Stock Certificate For S Corp

Description

How to fill out Alaska Notices, Resolutions, Simple Stock Ledger And Certificate?

Individuals frequently link legal documentation with a complex process that only an expert can manage.

In a sense, this holds true, as creating a Stock Certificate for an S Corp necessitates a deep understanding of the relevant criteria, encompassing both state and county laws.

Nevertheless, with US Legal Forms, everything has become simpler: pre-made legal documents for any personal and business situation tailored to state regulations are consolidated in a single online repository and are now accessible to all.

All templates in our library are reusable: once obtained, they remain saved in your profile. You can access them anytime via the My documents section. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe now!

- Carefully review the content on the page to ensure it fulfills your requirements.

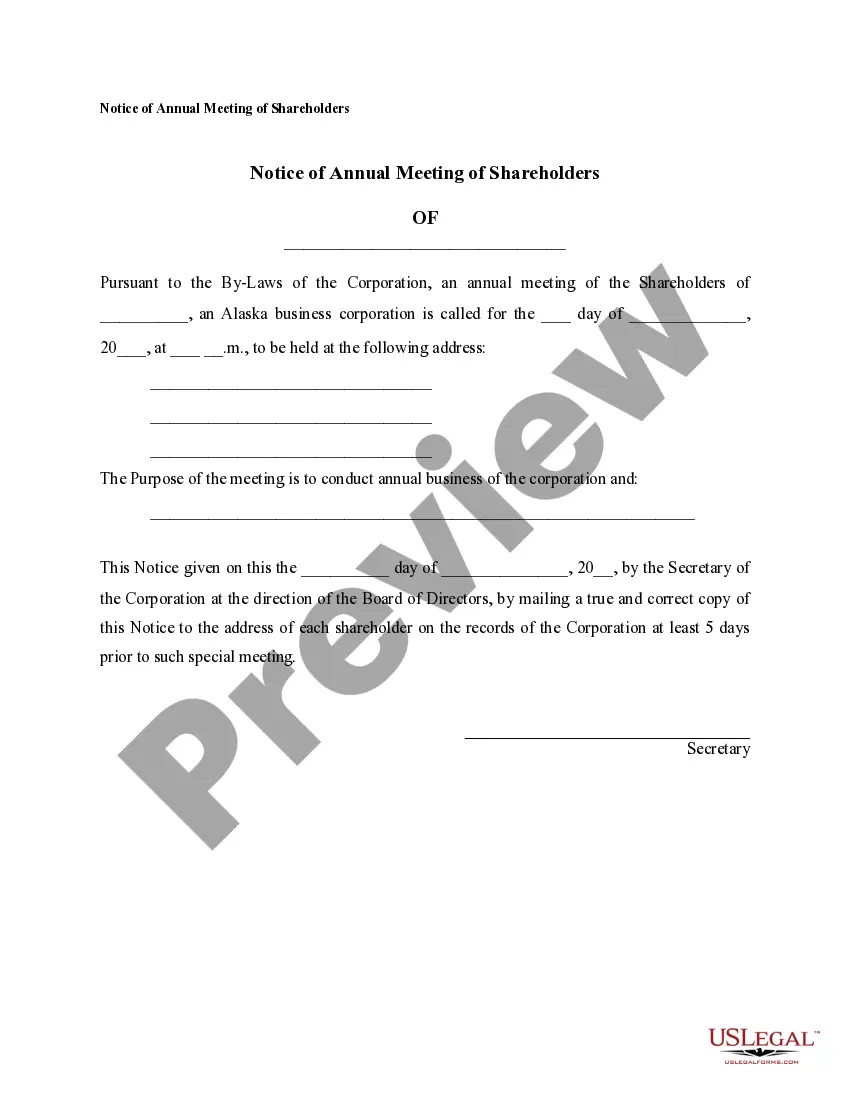

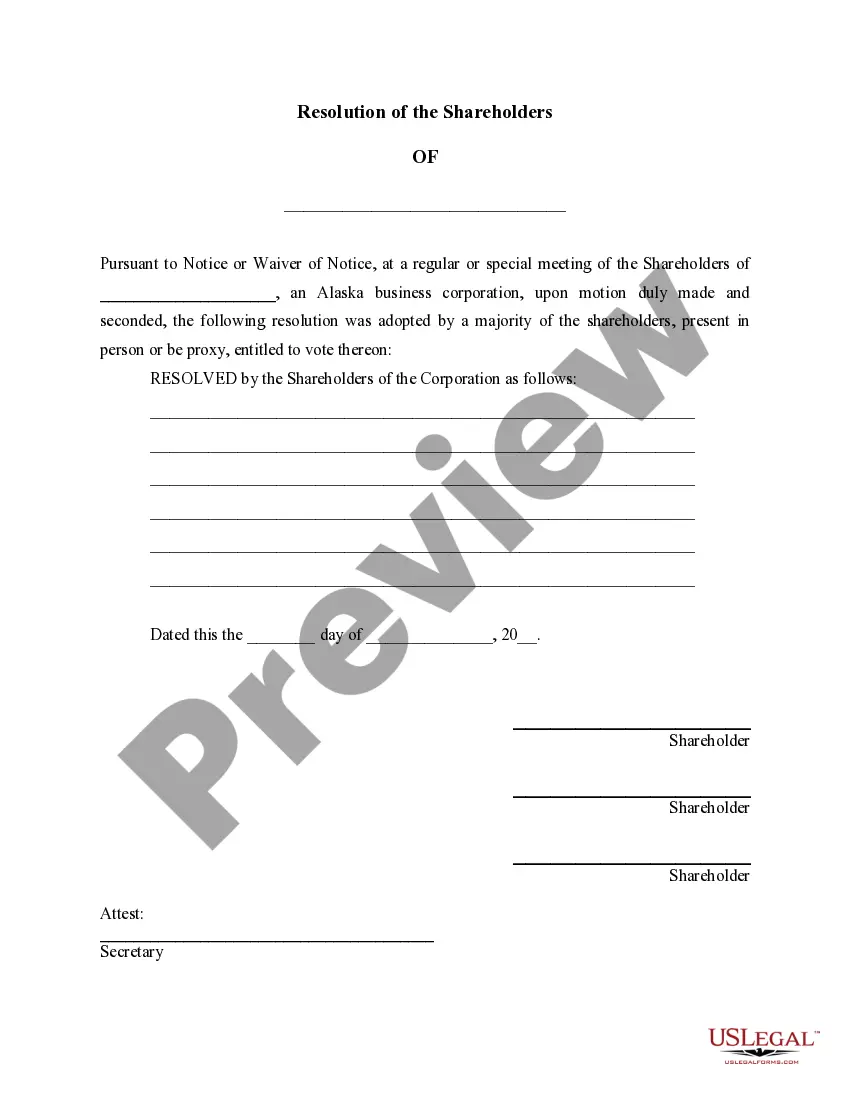

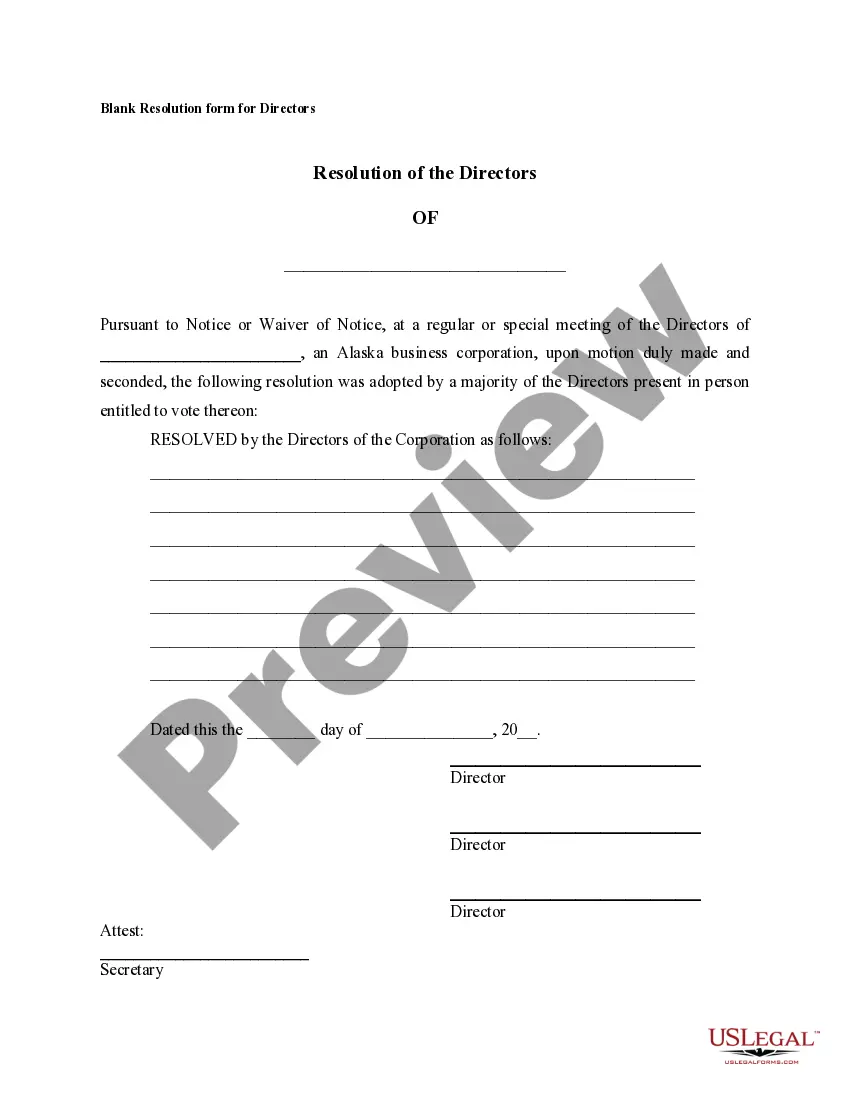

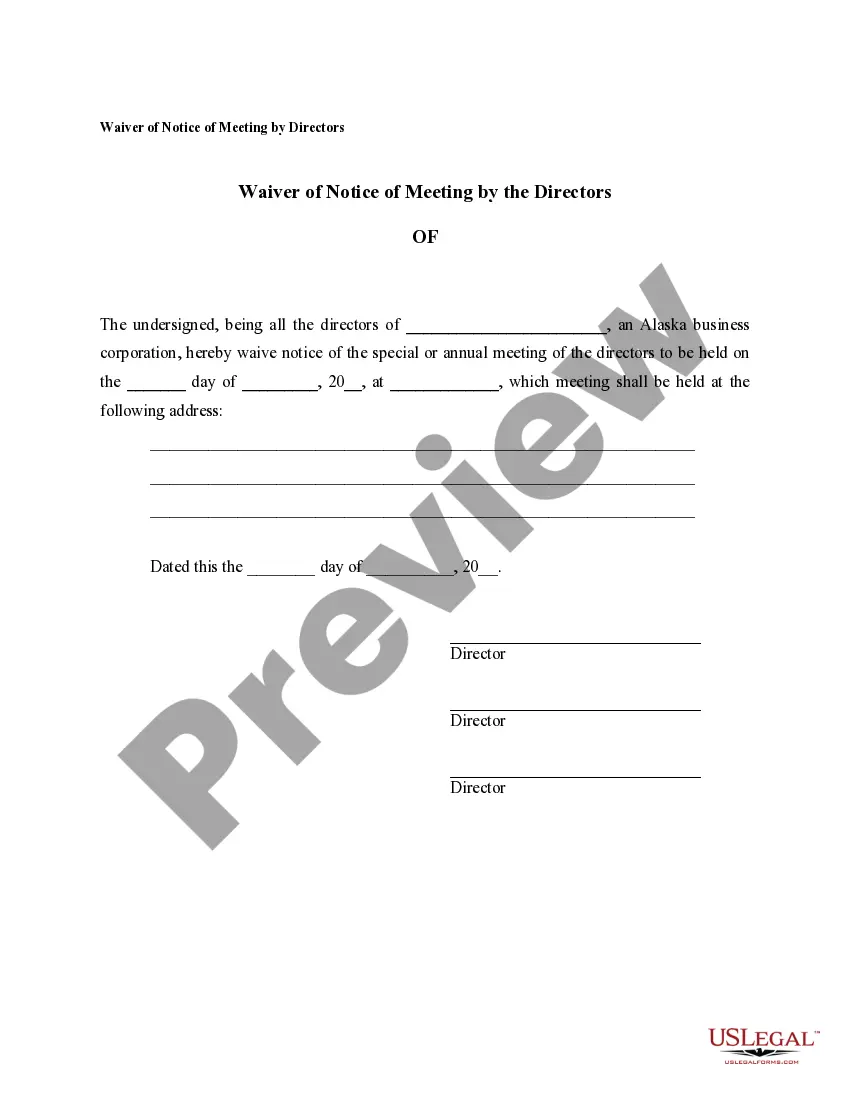

- Peruse the form description or view it through the Preview feature.

- If the previous sample does not fit your needs, search for another one using the Search bar in the header.

