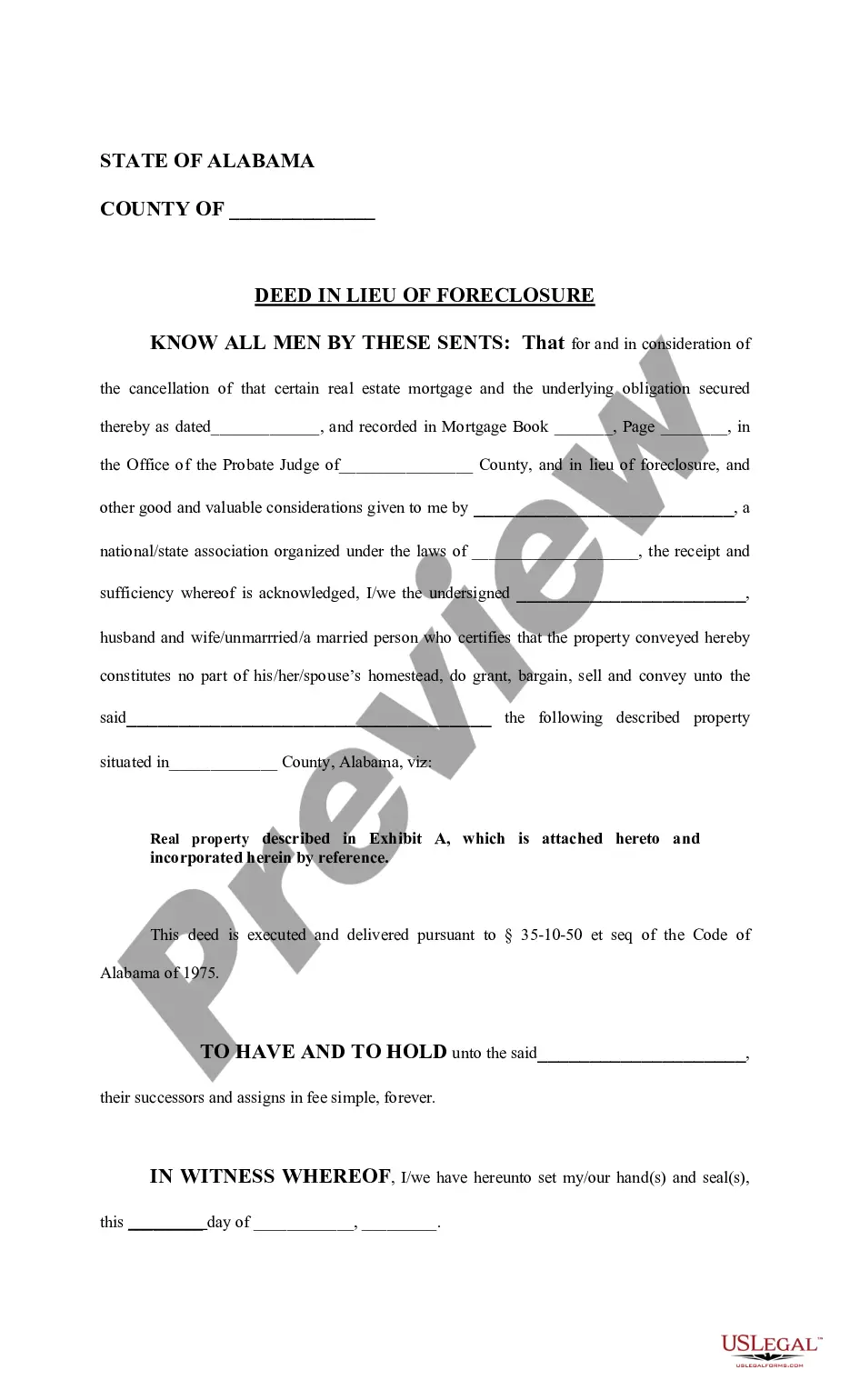

This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

Deed In Lieu Of Foreclosure Template Foreclosure

Description

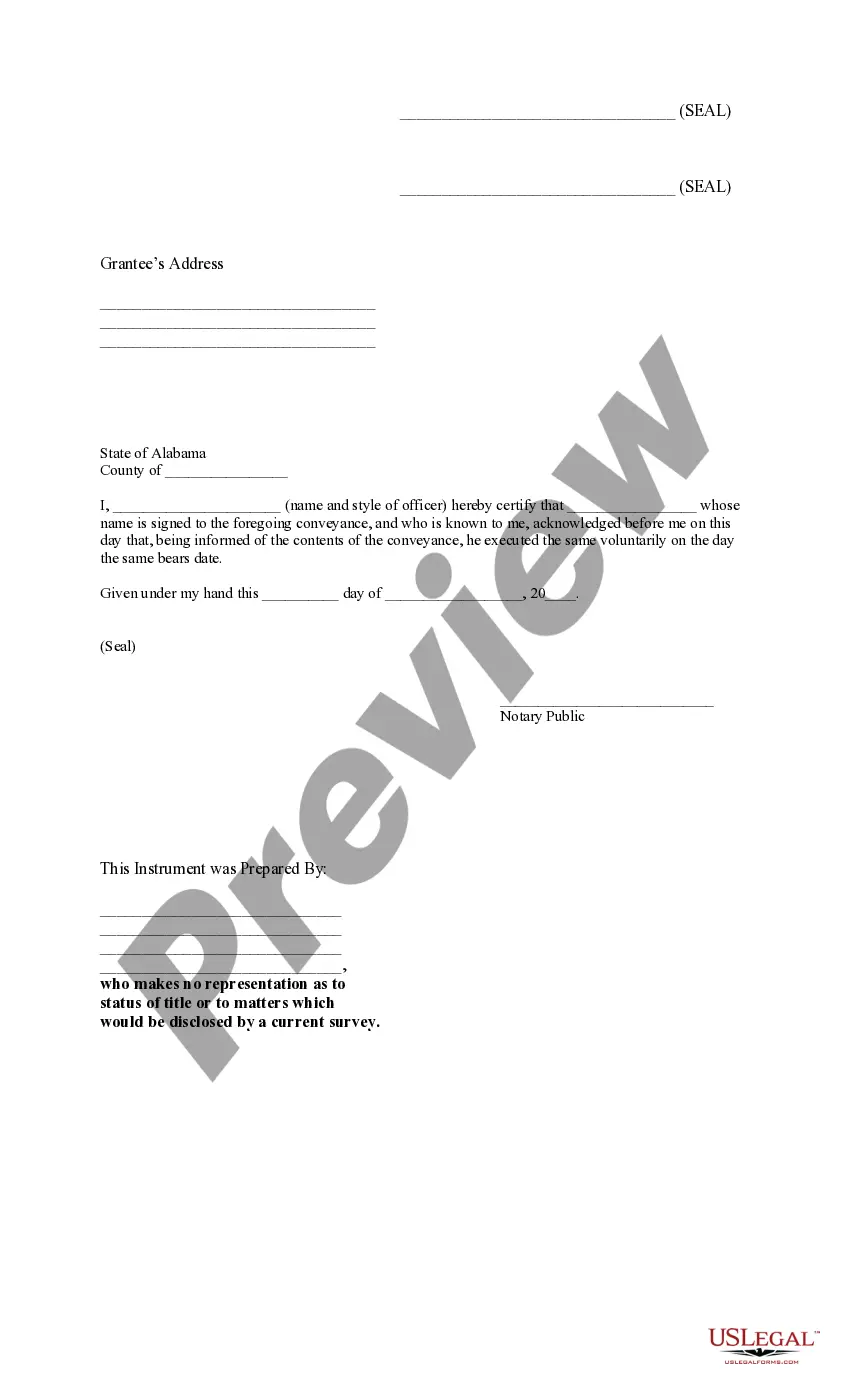

How to fill out Deed In Lieu Of Foreclosure Template Foreclosure?

There is no longer a necessity to squander time hunting for legal documents to adhere to your local state requirements.

US Legal Forms has gathered all of them in a single location and made their accessibility more straightforward.

Our platform offers over 85,000 templates for any business and personal legal needs categorized by state and usage area. All forms are properly drafted and verified for accuracy, so you can trust in obtaining an up-to-date Deed In Lieu Of Foreclosure Template Foreclosure.

Choose the preferred subscription plan and register for an account or sign in. Make your subscription payment via credit card or PayPal to proceed. Select the file format for your Deed In Lieu Of Foreclosure Template Foreclosure and download it to your device. Print your form to complete it by hand or upload the sample if you wish to work with an online editor. Drafting legal documents following federal and state regulations is fast and easy with our library. Attempt US Legal Forms now to maintain your documentation in order!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever required by accessing the My documents tab in your profile.

