Life Estate Deed Alaska With Powers

Description

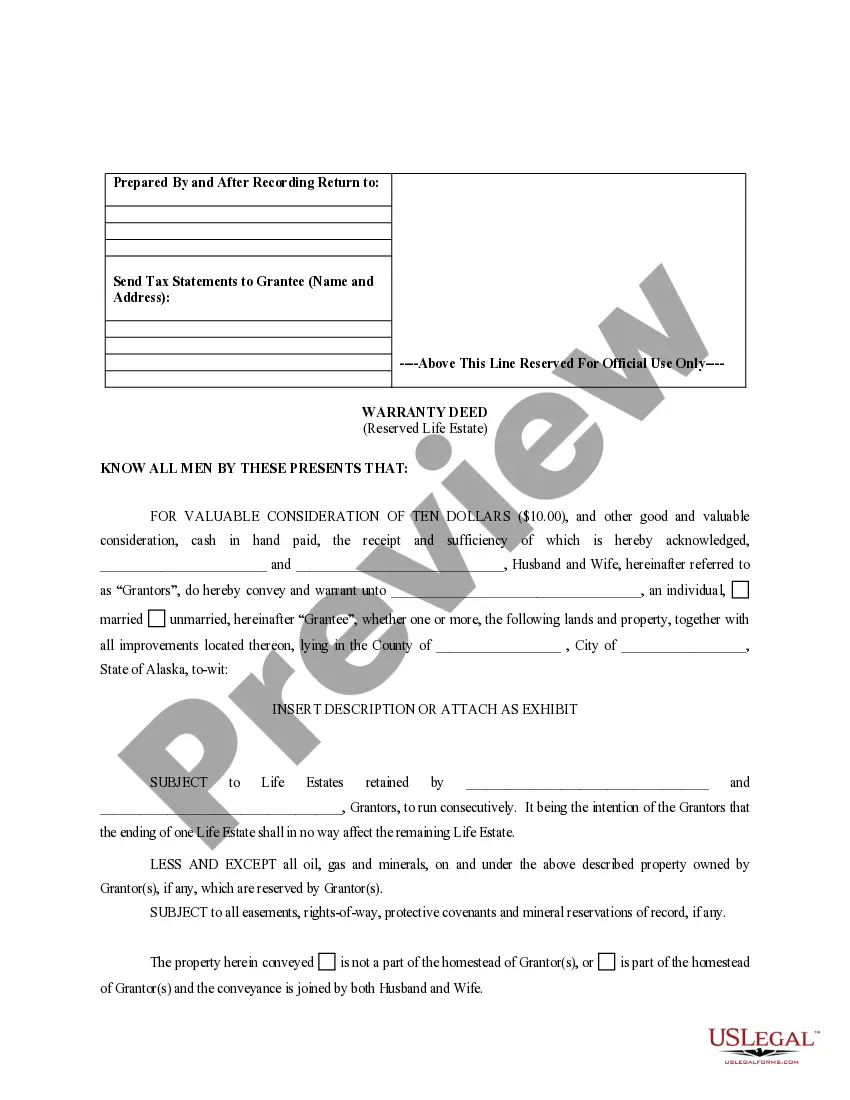

How to fill out Alaska Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether you handle documentation frequently or you occasionally need to submit a legal document, it is essential to have a reliable resource where all the samples are relevant and current.

The first step to take with a Life Estate Deed Alaska With Powers is to ensure that it is indeed its latest version, as this determines whether it can be submitted.

If you wish to streamline your search for the most recent document samples, consider looking for them on US Legal Forms.

Use the search menu to find your desired form. Review the Life Estate Deed Alaska With Powers preview and summary to confirm it is exactly what you are looking for. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Register an account or Log In to your existing one. Utilize your credit card information or PayPal account to finalize the purchase. Choose the file format for download and confirm it. Eliminate the confusion associated with managing legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes virtually any form sample you might seek.

- Search for the templates you need, review their applicability immediately, and learn more about their usage.

- With US Legal Forms, you have access to over 85,000 document templates across a diverse range of fields.

- Find the Life Estate Deed Alaska With Powers samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will provide you with access to all the samples you need with ease and less hassle.

- You simply have to click Log In in the website header and navigate to the My documents section, where all the forms you require will be at your fingertips, saving you time in locating the right template or verifying its legitimacy.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

Real property can be transferred without a probate if it is held in one of the following ways:By both spouses as tenants by the entirety;By both spouses as Alaska Community Property with a right of survivorship; or.By a Trustee in trust; or.More items...

If one person owns a parcel of property in fee simple, she has the most complete form of ownership allowed by law. She may do with the property practically anything she chooses. The estate lasts perpetually and may be transferred from heir to heir.

Alaska Transfer on Death Deed Information. Real property owners in Alaska have an estate planning option: the transfer on death deed (TODD). Find the full text in AS 13.48. This statute is based on the Uniform Real Property Transfer on Death Act (URPTODA).

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...