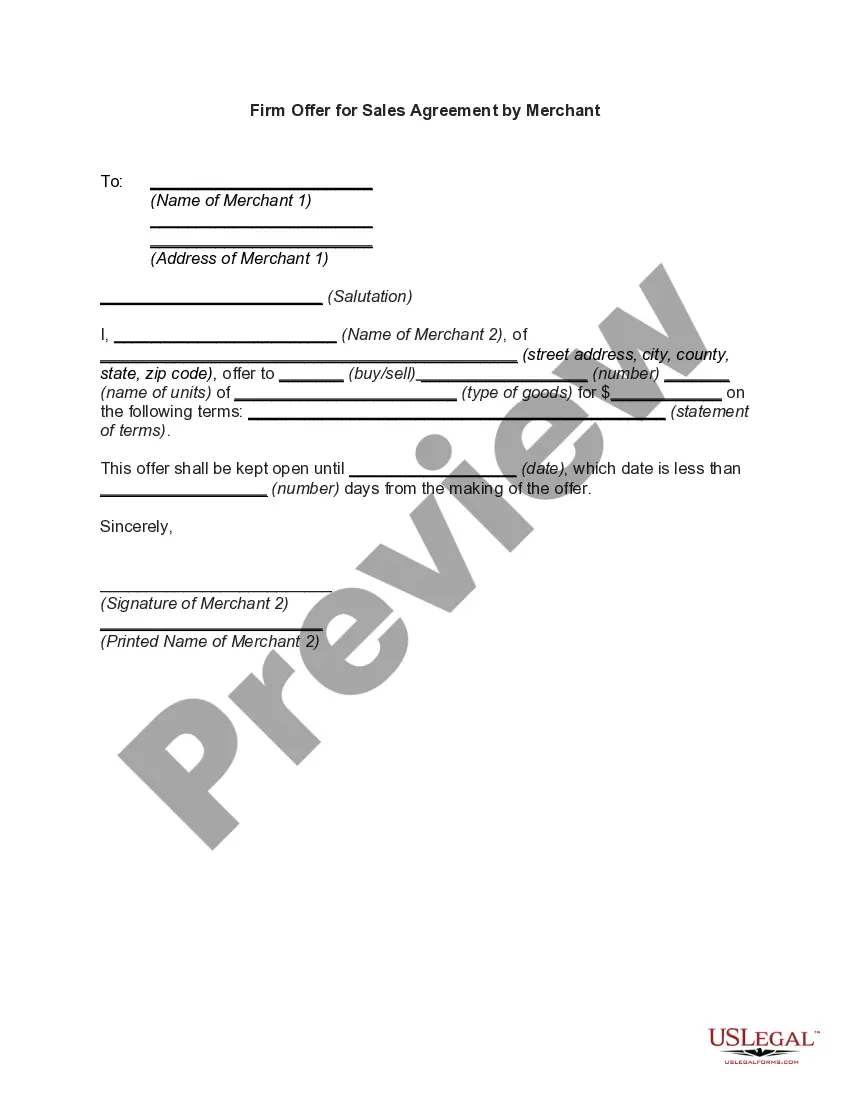

Virginia Firm Offer

Description

How to fill out Firm Offer?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can access or print.

By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms, such as the Virginia Firm Offer, in mere seconds.

If you hold a membership, Log In to access the Virginia Firm Offer in the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the purchase process. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit as needed. Complete, modify, and print, then sign the downloaded Virginia Firm Offer. Each form you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Make sure you have selected the correct form for your area/region.

