Executor Deed Form Texas

Description

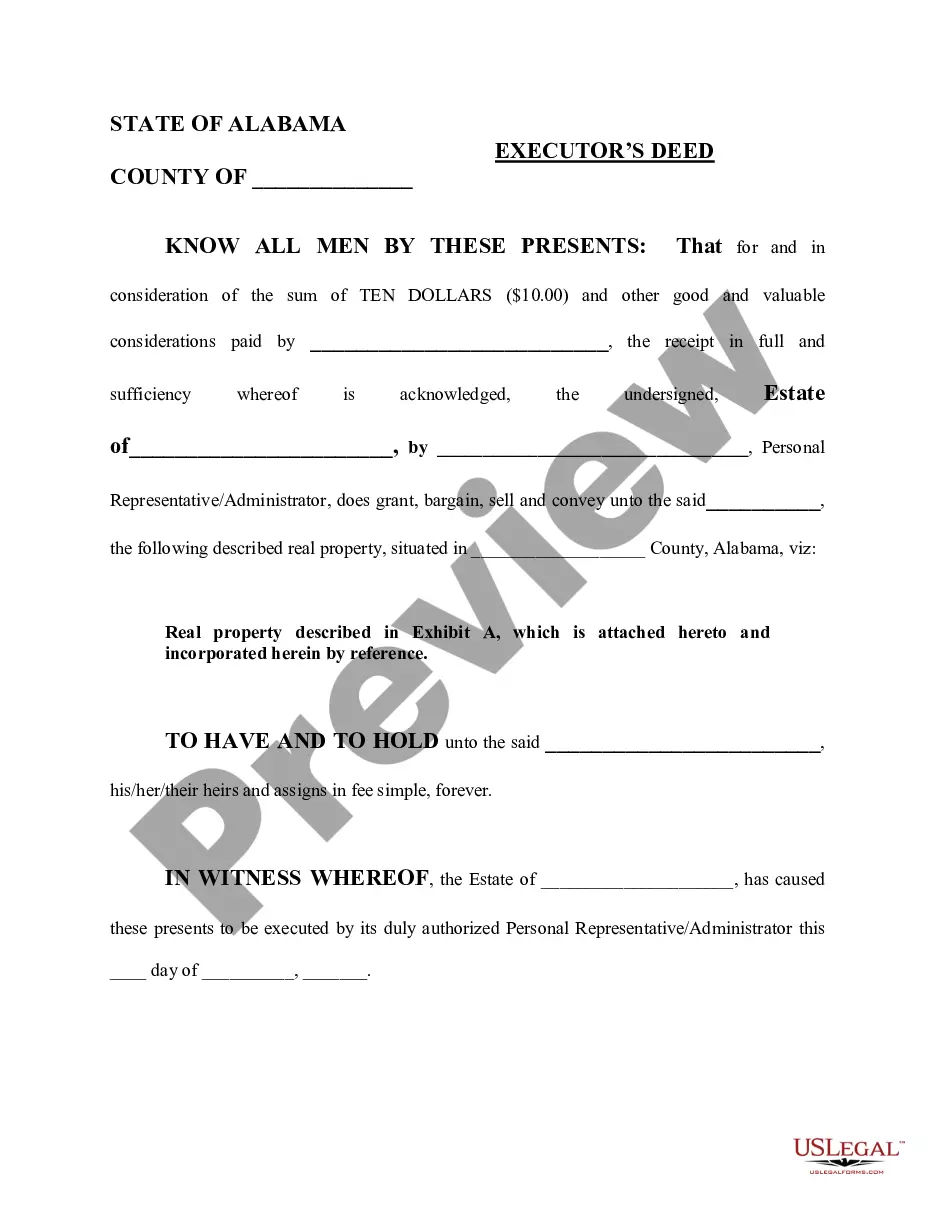

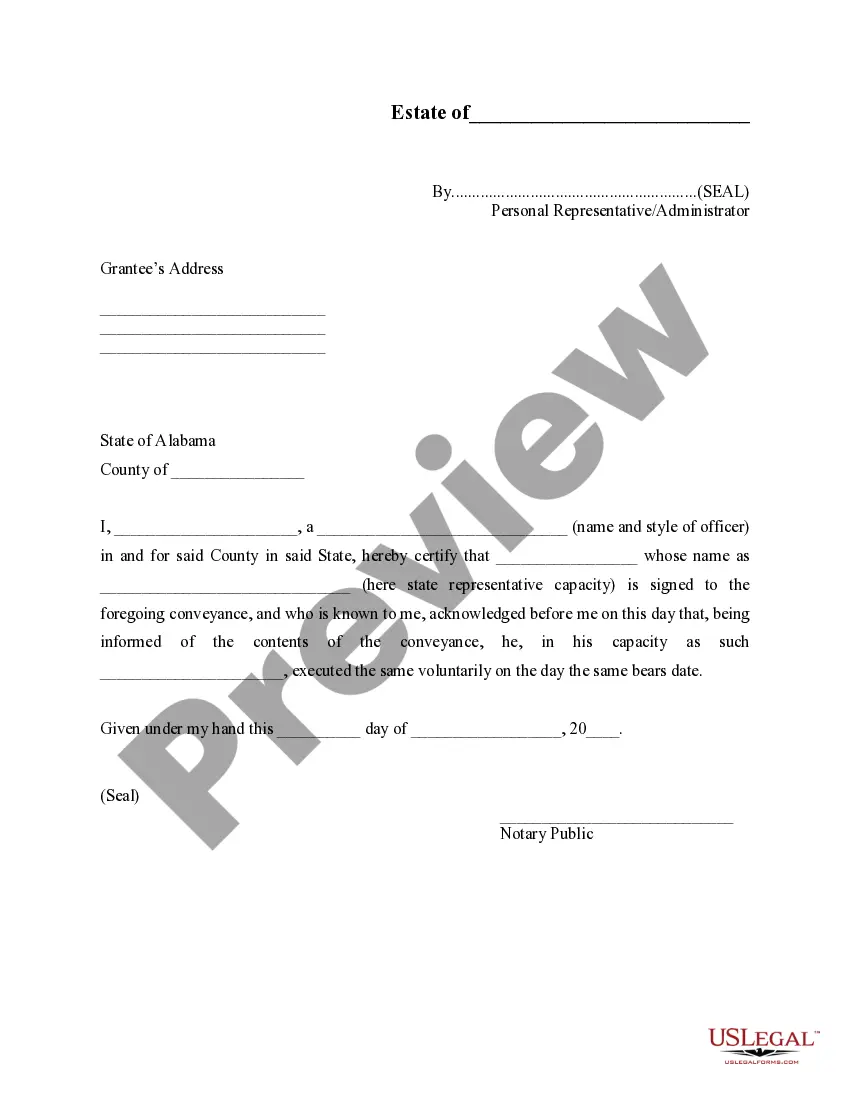

How to fill out Alabama Executor's Deed?

It’s well known that you cannot transform into a legal authority in a single night, nor can you swiftly learn how to proficiently create an Executor Deed Form Texas without possessing a specific skill set.

Assembling legal documents is a lengthy task that necessitates particular training and expertise. So why not entrust the creation of the Executor Deed Form Texas to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can obtain everything from court filings to templates for internal communication.

If you require a different template, restart your search.

Create a complimentary account and choose a subscription plan to buy the form. Click Buy now. After the payment is completed, you can obtain the Executor Deed Form Texas, fill it out, print it, and send or mail it to the relevant individuals or entities. You can access your documents again from the My documents tab at any time. If you're already a client, simply Log In to locate and download the template from the same section. Regardless of the intended use of your documents—be it financial, legal, or personal—our website is here to assist you. Give US Legal Forms a try today!

- Understand how crucial compliance with federal and state regulations is.

- That’s why, on our platform, all documents are region-specific and current.

- Begin your journey on our website and acquire the document you need in just a few moments.

- Locate the form you’re searching for using the search tool at the top of the page.

- Review it (if this option is available) and examine the accompanying description to ensure that Executor Deed Form Texas meets your requirements.

