Aviso de divulgación de la Ley de crédito justo - Fair Credit Act Disclosure Notice

Description

How to fill out Aviso De Divulgación De La Ley De Crédito Justo?

Among countless free and paid samples that you’re able to get on the web, you can't be certain about their accuracy. For example, who created them or if they’re competent enough to take care of what you need these to. Always keep relaxed and make use of US Legal Forms! Locate Fair Credit Act Disclosure Notice templates created by professional attorneys and get away from the costly and time-consuming procedure of looking for an attorney and then paying them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all your earlier downloaded files in the My Forms menu.

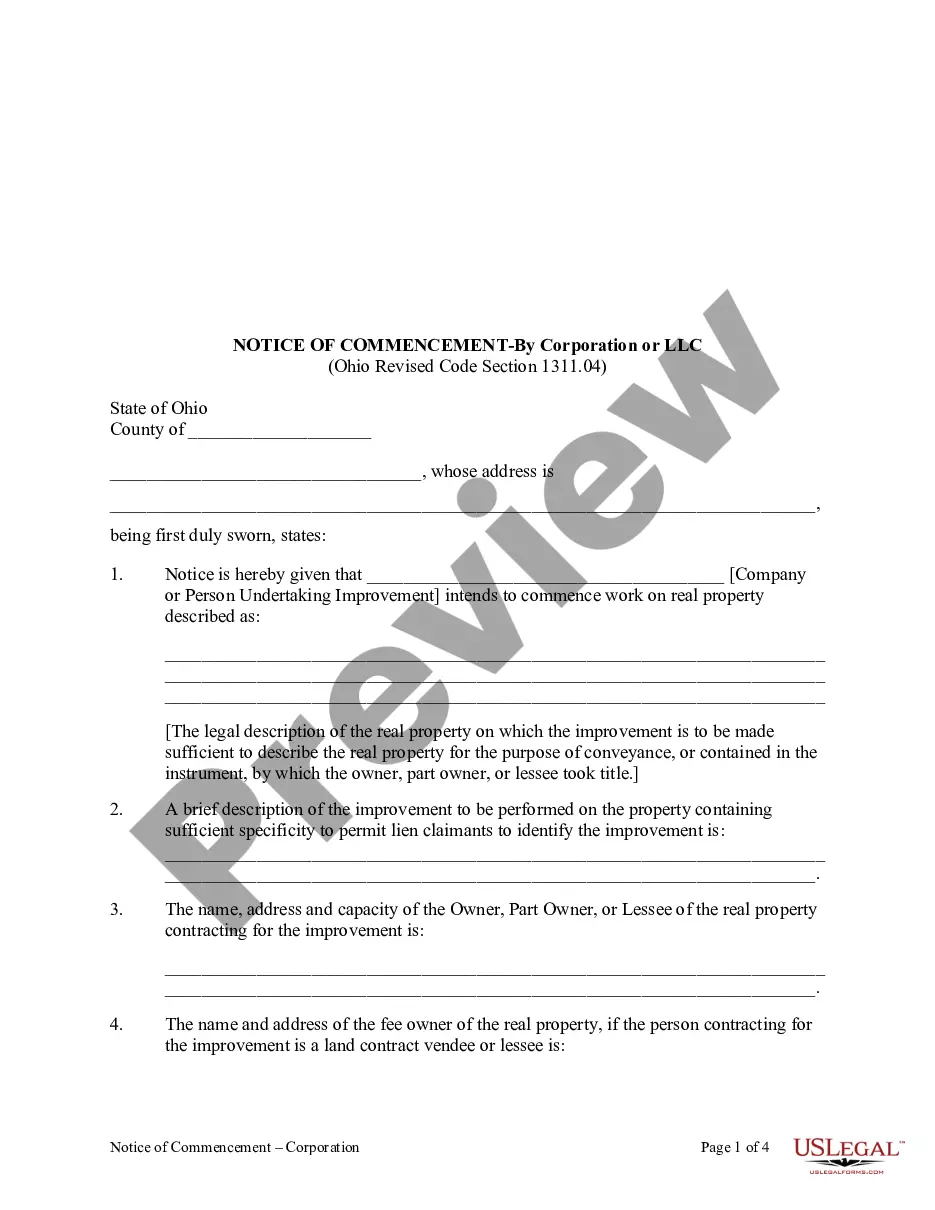

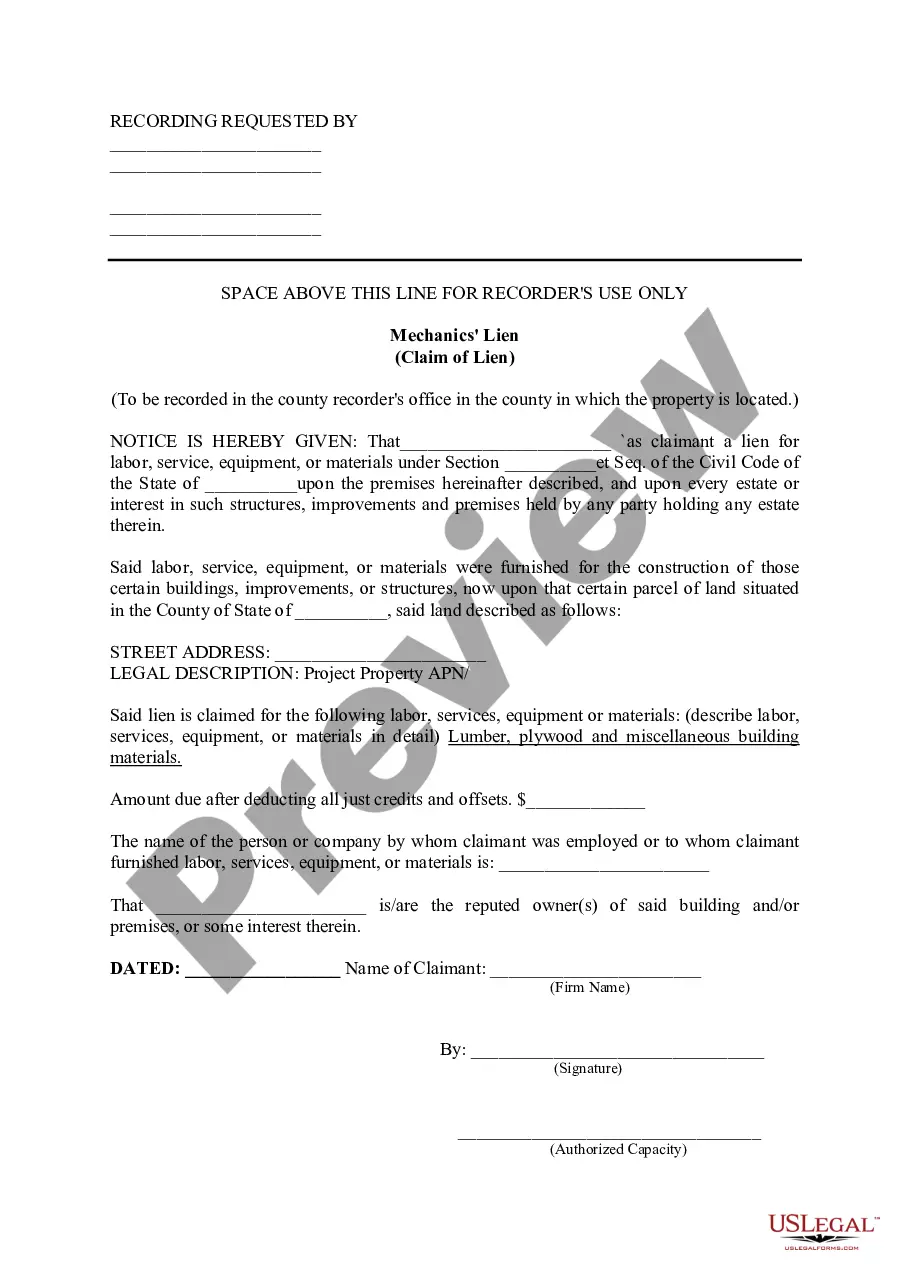

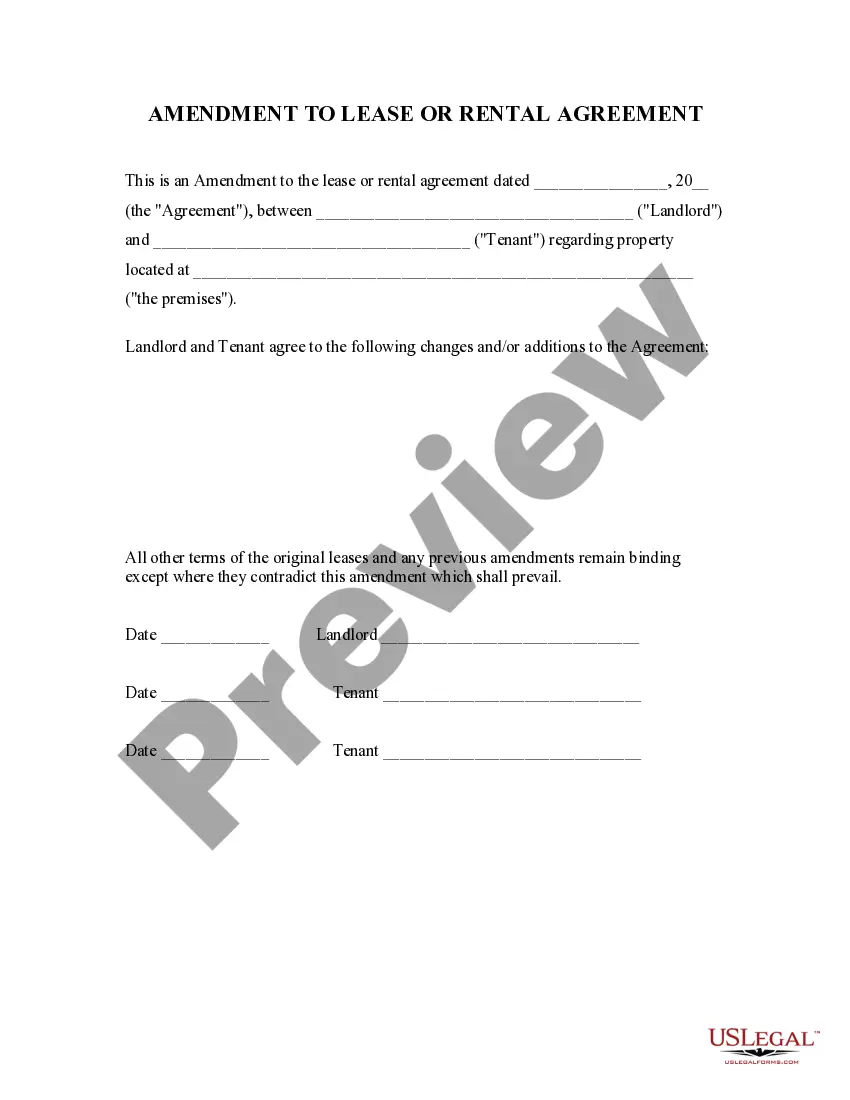

If you’re utilizing our website the very first time, follow the instructions listed below to get your Fair Credit Act Disclosure Notice quick:

