Chooses Bears Executrix With The Same Character

Description

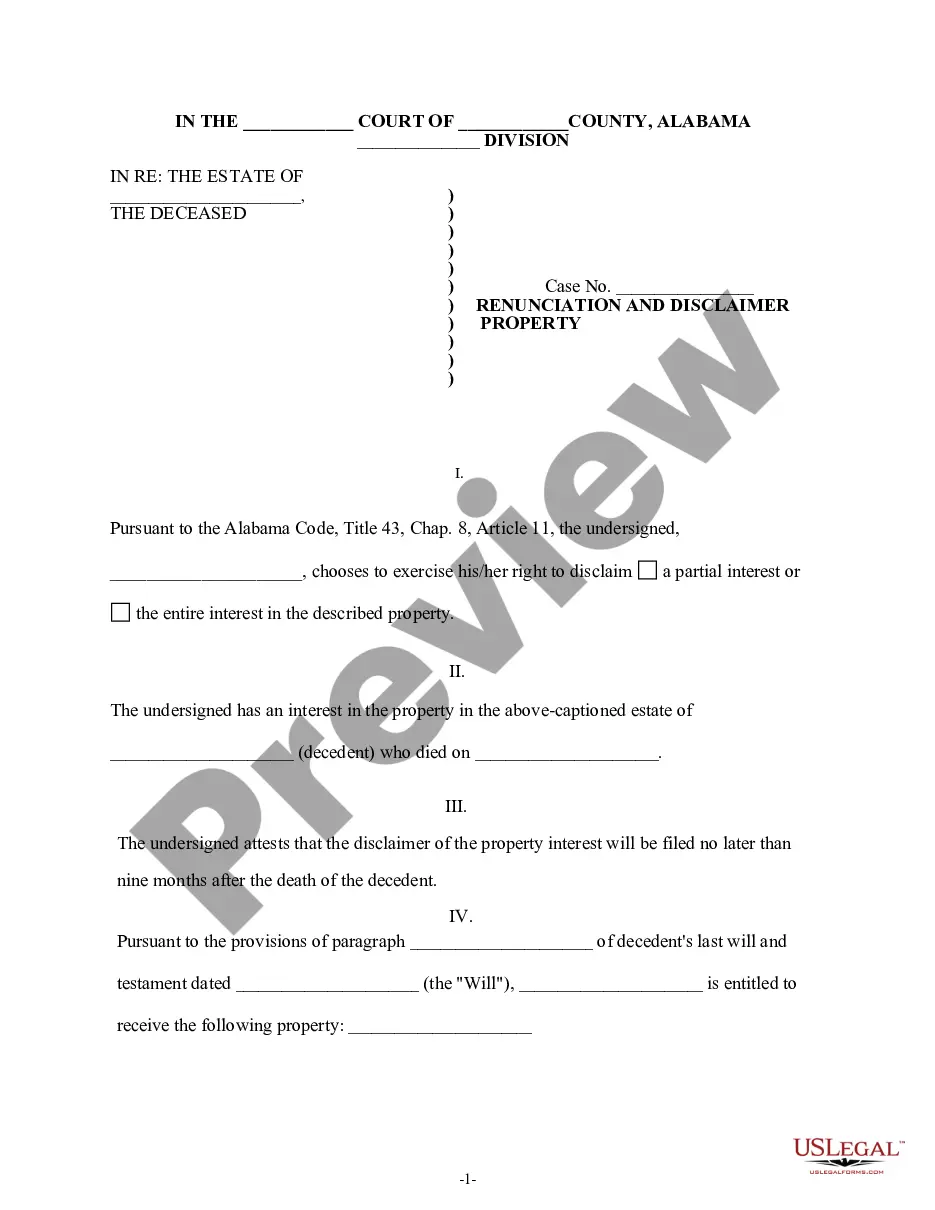

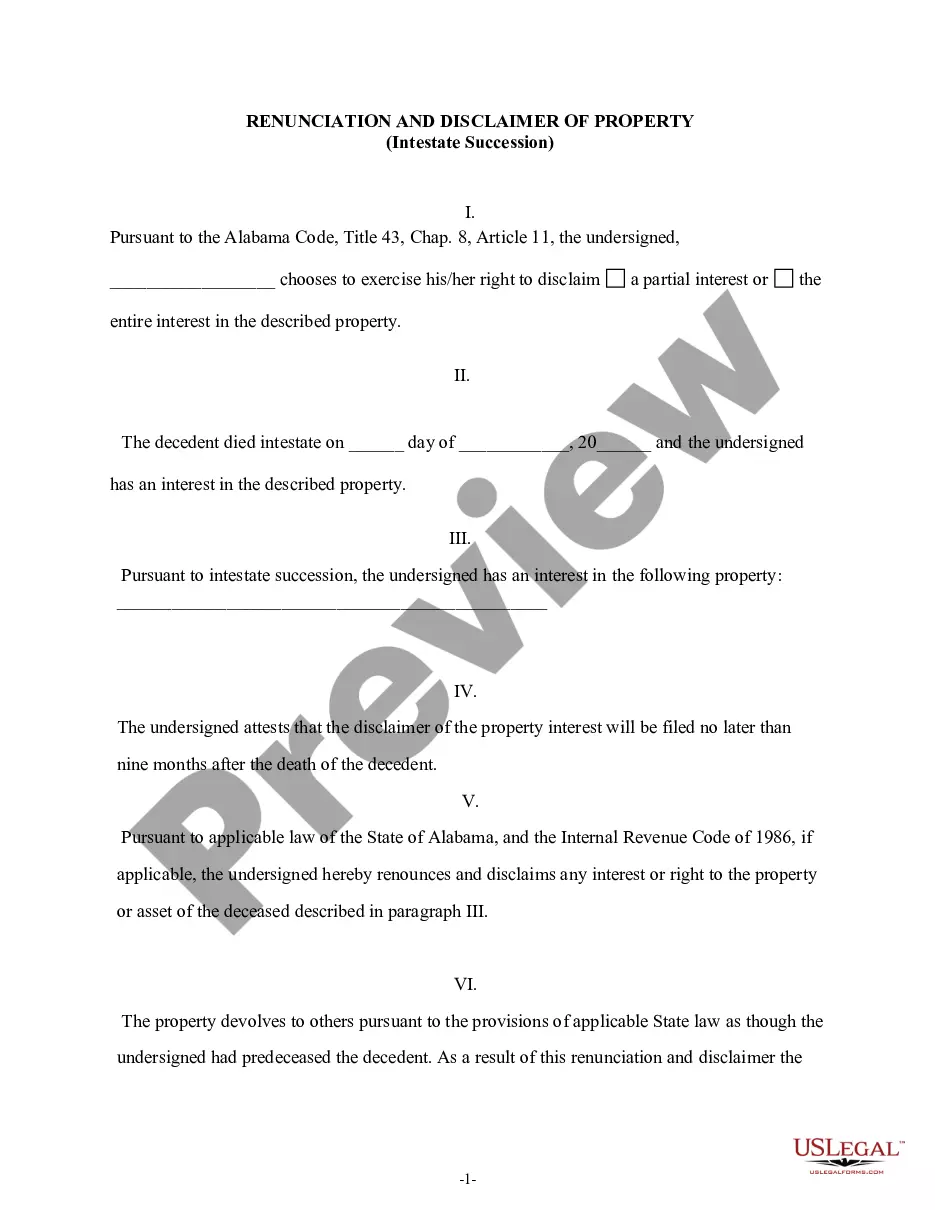

How to fill out Alabama Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- Log in to your existing US Legal Forms account. Check your subscription status to ensure it's active; renew if necessary.

- Browse the extensive online library. Utilize the Preview mode and form description to confirm that the selected document matches your needs and jurisdiction.

- If the current form isn't suitable, use the Search tab to find another template that fits.

- Once you've found the right document, select the Buy Now button to choose a subscription plan that best works for you.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download the chosen form. Save it on your device, and access it anytime through the My Forms menu in your profile.

Utilizing US Legal Forms simplifies the complex process of legal documentation. The platform's extensive resources ensure you have the necessary tools to execute legal forms efficiently.

Take advantage of US Legal Forms today for all your legal documentation needs. Start your journey towards hassle-free legal processes now!

Form popularity

FAQ

An executor can decide to appoint an alternate executor if necessary. When an executor chooses bears executrix with the same character, this offers flexibility and ensures that the estate can continue to be managed efficiently. However, it's essential to follow legal procedures outlined in the original will or state laws. Engaging legal help can provide clarity on such decisions.

Executor fees are classified as taxable income by the IRS. When an executor chooses bears executrix with the same character, understanding this financial obligation is crucial. Executors must report these earners on their tax returns. For clarity on tax matters, consulting a tax professional or utilizing an organized resource like US Legal Forms can be immensely helpful.

Yes, if the executor receives payment, the estate should issue a Form 1099 for those fees. When an executor chooses bears executrix with the same character, they must ensure all tax obligations are met. This includes reporting earnings, which helps clear any potential tax issues down the road. Consulting with tax professionals can provide guidelines on proper reporting.

An executor is the primary person responsible for managing an estate, while a co-executor shares these duties. When an executor chooses bears executrix with the same character, this teamwork can offer additional oversight and support. However, both executors must work closely to ensure seamless administration of the estate. Clear communication and defined roles are vital for effectiveness.

