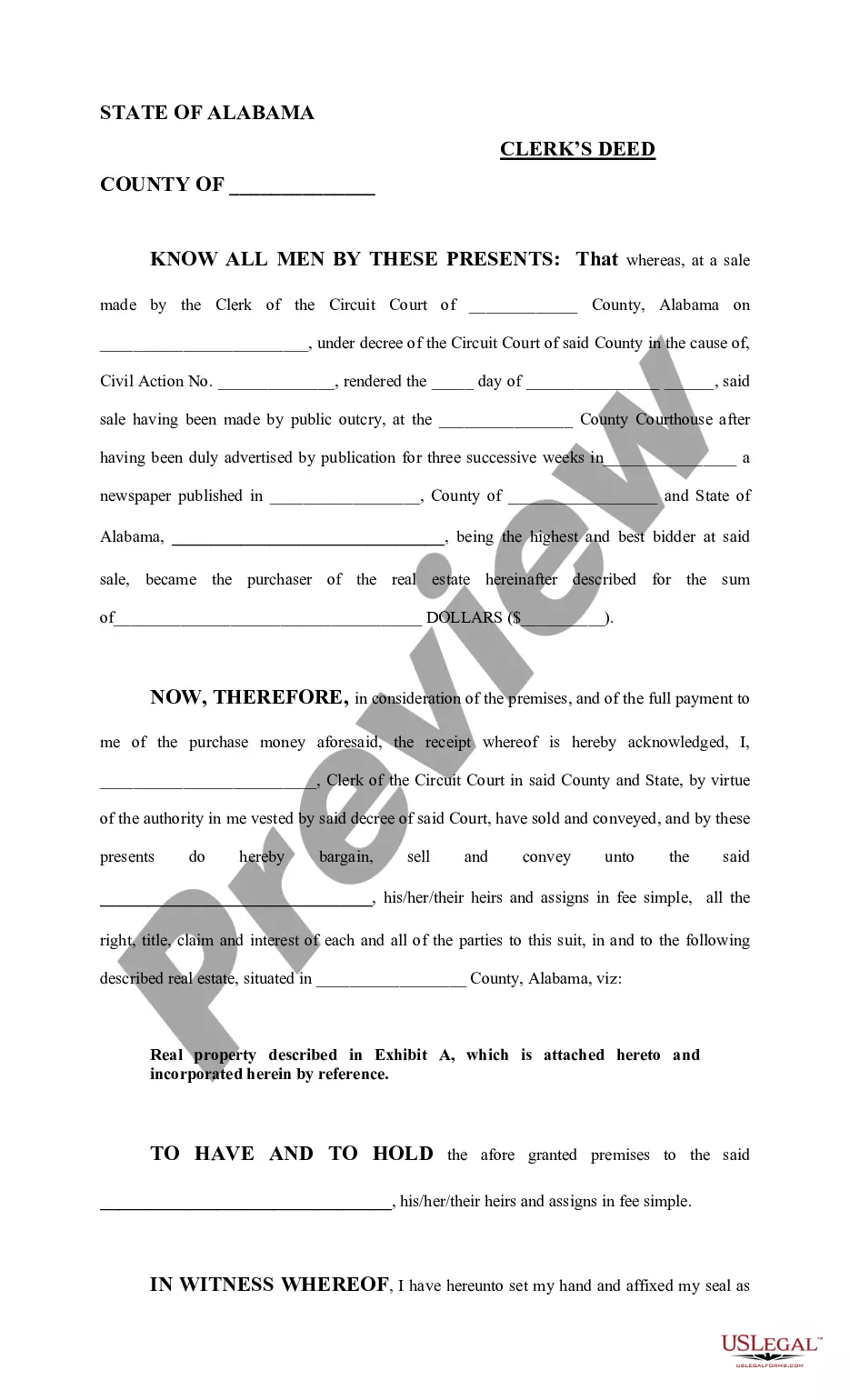

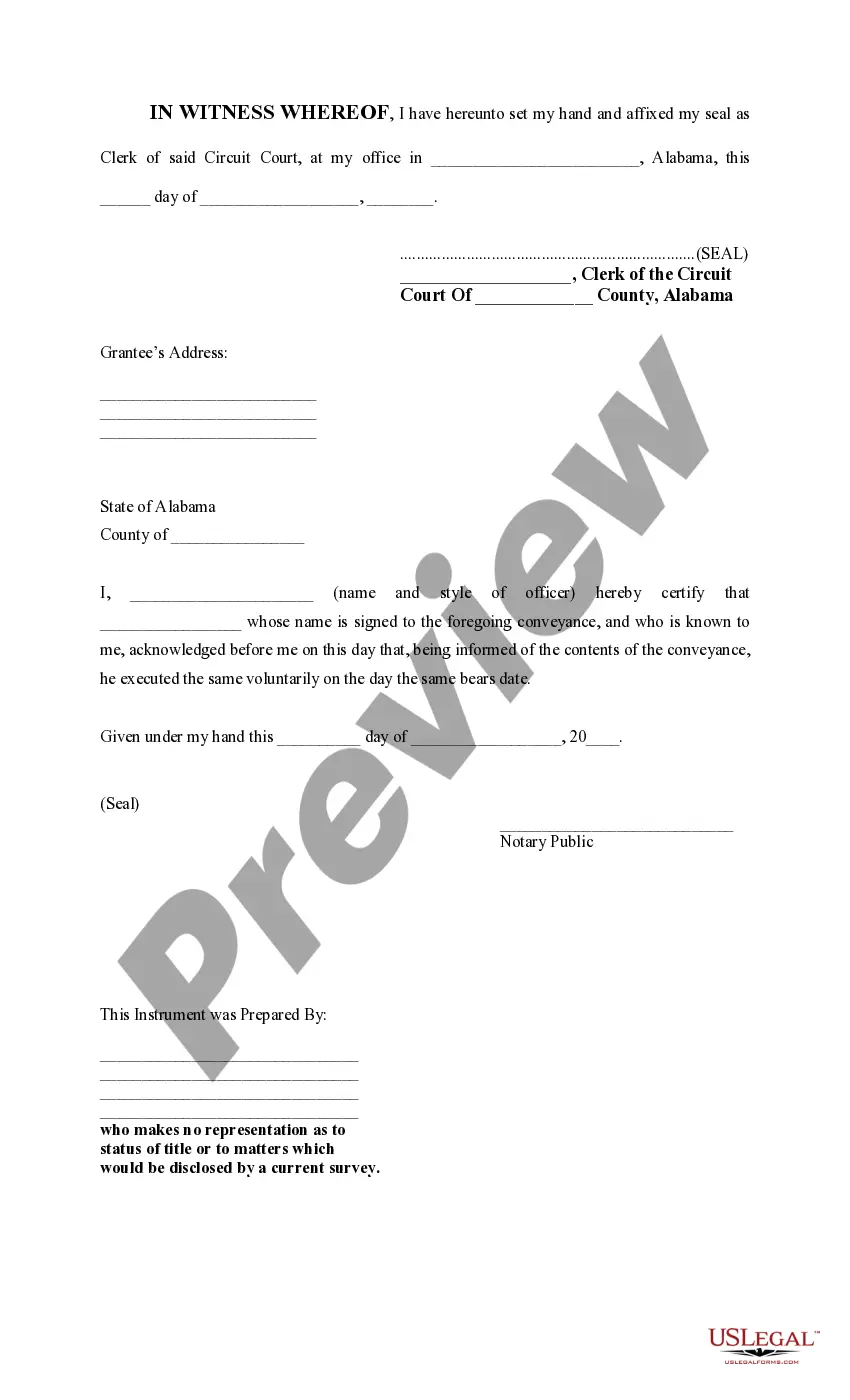

This type of deed is used to convey property by the circuit clerk when there has been a public sale of the property. The form is available in both word and word perfect formats.

Transfer On Death Deed Form Alabama For Iowa

Description

How to fill out Alabama Clerk's Deed?

It’s obvious that you can’t become a legal expert immediately, nor can you grasp how to quickly draft Transfer On Death Deed Form Alabama For Iowa without the need of a specialized background. Creating legal forms is a time-consuming venture requiring a particular training and skills. So why not leave the creation of the Transfer On Death Deed Form Alabama For Iowa to the specialists?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and obtain the form you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Transfer On Death Deed Form Alabama For Iowa is what you’re looking for.

- Start your search over if you need a different form.

- Register for a free account and select a subscription plan to buy the form.

- Pick Buy now. Once the payment is complete, you can get the Transfer On Death Deed Form Alabama For Iowa, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Hear this out loud PauseDisadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.

Hear this out loud PauseTransfer-on-death real estate, vehicles in Iowa In Iowa, transfer-on-death deeds or registration is not allowed for real estate or vehicles.

Hear this out loud PauseUnlike some states, Alabama does not currently allow the use of TOD deeds for real estate. Instead, other instruments such as joint tenancy or revocable living trusts are typically used to avoid probate when transferring real estate upon death.

Hear this out loud PauseReal Estate and TOD in Iowa In Iowa, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.