Life Estate Deed Form Alaska With Powers

Description

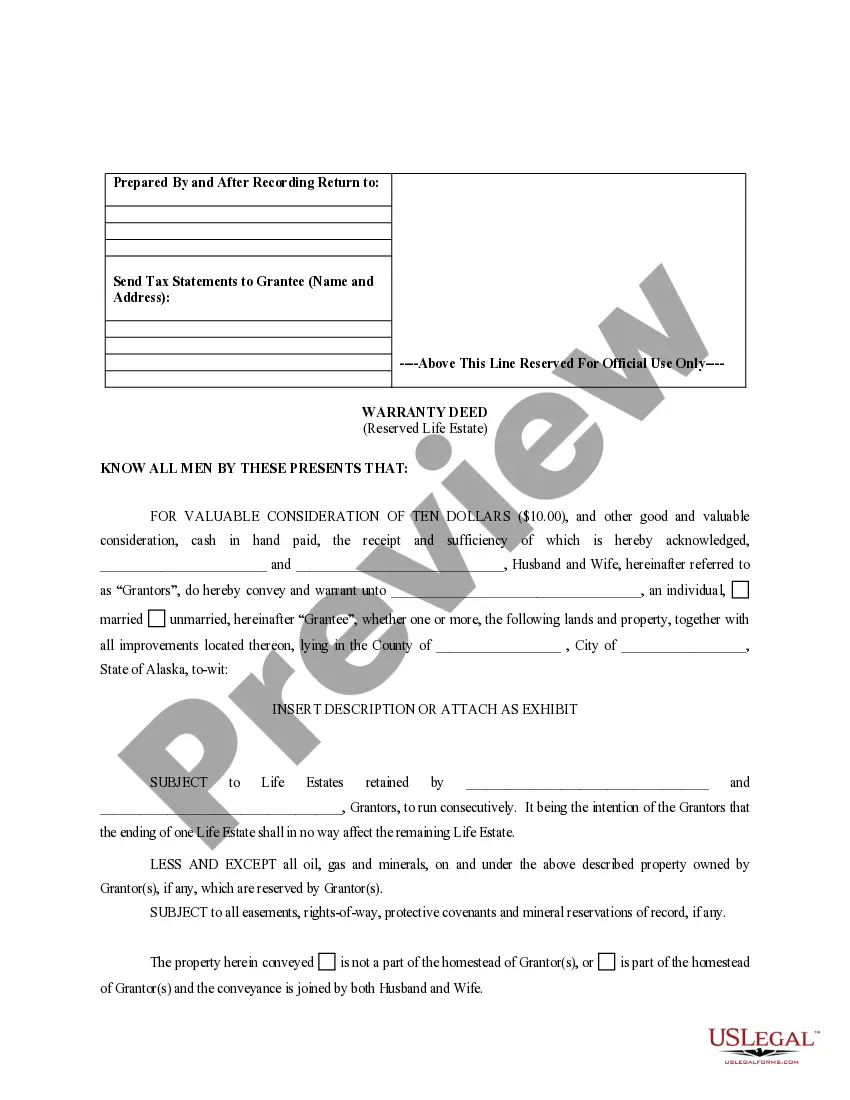

How to fill out Alaska Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether for business purposes or for personal affairs, everybody has to manage legal situations sooner or later in their life. Filling out legal paperwork demands careful attention, beginning from selecting the right form sample. For instance, when you pick a wrong version of the Life Estate Deed Form Alaska With Powers, it will be declined once you send it. It is therefore important to get a reliable source of legal files like US Legal Forms.

If you have to get a Life Estate Deed Form Alaska With Powers sample, follow these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to find the Life Estate Deed Form Alaska With Powers sample you need.

- Get the template when it matches your needs.

- If you already have a US Legal Forms account, click Log in to access previously saved templates in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the account registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Life Estate Deed Form Alaska With Powers.

- Once it is downloaded, you can complete the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time seeking for the right sample across the web. Take advantage of the library’s easy navigation to find the proper form for any situation.

Form popularity

FAQ

The deed should be recorded in the Recorder's District where the property is located. Make note of the document formatting requirements (additional fees will be charged if these are not met).

Because a quitclaim deed offers no protection for buyers, it should not be used during traditional real estate sales. There is no guarantee of a clear title. Instead, quitclaim deeds are used when there is a property transfer outside of a real estate sale.

Ownership Changes Recording a deed is best handled through a Title Company. For those doing their own deeds, deed templates are often available online or at office supply stores. The deed must have the names and addresses of both the current ownership and the new ownership, and the legal description of the property.

When property is co-owned with a right of survivorship, a deceased owner's interest automatically vests with the surviving owner upon the deceased owner's death. As noted, the Alaska legislature abolished joint tenancy except for co-ownership of personal property or co-ownerhsip of real estate by a married couple.

An Alaska quit claim deed is a document that includes the transfer of ownership in real estate, with no guarantees, from a grantor (seller) to a grantee (buyer). If the grantor has any ownership of the property, it will be transferred to the grantee.