection.

- Review the page content closely to ensure it includes the sample you require.

- To do this, utilize the form description and preview options if available.

- Use the search field above to find another sample if the previous one did not meet your needs.

- Click Buy Now beside the template title when you discover the appropriate one.

Form popularity

FAQ

One downside of a life estate is the limitation it places on the life tenant regarding property decisions. They cannot make significant changes or sell the property without the consent of the remainderman. Additionally, life estates might complicate tax situations or affect government benefits, making it crucial to consider your circumstances and consult a professional when using a life estate form.

People often choose a life estate to maintain control over their property during their lifetime while ensuring it passes directly to their heirs after their death. This arrangement can help avoid probate, which can be lengthy and costly. Thus, using a life estate form can be a practical estate planning tool that simplifies the transition of property.

Life estates have some drawbacks worth considering. One significant issue is that the life tenant cannot sell or mortgage the property without the consent of the remainderman. Additionally, life estates could expose your property to legal claims if financial issues arise, making it essential to weigh your options carefully.

A life estate generally does take precedence over a will regarding the property involved. This means that if you designate a beneficiary through a life estate deed, that arrangement will prevail, regardless of what your will states. So, using a life estate form can be a smart way to ensure your property goes to the right person without complications.

Yes, you can create your own life estate deed using a life estate form. Many online platforms, like uslegalforms, provide user-friendly templates to help you draft your deed accurately. However, it’s wise to consult with a legal professional to ensure compliance with local laws and avoid potential issues later on.

The most common way to create a life estate is through a life estate deed. This legal document allows one person, known as the life tenant, to use the property during their lifetime. Upon their passing, the property automatically transfers to the designated beneficiaries. Utilizing a life estate form makes this process straightforward and ensures proper legal coverage.

To create a life estate, specific language is required in your deed, such as 'to Name, for their life.' This language indicates that the individual receives ownership during their lifetime but not after. It is crucial to clearly express your intent in the life estate form to avoid misunderstandings. Utilizing resources from US Legal Forms ensures you include the necessary words and phrases to establish a valid life estate.

A life estate can be deemed invalid for several reasons, including lack of proper legal documentation, inability to define the life tenant, or failure to comply with state laws. If the life estate form does not follow the necessary legal requirements, it might not hold up in court. Therefore, working with legal professionals or using US Legal Forms can help ensure your life estate form is valid and enforceable. This diligence protects your interests and those of your beneficiaries.

The IRS has specific rules regarding life estates related to taxation and transfer of property. Generally, the transferring owner retains certain rights, and these rights can affect gift tax implications and property tax responsibilities. When you complete your life estate form, it’s important to consult a tax professional to understand any potential tax liabilities that may arise. This knowledge helps you make informed decisions about your estate planning.

Yes, a life estate deed must be recorded to be enforceable and valid. This deed outlines the terms of the life estate and identifies the parties involved. By recording your life estate form, you ensure that your intentions regarding property transfer are legally acknowledged. This step is essential to maintain clarity and prevent future disputes over the property.