This is an official form from the Judicial Branch of Wyoming which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Wyoming statutes and law.

Wyoming Child Support Presumptive Guidelines Computation Form

Description

How to fill out Wyoming Child Support Presumptive Guidelines Computation Form?

Use US Legal Forms to get a printable Wyoming Child Support Presumptive Guidelines Computation Form. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms library on the internet and offers cost-effective and accurate samples for customers and legal professionals, and SMBs. The templates are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to quickly find and download Wyoming Child Support Presumptive Guidelines Computation Form:

- Check out to make sure you get the proper form in relation to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search field if you want to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Wyoming Child Support Presumptive Guidelines Computation Form. Above three million users have already utilized our platform successfully. Choose your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

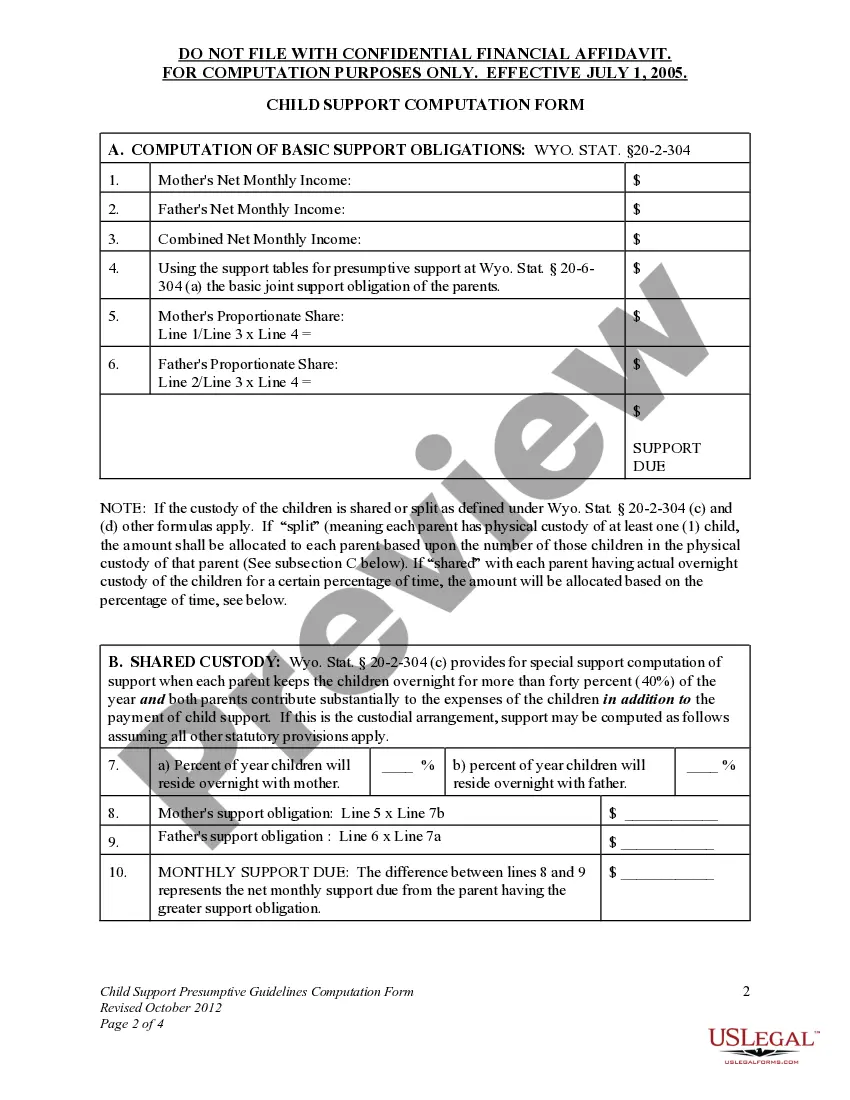

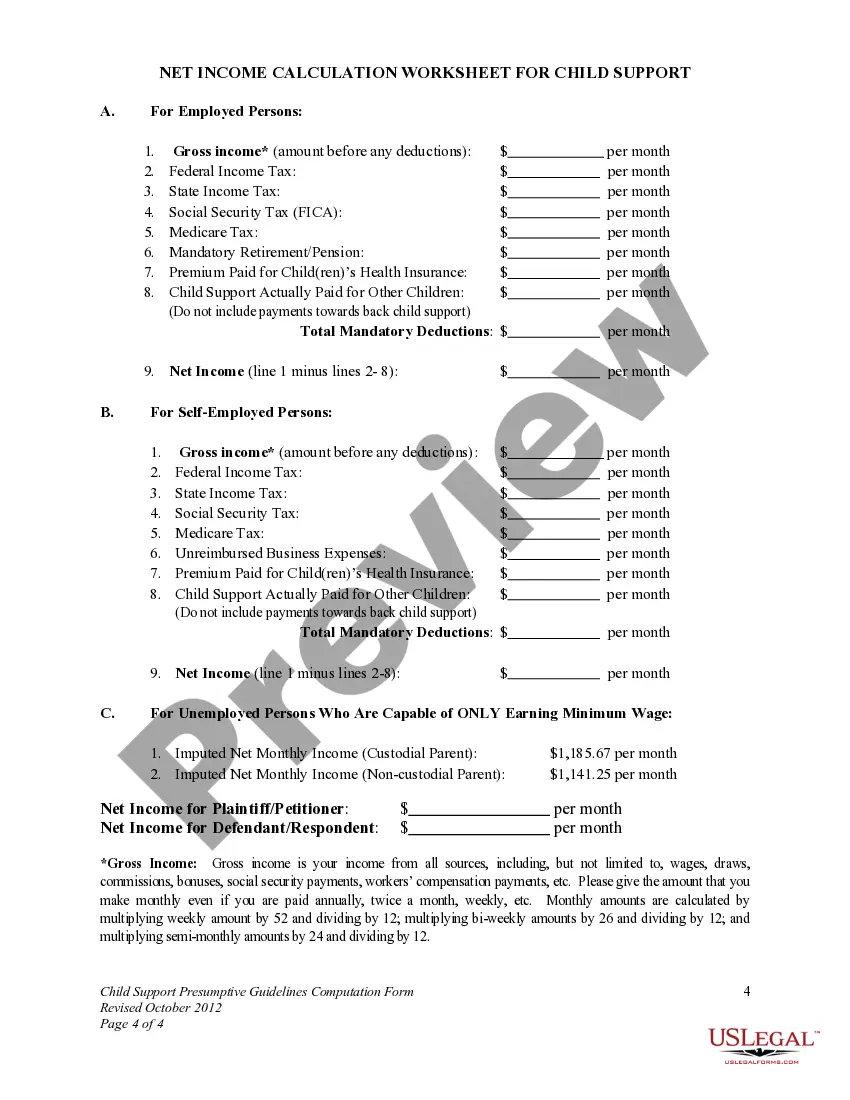

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

Deductions of child support are made after tax withheld deductions and formal salary sacrificing. This is before other deductions such as voluntary superannuation, health fund and loan repayments. Once you make a deduction from your employee's or contractor's pay, you're legally required to pay it to us.