Form popularity

FAQ

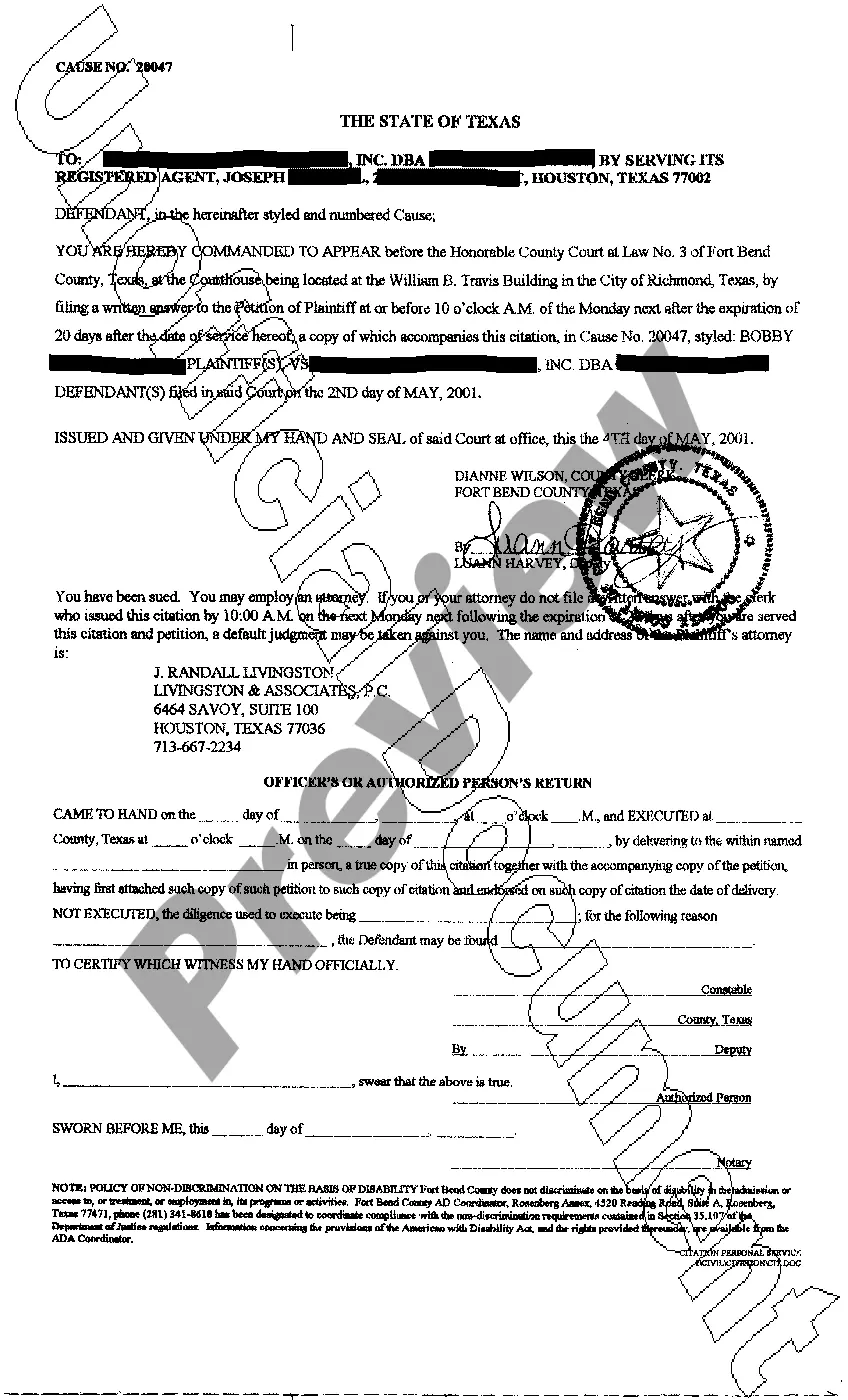

To transfer ownership of property after death in Texas, you must first initiate the probate process. This involves validating the will and appointing an executor, who will manage the estate’s assets. The executor will then use an executor deed to transfer the property to designated beneficiaries or heirs. Utilizing the executor deed form Texas simplifies documenting this crucial transfer.

An executor's deed in Texas is a legal document that transfers real estate property from the deceased’s estate to the beneficiaries. This deed requires the executor to follow the instructions outlined in the will or court order. It ensures that the property is transferred correctly and legally, reflecting the decisions made during estate administration. For accurate execution, utilizing the executor deed form Texas is essential.

How do I stop the garnishment on my wages? The defendant may, upon payment of a $25.00 filing fee, file a motion for installment payments. A stay of garnishment is issued upon the first filing of a motion for installment payments.

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.

You will need to file a Slow Pay motion in the court where the judgment was entered. In your motion, you must include the payment amount and frequency (e.g., monthly, biweekly) that you are proposing to pay on the judgment.

It is also possible to stop a garnishment or levy by filing Chapter 7 or Chapter 13 bankruptcy. Upon filing bankruptcy, a creditor is automatically stopped from taking collection action against you without going through bankruptcy court.

Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income. ... The amount of your weekly disposable income that is left over after you are paid 30 times the federal minimum wage.

You may apply to the court for an order suspending further garnishments by the same creditor upon your paying a certain sum of money weekly, biweekly, or monthly, to pay the judgment. If you file this motion, the garnishment of your wages will stop for as long as you make the payments ordered by the court.

?Slow pay? is the designation used for companies that pay their bills past terms. This can also be referred to as ?slow payments,? ?delinquent payments,? or ?late payments.? The most common payment term is known as net 30, where the payment is due in full 30 days after purchase or delivery.

Both state and federal laws limit the amount of money that may be withheld from your weekly pay. The state and federal exemptions are nearly identical. Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income.