- Make sure that the file you find is valid in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you have signed up and purchased your subscription, you may use your Fair Credit Act Disclosure Notice as many times as you need or for as long as it stays valid in your state. Change it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.

La Ley de informe imparcial de credito (FCRA, por sus siglas en inglA©s) promueve la precisiA³n, imparcialidad y privacidad en la informaciA³n en poder de las oficinas de crA©dito.Puede solicitar y obtener toda la informaciA³n sobre usted que tiene en su poder una oficina de crA©dito.

Un informe de credito es una declaraciA³n que tiene informaciA³n acerca de su actividad crediticia y de su situaciA³n actual de crA©dito, como el historial de pago de sus prA©stamos y el estado de sus cuentas de crA©dito. La mayorAa de la gente tiene mA¡s de un informe de crA©dito.

La Ley Federal de Informe Justo de Credito (Fair Credit Reporting Act, FCRA) fomenta la exactitud, justicia y privacidad de la informaciA³n en los expedientes de las agencias de informe del consumidor.

La Ley de Informe Justo de Credito le da el derecho a ser informados si la informaciA³n en su expediente se ha usado en su contra, el derecho a saber lo que estA¡ en su expediente, el derecho a pedir su puntuaciA³n de crA©dito, y mucho mA¡s. Aprenda cA³mo informar y resolver errores en los informes de crA©dito.

Usted puede solicitar y revisar su informe gratuito en una de las siguientes maneras:En linea: Visite AnnualCreditReport.com (El sitio estA¡ en inglA©s).Por telA©fono: Llame al (877) 322-8228.Por correo: Descargue y complete el formulario de Solicitud de Informe de CrA©dito Anual (en inglA©s).Dec 28, 2018

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The Fair Credit Reporting Act (FCRA) is the act that regulates the collection of credit information and access to your credit report. It was enacted in 1970 to ensure fairness, accuracy and privacy of the personal information contained in the files of the credit reporting agencies.

La Ley de Informe Justo de Credito (Fair Credit Reporting Act, FCRA), una ley federal, fomenta la exactitud, imparcialidad y privacidad de la informaciA³n en los archivos de las agencias de informe del consumidor.