Probate Forms For Alabama

Description

Form popularity

FAQ

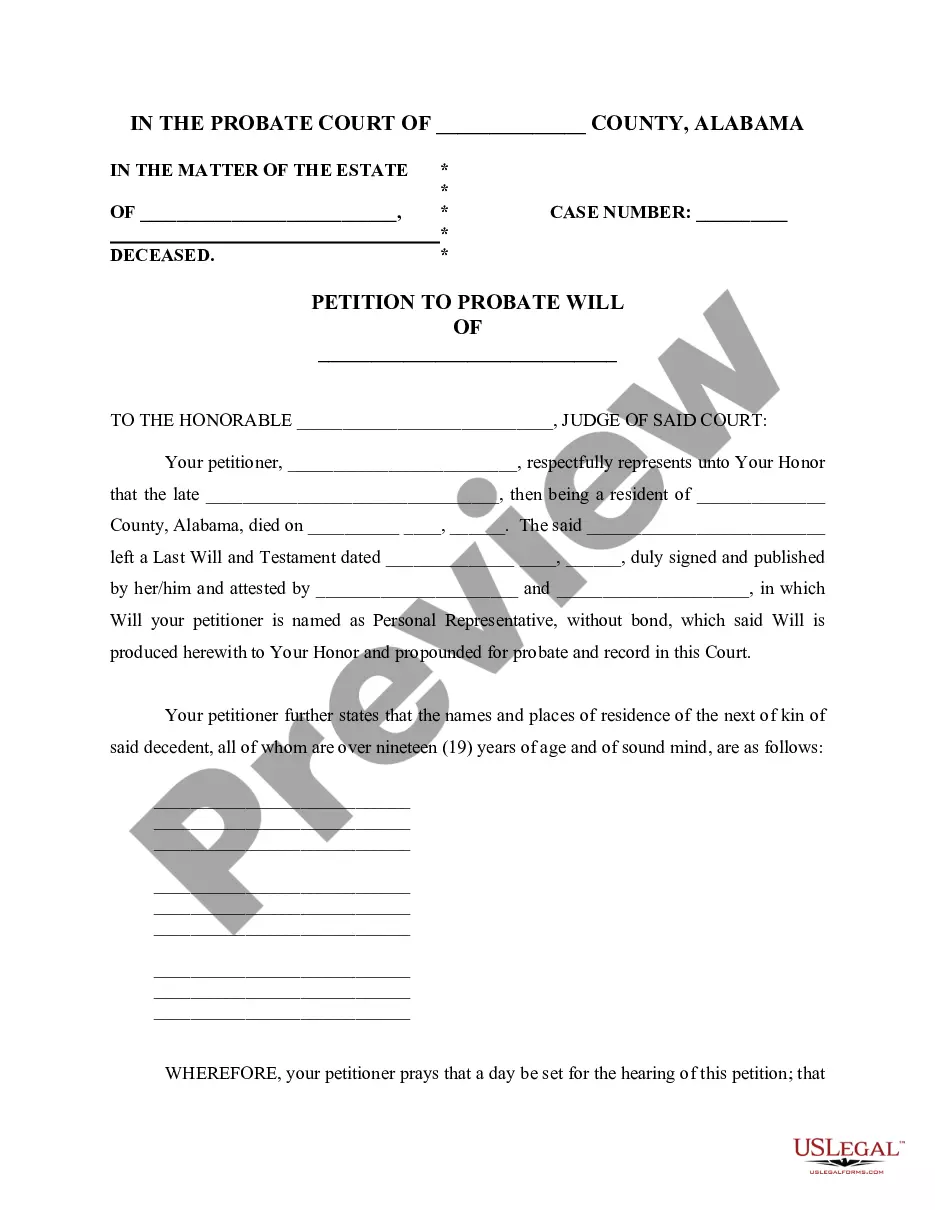

To begin the probate process in Alabama, first, gather all necessary documents, including the deceased's will and death certificate. You will then need to file a petition for probate with the local probate court, which will review the will and appoint an executor if one is named. Following this, it is essential to notify all interested parties, like heirs and creditors, about the probate proceedings. Utilizing resources such as probate forms for Alabama from US Legal Forms can help streamline this process by providing the necessary documents to ensure compliance with state requirements.

While you are not required to hire a lawyer to probate a will in Alabama, having legal assistance can be beneficial, especially for complex cases. Many individuals successfully navigate the process on their own by using accurate probate forms for Alabama. Our platform offers these forms, making it easier for you to handle probate without legal jargon or unnecessary complications.

Filing probate in Alabama involves several key steps, starting with the submission of the will and necessary probate forms for Alabama to the appropriate probate court. You will need to provide information about the deceased's assets, debts, and beneficiaries. Our user-friendly platform makes it easy to complete and file these forms, simplifying the overall process for you.

Probating a will in Alabama generally varies in duration, typically ranging from six months to a year. The timeline depends on factors like estate size and any disputes among heirs. By using appropriate probate forms for Alabama, you can help expedite the process and ensure compliance with state laws. Our platform provides these necessary forms to help you navigate the process smoothly.

The probate process in Alabama can take several months to more than a year, depending on factors such as the estate's size and complexity. Generally, simpler estates may complete probate in about six months, while more complicated cases may take longer. With the right probate forms for Alabama, you can streamline the process and reduce delays. Utilizing our platform can make obtaining and filing these forms easier.

Yes, an estate can often be settled without probate in Alabama, especially if all assets are non-probate assets or if the estate's total value is below a certain threshold. In these cases, heirs may use simpler procedures to transfer property without going through the full probate process. Utilizing probate forms for Alabama can still enhance clarity even in straightforward cases.

Avoiding probate in Alabama can be achieved through careful estate planning. Strategies include establishing living trusts, holding assets jointly, and naming beneficiaries on accounts. By implementing these methods, you can simplify the transfer of assets and reduce the use of probate forms for Alabama at the time of death.

In Alabama, there is generally a time limit to settle an estate, which typically spans six months from the appointment of an executor. However, complications can arise if claims against the estate or disputes emerge. Adhering to timelines is vital for effective estate management, often facilitated by using probate forms for Alabama.

Yes, property can be transferred without probate in Alabama under certain circumstances. For example, joint tenancy, certain types of trusts, and designated beneficiaries for specific accounts can bypass the probate process. However, using probate forms for Alabama may still provide a clearer process for transferring ownership.

If a will is not probated in Alabama, the estate cannot be legally distributed. Assets may remain in limbo, as they cannot be transferred to beneficiaries without probate. Furthermore, unpaid debts may accumulate, creating complications for heirs and possibly delaying inheritance.