In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

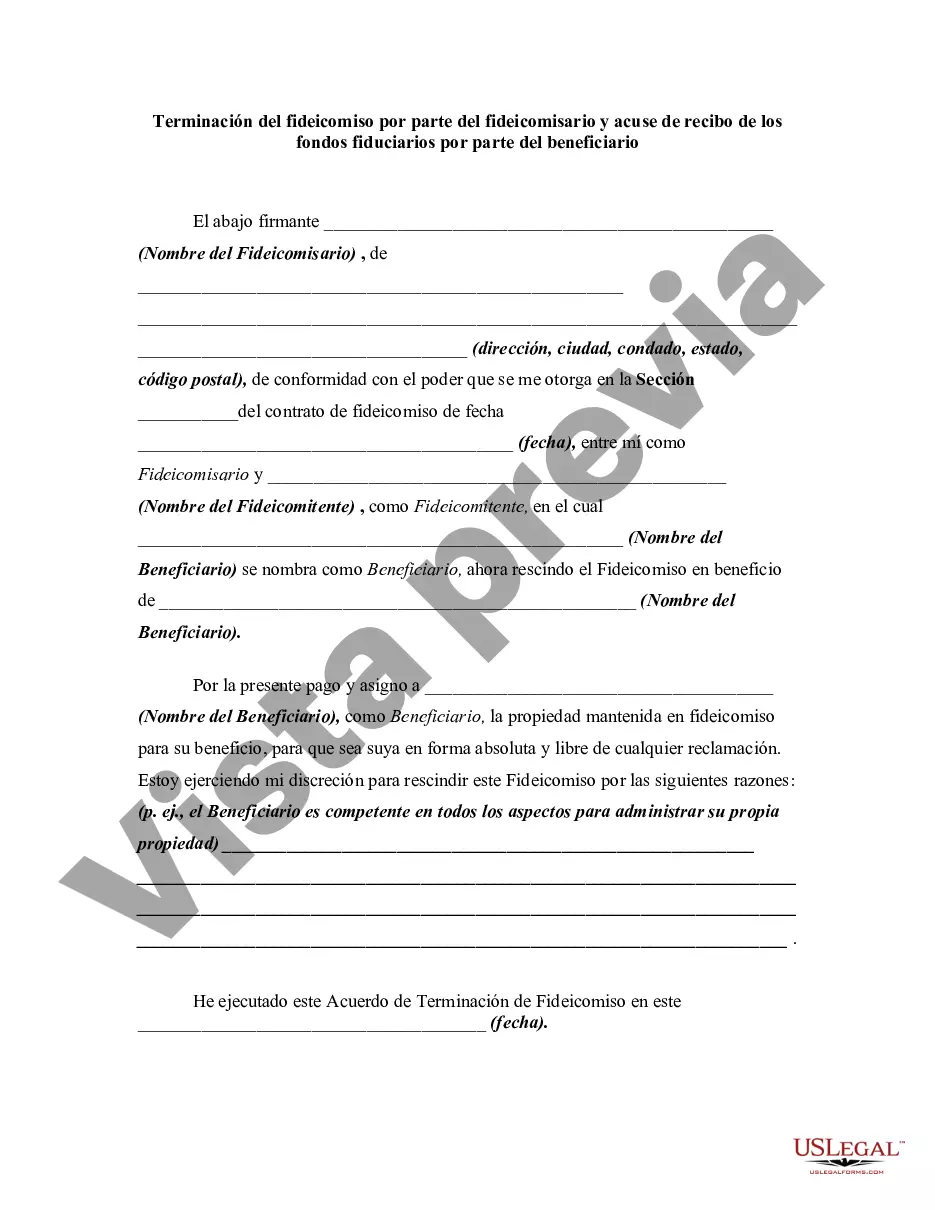

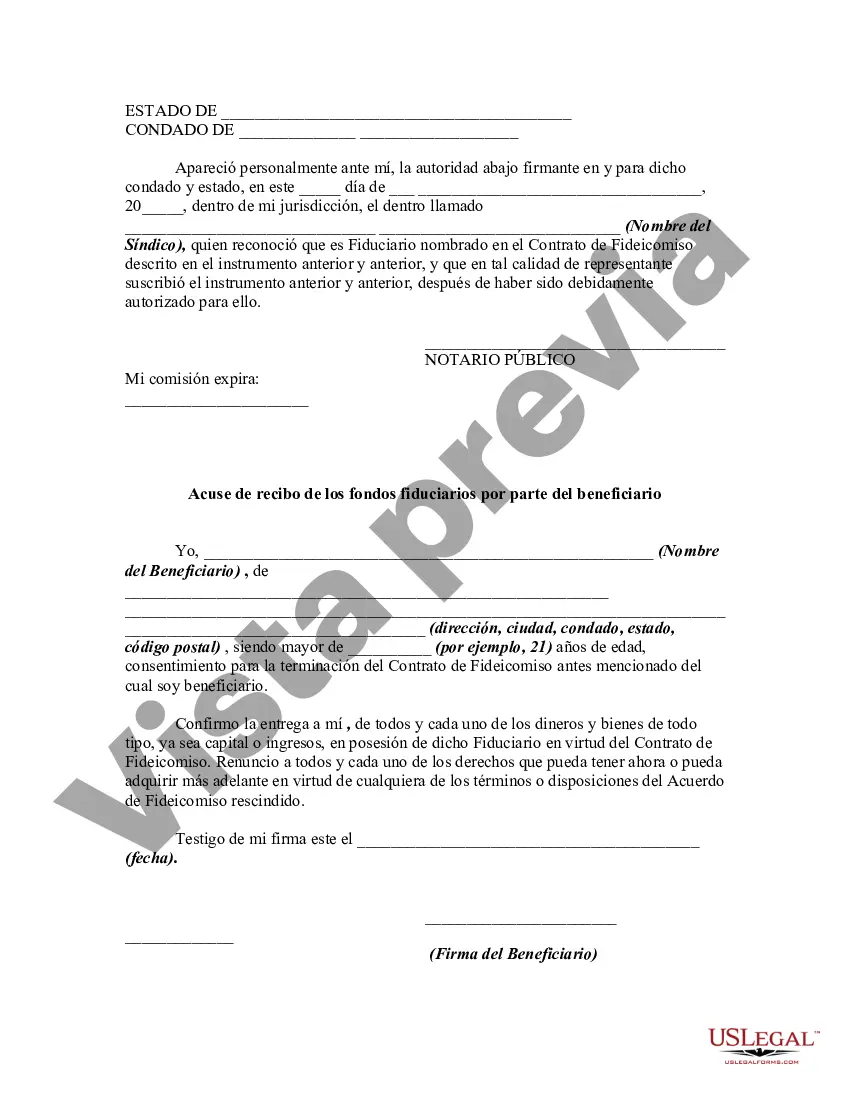

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Terminación del fideicomiso por parte del fideicomisario y acuse de recibo de los fondos fiduciarios por parte del beneficiario - Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

Key Concepts & Definitions

Termination of Trust by Trustee and Acknowledgment involves the process where a trust, established as part of estate planning, is ended by the trustee. This can happen for reasons outlined in the trust agreement or under state laws. Critical terms include trust assets, which are the contents (financial and physical property) held in the trust, and trustee acknowledgment, a formal statement confirming all actions related to the trust's termination have been completed lawfully and successfully.

Step-by-Step Guide to Terminating a Trust

- Review the Trust Document: Verify the terms for termination are met and understand the conditions outlined.

- Notification: Inform all beneficiaries and co-trustees about the intention to terminate the trust.

- Distribute Assets: Carefully allocate trust assets to rightful beneficiaries as per the trusts instructions.

- Prepare Final Accounts: Complete financial statements, detailing income and distributions from the trust.

- Trustee Acknowledgment: Draft and sign the acknowledgment receipt, confirming proper management and closure of trust.

- Legal Filings: File any required documents with local courts or governmental bodies, routine in cases involving complex trust funds or large estates.

- Filing Taxes: Submit any necessary tax filings for the trust, which may involve capital gains or estate tax returns.

Risk Analysis

Terminating a trust involves several risks:

- Legal Compliance: Failing to comply with legal standards for proper notification and distribution can result in lawsuits or financial penalties.

- Financial Errors: Incorrect handling of trust assets or filing taxes inaccurately can lead to serious financial implications.

- Beneficiary Disputes: Miscommunications or dissatisfaction among beneficiaries can lead to conflicts or legal challenges.

Common Mistakes & How to Avoid Them

- Neglecting Documentation: Always keep detailed records of all decisions and actions taken during the termination process.

