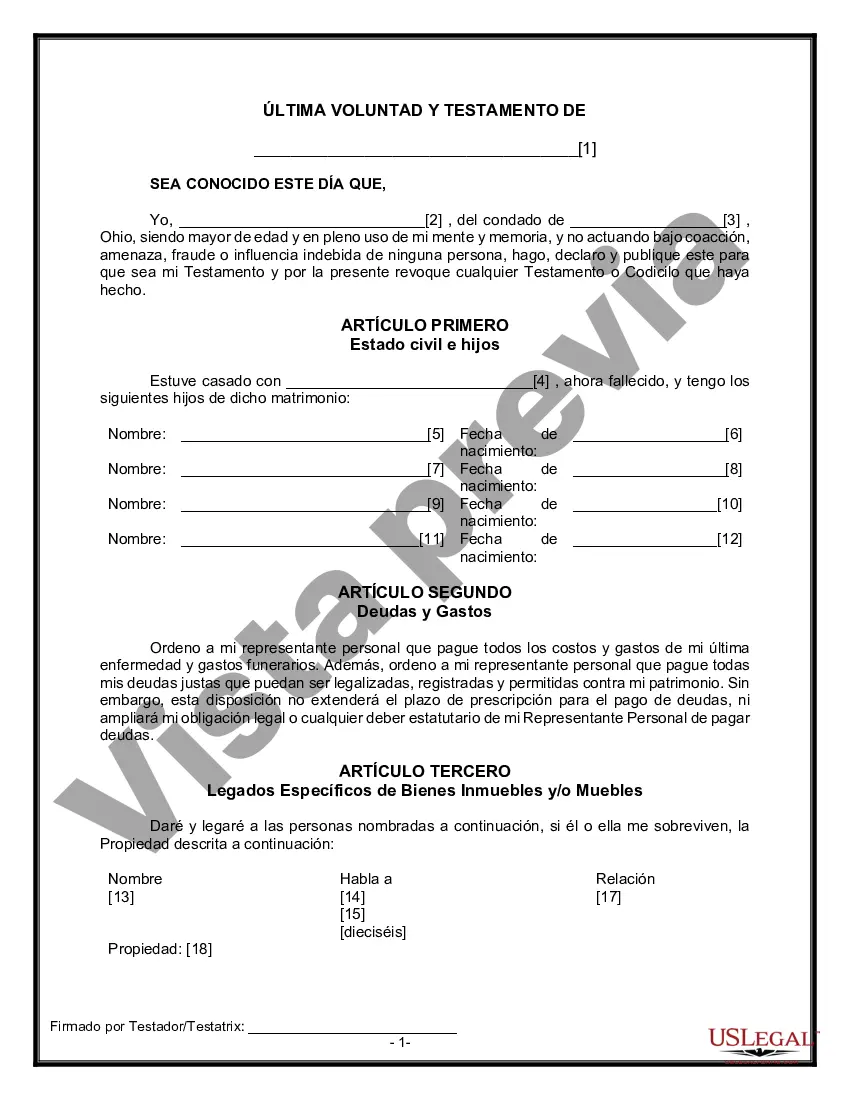

Franklin Ohio Formulario Legal de Última Voluntad y Testamento para una Viuda o Viudo con Hijos Adultos y Menores - Ohio Last Will and Testament for a Widow or Widower with Adult and Minor Children

Description

How to fill out Ohio Formulario Legal De Última Voluntad Y Testamento Para Una Viuda O Viudo Con Hijos Adultos Y Menores?

If you are in search of a legitimate form template, it’s challenging to identify a more suitable location than the US Legal Forms website – likely the most comprehensive repositories available online.

Here, you can locate thousands of document samples for business and personal use categorized by types and regions, or keywords.

With our premium search feature, finding the most recent Franklin Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the form. Choose the file format and download it onto your device. Modify as needed. Fill out, edit, print, and sign the obtained Franklin Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children. Each form you save in your account has no expiration date and is yours indefinitely. You can easily access them through the My documents section, allowing you to download another copy for enhancing or producing a hard copy at any time.

- Moreover, the validity of each document is verified by a team of experienced attorneys who routinely assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Franklin Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children is to Log In to your account and select the Download option.

- If this is your first time using US Legal Forms, simply follow the guidelines provided below.

