Alaska Transfer On Death Deed Form

Description

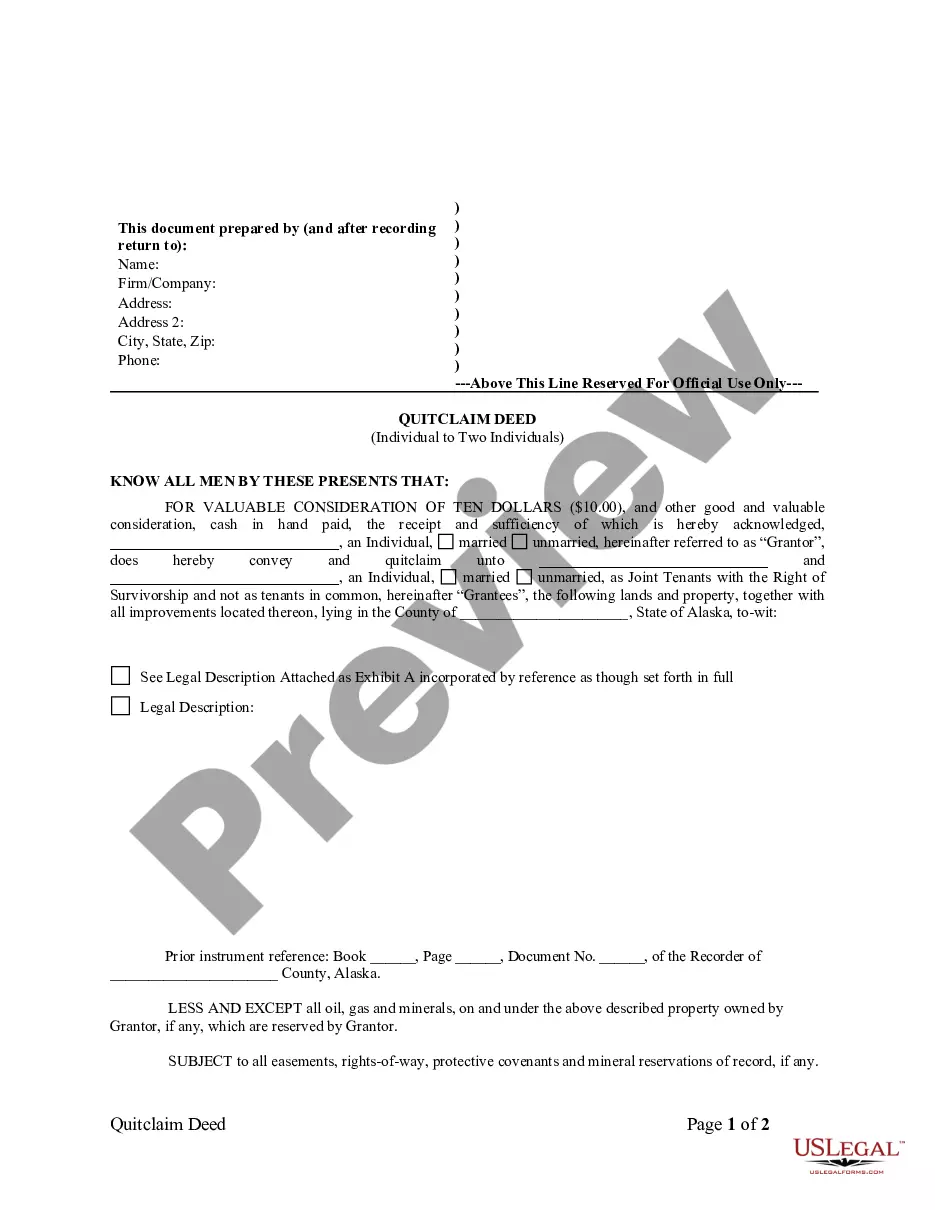

How to fill out Alaska Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

Individuals typically connect legal documentation with complexity that only a specialist can manage.

In some respects, this is accurate, as preparing the Alaska Transfer On Death Deed Form requires significant knowledge of subject matters, including state and county laws.

Nonetheless, with US Legal Forms, the process has become more user-friendly: pre-prepared legal templates for any personal and commercial situation tailored to state legislation are gathered in a single online repository and are now available to all.

All templates in our library are reusable: once acquired, they are stored in your profile. You can access them anytime via the My documents tab. Discover the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and usage area, making it quick to find the Alaska Transfer On Death Deed Form or any other specific template.

- Existing users with an active subscription must Log In to their account and click Download to access the form.

- New users will need to create an account and subscribe before saving any documentation.

- Here’s a step-by-step guide on how to obtain the Alaska Transfer On Death Deed Form.

- Review the content on the page carefully to ensure it fits your requirements.

- Examine the form description or confirm it through the Preview feature.

- If the previous template doesn't meet your needs, find another sample using the Search bar in the header.

- Once you find the correct Alaska Transfer On Death Deed Form, click Buy Now.

- Select a pricing plan that suits your needs and budget.

- To continue to the payment page, create an account or Log In.

- Complete your payment through PayPal or with your credit card.

- Choose your preferred file format and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

In Alaska, when a husband dies, the wife is entitled to a portion of the estate, depending on the marital property laws and whether there is a will. If no will exists, the wife will inherit a significant share of the community property and potentially other assets. Using an Alaska transfer on death deed form can help ensure that the surviving spouse receives designated property directly, bypassing any complications related to probate.

Alaska law allows individuals to use a transfer on death deed to designate beneficiaries who will receive property upon the owner’s death. This deed must be recorded with the appropriate local office to be valid. By completing the Alaska transfer on death deed form correctly, property owners can avoid probate and expedite transferring their assets to their chosen beneficiaries.