- Ignoring Tax Implications: Consult a tax professional to ensure all tax liabilities are correctly calculated and paid.

- Failing to Communicate: Regular updates and transparent communication with all parties involved can prevent misunderstandings and disputes.

Best Practices

- Educate Yourself and Consult Experts: Understand the laws and seek advice from estate planning attorneys.

- Meticulous Record-Keeping: Maintain comprehensive records including all communications and financial transactions related to the trust.

- Clear Beneficiary Identification: Verify all beneficiaries and ensure clear and fair distribution of assets.

FAQ

What happens if a trust is terminated incorrectly? Improper termination can result in legal proceedings, potential fines, or disputes among beneficiaries. Can a trustee terminate a trust without beneficiary consent? Depending on the terms of the trust, trustee may require permission from beneficiaries or may proceed independently if explicitly allowed by the trust document.

How to fill out Terminación Del Fideicomiso Por Parte Del Fideicomisario Y Acuse De Recibo De Los Fondos Fiduciarios Por Parte Del Beneficiario?

Aren't you sick and tired of choosing from countless samples every time you require to create a Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary? US Legal Forms eliminates the wasted time millions of Americans spend exploring the internet for suitable tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Samples library, so it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription need to complete easy steps before being able to download their Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary:

- Utilize the Preview function and read the form description (if available) to make certain that it is the correct document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper sample for your state and situation.

- Use the Search field on top of the site if you have to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your sample in a required format to finish, create a hard copy, and sign the document.

After you’ve followed the step-by-step guidelines above, you'll always be capable of log in and download whatever file you require for whatever state you require it in. With US Legal Forms, finishing Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary samples or other legal paperwork is not hard. Get started now, and don't forget to examine your samples with accredited attorneys!