Wisconsin Partnership Agreement for LLP

Description

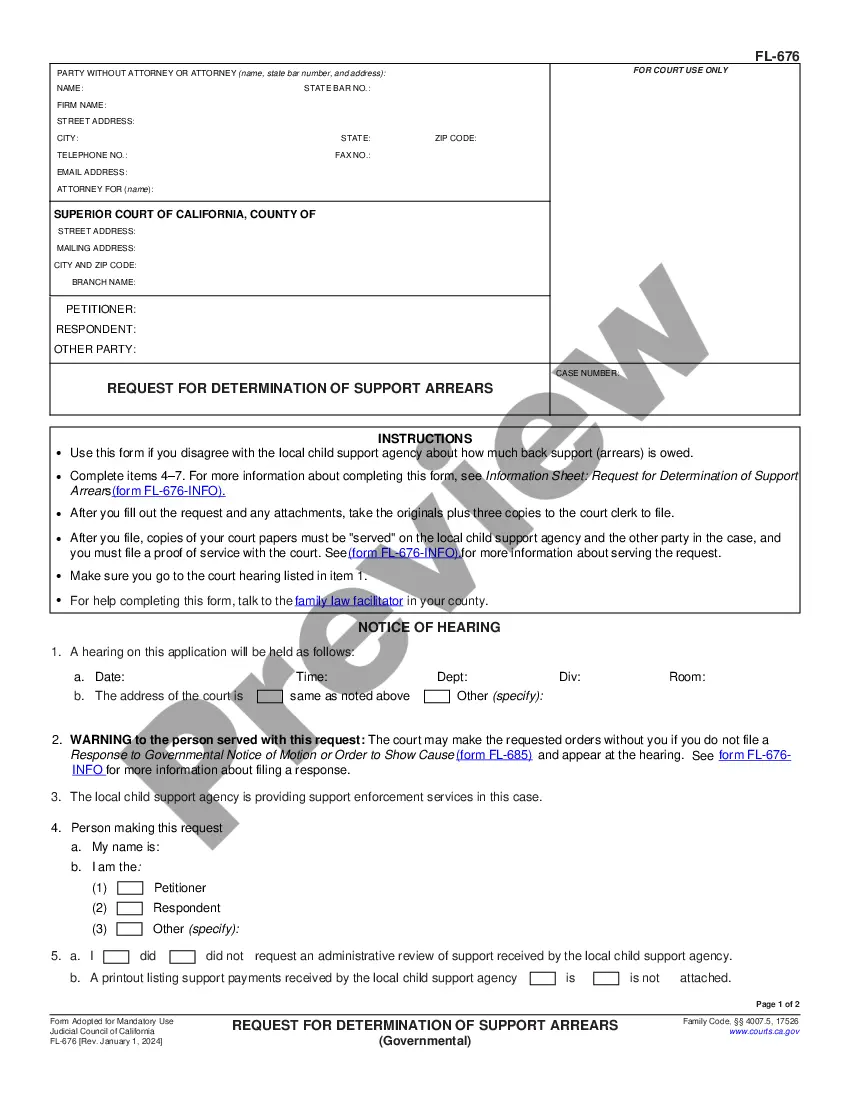

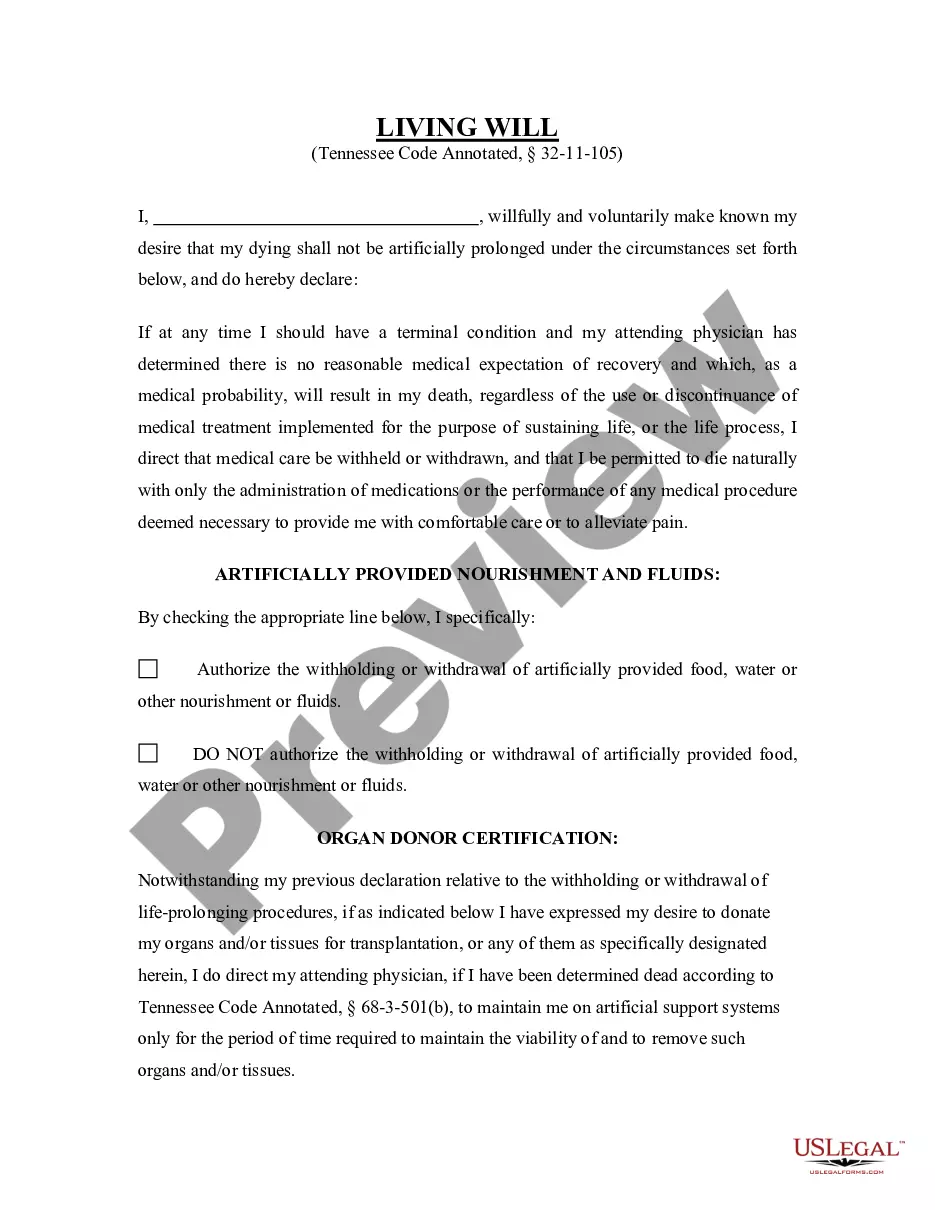

How to fill out Partnership Agreement For LLP?

US Legal Forms - one of the largest collections of legal templates in the country - offers a broad selection of legal document templates available for download or printing.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Wisconsin Partnership Agreement for LLP in just a few seconds.

Read the form summary to confirm that you have selected the appropriate form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you have a monthly subscription, Log In and download the Wisconsin Partnership Agreement for LLP from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously saved forms from the My documents section of your account.

- To utilize US Legal Forms for the first time, here are simple instructions to help you start.

- Verify you have selected the correct form for your city/state.

- Click the Review button to inspect the content of the form.

Form popularity

FAQ

Choosing between an LLC and an LLP depends on your business needs and goals. A Wisconsin Partnership Agreement for LLP provides flexible management and partnership features, while an LLC offers strong liability protection for all members. Consider factors like the number of owners, management structure, and liability concerns to determine which option serves your business better.

It's not a legal requirement to enter into a limited liability partnership agreement and an LLP can be set up without one. However, it's a very common and generally sound recommendation that a new LLP puts a partnership agreement in place.

Are there rules on how partnerships are run? The only requirement is that in the absence of a written agreement, partners don't draw a salary and share profits and losses equally. Partners have a duty of loyalty to the other partners and must not enrich themselves at the expense of the partnership.

- Save as otherwise provided, the provisions of the Indian Partnership Act, 1932 (9 of 1932) shall not apply to a limited liability partnership. This section provides that the provisions of the Indian Partnership Act, 1932 shall not apply to an LLP.

If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally. The agreement outlines the rights, responsibilities, and duties each partner has to the company and to each other.

A limited partnership is different from a general partnership in that it requires a partnership agreement. Some information about the business and the partners must be filed with the appropriate state agency (usually the secretary of state). Additionally, a limited partnership has both limited and general partners.

LLP is a legal entity partnership act.

Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities are limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

A limited partnership is a type of partnership that consists of at least one general partner and at least one limited partner. A limited liability partnership does not have a general partner, since every partner in an LLP is given the ability to take part in the management of the company.

To form a partnership in Wisconsin, you should take the following steps:Choose a business name.File a trade name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.