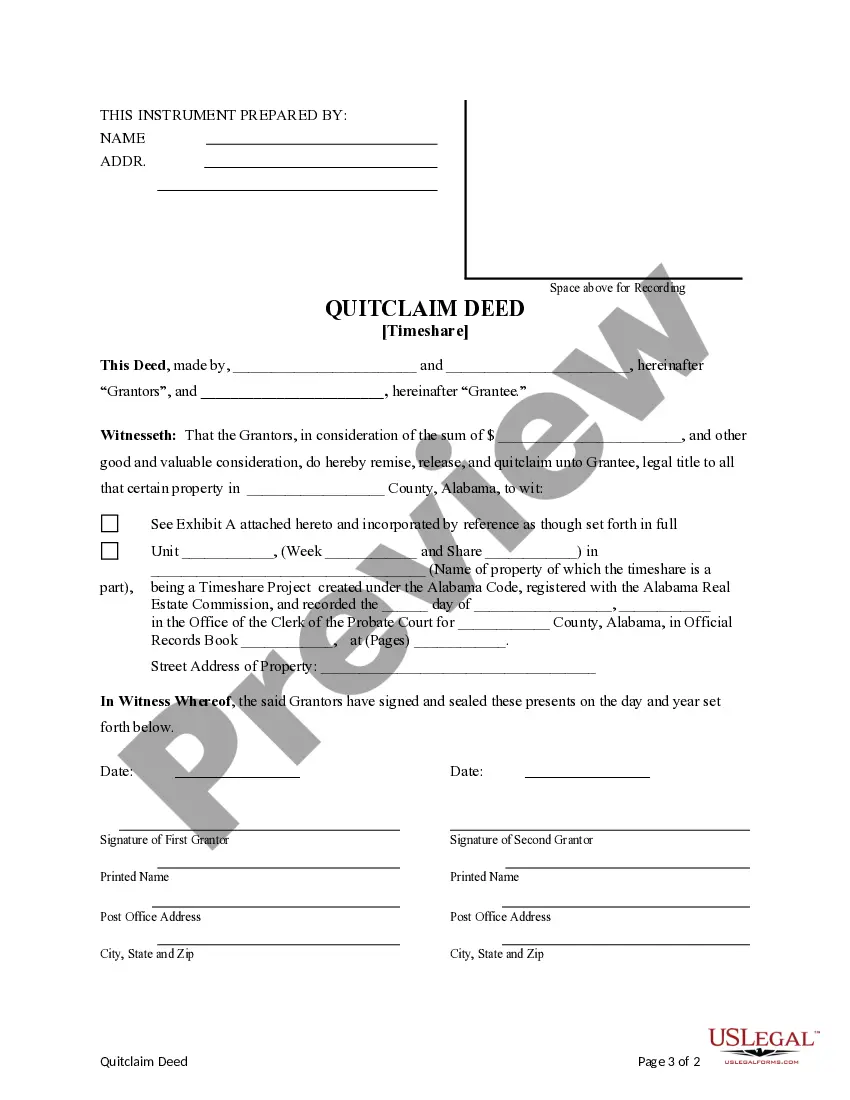

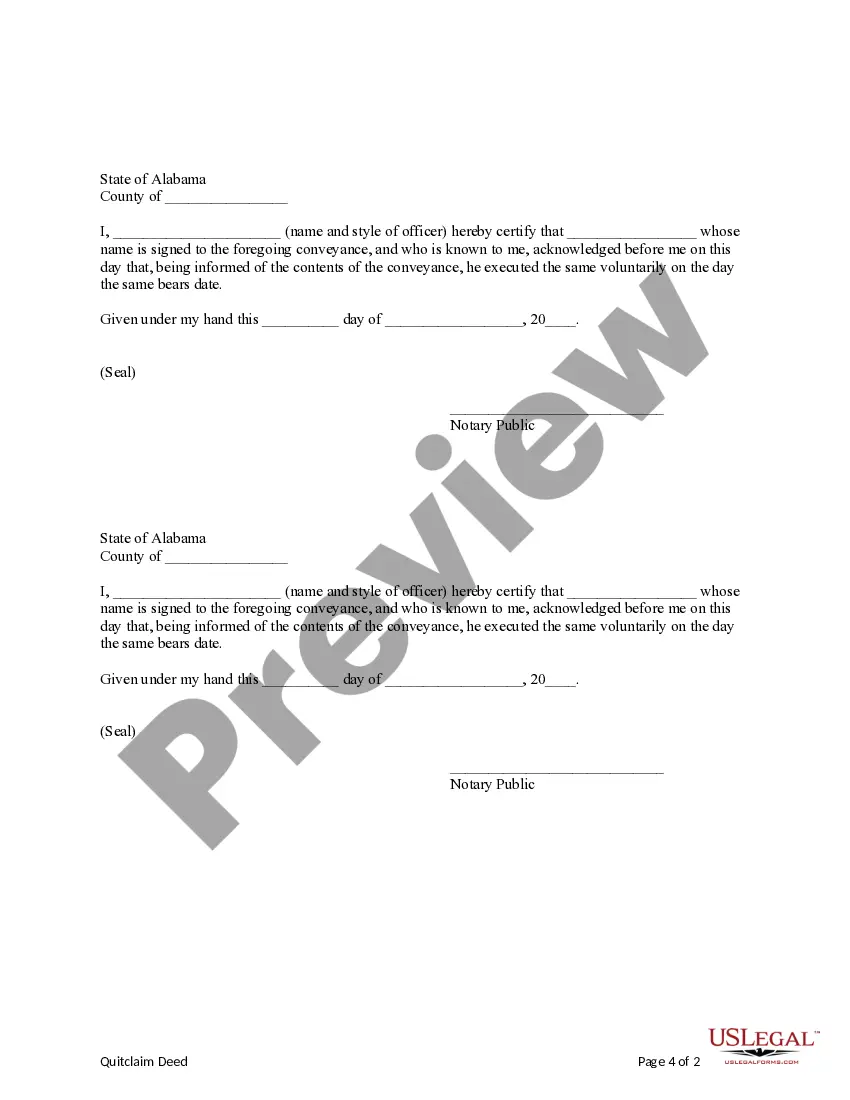

This form is a Quitclaim Deed where the Grantors are two individuals and the Grantee is an individual. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Quitclaim Deed With Right Of Survivorship

Description

How to fill out Quitclaim Deed With Right Of Survivorship?

How to locate professional legal documents that adhere to your state laws and create the Quitclaim Deed With Right Of Survivorship without consulting an attorney.

Numerous online services offer templates to address various legal scenarios and requirements. However, it may require some time to ascertain which of the available examples meet both your specific needs and legal standards.

US Legal Forms is a trustworthy service that assists you in discovering official documents crafted according to the latest state law revisions and helps you save on legal fees.

If you do not possess an account with US Legal Forms, follow the instructions below: Examine the webpage you have accessed and verify if the form meets your requirements. Utilize the form description and preview options if they are available. Seek another template in the header identifying your state if needed. Click the Buy Now button upon locating the appropriate document. Select the most fitting pricing plan, then Log In or register for an account. Choose your payment method (by credit card or via PayPal). Select the file format for your Quitclaim Deed With Right Of Survivorship and click Download. The downloaded templates will remain with you: you can always access them again in the My documents section of your profile. Sign up for our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not a conventional web library.

- It is a compilation of over 85,000 verified templates for diverse business and personal situations.

- All documents are categorized by field and state to enhance your search efficiency and convenience.

- It also includes robust tools for PDF editing and eSignature, allowing users with a Premium subscription to efficiently finalize their paperwork online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Quitclaim Deed With Right Of Survivorship using the corresponding button next to the file name.

Form popularity

FAQ

A survivorship clause typically appears in a property deed stating that, upon the death of one owner, the remaining owner will inherit the deceased's share automatically. For instance, a Quitclaim deed with right of survivorship may specify that both parties hold equal shares and that ownership transfers entirely to the surviving owner upon death. This clause can prevent future disputes and ensures a smooth transition of property. For tailored legal documents, consider using a platform like uslegalforms.

One disadvantage of the right of survivorship involves loss of control over how assets are distributed after death. With a Quitclaim deed with right of survivorship, co-owners cannot dictate different heirs for their shares. Additionally, if one owner has financial issues, creditors may be able to claim the property. It’s essential to weigh these risks before opting for this form of ownership.