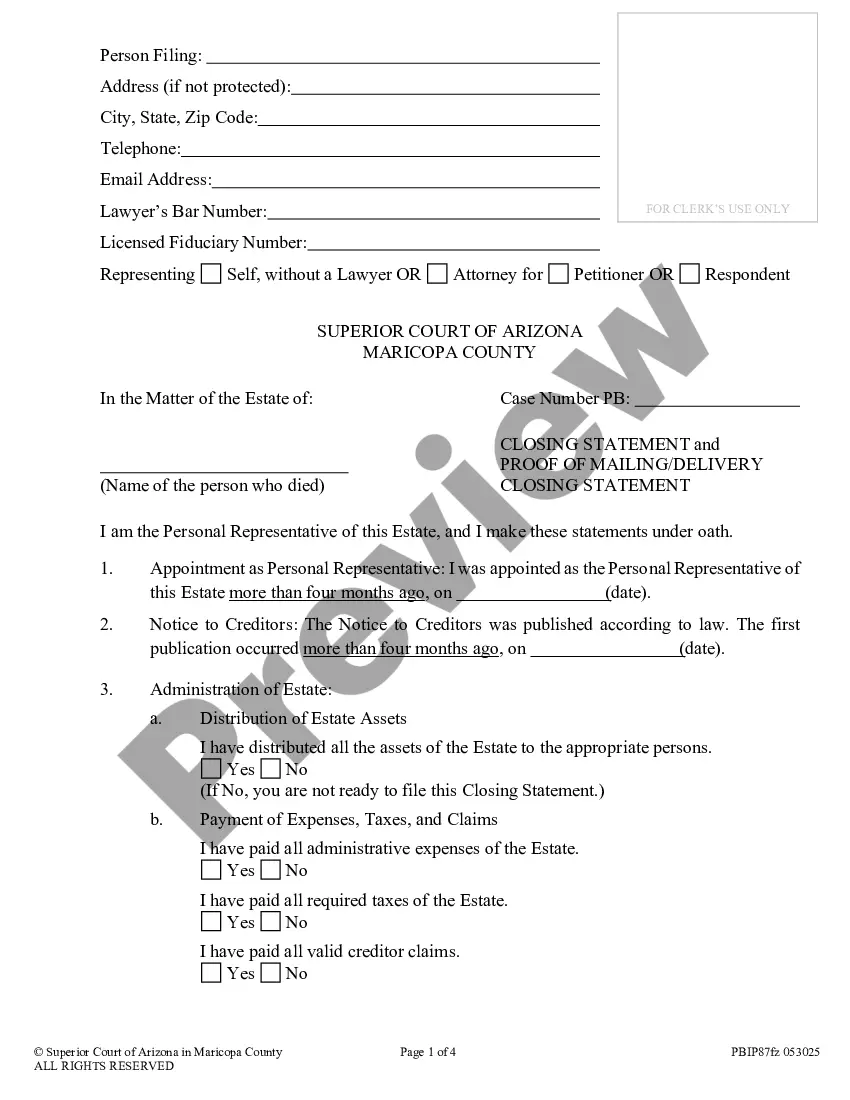

- Ensure you have accessed the sample you require. Review its description and utilize the Preview feature to inspect its contents. If it doesn’t satisfy your needs, use the Search option at the upper part of the screen to find the suitable document.

- Verify your selection. Click the Buy now button. Then, pick your desired pricing plan and submit details to create an account.

Form popularity

FAQ

Si en la herencia tienen que partir la viuda junto a hijos o descendientes, le correspondera el usufructo de una tercera parte de la herencia. Si en la herencia tienen que partir la viuda con los padres del fallecido y no hay hijos: le corresponde el usufructo de la mitad de la herencia.

El viudo o viuda tendra derecho a heredar de sus suegros si el conyuge acepta la herencia. En caso contrario no tendra derecho a heredar.

El patrimonio de una pareja corresponde a los dos conyuges en partes iguales, 50% para cada uno, y cuando uno de ellos fallece, los hijos solo pueden recibir la parte el 50% que le correspondia al fallecido.

El porcentaje de herencia de conyuge e hijos cuando hay testamento sera del 66,6% de la herencia para los descendientes en propiedad pero con un 33,3% de usufructo para el viudo o viuda. En cualquier caso, este usufructo es lo que en derecho se denomina conmutable.

Solo conyuge viudo: Si al fallecimiento del consorte no hay descendientes ni ascendientes, el conyuge viudo tendra derecho al usufructo de los dos tercios de la herencia.

Si el fallecido deja viudo o viuda, tendra derecho al usufructo de la mitad de la herencia. Si a la fecha de fallecimiento vive uno solo de los padres sera el que herede todo. Si no vive ninguno de los padres, recibiran la herencia los abuelos, si sobreviven, dividiendo la herencia entre la linea materna y paterna.

La legitima del conyuge viudo/a es independiente a sus derechos sobre los bienes gananciales: Al fallecer el conyuge, casados en gananciales, el viudo/a tiene derecho al 50% de los bienes gananciales, con independencia de sus derechos hereditarios sobre el otro 50%.

La herencia se repartira entre la conyuge e hijos, donde el codigo civil senala que el conyuge o conviviente civil tendra derecho al doble de lo que le corresponde a cada hijo. En los casos que existan un hijo, la parte de la conyuge o conviviente civil correspondera a la misma parte que la del hijo.

Ello son los hijos/as, la/el esposa/o y los padres de quien fallece. En nuestro pais, una persona casada sin hijos puede hacer un testamento por la mitad de sus bienes. Si esta casado y tiene hijos, solo puede hacer un testamento por un tercio de sus bienes.