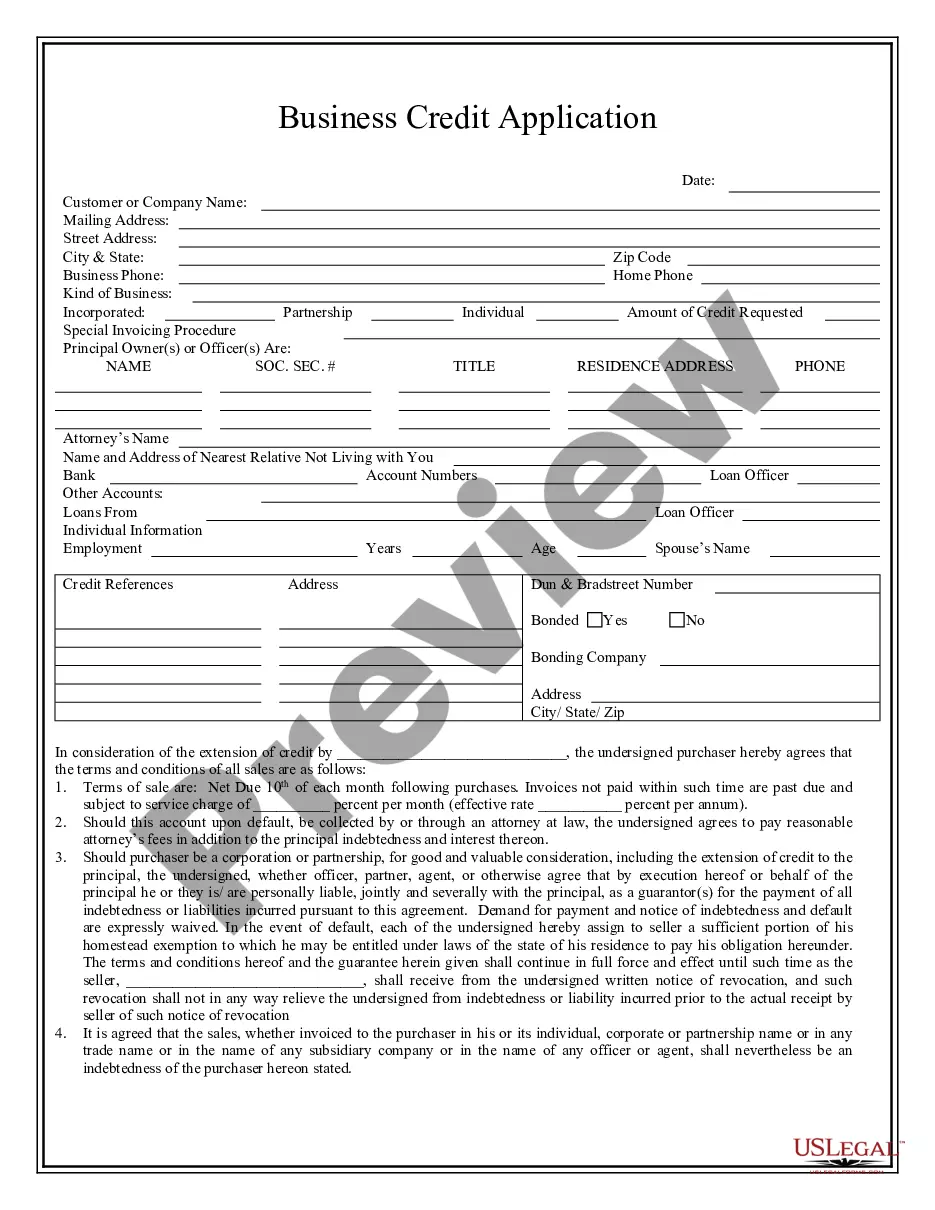

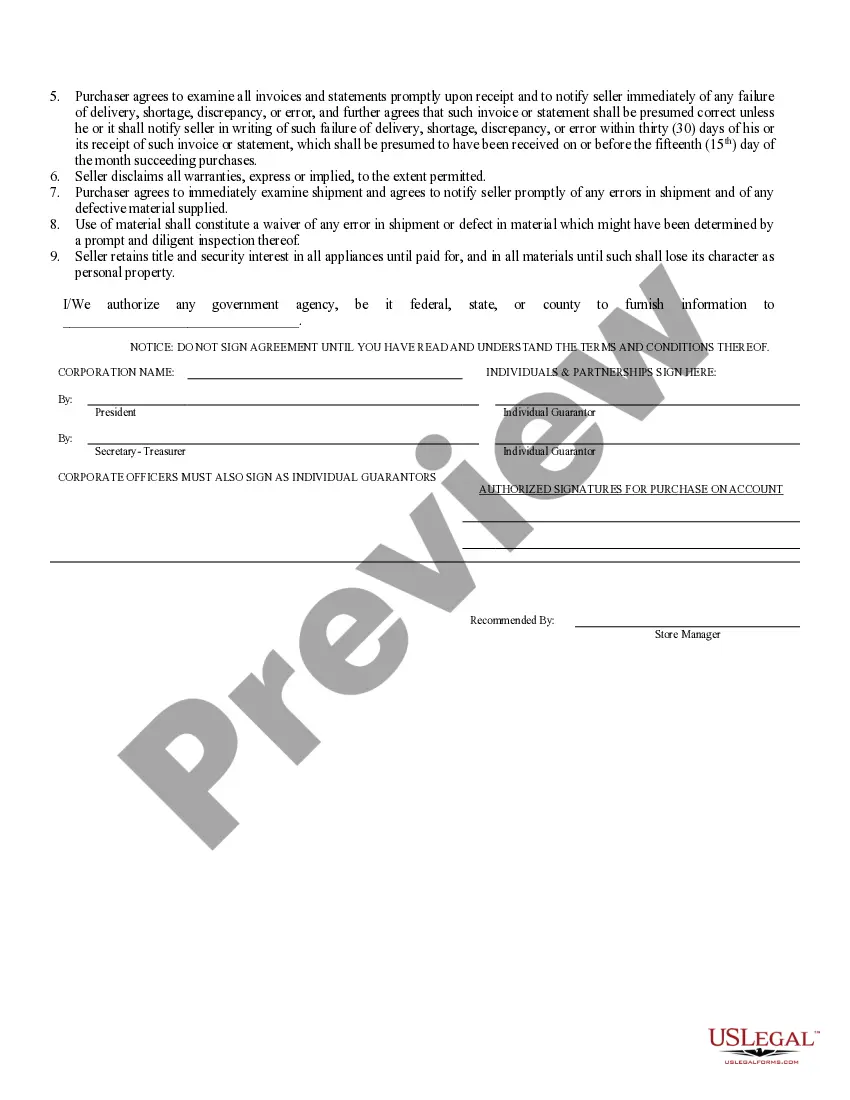

The Charlotte North Carolina Business Credit Application refers to the process by which businesses in Charlotte, North Carolina, apply for credit from various financial institutions and lenders. It involves submitting detailed information about the business's financial history, current financial standing, and creditworthiness to determine the business's eligibility and terms for obtaining credit. The key elements of a Charlotte North Carolina Business Credit Application typically include: 1. Business information: This includes the legal name of the business, address, phone number, and other relevant contact details. 2. Ownership and management details: Information about the business's ownership structure, including the names and positions of partners, directors, or officers. 3. Business financials: This section requires providing detailed financial statements such as balance sheets, income statements, and cash flow statements. It may also ask for tax returns, profit and loss statements, and any relevant financial documentation. 4. Business history: A description of the business's history, including its establishment date, previous credit or loan history, and any significant achievements or milestones. 5. Purpose and amount of credit: The intended use of the credit (e.g., working capital, investment in assets, expansion) and the requested credit amount. 6. Collateral and security: Any assets or property the business is willing to pledge as collateral to secure the credit. 7. Personal and business credit history: Information regarding the business owner(s) and principal(s) credit history, including any previous bankruptcies, default history, or outstanding debts. 8. Legal documentation: Required legal documents may vary depending on the type of business and credit application, but it may include articles of incorporation, partnership agreements, or operating agreements. Different types of Charlotte North Carolina Business Credit Applications can include: 1. Small Business Credit Application: Tailored for small businesses seeking credit for various purposes like operational expenses, inventory purchase, or equipment financing. 2. Commercial Credit Application: For larger businesses and corporations requiring significant credit for expansion, mergers and acquisitions, or long-term investments. 3. Startup Business Credit Application: Designed explicitly for newly established businesses seeking initial capital to launch their operations. 4. Vendor Credit Application: The application businesses submit to their suppliers or vendors to establish a line of credit for purchasing goods or services on credit terms. Overall, the Charlotte North Carolina Business Credit Application is a crucial process for businesses based in Charlotte, enabling them to access funds and credit facilities necessary for growth, expansion, and operational needs.

What Does A Nc Business License Look Like

Description

How to fill out Charlotte North Carolina Business Credit Application?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Charlotte North Carolina Business Credit Application or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Charlotte North Carolina Business Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Charlotte North Carolina Business Credit Application is suitable for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!