Promissory Note Template Alabama With Compound Interest

Description

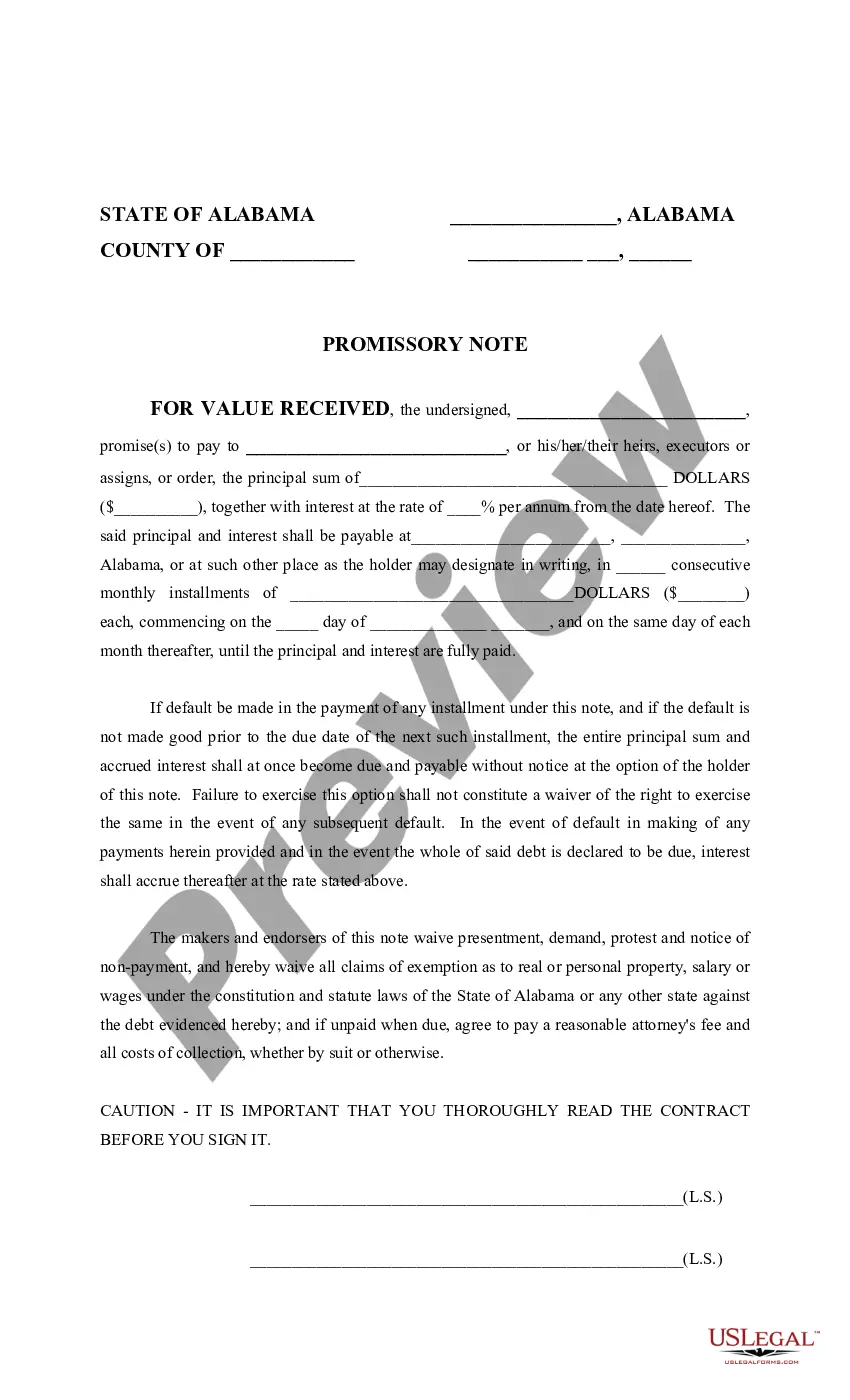

How to fill out Alabama Promissory Note?

Whether you regularly handle documents or occasionally need to submit a legal report, it is vital to find a source where all samples are pertinent and current.

The initial step when using a Promissory Note Template Alabama With Compound Interest is to confirm that it is indeed the most recent version, as this determines its acceptability.

If you want to streamline your search for the newest document examples, check out US Legal Forms.

1. Utilize the search menu to find the desired form. 2. Examine the Promissory Note Template Alabama With Compound Interest preview and summary to ensure it is exactly what you are searching for. 3. After confirming the form, simply click Buy Now. 4. Choose a subscription plan that suits you. 5. Create an account or sign in to your existing one. 6. Enter your bank card or PayPal information to finalize the purchase. 7. Select the document format for download and confirm it. 8. Eliminate any confusion associated with legal documentation. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a directory of legal documents that includes nearly every template you might need.

- Look for the needed templates, assess their relevance immediately, and discover more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates spanning various fields.

- Easily locate Promissory Note Template Alabama With Compound Interest samples with just a few clicks and save them in your account at any time.

- Having a US Legal Forms account will enable you to retrieve all the templates you require with added ease and less hassle.

- Simply click Log In in the header of the website, and navigate to the My documents section where all the forms you need will be at your fingertips, eliminating the need to spend time searching for the right template or examining its relevance.

- To acquire a form without an account, follow these instructions.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

1. INTEREST. Interest shall accrue on the unpaid principal balance of the Promissory Note at the applicable federal rate in effect on , 199 , which was percent ( %) per annum, compounded semiannually.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

Find the principal amount of the loan as stated in the promissory note. Use a free online amortization calculator to calculate the amount of monthly interest. Divide the monthly interest amount by the principal loan amount to get the monthly interest rate.

Calculating Compound Interest Compound interest uses a more complicated formula: You must add 1 to the interest rate (for example, a 5 percent interest rate would mean 1 + 0.05 = 1.05) and then raise the total to the power of whatever the number of periods is for repayment.