Employment Status Form

Description

How to fill out Employment Status Form?

Utilize the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for getting updated Employment Status Form templates. Our platform offers a large number of legal documents drafted by certified lawyers and sorted by state.

To obtain a sample from US Legal Forms, users only need to sign up for an account first. If you are already registered on our platform, log in and choose the document you are looking for and buy it. Right after buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

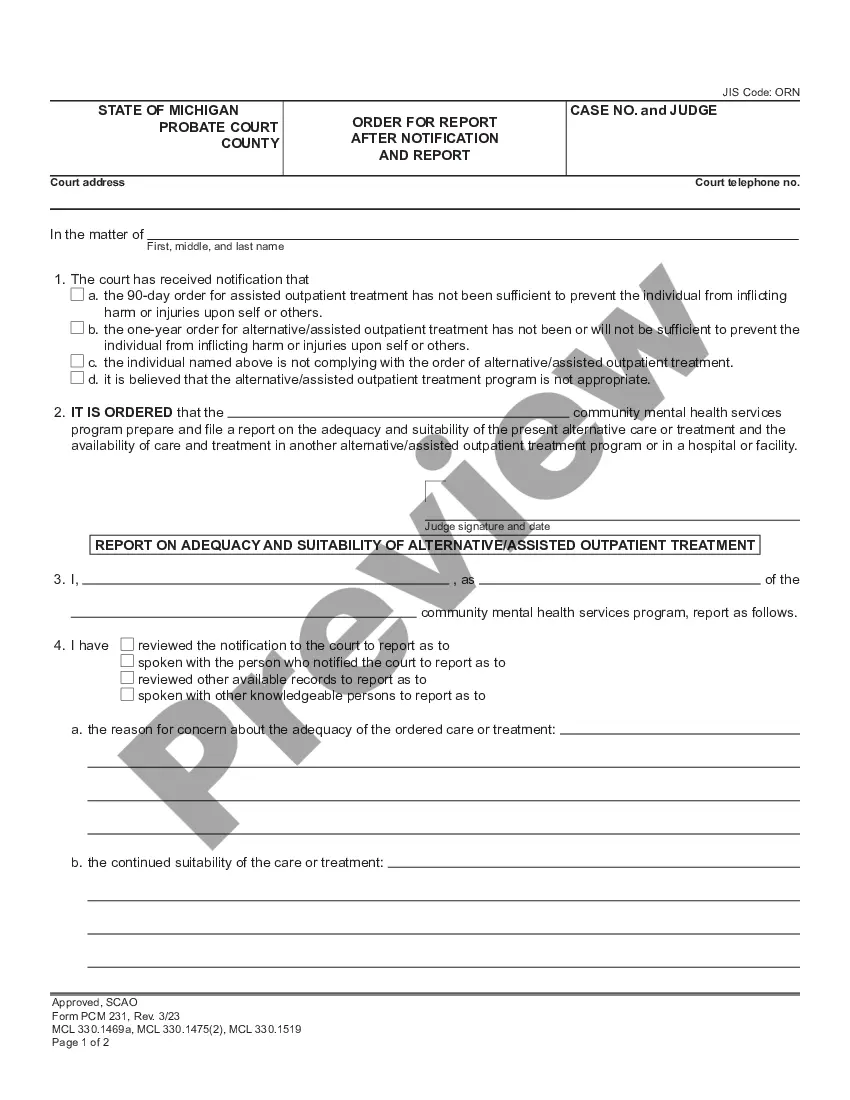

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- In case the template has a Preview function, utilize it to review the sample.

- If the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/visa or mastercard.

- Select a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your effort and time with the service to find, download, and fill in the Form name. Join thousands of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

It takes about two months to get approved in the program. Employers who are approved receive a guarantee that the IRS will not audit their past payroll activities. And they only have to pay 10% of the payroll taxes they would have paid for the previous year, without any penalties.

Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. By filing this form, your social security earnings will be credited to your social security record.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work, not what will be done and how it will be done.Whether a worker is an independent contractor or employee depends on the facts in each situation.

In general, U.S. organizations use employment status to refer to the type of implied or written contract between the employer and employee, e.g., full-time employment, part-time employment, temporary or contract employment, or an internship or apprenticeship.

Firms and workers file Form SS-8 to request a determination of the status of a worker for purposes of federal employment taxes and income tax withholding.

SF-8 Unemployment Compensation_0.pdf. This form has been given to you because (1) you have been separated from your job, or (2) you were placed in a nonpay status, or (3) your records have been transferred to a different payroll office.

Your 'employment status' is your legal status at work. It can be determined by: the type of employment contract you have. the way you get paid.

Level of control How much say does the employer have over the individual? Mutuality of obligations Is there a duty to offer work and for the individual to carry it out? Personal service Can someone else step in if they can't do the work?

There are three types of employment status: employee, worker and self-employed.