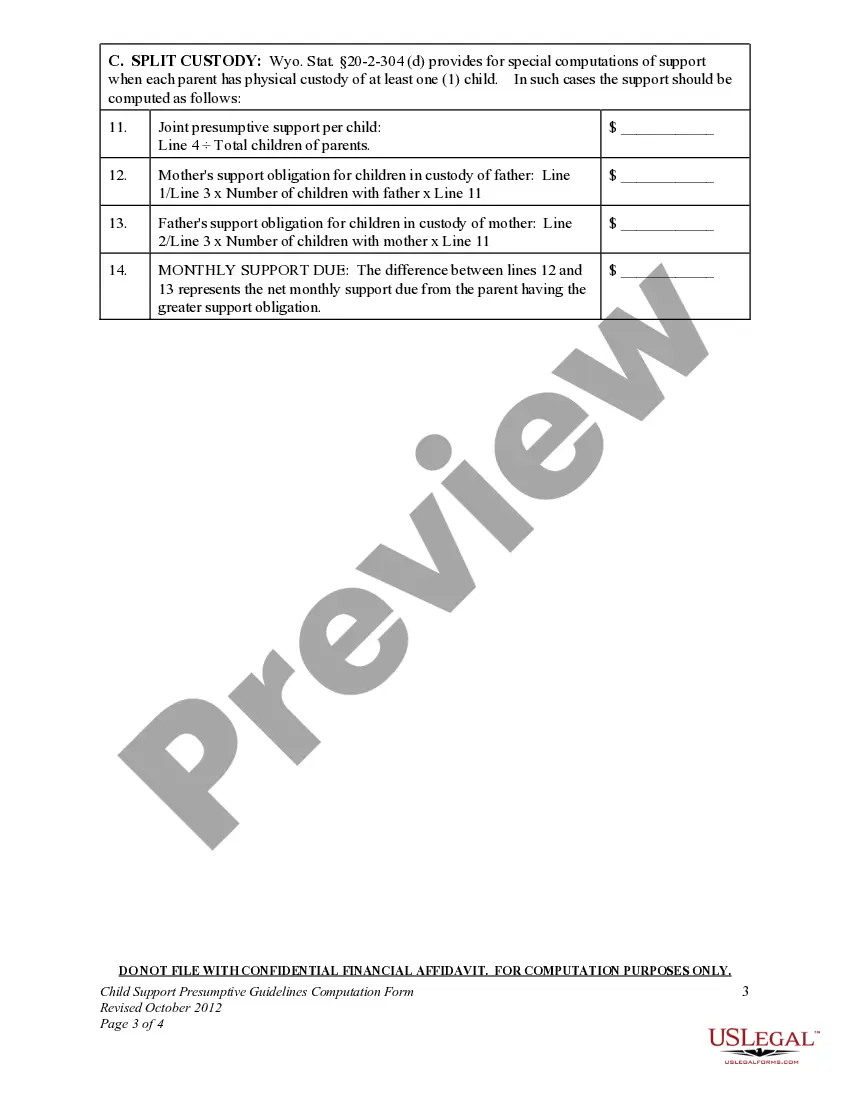

Child Support Modifications Aren't (Usually) Retroactive For the most part, modifications made to child support orders only go back to the date the request for the change was filed.In most cases, the court will only consider changing the child support order back to the date you filed the motion to modify.

Request Review or Modification of Your Child Support Order If you do not already have an open child support case, you will need to open one. Once the local office has completed its review, a petition to modify will be filed or the local office will inform you that it has determined a modification is not appropriate.

CHILD SUPPORT BASED ON GROSS INCOME CSA advises parties that this is what the children would be entitled to if the two parents were still together. But they would only be entitled to a net amount if the two parents were still together.

If a paying parent has to pay child maintenance for one child, they must pay 12 percent of their gross weekly income. If a paying parent has to pay child maintenance for two children, they must pay 16 percent of their gross weekly income.