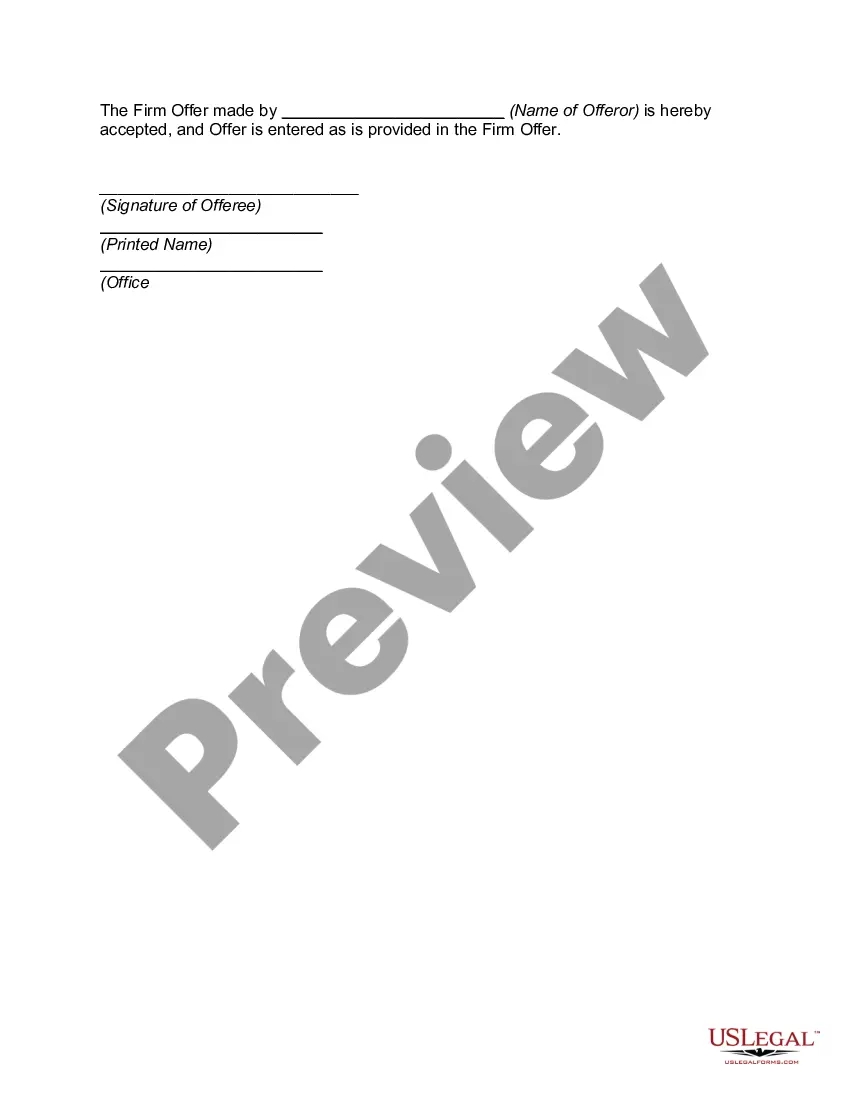

- Click the Preview button to review the contents of the form.

- Check the form details to confirm that you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

A firm offer signifies a promise by the offeror to keep the offer open and respected until a specified time or event occurs. In legal contexts, it indicates a serious intention to create a binding agreement. Recognizing the importance of a Virginia Firm Offer ensures that your agreements are respected and enforceable. This understanding can help mitigate potential disputes.

Yes, Virginia provides an e-filing option for both residents and non-residents, enhancing convenience and efficiency in tax submissions. E-filing often results in quicker processing times and faster refunds. You can use various online platforms to file electronically. Utilizing the Virginia Firm Offer can help streamline your e-filing experience.

State of Virginia Offer in CompromiseYou don't need to submit a payment with your Offer, but you can.If you owe personal tax and business tax, and would like to request a Compromise for both, you will need to complete and submit a separate OIC for each tax debt.The OIC may be used to request a Penalty Waiver.More items...

The Virginia Form VA-4, Employee's Virginia Income Tax Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

FORM VA-4 INSTRUCTIONSYou must file this form with your employer when your employment begins. If you do not file this form, your employer must withhold Virginia income tax as if you had no exemptions.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Resident Aliens (RA) may complete the W-4 and VA-4 just like a U.S. citizen. Please use the worksheet on both forms to calculate your allowances and exemptions. Non-Resident Aliens (NRA) have certain requirements for filling out tax paperwork. Please follow the directions below to correctly complete these forms.

If you don't have an SSN or ITIN, you can still get an EIN for your Virginia LLC. You just can't apply for an EIN online. You will need to mail or fax Form SS-4 to the IRS instead and you must fill the form out in a certain way.

To obtain your Tax ID (EIN) in Virginia start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.