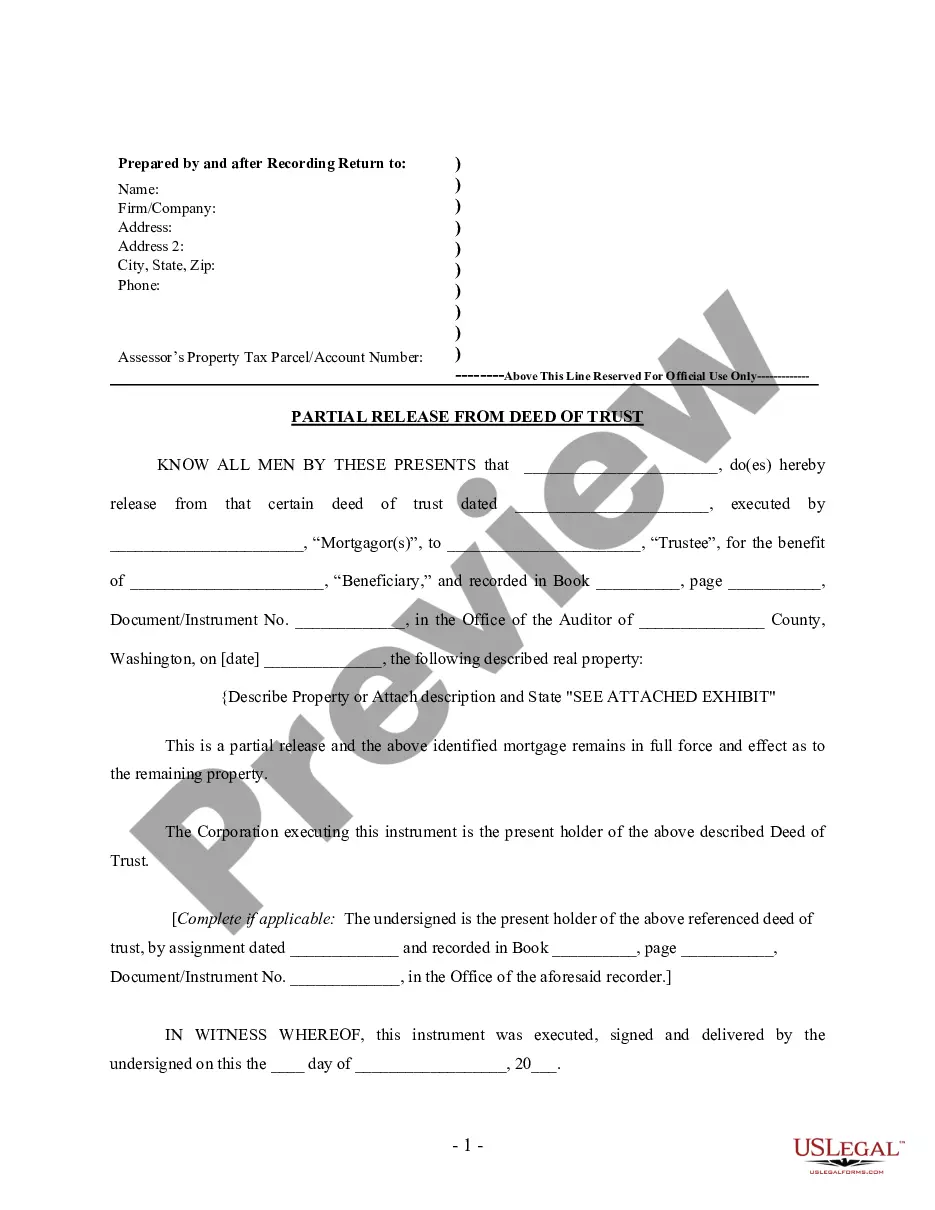

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Washington Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out Washington Partial Release Of Property From Deed Of Trust For Corporation?

Out of the large number of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its extensive library of 85,000 templates is categorized by state and use for simplicity. All of the forms on the service have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the template, hit Download and get access to your Form name in the My Forms; the My Forms tab holds all of your saved documents.

