This is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more.

Alabama Foreign Corporation Withdrawal

Description

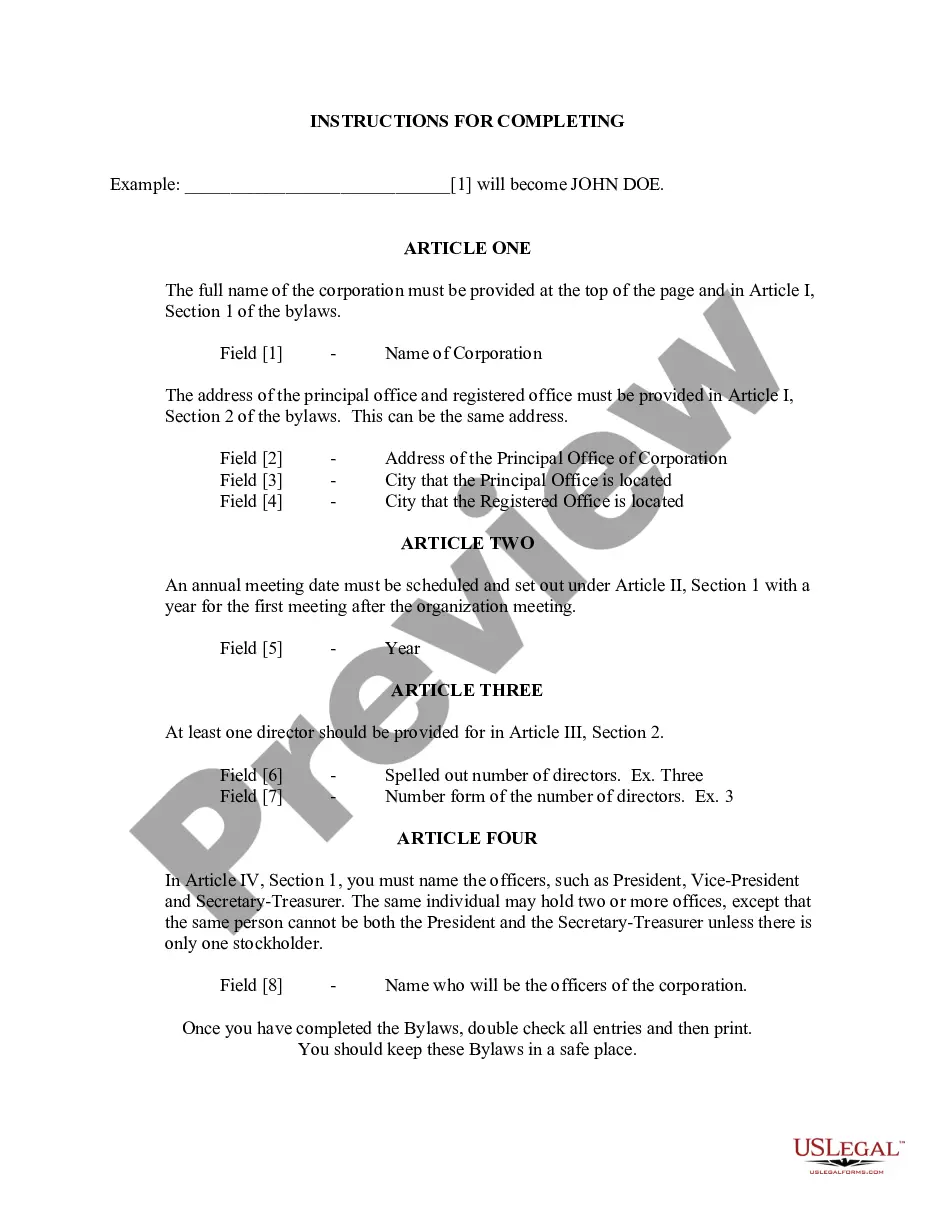

How to fill out Alabama Bylaws For Corporation?

How to locate professional legal documents that adhere to your state regulations and complete the Alabama Foreign Corporation Withdrawal without engaging a lawyer.

Numerous online services offer templates to address various legal situations and formalities. However, it might take some time to identify which of the existing samples satisfy both your use case and legal standards.

US Legal Forms is a trustworthy service that aids in discovering official documents created in line with the most recent updates to state laws, helping you save money on legal support.

