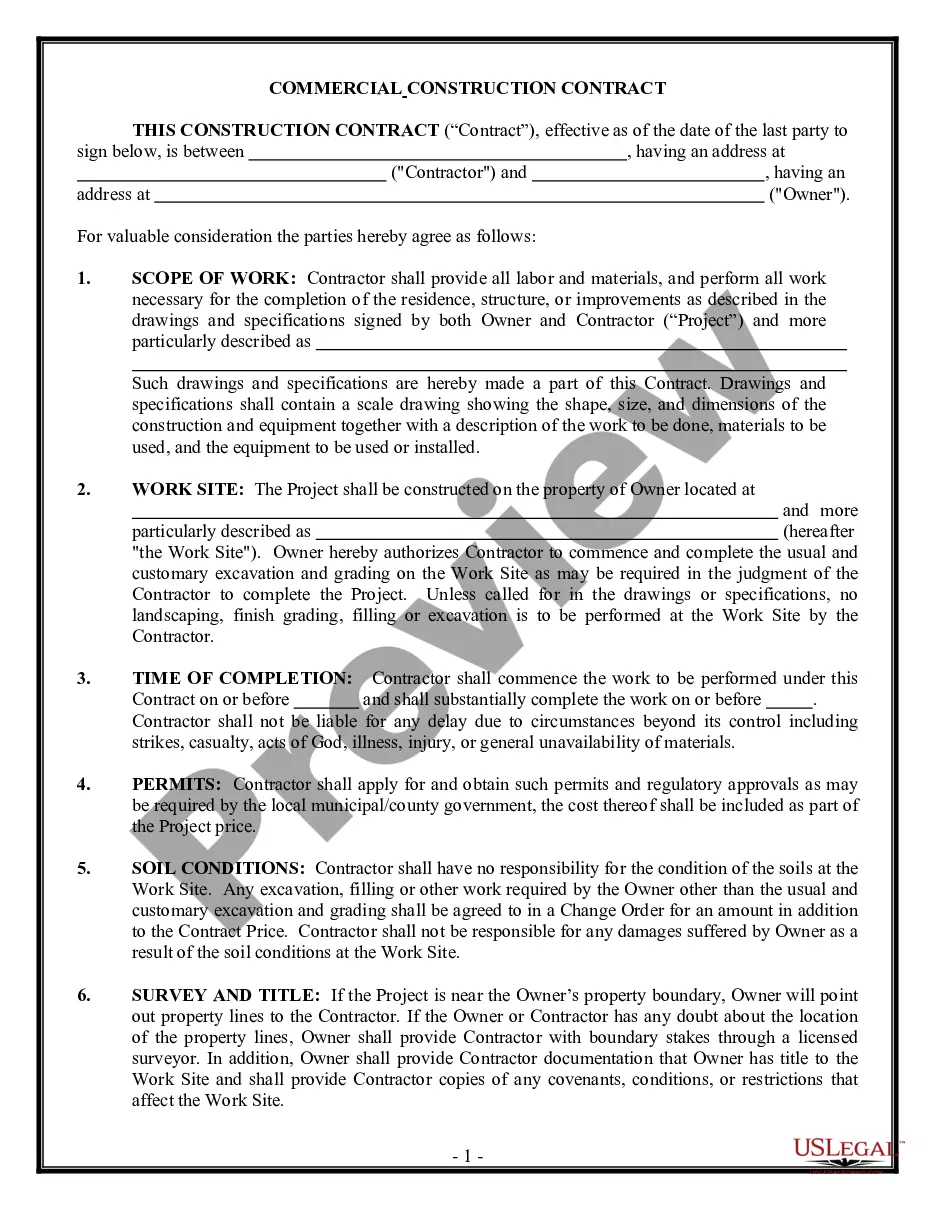

Buy Promissory Notes Forged

Description

How to fill out Alabama Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Individuals commonly link legal documentation with complexities that only an expert can manage.

In some respects, this is accurate, as preparing Buy Promissory Notes Forged necessitates considerable understanding of subject specifics, including state and municipal laws.

Nonetheless, with US Legal Forms, the process has become more user-friendly: ready-to-use legal templates for any personal and business circumstances tailored to state regulations are compiled in one online repository and are now easily accessible to everyone.

All templates in our library are reusable: once obtained, they remain saved in your profile. You can access them whenever needed through the My documents section. Experience all the benefits of the US Legal Forms platform. Sign up today!

- US Legal Forms provides over 85,000 current forms categorized by state and purpose, allowing for quick searches for Buy Promissory Notes Forged or any other specific template.

- Existing users with an active subscription must Log In to their account and click Download to acquire the document.

- New users must create an account and subscribe before they can save any documents.

- Here’s a detailed guide on how to obtain the Buy Promissory Notes Forged.

- Review the page content carefully to confirm it satisfies your requirements.

- Read the form details or view it through the Preview option.

- Search for another example using the Search field above if the previous one does not fit your needs.

- Press Buy Now once you've located the proper Buy Promissory Notes Forged.

- Select a pricing plan that aligns with your needs and financial situation.

- Create an account or Log In to move to the payment section.

- Complete your subscription payment using PayPal or a credit card.

- Select the file format and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

Only legal tender money is acceptable as promissory note. Rare currencies or coins wouldn't be taken as valid promissory notes. The amount to be paid should also be certain. It is not payable to bearer It is illegal to make promissory note payable to bearer under the provisions of the RBI Act.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021