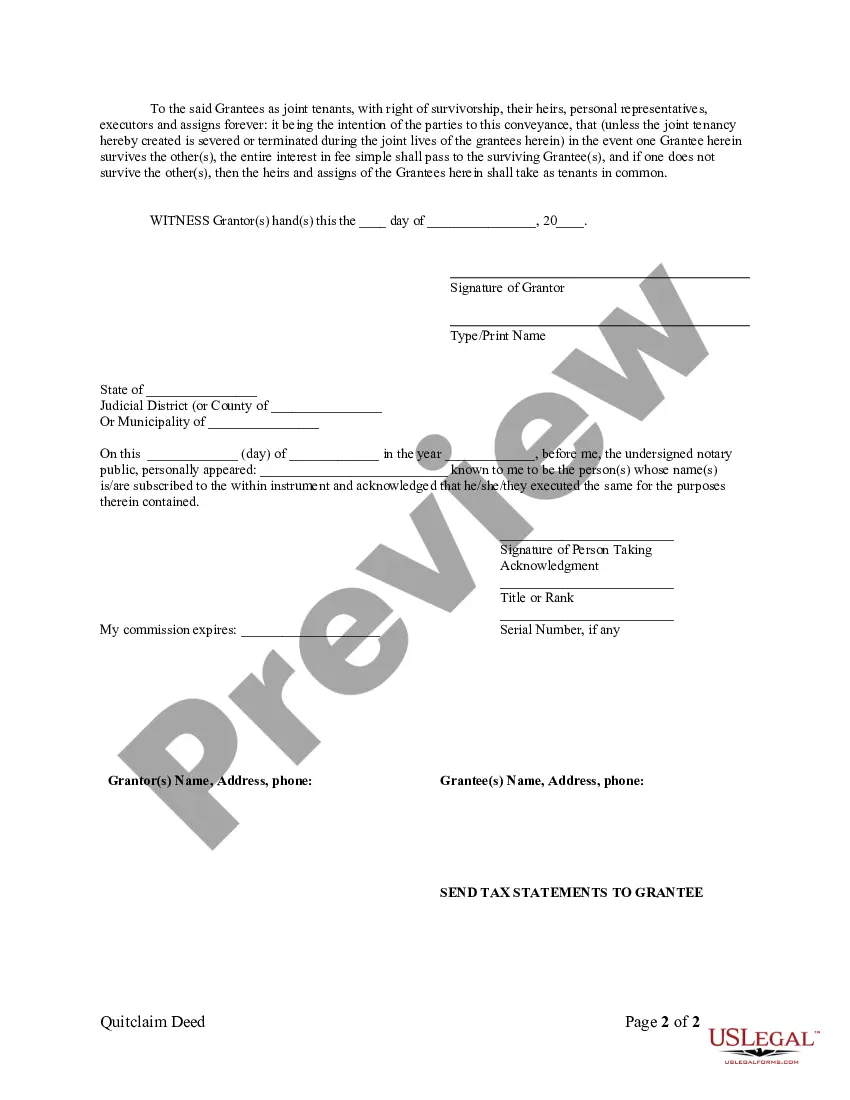

The rule of survivorship ensures that when one owner of a property passes away, their share automatically transfers to the surviving owner without going through probate. This rule is particularly significant in joint ownership situations, such as joint tenancy. By utilizing an Alaska transfer on death deed form, property owners can simplify the transfer process, ensuring that their assets smoothly move to the intended party upon their death.

To transfer property ownership in Alaska, you typically need to prepare a deed that outlines the new ownership and includes all necessary property details. After signing and notarizing the deed, you must file it with the appropriate county office. Opting for the Alaska transfer on death deed form can provide a straightforward solution for transferring ownership after death without complicated legal hurdles.

Filing a quitclaim deed in Alaska requires you to complete the deed form and have it signed in front of a notary. After notarization, you take the deed to the local recorder’s office to officially record the transfer. Using the Alaska transfer on death deed form can streamline this process, especially for property owners who want to ensure their assets are passed on to beneficiaries without delay.

Transferring ownership of property in Alaska typically involves preparing a deed, such as a quitclaim or warranty deed, that clearly states the transfer of interest. You will also need to sign and notarize the deed before submitting it to the appropriate county recorder's office. For a seamless transfer process, individuals may explore the Alaska transfer on death deed form, which simplifies transferring ownership upon death.

The right of survivorship in Alaska refers to a legal arrangement where, upon the death of one joint tenant, their share automatically transfers to the surviving joint tenant(s). This arrangement is common in real estate transactions and helps avoid probate, ensuring a quick transfer of assets. To establish clear ownership rights and manage bequests, consider using the Alaska transfer on death deed form.

To complete a quitclaim deed in Alaska, you must first obtain the appropriate form, which includes basic details about the property and the parties involved. Once you fill out the necessary information, you will need to have the form notarized and then file it with the local recording office. For an efficient process, using an Alaska transfer on death deed form may be a helpful alternative for direct transfer.

In Alaska, the statute for the transfer on death deed is outlined in Alaska Statute 13.48. This statute provides clear guidelines for property owners wishing to transfer assets to beneficiaries without going through probate. Utilizing the Alaska transfer on death deed form ensures that your property transfers smoothly to your chosen beneficiaries upon your passing.

A quitclaim deed is most beneficial for individuals looking to transfer property quickly and easily, often without the complexity of traditional sales. This deed allows the transferor to convey whatever interest they have in the property, making it ideal for family transfers or to clear title issues. If you need an uncomplicated solution for property transfer, consider using the Alaska transfer on death deed form for a smoother process.