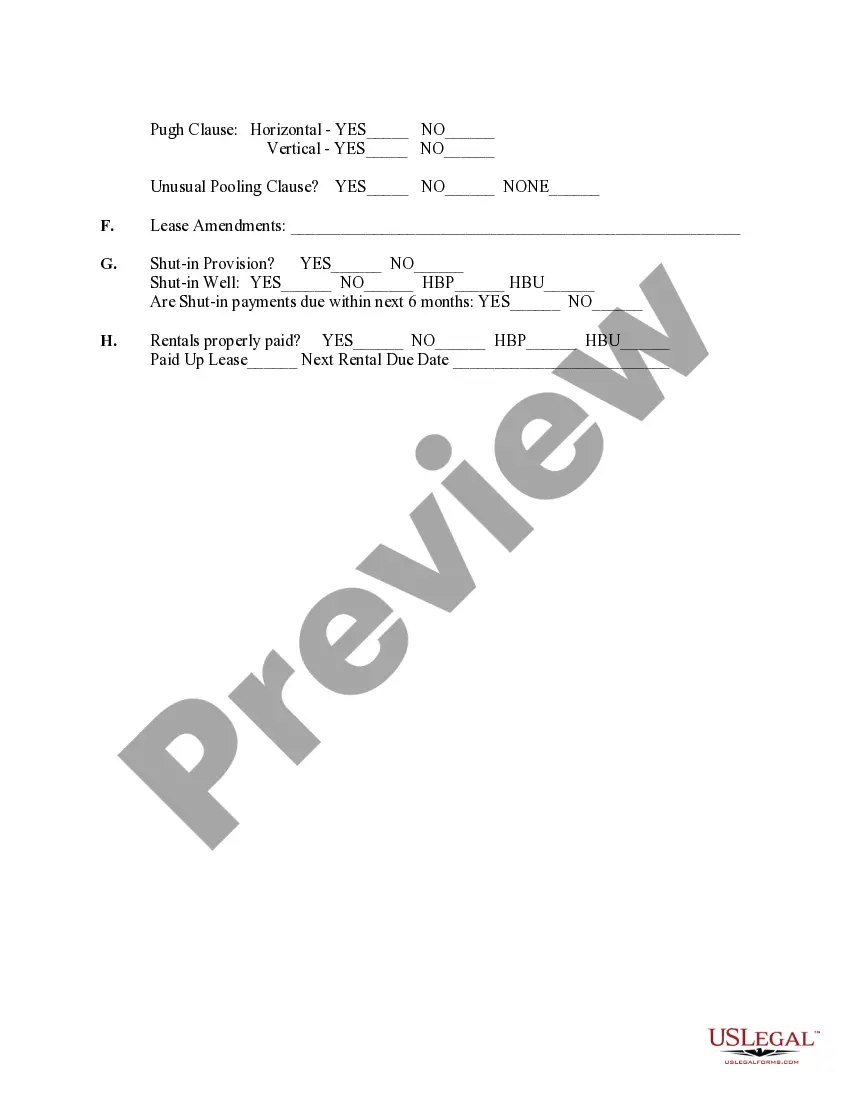

Lease Information

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

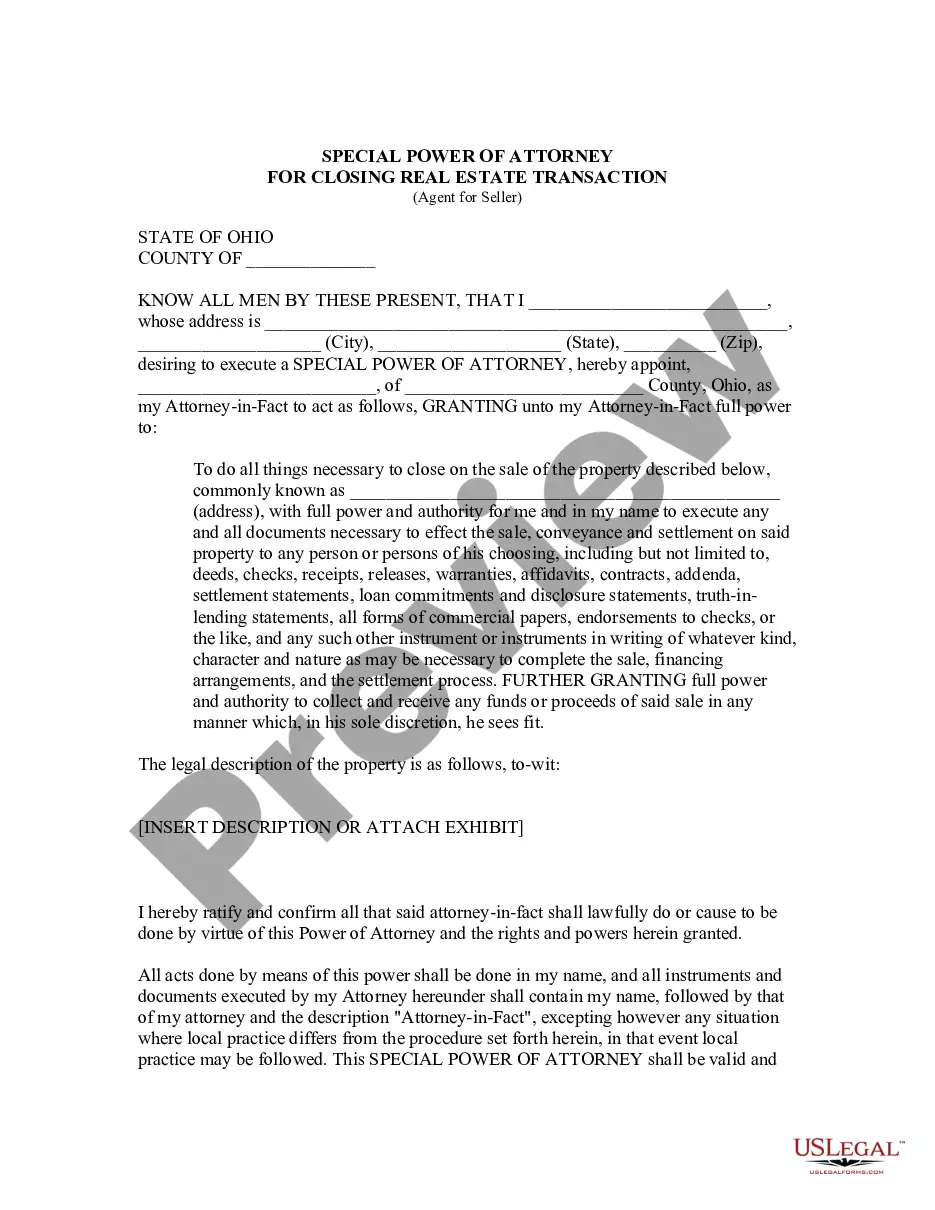

Looking for another form?

How to fill out Lease Information?

When it comes to drafting a legal document, it’s better to delegate it to the experts. However, that doesn't mean you yourself cannot find a sample to use. That doesn't mean you yourself can not get a sample to use, nevertheless. Download Lease Information from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we have included an 8-step how-to guide for finding and downloading Lease Information promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

After the Lease Information is downloaded you are able to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A lease is a contractual arrangement calling for the lessee (user) to pay the lessor (owner) for use of an asset.For example, a person leasing a car may agree to the condition that the car will only be used for personal use. The term rental agreement can refer to two kinds of leases.

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other assets. The two most common types of leases in accounting are operating and financing (capital leases). Advantages, disadvantages, and examples. Lessor vs Lessee.

The time duration for leasing is long, whereas rent is for the short term. There are two parties in a lease agreement, i.e. lessor and lessee. Conversely, the landlord and tenant are the parties in case of renting. The lessee pays lease rentals to the lessor while the tenant pays rent to the landlord.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

In leasing, the servicing and maintenance are done by the lessee when s/he takes the equipment on lease. In renting, on the other hand, the servicing and maintenance are done by the landlord even if the tenant takes the property on rent. Leasing is done for a fixed period of time mostly for the medium to long term.

Names of All Tenants and Occupants. Description of Rental Property. Term of the Tenancy. Rental Price. Security Deposits and Fees. Repair and Maintenance Policies. Landlord's Right to Enter Rental Property. Rules and Important Policies.

Financial Lease. Financial leasing is a contract involving payment over a longer period. Operating Lease. Leveraged and non-leveraged leases. Conveyance type lease. Sale and leaseback. Full and non pay-out lease. Specialized service lease. Net and non-net lease.

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other assets. The two most common types of leases in accounting are operating and financing (capital leases). Advantages, disadvantages, and examples. Lessor vs Lessee.