Promissory Note Template Alabama With Co-maker

Description

How to fill out Alabama Promissory Note?

Administered processes necessitate exactness and correctness.

If you do not manage paperwork like the Promissory Note Template Alabama With Co-maker on a regular basis, it may result in some confusions.

Selecting the appropriate template from the outset will ensure that your document submission proceeds smoothly and avoids the hassles of re-sending a document or repeating the same task from the top.

Stop worrying about bureaucratic procedures and make your document handling easier.

- US Legal Forms is the largest online repository of forms offering over 85 thousand templates covering a wide range of topics.

- You can quickly locate the latest and most suitable version of the Promissory Note Template Alabama With Co-maker by searching for it on the site.

- Find, store, and save templates within your account or refer to the description to confirm you have the correct one ready.

- With a US Legal Forms account, you can obtain, store in one place, and navigate through the templates you save for access in just a few clicks.

- While on the website, click the Log In button to authenticate.

- Then, go to the My documents section, where your document list is maintained.

- Browse through the form descriptions and retain the ones you need anytime.

- If you are not a subscribed member, finding the necessary template will take a few more steps.

Form popularity

FAQ

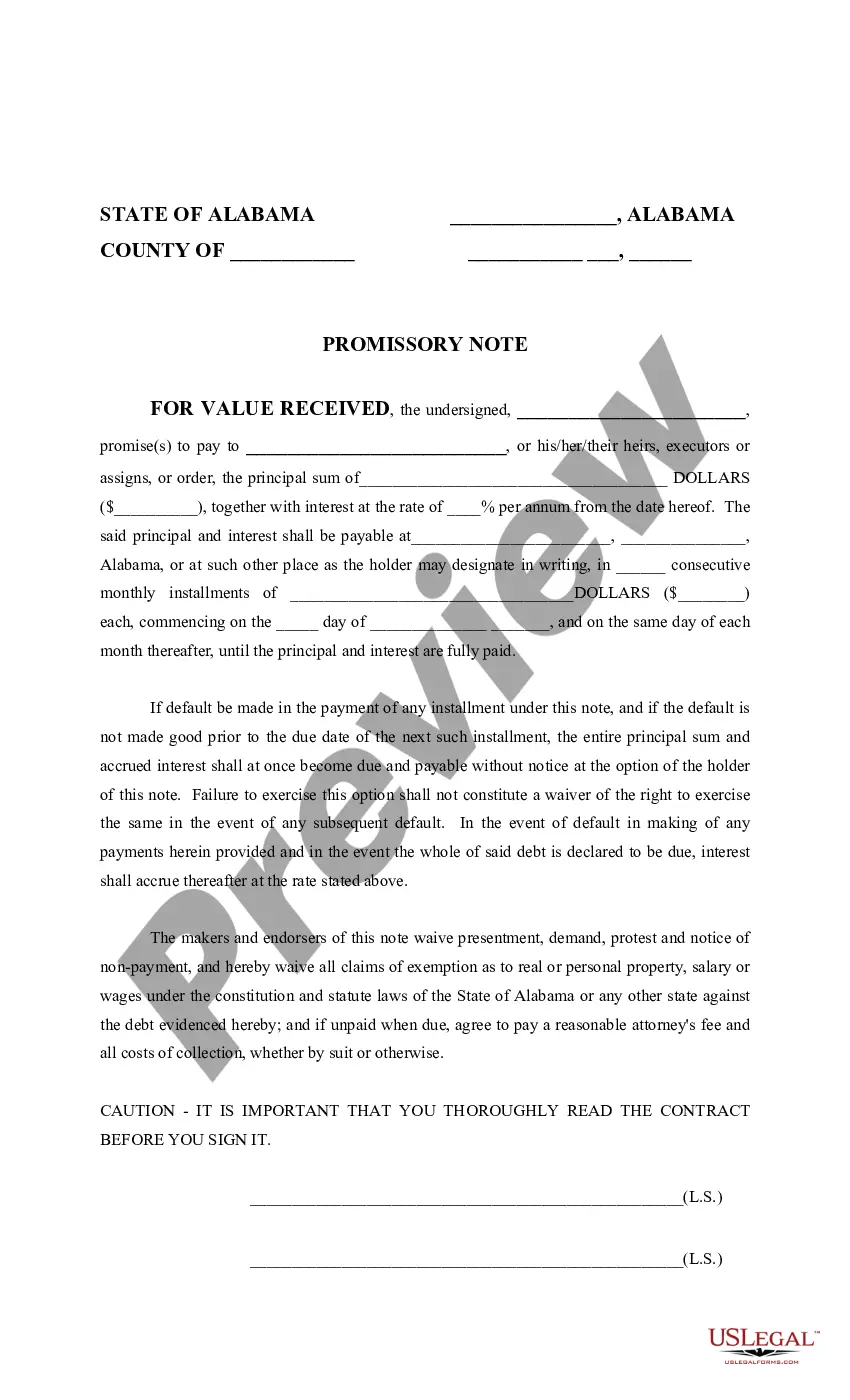

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.