An example of the right of survivorship can be seen in joint property ownership between spouses. If one spouse passes away, their share automatically transfers to the surviving spouse through a Quitclaim deed with right of survivorship. This arrangement ensures that the surviving spouse maintains full ownership and control of the property. It provides peace of mind during difficult times.

Assets that typically pass by survivorship include real estate, bank accounts, and securities titled in joint ownership. With a Quitclaim deed with right of survivorship, property ownership effectively transfers directly to the surviving owner upon death. This method avoids the complexities of probate, allowing for quicker access to the assets. Always consult legal resources, as certain exceptions may apply.

Survivorship refers to the legal right of a surviving co-owner to inherit the deceased co-owner's share of property. When using a Quitclaim deed with right of survivorship, both owners jointly hold the title. Upon one owner's death, the other automatically becomes the sole owner without the need for probate. This simplifies the transfer process and maintains family harmony.

While you can complete a survivorship application without a lawyer in Ontario, seeking legal advice can be beneficial. A quitclaim deed with right of survivorship involves important legal implications, and having a professional guide you can help avoid potential pitfalls. Utilizing platforms like US Legal Forms can provide you with the necessary forms and resources to make the process smoother, whether on your own or with legal assistance.

One notable disadvantage of a quitclaim deed with right of survivorship is that it does not guarantee a clear title to the property. This means that if there are any existing liens or claims against the property, they may transfer to the new owner. Additionally, this type of deed provides no warranty against future claims, which can be a concern for those protecting their investments.

The rule of survivorship states that when one owner of a property dies, the ownership automatically transfers to the surviving owner or owners. This principle is particularly relevant in the context of a quitclaim deed with right of survivorship, ensuring that the remaining owners retain full control of the property without going through probate. You can establish this arrangement easily, making it a favorable choice for couples or joint owners.

Quitclaim deeds are most often used to transfer property among family members, such as in situations involving divorces or estate planning. These deeds allow individuals to easily transfer ownership without the complexities of traditional property sales. The quitclaim deed with right of survivorship is beneficial for couples who wish to ensure continuity of ownership after one’s death. Whether it's a gift or settling an estate, quitclaim deeds offer a flexible solution.

Right of survivorship on a deed means that upon the death of one owner, their interest in the property passes directly to the surviving owner(s). This legal concept eliminates the need for probate, thereby speeding up the transfer process. In instances such as a quitclaim deed with right of survivorship, it plays a crucial role in maintaining ownership among family members or partners. Understanding this right can significantly affect how your estate is handled.