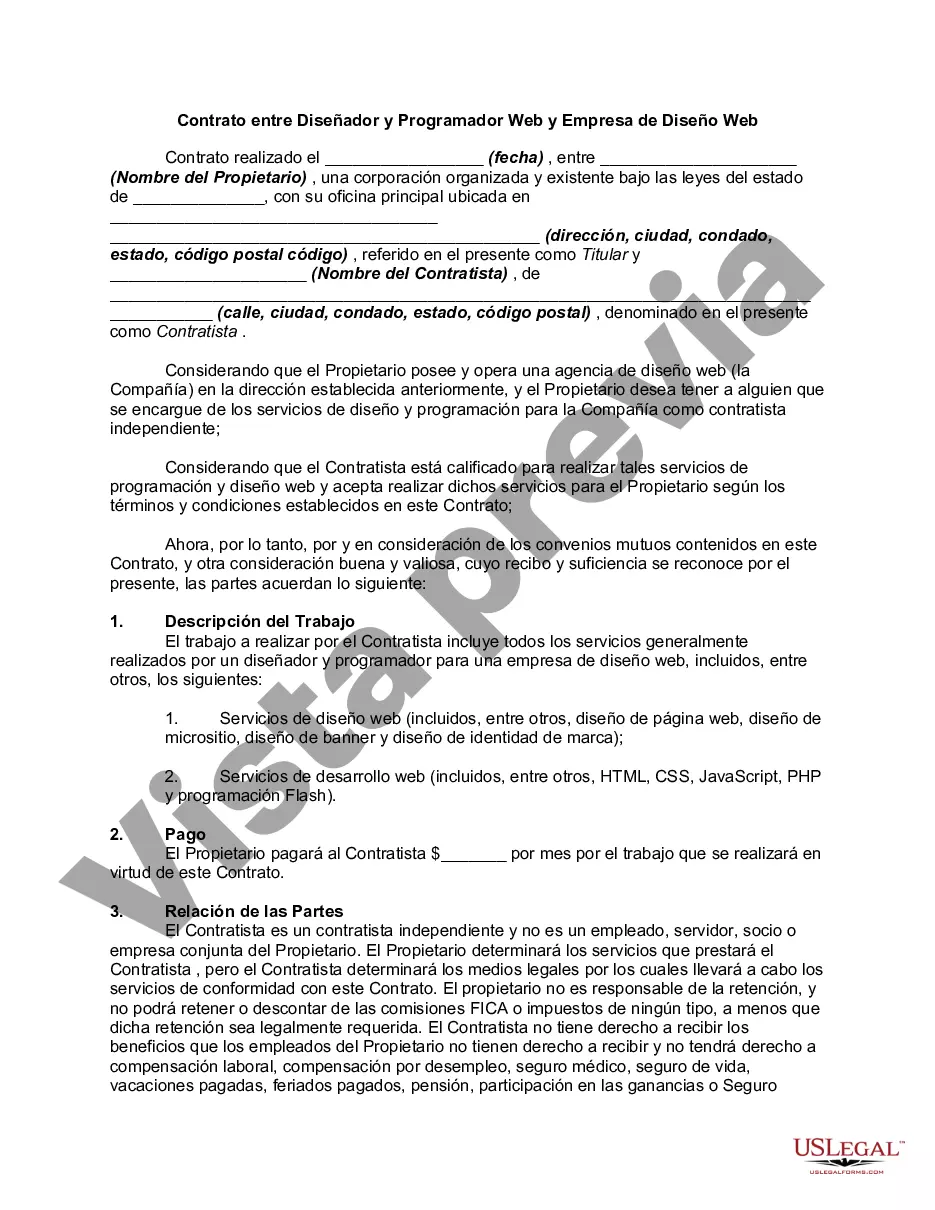

Detroit Michigan Contrato entre diseñador y programador web y empresa de diseño web - Contract Between Web Designer and Programmer and Web Design Company

Category:

State:

Multi-State

City:

Detroit

Control #:

US-02649BG

Format:

