Utah Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Resolution Selecting Depository Bank For Corporation And Account Signatories?

It is feasible to spend countless hours online attempting to locate the approved document format that aligns with the state and federal requirements you will require.

US Legal Forms provides a vast array of authorized templates that can be assessed by experts.

You can conveniently download or print the Utah Resolution Choosing Depository Bank for Corporation and Account Signatories from my services.

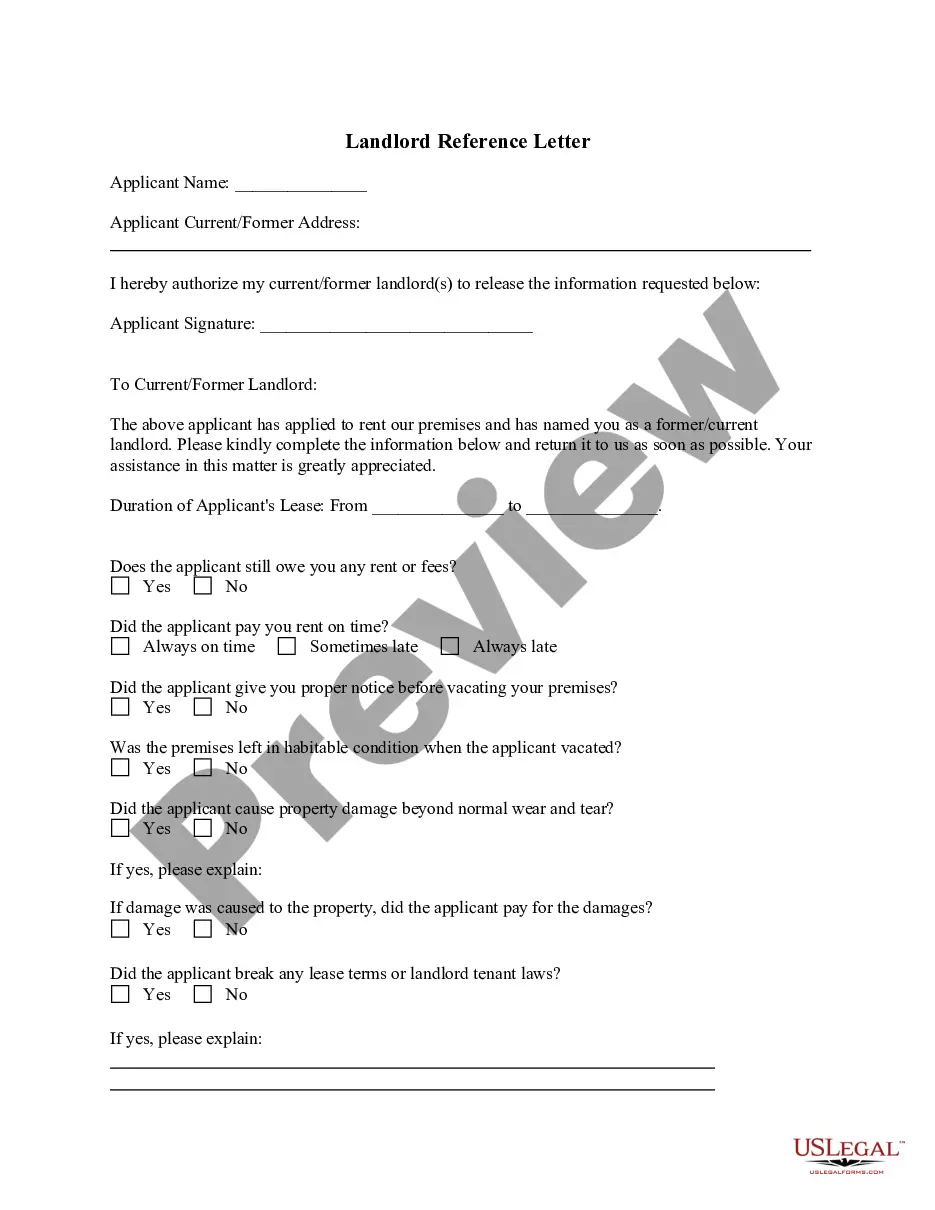

If available, utilize the Preview button to view the document format at the same time.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Utah Resolution Choosing Depository Bank for Corporation and Account Signatories.