If you do not have an account with US Legal Forms, then follow the instructions below: Review the webpage you've opened and ascertain if the form meets your requirements. To accomplish this, utilize the form description and preview options if available. Search for an alternative template in the header specifying your state if needed. Click the Buy Now button when you find the appropriate document. Choose the most suitable pricing plan, then either sign in or register for an account. Select the payment method (either by credit card or through PayPal). Modify the file format for your Alabama Foreign Corporation Withdrawal and click Download. The downloaded templates remain yours: you can always access them in the My documents tab of your profile. Sign up for our platform and create legal documents independently like a skilled legal professional!

- US Legal Forms is not just a typical online database.

- It comprises over 85k verified templates catering to different business and personal circumstances.

- All documents are organized by industry and state to expedite your search process, making it more convenient.

- Moreover, it integrates with robust tools for PDF editing and eSignature, enabling users with a Premium subscription to effortlessly finalize their paperwork online.

- It requires minimal effort and time to obtain the necessary documents.

- If you already possess an account, Log In and ensure your subscription is active.

- Download the Alabama Foreign Corporation Withdrawal using the relevant button beside the file name.

Form popularity

FAQ

Dissolving an LLC in Alabama can be done conveniently online through the Alabama Secretary of State's website. You will need to fill out the Articles of Dissolution form, which requires basic details about your LLC. Once submitted, the state will review your request and confirm the dissolution. Utilizing platforms like uslegalforms can simplify this process by providing guidance for your Alabama foreign corporation withdrawal.

To dissolve a corporation in Alabama, you must file a Certificate of Dissolution with the Secretary of State. This document includes key information about your corporation and confirms your intent to dissolve. Upon acceptance, the state will process the dissolution, allowing you to officially begin the Alabama foreign corporation withdrawal process. It is advisable to also notify creditors and settle any pending obligations during this time.

When a corporation is dissolved, it effectively ceases to exist as a legal entity. This means it can no longer conduct business, enter contracts, or hold assets. The dissolution process also involves settling any outstanding obligations, such as debts and tax responsibilities. It is essential to complete these steps properly to ensure compliance, especially when considering Alabama foreign corporation withdrawal.

Similar to LLCs, a domestic corporation is incorporated in the state where it conducts business, whereas a foreign corporation is formed in a different state and must register to operate in Alabama. This registration is essential for compliance, especially if you plan an Alabama foreign corporation withdrawal in the future. Knowing the distinction can help you navigate the regulatory landscape effectively.

A domestic company operates within the state where it is formed, while a foreign company operates in a different state. The distinction is crucial, particularly concerning regulations, taxation, and state-specific compliance needs. When dealing with an Alabama foreign corporation withdrawal, understanding this difference can help you address your obligations properly. Make sure to consult resources that provide clear guidance.

A foreign LLC in Alabama refers to a limited liability company that is established in another state but seeks to operate within Alabama. To legally operate, the foreign LLC must register with the Alabama Secretary of State. This registration process is crucial for compliance, especially when contemplating Alabama foreign corporation withdrawal in the future. Seeking guidance can simplify this process for you.

In Alabama, you can establish several types of corporations, including C Corporations, S Corporations, and non-profit corporations. Each type offers unique tax structures and operational guidelines that can impact your business. Understanding these types can assist you in making the best choice for your organization. Consider consulting with experts to help navigate your options.

To cancel your Alabama LLC, you need to file the Articles of Dissolution with the Secretary of State. This process effectively handles the Alabama foreign corporation withdrawal by notifying the state of your intention to cease operations. Once your filing is processed, ensure that you settle any outstanding taxes or obligations. It's advisable to seek guidance from a professional if you're unsure about the specific steps.

Closing an LLC in Alabama involves submitting a Certificate of Cancellation to the Secretary of State. Ensure that all debts are settled and final tax returns are filed before taking this step. If applicable, an Alabama foreign corporation withdrawal will also be necessary if your LLC is registered as a foreign entity. For assistance, consider using a platform like uslegalforms to navigate the process smoothly.

To file a foreign entity in Alabama, you need to complete an Application for Registration of Foreign Entity and submit it to the Secretary of State. This application ensures your foreign corporation is legally recognized to conduct business in Alabama. If at any time you must evaluate Alabama foreign corporation withdrawal, our platform can simplify the process by providing detailed guidance and necessary forms.