- If you have not previously engaged with our platform, the process will necessitate additional steps to conclude.

- Here’s how new users can locate the Deed In Lieu Of Foreclosure Template Foreclosure in our catalog.

- Examine the page content thoroughly to confirm it includes the sample you need.

- Utilize the form description and preview options if available.

- Employ the Search field above to look for an alternative template if the current one doesn't meet your needs.

- Click Buy Now adjacent to the template title once you identify the appropriate one.

Form popularity

FAQ

One significant disadvantage of a deed lies in its impact on future credit opportunities for the borrower. Accepting a deed in lieu of foreclosure can result in lasting consequences, making it harder to secure future financing. Furthermore, depending on the local laws, borrowers may still retain personal liability for any remaining debts tied to the mortgage after the deed transfer. Engaging with uslegalforms can help simplify the process and clarify potential consequences through a reliable deed in lieu of foreclosure template foreclosure.

While using a deed in lieu of foreclosure can be beneficial, it also presents certain disadvantages. Borrowers may face challenges regarding their credit, as lenders often report such transactions, causing credit scores to suffer. Additionally, mortgage deficiencies can initially remain, which may lead to tax liabilities. It's essential to consult a knowledgeable platform like uslegalforms to access a comprehensive deed in lieu of foreclosure template foreclosure and ensure that all legal aspects are considered.

One of the most effective alternatives to foreclosure is a deed in lieu of foreclosure. This option allows the borrower to voluntarily transfer ownership of the property to the lender, helping avoid the lengthy and costly foreclosure process. For borrowers facing financial difficulties, this approach can lead to less damaging consequences for their credit score. Using a deed in lieu of foreclosure template foreclosure can streamline this process, making it easier for both parties to agree.

The primary disadvantage for lenders accepting a deed in lieu of foreclosure stems from potential losses linked to property value fluctuations. If the property’s market value is lower than the outstanding mortgage, the lender could incur significant financial losses. Additionally, the lender may struggle with disposing of the property efficiently, leading to prolonged vacancy and maintenance costs. A well-structured deed in lieu of foreclosure template foreclosure can help facilitate the process but does not eliminate the inherent risks.

The biggest disadvantage for a lender accepting a deed in lieu of foreclosure is the risk of property maintenance and market fluctuations. Once they take ownership, the property can require repairs, and any decline in market value directly affects their financial situation. This uncertainty makes lenders cautious about accepting this option. For a structured approach in dealing with such situations, lenders can rely on a deed in lieu of foreclosure template foreclosure.

The main disadvantage for lenders accepting a deed in lieu of foreclosure is the potential loss of financial recovery. Unlike foreclosure, where they may auction the property to recover losses, a deed in lieu means they must manage and sell the property themselves. This process can be time-consuming and costly. Using a deed in lieu of foreclosure template foreclosure can help lenders navigate this transition more smoothly.

A CA deed in lieu of foreclosure is a specific type of deed applicable in California, where homeowners voluntarily transfer ownership of their property to the lender. This legal process can help homeowners avoid the negative repercussions of foreclosure, while also expediting the resolution of their financial difficulties. Following a deed in lieu of foreclosure template foreclosure can provide clarity and ensure compliance with California laws.

One significant disadvantage of a deed in lieu foreclosure is that it may not satisfy all financial obligations. If there is a remaining balance on the mortgage, the lender might pursue a deficiency judgment against you. This outcome can add financial strain, despite the help a deed in lieu of foreclosure offers. To minimize risks, using a deed in lieu of foreclosure template foreclosure can guide you through set expectations and conditions.

Yes, you can buy a house after a deed in lieu of foreclosure, but it may take some time. Lenders typically require a waiting period, often between two to four years, before you can qualify for a new mortgage. Your financial situation and credit score will play crucial roles in this process. Utilizing a deed in lieu of foreclosure template foreclosure can help you better understand your next steps towards homeownership.

A deed in lieu of foreclosure provides several advantages for homeowners facing financial distress. Firstly, it allows you to avoid the lengthy and costly foreclosure process. Additionally, it can help protect your credit score by minimizing the negative impact compared to a traditional foreclosure. To make the process smoother, you can use a deed in lieu of foreclosure template foreclosure to ensure all necessary documentation is properly completed.