- Each authorized document format you purchase is yours to keep indefinitely.

- To obtain an additional copy of any acquired form, go to the My documents tab and click the respective button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the state/city of your choice.

- Review the form synopsis to confirm you have selected the correct document.

Form popularity

FAQ

When considering the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories, it is essential to be aware of the three primary types of accounts at a depository institution. These include demand deposit accounts, savings accounts, and certificates of deposit. Demand deposit accounts provide easy access to funds, while savings accounts encourage saving with interest. Certificates of deposit offer higher interest rates in exchange for locking in funds for a set period. Understanding these accounts helps corporations effectively manage their finances and select the right banking solutions.

Filling out a banking resolution involves providing specific, clear information about the corporation and its authorized signatories. Begin by stating the corporation's name, its business purpose, and the decision to open the bank account. It's also essential to list the names and titles of authorized individuals. To ensure accuracy and compliance with banking standards, you can consult the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories for step-by-step instructions.

A corporate resolution to add a signer to a bank account is a formal document that specifies who is authorized to access the account. This resolution must be adopted by the corporation’s board and clearly outlines the rights and limitations of the new signatory. Banks require this document to ensure they follow the correct procedures in updating account access. For assistance in drafting this resolution, refer to the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories.

In most cases, a corporate resolution is required to open a business bank account. This document ensures the bank acknowledges the designated individuals authorized to manage the account on behalf of the corporation. It serves as a protective measure for both the corporation and the bank. To effectively navigate this requirement, utilize the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories.

Correct, a corporate resolution is indeed a required document when you open an account for a corporation. This legal document highlights the decision made by the corporation’s board regarding who has the authority to handle banking transactions. Without it, the bank may not allow account setup, so having this resolution prepared in advance is crucial. The Utah Resolution Selecting Depository Bank for Corporation and Account Signatories can assist you in preparing this important document.

A corporate resolution for a bank account is a formal document that grants specific individuals the authority to manage the corporation’s bank affairs. This resolution details who can deposit, withdraw, and sign documents on behalf of the entity. It acts as a safeguard for the financial institution, confirming that the actions are approved by the corporation. Using the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories can help ensure your resolution meets all necessary requirements.

To successfully open a corporate bank account, you typically need several key documents, including a corporate resolution, your employer identification number (EIN), and the articles of incorporation. Depending on your bank, additional items like identification for signatories may also be required. Ensuring you have these documents ready can streamline the process for your Utah Resolution Selecting Depository Bank for Corporation and Account Signatories.

The LLC resolution to open a bank account serves as an official document indicating the members of the LLC who are authorized to act on its behalf at the bank. This resolution supports the opening process, confirming the legitimacy and intention behind opening a corporate account. It's important to draft this resolution according to the specific requirements of your bank. You can refer to the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories for guidance.

Yes, when you choose to open a bank account for your corporation, a corporate resolution is typically required. This document formally authorizes specific individuals to act on behalf of the corporation. It validates your intent to open an account, ensuring that the bank recognizes the appointed signatories. Utilizing the Utah Resolution Selecting Depository Bank for Corporation and Account Signatories can simplify this process.

To write a board resolution for an authorized signatory, you should start by clearly stating the purpose of the resolution. Include details regarding the selected signatories and their specific roles, along with any relevant resolutions about your depository bank. A well-crafted Utah Resolution Selecting Depository Bank for Corporation and Account Signatories helps eliminate confusion and clarifies each individual's responsibilities. Additionally, you might consider using platforms like uslegalforms to streamline this process and ensure compliance.