- Click Buy Now once you have located the appropriate Stock Certificate for S Corp.

- Choose a subscription plan that aligns with your needs and financial considerations.

- Create an account or Log In to advance to the payment page.

- Complete your subscription payment using PayPal or with your credit card.

- Select the file format and click Download.

- Print your document or upload it to an online editor for expedited completion.

Form popularity

FAQ

Properly filling out a stock certificate for an S Corp requires attention to detail. Ensure you include the corporation's name at the top and specify the shareholder's name along with the number of shares issued. Sign the certificate, include the date of issuance, and keep accurate records of all issued stock certificates for your corporate records.

A corporate stock certificate typically features a formal and structured design. It showcases the corporation's name prominently at the top, includes spaces for the shareholder's information, and presents the number of shares issued. Additionally, it often carries decorative elements and security features to prevent forgery.

When filling out a share certificate for an S Corp, make sure to enter the necessary details clearly. Write the corporation's name, the recipient's name, and the quantity of shares being allocated. Sign and date the certificate, ensuring that it reflects the official status of the stock issuance.

Filling out a stock certificate for an S Corp involves writing specific information in designated fields. Begin with the corporation's name and the shareholder's name. Add the number of shares being issued and the date, ensuring your signature appears at the bottom to finalize the document.

To fill in a share certificate for your S Corporation, start with the name of your business at the top. Next, write the shareholder's name, the total number of shares issued, and the date of issuance. Finally, sign the certificate with the title of your corporate role to authenticate the document.

A share certificate for an S Corp must include several key components. These include the corporation's name, the state of incorporation, the issue date, the name of the shareholder, number of shares, and the certificate number. Don't forget to add any applicable restrictions on share transfers and the signature of an authorized officer to ensure compliance.

To complete a share certificate for an S Corporation, begin by clearly labeling it as a stock certificate. Include the corporation's name, the shareholder's name, the number of shares issued, and the date. Ensure you sign the certificate as an authorized corporate officer, which validates the ownership of the shares.

Yes, an S corporation can issue stock options to its employees and shareholders, but certain rules apply. It's crucial to understand the tax implications and the structure of stock options when offering them. Properly documenting these options and issuing a stock certificate for S corp shares when exercised will keep your business in compliance with regulations.

Filling out a corporate stock certificate involves including key details such as the corporation's name, the shareholder's name, the number of shares issued, and the date of issuance. Additionally, you may include the signatures of authorized officers of the corporation. Using a template or service to create a stock certificate for S corp shares can streamline this process and ensure you meet all legal requirements.

Yes, you can file for an S corporation yourself, but it requires some understanding of the process. You need to fill out Form 2553 and ensure all requirements are met. Additionally, using tools or services that help with issuing stock certificates for S corps can simplify this process and help avoid potential pitfalls.