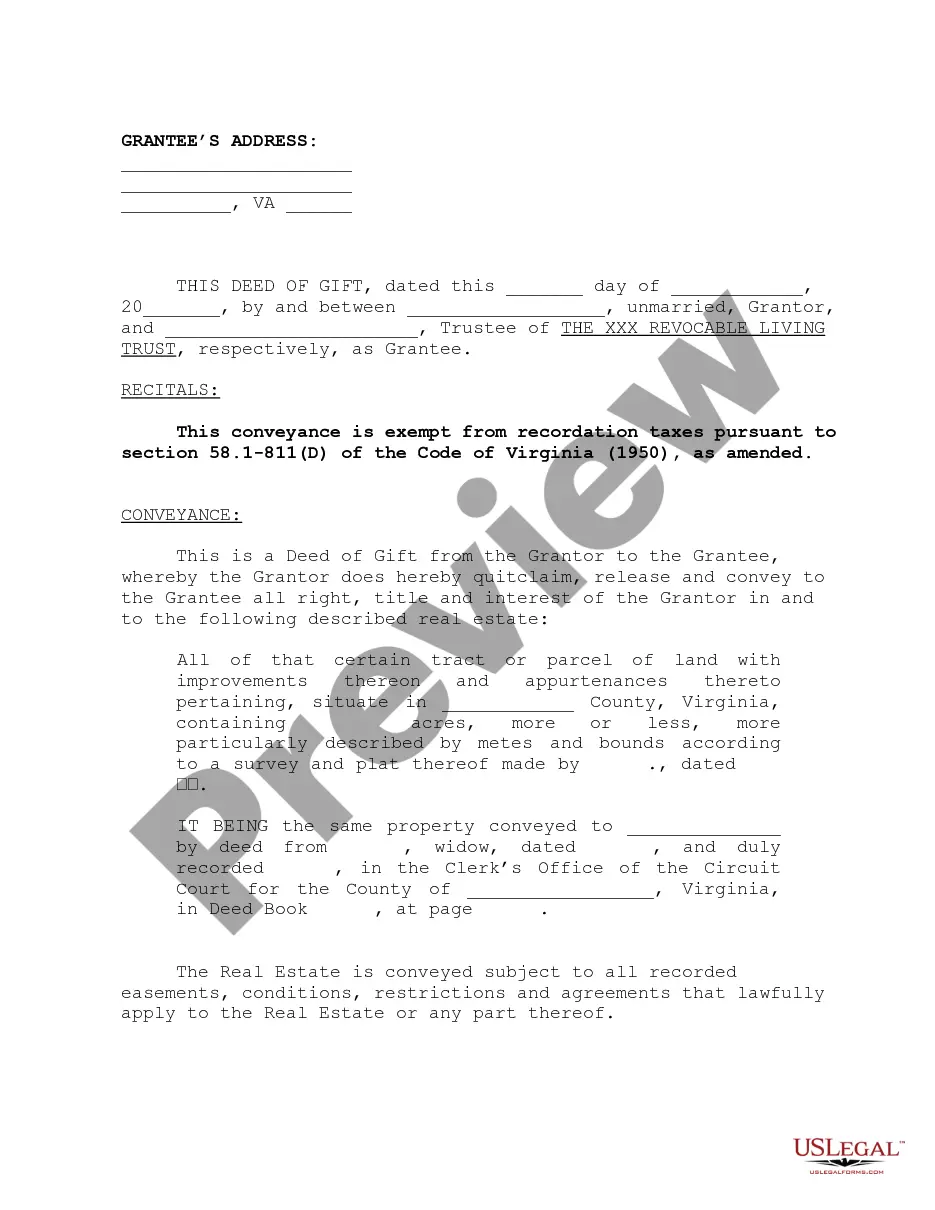

Virginia Deed of Gift to Trust of Real Estate

Definition and meaning

A Virginia Deed of Gift to Trust of Real Estate is a legal document that allows an individual, referred to as the Grantor, to transfer ownership of real estate property to a trust, managed by a Trustee, without any monetary exchange. This type of deed is often used for estate planning purposes, ensuring that the property is protected and managed according to the Grantor's wishes.

How to complete a form

To accurately complete the Virginia Deed of Gift to Trust of Real Estate, follow these steps:

- Provide the names and addresses of both the Grantor and the Trustee.

- Clearly describe the property being transferred, including any improvements or appurtenances.

- Specify the date of the transfer.

- Include any relevant details regarding the property's history, such as previous ownership.

- Ensure the deed is signed and dated in the presence of a notary public.

Key components of the form

The Virginia Deed of Gift to Trust of Real Estate includes several vital components:

- Grantor and Grantee Information: Names and addresses of the Grantor and the Trustee.

- Property Description: A clear and detailed description of the real estate being transferred.

- Exemption Clauses: Notes on any exemptions related to taxes or fees associated with the transfer.

- Notary Signature: The deed must be acknowledged and notarized for it to be legally binding.

Who should use this form

The Virginia Deed of Gift to Trust of Real Estate is suitable for individuals looking to transfer property into a trust for various reasons, including:

- Estate planning to pass property to heirs.

- Ensuring property management according to specific wishes.

- Minimizing estate taxes or avoiding probate.

What to expect during notarization or witnessing

When finalizing the Virginia Deed of Gift to Trust of Real Estate, it's important to understand the notarization process:

- The Grantor must appear before a notary public to sign the document.

- The notary will verify the identity of the Grantor.

- After signing, the notary will complete the notarization by adding their seal and signature to the document.

Form popularity

FAQ

Virginia allows you to leave real estate with transfer-on-death deeds, also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

Any person of sound mind, and above the age of 18 can be a witness. any least two witnesses should attest in the gift deed . - Since, the said property is self acquired property of your grandfather , then he is having his right to gift you without the interfere of any other legal heirs like your father etc.

It is however difficult to prove the same. You should have clinging evidence to show that it was against the wish of owner of through fraud, misrepresentation, coercion etc. As it is registered gift deed under sec 17 of Registration Act 1908 it becomes a valid and authentic document.

California doesn't enforce a gift tax, but you may owe a federal one. However, you can give up to $15,000 in cash or property during the 2019 and 2020 tax years without triggering a gift tax return.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person.The person who creates and executes a Deed of Gift to transfer money or property from himself to another person is called a Donor and the person receiving the gift is called the Donee.

It is executed during the life time of donor and transfer happens immediately whereas Will is applicable after death. Gift deed needs to be registered; only then it is effective. Registration renders it less liable to litigation. Transfer using gift deeds are tax free in the hands of donor and donee.

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee), typically between family members or close friends. Gift deeds are also used to donate to a non-profit organization or charity.