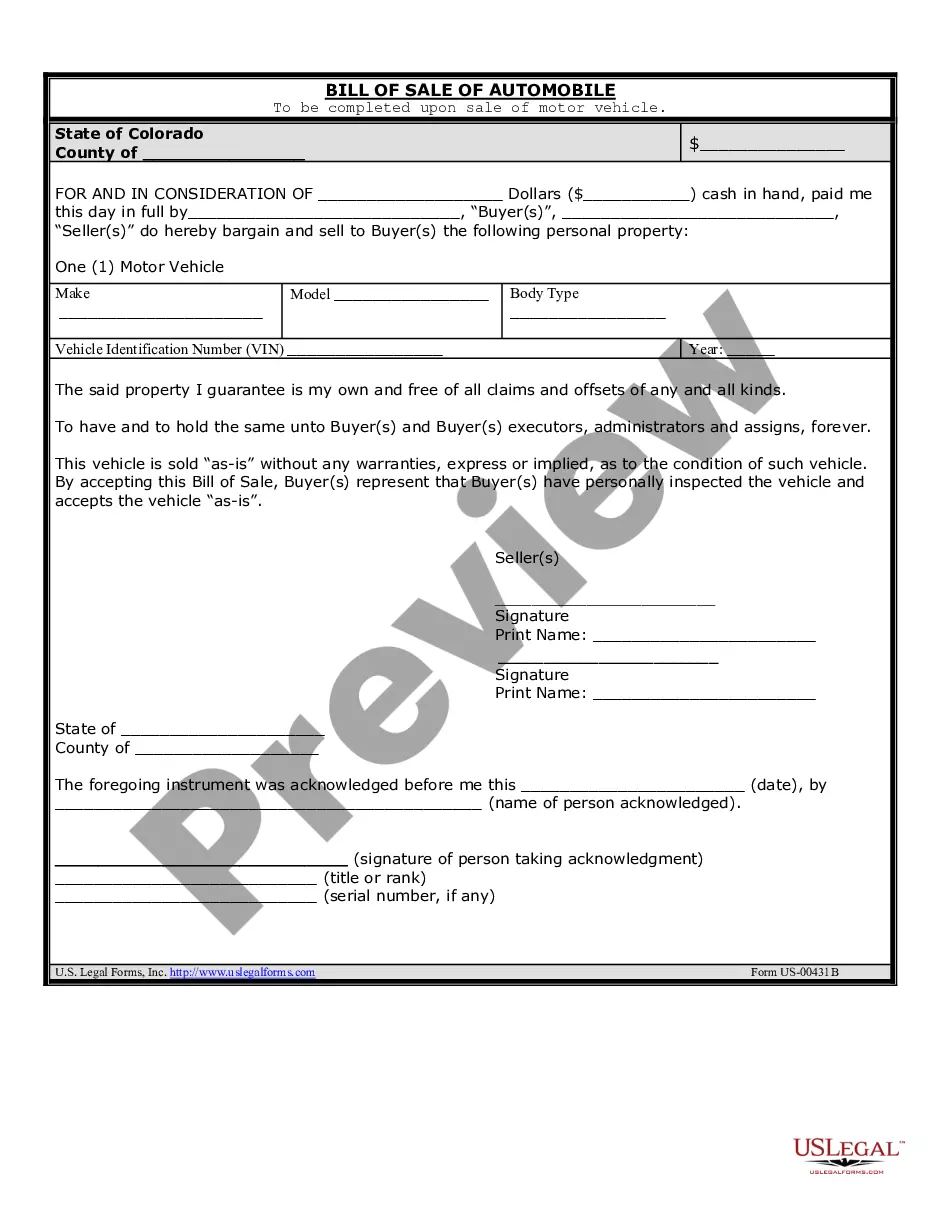

Keep to the tips listed below to get the form:

- Once you discover a Form name, make certain it is the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Search for a new template via the Search field if the one you’ve already found is not appropriate.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

After you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it in an web-based editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our platform offers fast and easy access to samples that fit both lawyers as well as their customers.

Form popularity

FAQ

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note. This process is called a Trustee Sale.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. It's signed by a representative of the lender and notarized, like other types of deeds.