Yes, executor fees are considered taxable income and must be reported to the IRS. When an executor chooses bears executrix with the same character, they should retain records of any payments received for processing the estate. Reporting these fees accurately is essential to avoid potential legal issues. Utilizing a dedicated platform like US Legal Forms can streamline this process.

To add a co-executor to a will, you must create or amend the document, clearly stating the co-executor's role. When an executor chooses bears executrix with the same character, this collaboration can enhance management efficiency. It is advisable to consult with legal professionals to ensure proper language and compliance with your jurisdiction's laws. This way, the intentions of the testator remain clear.

An executor can be personally liable for unpaid taxes if they fail to distribute the estate properly or ignore tax obligations. When an executor chooses bears executrix with the same character, they must act prudently and fulfill tax duties. It is critical to understand that improper handling of tax matters can lead to financial repercussions for the executor. Thus, seeking professional advice is often beneficial.

Having co-executors can be a good idea if they complement each other's strengths. When you choose individuals with the same character, they can work together to handle the estate efficiently. However, consider potential conflicts or issues that might arise from too many opinions. Balancing the team dynamic is crucial for smooth administration, and uslegalforms can help in documenting such arrangements clearly.

Selecting the right executor involves assessing a person’s integrity, organizational skills, and availability. Choose someone who shares the same character and can remain impartial during stressful times. They should understand the responsibilities of handling your estate and be comfortable making tough decisions. You might want to consider using uslegalforms to create a comprehensive will, which can clarify your preferences.

In general, the executor does not override the trustee, as they serve different functions. An executor administers the will while a trustee manages the trust. However, if the will and trust conflict, the specific terms of each document matter most. It’s essential to choose individuals who understand their respective roles and responsibilities.