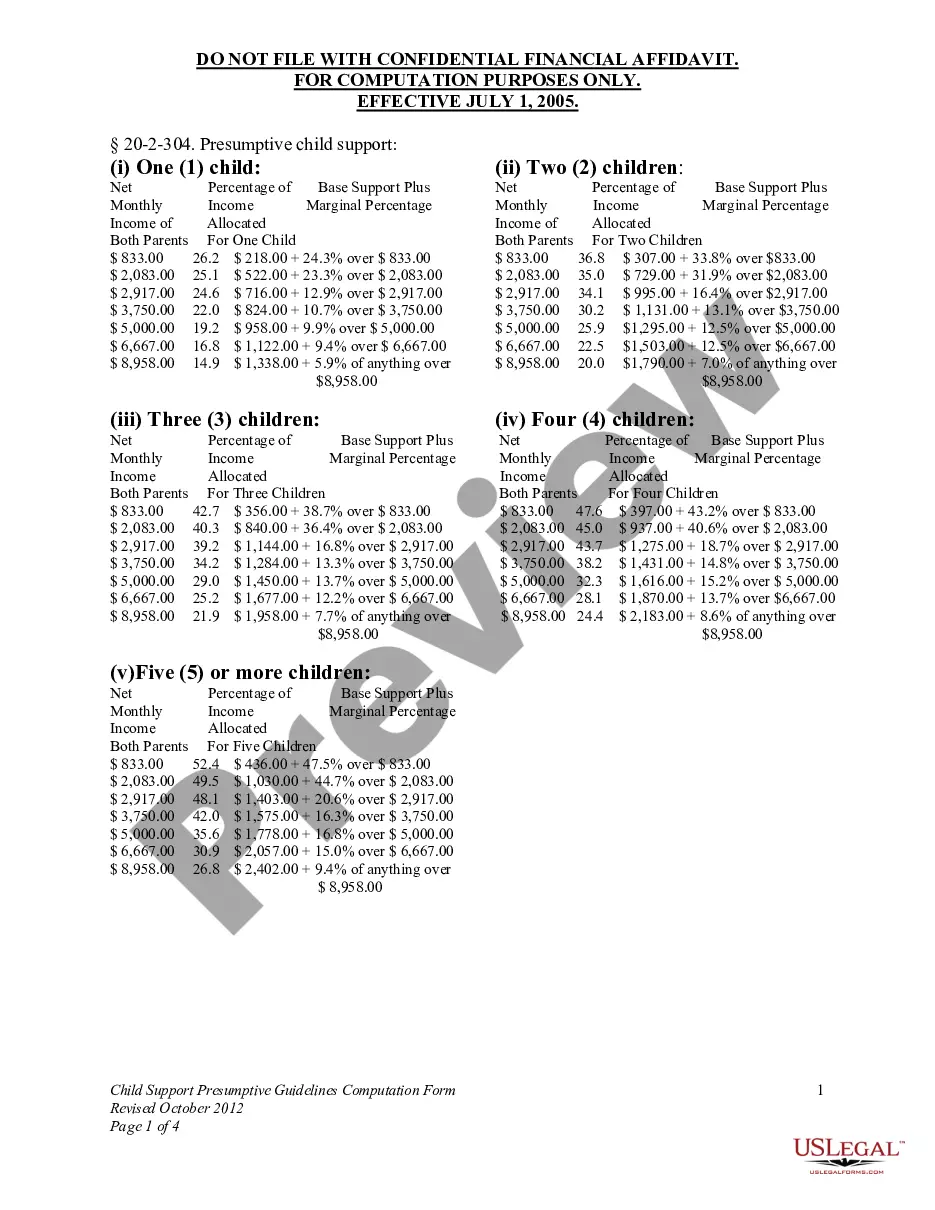

According to the guidelines, for two kids, you must pay between 20% to 36.8% of your net income, plus an additional percentage of any income above a certain baseline amount. The baseline for our example net income of $2,500) is $2,083. The percentage of child support due on $2,083 is 35%.

Modifying Child Support Without Going to Court It is possible to have your child support order modified without having to go to court--but only in very limited circumstances. Some judges include a Cost of Living Adjustment (COLA) clause in all of the child support orders they issue.

Deductions of child support are made after tax withheld deductions and formal salary sacrificing. This is before other deductions such as voluntary superannuation, health fund and loan repayments. Once you make a deduction from your employee's or contractor's pay, you're legally required to pay it to us.