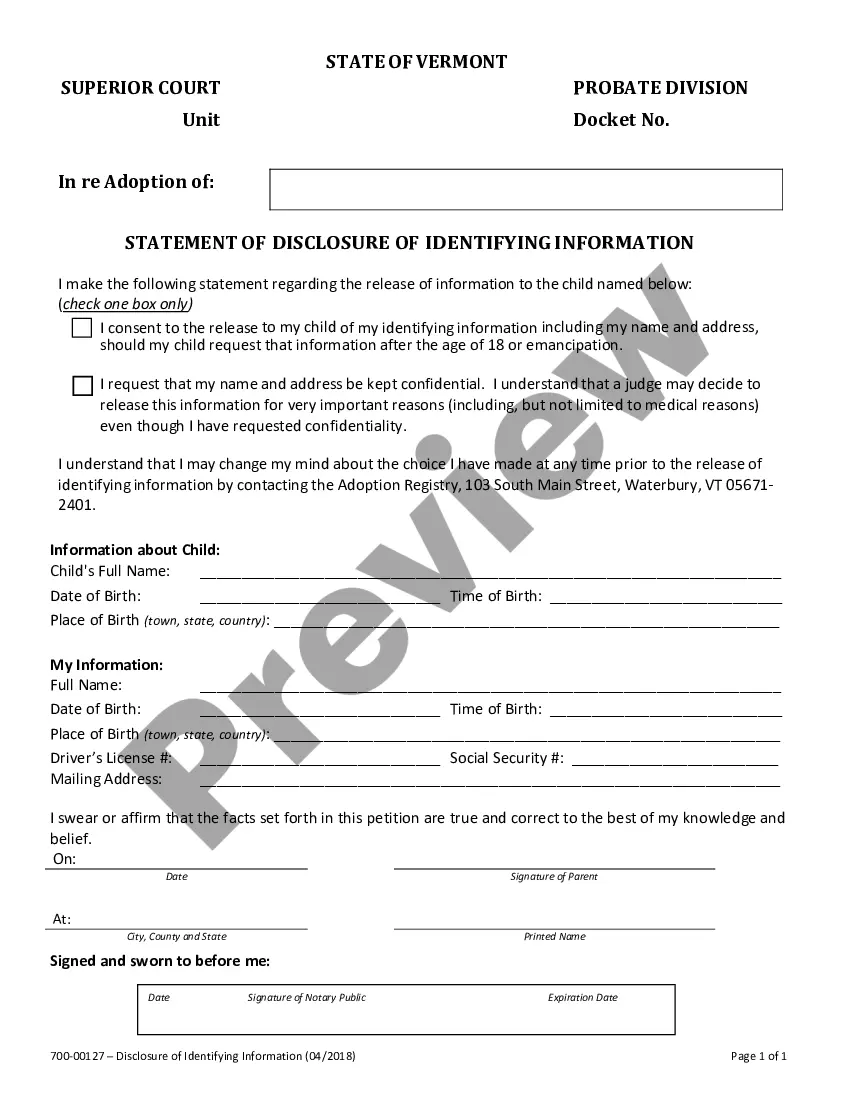

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

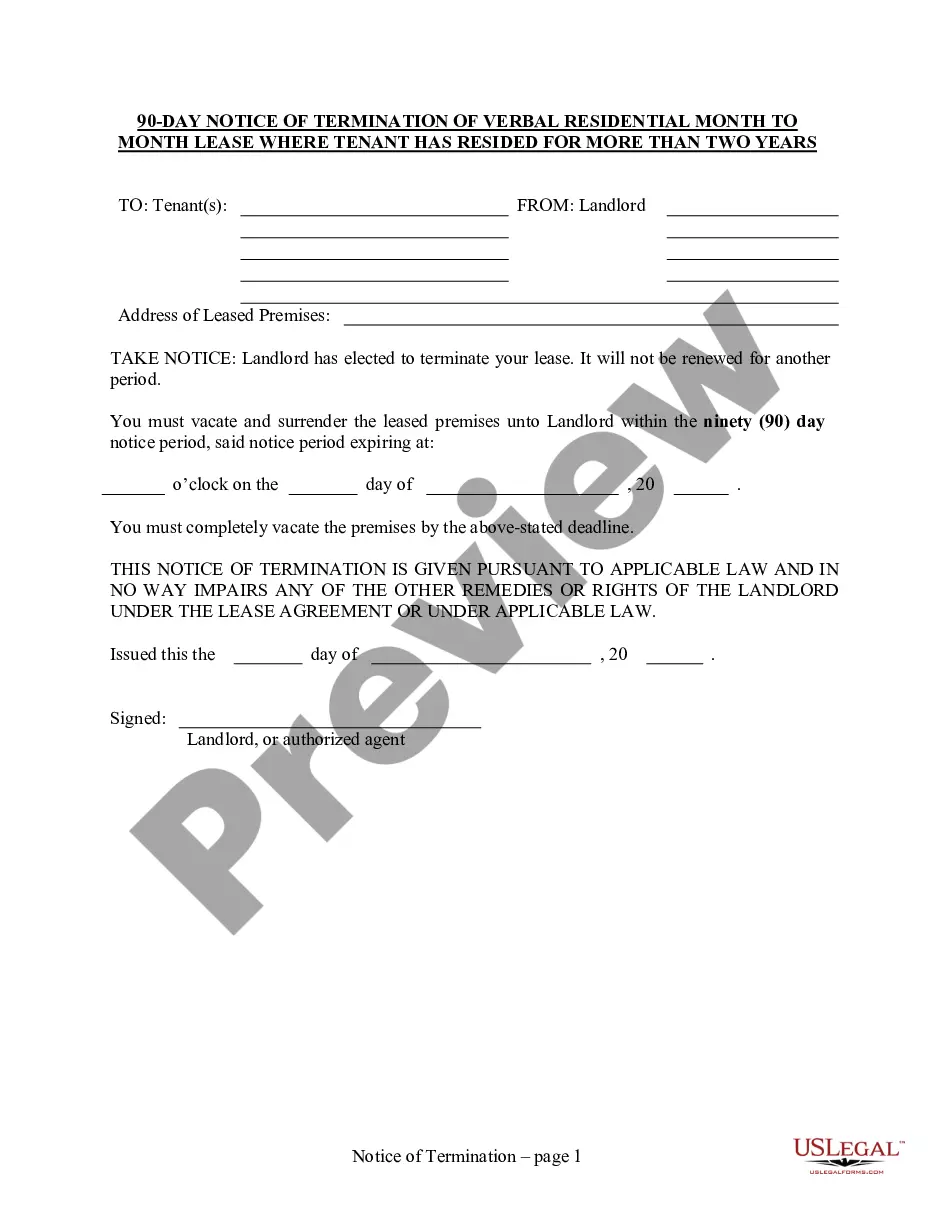

A release clause is a term that refers to a provision within a mortgage contract. The release clause allows for the freeing of all or part of a property from a claim by the creditor after a proportional amount of the mortgage has been paid.

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.