Word

Instant download

Description

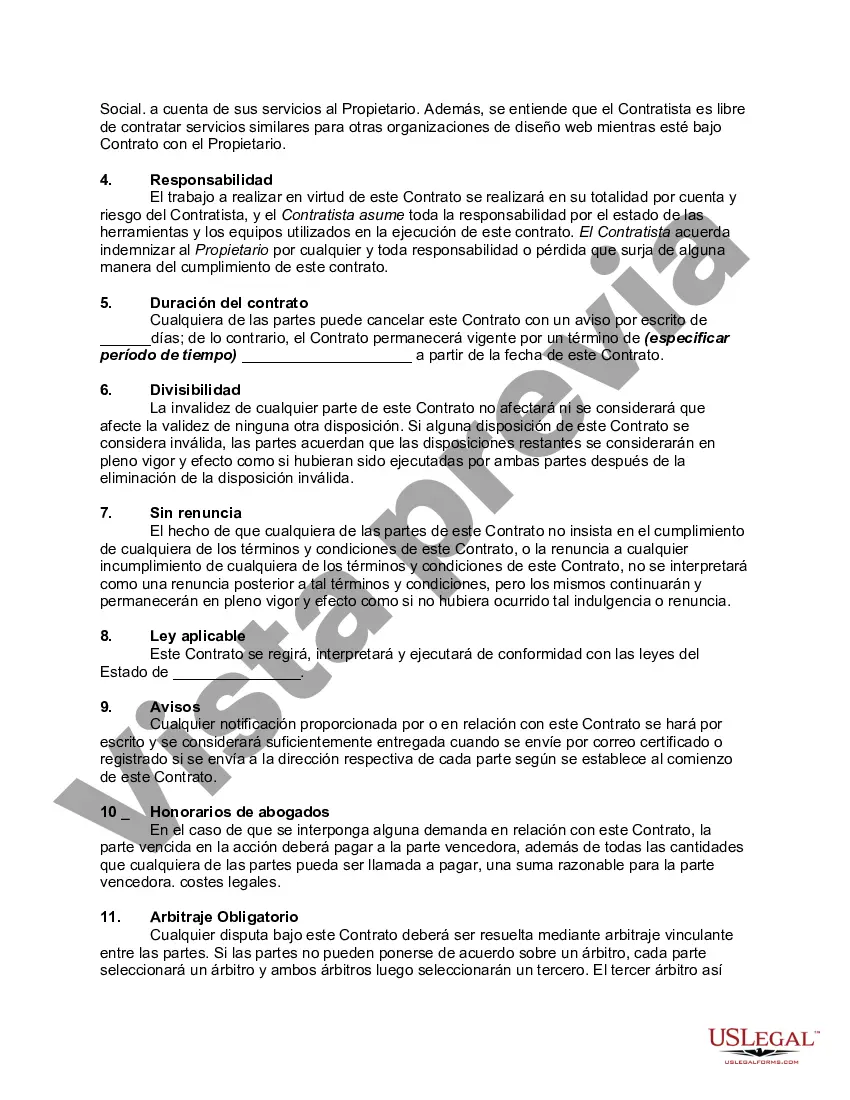

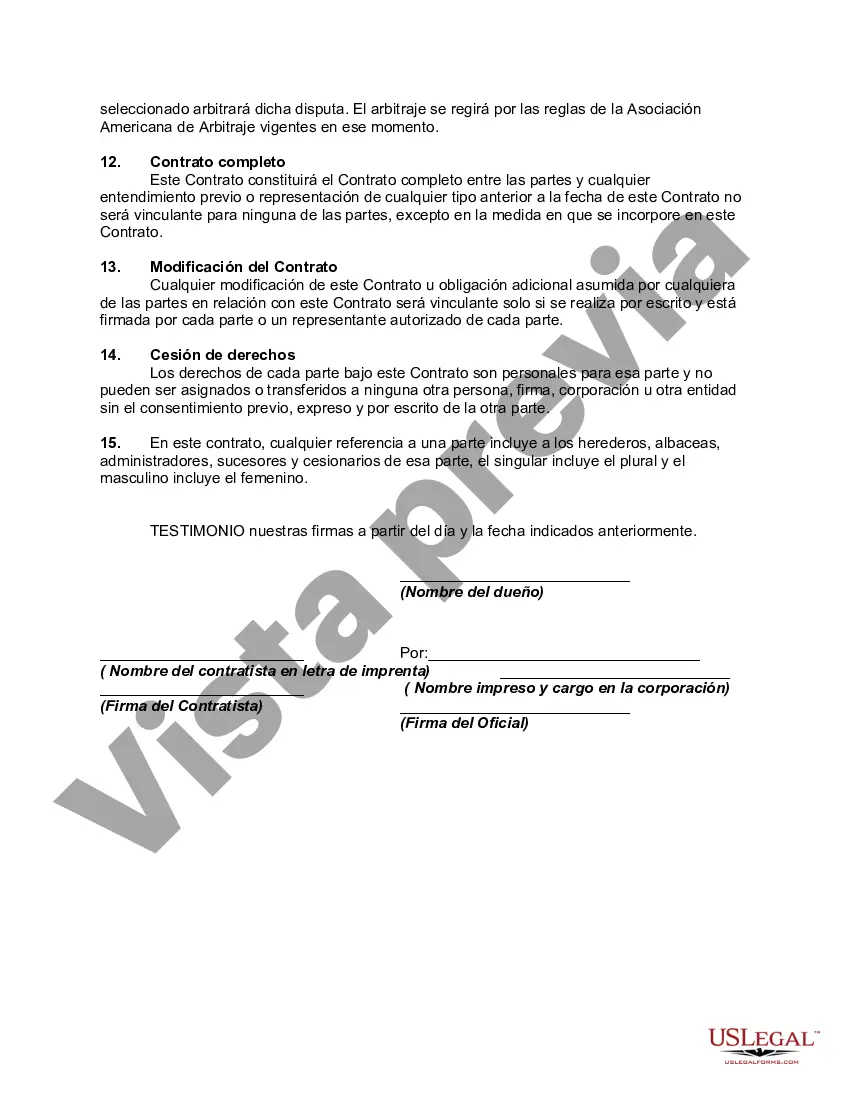

An independent contractor is a person or business who performs services for another person under an express or implied agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The person who hires an independent contractor is not liable to others for the acts or omissions of the independent contractor. An independent contractor is distinguished from an employee, who works regularly for an employer. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview