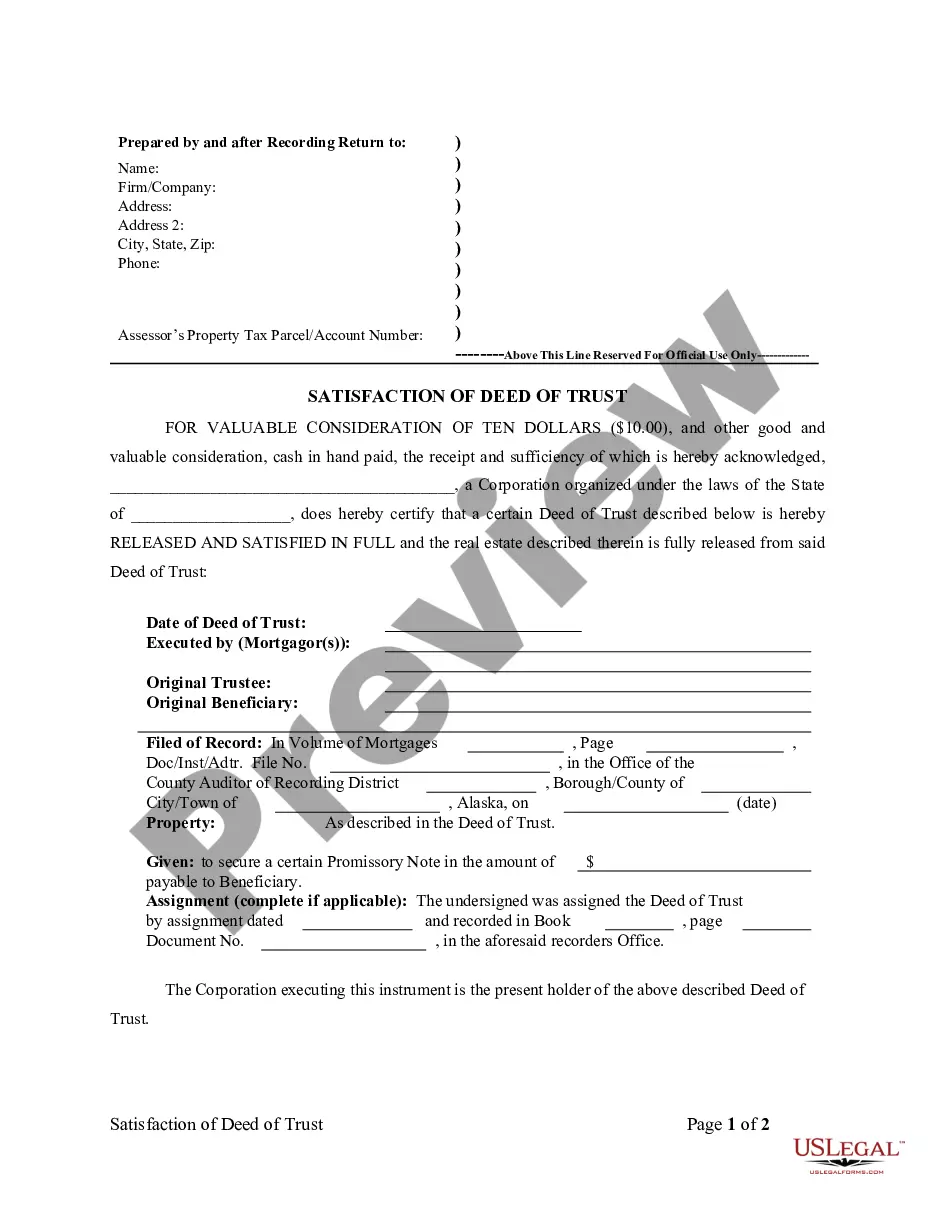

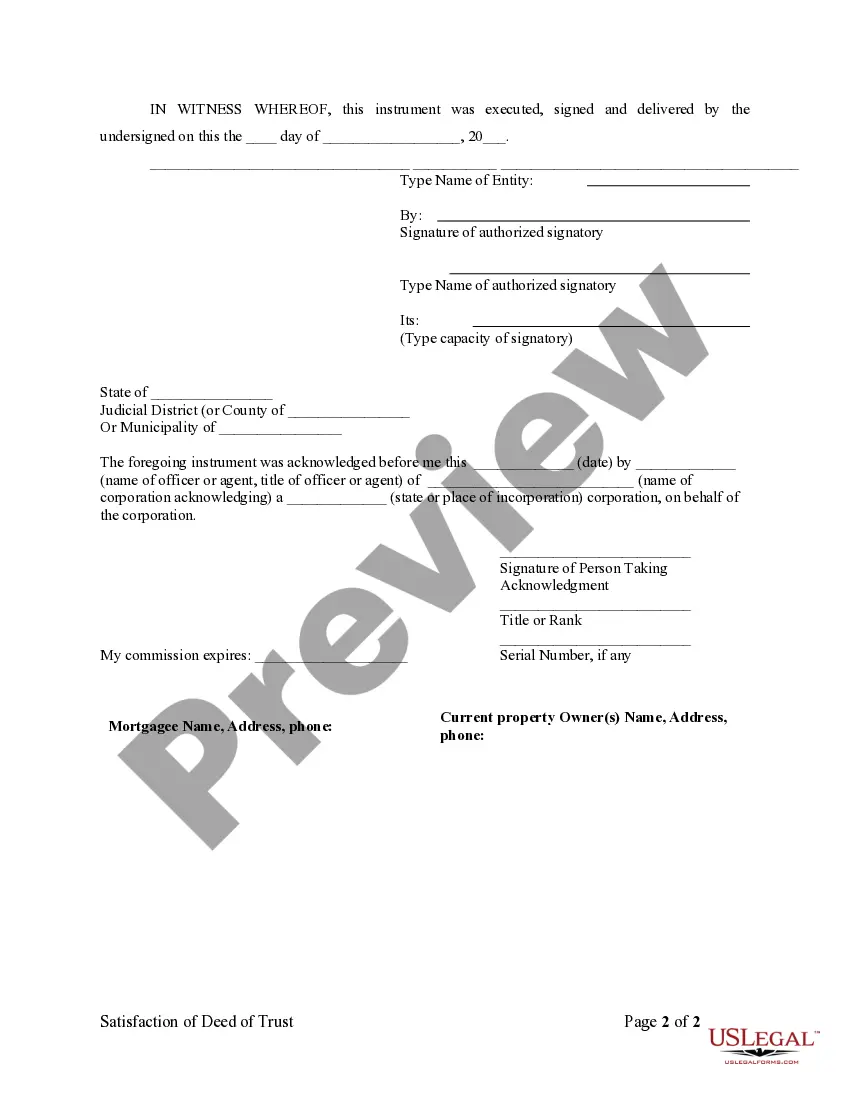

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Alaska by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Alaska Satisfaction Of Mortgage Law Withdrawal

Description

Form popularity

FAQ

To pull a mortgage, you typically need to contact your lender or mortgage servicer. They will assist you in gathering the necessary documents, such as the original mortgage agreement. It's essential to follow the correct procedures, as outlined by the Alaska satisfaction of mortgage law withdrawal, to ensure a smooth process. Engaging with professionals can simplify this task.

Generally, a satisfaction of a mortgage should be notarized to ensure its validity and to provide an official record. Notarization verifies the identity of the person signing and lends credibility to the document. To comply with various regulations, including the Alaska satisfaction of mortgage law withdrawal, having a notarized form is often recommended.

To obtain satisfaction of a mortgage, you should first verify that all mortgage payments have been made in full. Next, request a satisfaction document from your lender, confirming your mortgage status. Following the guidelines of the Alaska satisfaction of mortgage law withdrawal is essential to effectively process this documentation and record it properly.

Yes, a release of mortgage is effectively the same as a satisfaction of mortgage. Both terms refer to the legal document that confirms the mortgage obligation has been fulfilled. Understanding this distinction can aid you in navigating the Alaska satisfaction of mortgage law withdrawal with ease, ensuring you use the correct terminology in any legal documents.

When writing a letter of explanation for a mortgage lender, clearly and concisely address the specific issue that requires explanation. Include any relevant details that support your case and illustrate your financial stability. Ensure you express your intent to comply with the requirements under the Alaska satisfaction of mortgage law withdrawal, reinforcing your transparency to the lender.

Filling out a mortgage release form is straightforward. Begin by providing your personal information and the details of the mortgage you wish to release. Clearly indicate your satisfaction with the mortgage based on the Alaska satisfaction of mortgage law withdrawal, and be sure to sign the form to validate it before submission.

In NYC, you must complete a satisfaction of mortgage form and file it with the appropriate county clerk’s office. Typically, you will need to present the original mortgage document along with the satisfaction form. It is crucial to follow the specific guidelines outlined by New York law, including the Alaska satisfaction of mortgage law withdrawal where applicable, to ensure your filing is accepted.

To fill out a satisfaction of mortgage, start by obtaining the correct form, which you can often find on your state’s court or official website. Fill in your personal details, including the mortgagee's name and the mortgage details. Ensure that you clearly state that you are satisfied with the mortgage under the Alaska satisfaction of mortgage law withdrawal, and then sign and date the form before submitting it.